Take control with Xero cash flow forecasting software

Xero gives you the tools and insights to keep a tight grip on your business’s cash flow. Closely predict and manage your cash position, spot shortfalls before they cause problems, and make confident, data-backed decisions on your spending with Xero cash flow projection software.

Know your cash flow, know your business

Xero’s cash flow forecasting software helps you plan ahead. See money coming in and out, prepare for challenges, and stay in control.

Visualize your cash flow

Clearly see the money passing in and out of your bank account over the next month.

Plan for every scenario

Xero’s advanced tools help you prepare for any challenges – such as late payments – and come up with a plan.

Stay in control of your cash flow

Check your cash flow anytime, from anywhere, so you always have the right information to decide your business’s future.

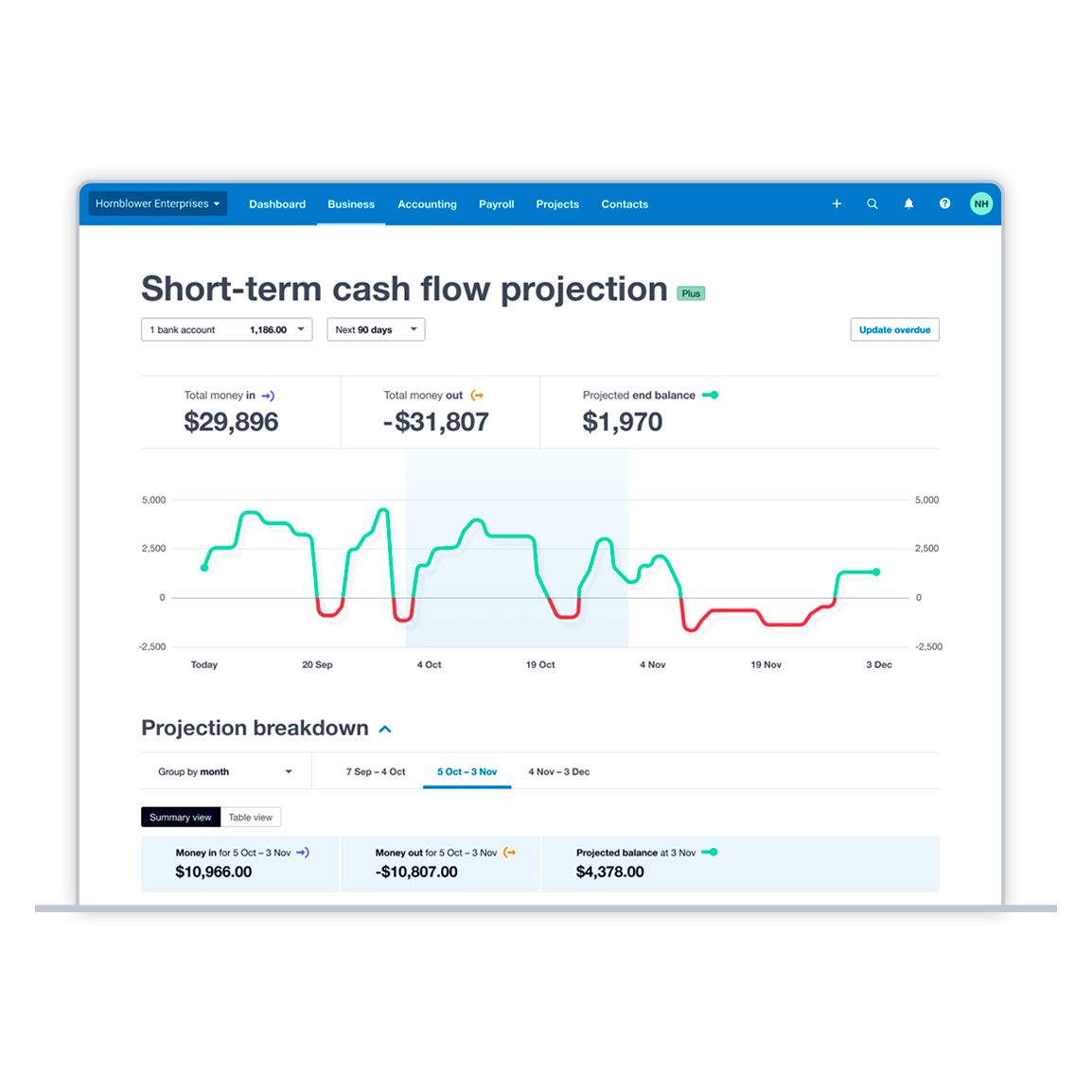

Forecast your cash for the next month

Better understand what the future holds with Xero’s short-term cash flow projection software. Data visualisations show your balance in real time, and your expected cash flow for the next 7 or 30 days. Wondering how much cash you'll have next week? Or when that big payment is due? Get clear answers.

- Check the short-term cash flow dashboard whenever you want to plan your spending

- Spot potential issues for the next month – and make adjustments before they happen

- Connect all your business bank accounts to track all your cash flows in one place

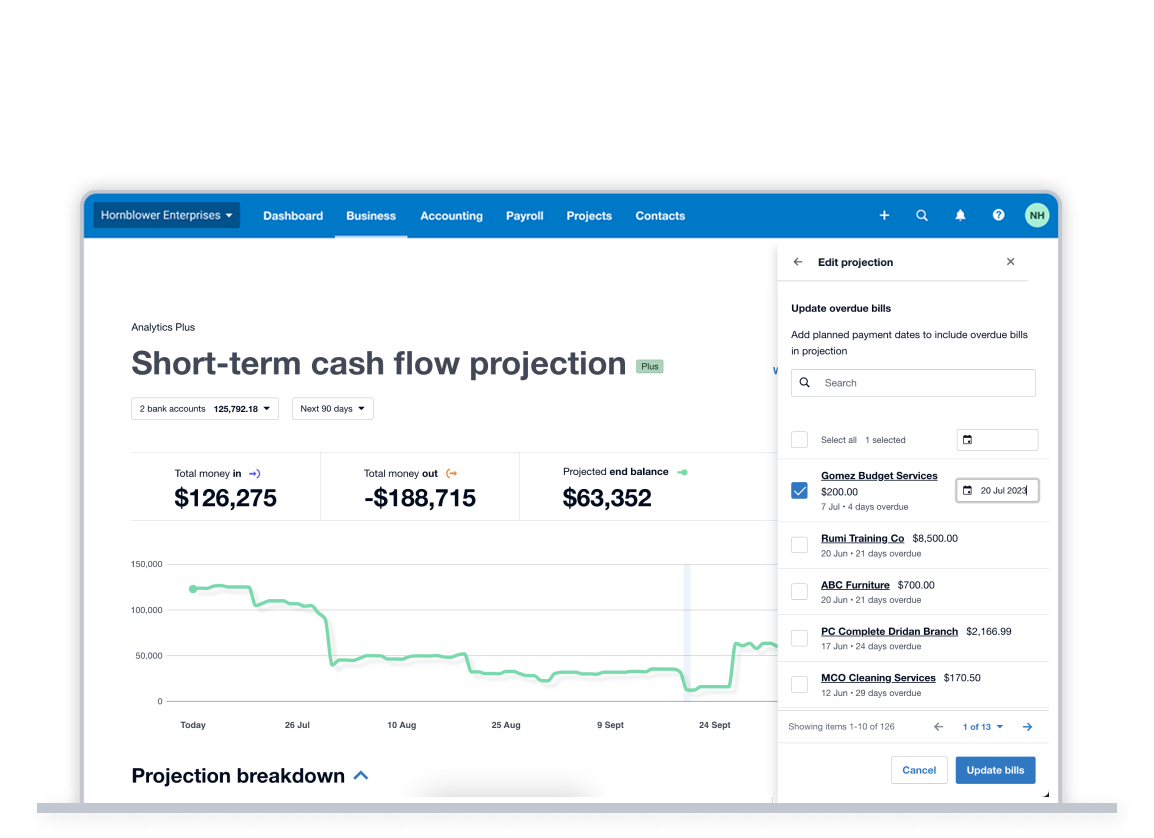

See what’s affecting your cash flow

Xero’s cash flow forecasting software shows what’s affecting your bank balance, so you can make smart spending decisions. See invoices due, bills to pay, and add expected payment dates to overdue invoices for accuracy. Get clear data to make confident, data-backed choices for your business.

- Drill into the detail of your projection – including the invoice payments due in, and bills to be paid

- Add expected payment dates to your overdue invoices to make the projections more accurate

- Get clear data to be able to make confident, data-backed decisions for your business

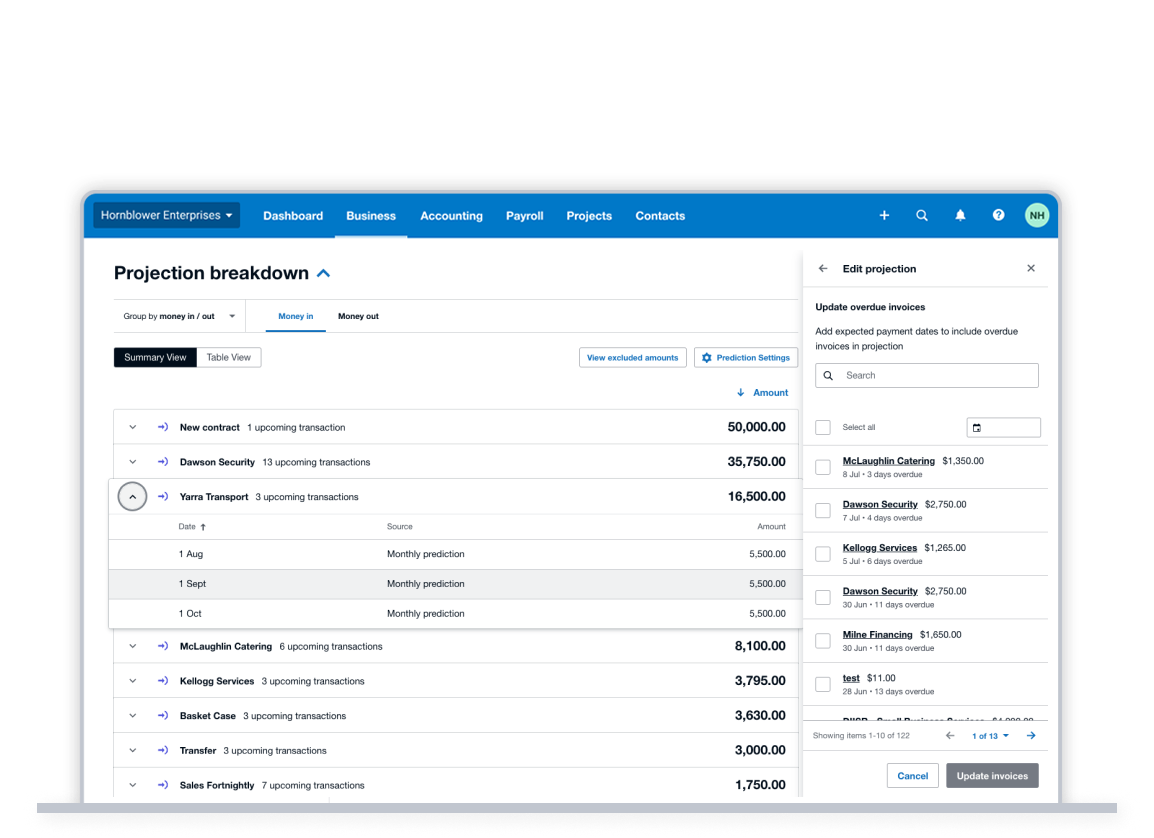

Expertly manage your cash flow

Xero’s projection insights help keep your books in shape and make cash flow management much easier. How? By closely tracking which invoices are due, spotting the clients you need to chase up, and giving you the info to decide when to pay your bills.

- See the projected breakdown for a weekly or daily view of your invoices due, bills to pay, and your projected balance

- Find the due dates of any outstanding invoices – and click through to the original invoices for the important details

- Check all the bills you need to pay, including their deadlines, and how they affect your cash flow

Plan for different scenarios

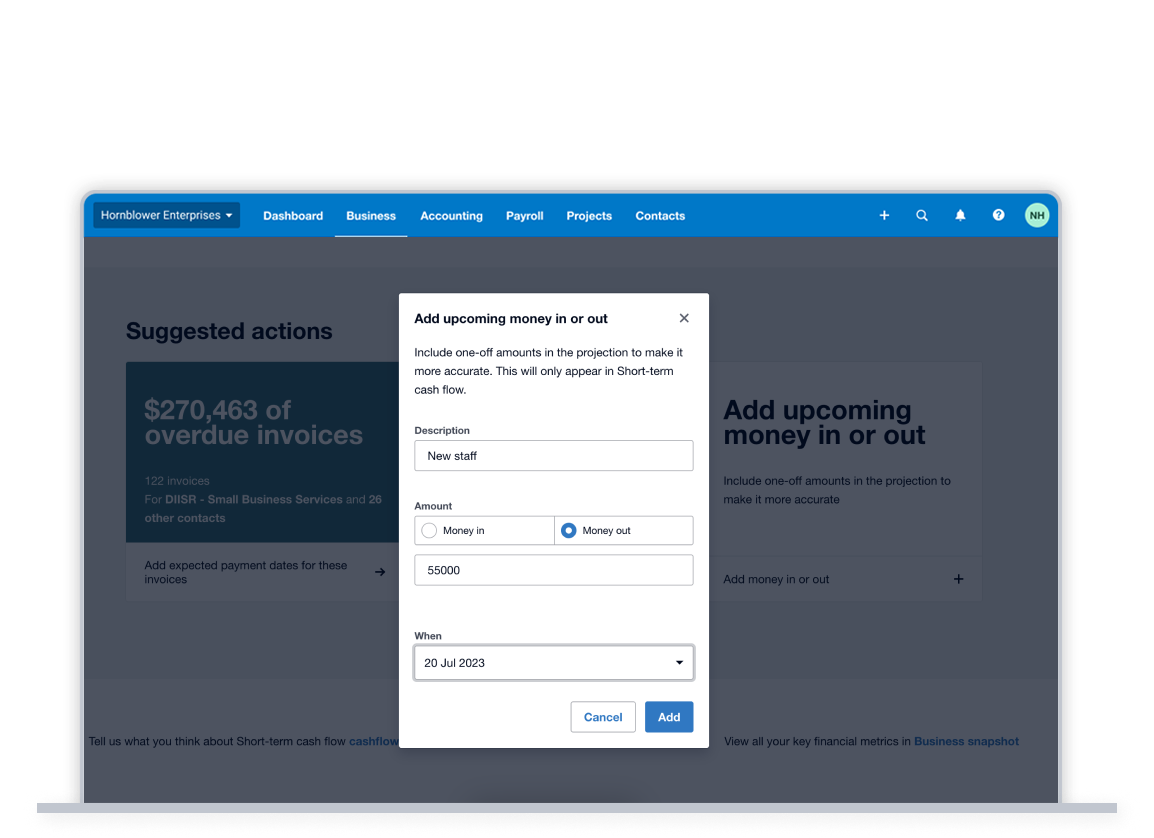

With Xero’s forecasting features, you can feel more prepared. What happens if you make a large sale tomorrow, or your client doesn’t pay that big invoice next week? Find out by simply adding or subtracting these amounts to your operating cash flow.

- Test out different scenarios to see how each one affects your cash flow management

- Manually adjust projections to help you prepare your business

- Plan in partnership with your accountant on the same cash flow projections in Xero’s cloud-based software

How Xero’s cash flow forecasting helps small businesses

Xero gives you the insights to make smart cash flow management decisions. See what’s coming in and going out, so you can plan ahead.

Improve your financial planning

Know what cash is flowing in and out of your bank accounts so you can confidently and accurately plan ahead.

Avoid cash shortages

Use Xero’s data visualisations to help you pinpoint when you might be short on cash – and take action!

Boost your profitability

Manage your cash flow and you’ll be able to access the cash you need to invest in your growth.

When it comes to raising capital the investors want to see financial projections and having those reports available in Xero means I can clearly show what I can do by myself, and what I can do if I take on three production staff.”

Jack Candlish, Verdure Surf

FAQs on Xero cash flow forecasting software

Small business cash flow projections help you understand what’s happening with your cash flow. Let’s say you expect to receive several invoice payments next month, and you need to pay some bills. Xero software summarizes the incoming and outgoing amounts for you, and your projected balance at the end of the month. This helps you see whether you have the cash to cover your bills, and to make decisions on your spending.

Small business cash flow projections help you understand what’s happening with your cash flow. Let’s say you expect to receive several invoice payments next month, and you need to pay some bills. Xero software summarizes the incoming and outgoing amounts for you, and your projected balance at the end of the month. This helps you see whether you have the cash to cover your bills, and to make decisions on your spending.

When you use Excel spreadsheets to forecast your cash flow, you first need to add your own formulas, which can be time-consuming and result in human errors. Xero cash flow forecasting software does the hard work for you – it gives you accurate numbers every time, and dynamic data visualisations instead of just figures on a page.

When you use Excel spreadsheets to forecast your cash flow, you first need to add your own formulas, which can be time-consuming and result in human errors. Xero cash flow forecasting software does the hard work for you – it gives you accurate numbers every time, and dynamic data visualisations instead of just figures on a page.

A business experiences positive cash flow when more money flows into its bank account than goes out, allowing the owner to cover expenses and maintain financial stability. Negative cash flow occurs when more money leaves the account than comes in. While short-term negative cash flow might be manageable, small business owners can use cash flow management strategies to track and forecast their finances. This helps ensure they can balance cash inflows and outflows, ultimately keeping their business financially healthy.

A business experiences positive cash flow when more money flows into its bank account than goes out, allowing the owner to cover expenses and maintain financial stability. Negative cash flow occurs when more money leaves the account than comes in. While short-term negative cash flow might be manageable, small business owners can use cash flow management strategies to track and forecast their finances. This helps ensure they can balance cash inflows and outflows, ultimately keeping their business financially healthy.

To calculate your cash flow, start with your total cash inflows (all the payments coming into your bank account) and subtract your total cash outflows (all the payments leaving your bank account). This gives you your net cash flow—the amount of money your business gains or loses over a given period. Using cash flow projection software can help small business owners track and forecast these numbers, making it easier to manage finances and plan for the future.

Here’s Xero’s cash flow calculatorTo calculate your cash flow, start with your total cash inflows (all the payments coming into your bank account) and subtract your total cash outflows (all the payments leaving your bank account). This gives you your net cash flow—the amount of money your business gains or loses over a given period. Using cash flow projection software can help small business owners track and forecast these numbers, making it easier to manage finances and plan for the future.

Here’s Xero’s cash flow calculatorWith cash flow projection software like Xero Analytics Plus, gain deeper insights into your cash flow. Use the dashboard to forecast cash flow for the next 7, 30, 60, or 90 days. See predicted recurring transactions based on past data, and manually add one-off amounts to model different scenarios—like a late client payment or a major purchase.

Here’s more on Xero’s advanced short-term cash flow predictionsWith cash flow projection software like Xero Analytics Plus, gain deeper insights into your cash flow. Use the dashboard to forecast cash flow for the next 7, 30, 60, or 90 days. See predicted recurring transactions based on past data, and manually add one-off amounts to model different scenarios—like a late client payment or a major purchase.

Here’s more on Xero’s advanced short-term cash flow predictions

More than your cash flow

Want to track more than just your cash flow? Xero’s cash flow forecasting software lets you understand and optimize all aspects of your business’s finances. Spot and compare your data trends, follow crucial performance metrics, and get the insights you need to take your business to the next level.

Explore the features of Xero analytics software

Accounting software for your US small business

Run your business accounting online with Xero. Easy-to-use accounting software, designed for your small business.

- Everything in one place

- Connect to your bank

- Collaborate in real time

- Customize to suit your needs

Resources for simpler accounting

Small business accounting doesn’t need to be complicated. Here are some expert guides to simplify your financial admin.

Cash flow forecasting for beginners

Learn the ins and outs of forecasting, and take control of your cash flow.

5 rules for managing your small business cash

Get the essentials on how to manage cash flow for your business.

Cash flow forecasting template

Download a free cash flow forecasting template for your business, so you can get started today.

Plans to suit your business

All pricing plans cover the accounting essentials, with room to grow.

Early

Usually $20

Now $2

USD per month

Save $54 over 3 months

Growing

Usually $47

Now $4.70

USD per month

Save $126.90 over 3 months

Established

Usually $80

Now $8

USD per month

Save $216 over 3 months

Get one month free

Purchase any Xero plan, and we will give you the first month free.