What is working capital?

Working capital (definition)

Working capital measures a business’s ability to cover upcoming costs. The surplus or deficit is measured in dollars.

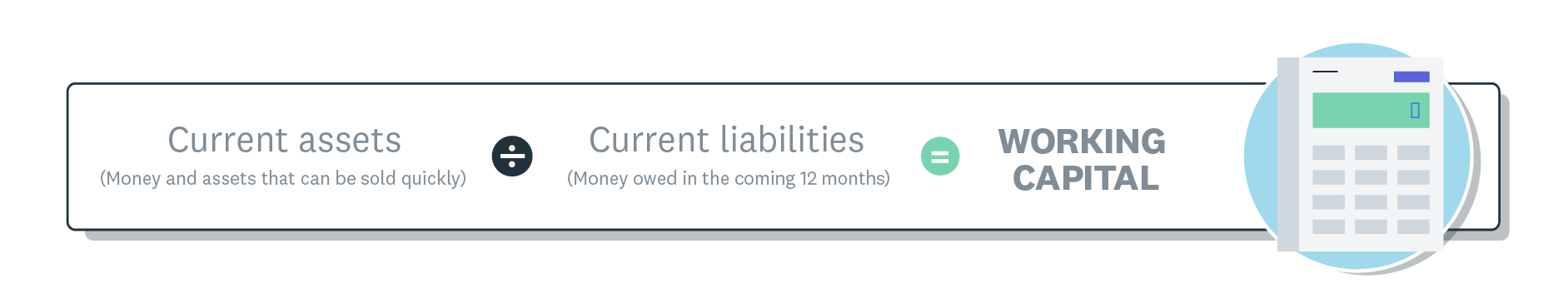

Working capital is calculated by subtracting current liabilities (amounts owed within the next 12 months) from current assets. Current assets include cash the business has, plus payments due to come in, plus anything that could be sold quickly if required.

Working capital formula.

What working capital means for a business

Positive working capital means the business can pay its bills and debts in the coming months.

The surplus can be invested in new projects to grow or evolve the business.

Negative working capital indicates a business won’t be able to pay all its debts and may need to arrange finance. If the trend continues, the business may become insolvent and unable to trade.

While consistently low working capital may prevent a business from reinvesting to improve itself, really high working capital isn’t great either. It suggests the business may have run out of ideas for innovating or taking the next step.

How working capital differs from liquidity, free cash flow, and cash flow

Working capital is a measure of spending power, similar to cash flow, free cash flow, and liquidity. Each of these terms has its own complexities, but here’s roughly how they compare:

- Cash flow refers to the general availability of cash

- Liquidity shows how easily a business can cover upcoming costs (expressed as a ratio)

- Working capital shows how much money will be left after covering those upcoming costs

- Free cash flow is the amount of cash left after making capital investments

See related terms

Handy resources

Advisor directory

You can search for experts in our advisor directory

Xero Small Business Guides

Discover resources to help you do better business

Online accounting with Xero

Automate your accounting in the cloud

Disclaimer

This glossary is for small business owners. The definitions are written with their requirements in mind. More detailed definitions can be found in accounting textbooks or from an accounting professional. Xero does not provide accounting, tax, business or legal advice.