Accept online payments to help get paid fast

Get the money in your account by giving your customers the chance to pay online by card, and accept payments straight from your invoices. Xero works with secure online payment services to help you get paid sooner.

Receiving payments online helps make business better

Running your small business is easier when you accept online payments.

Speed up invoice payments

A ‘Pay’ button on your online invoices means you can collect payments, without the hassle. Get paid up to twice as fast.

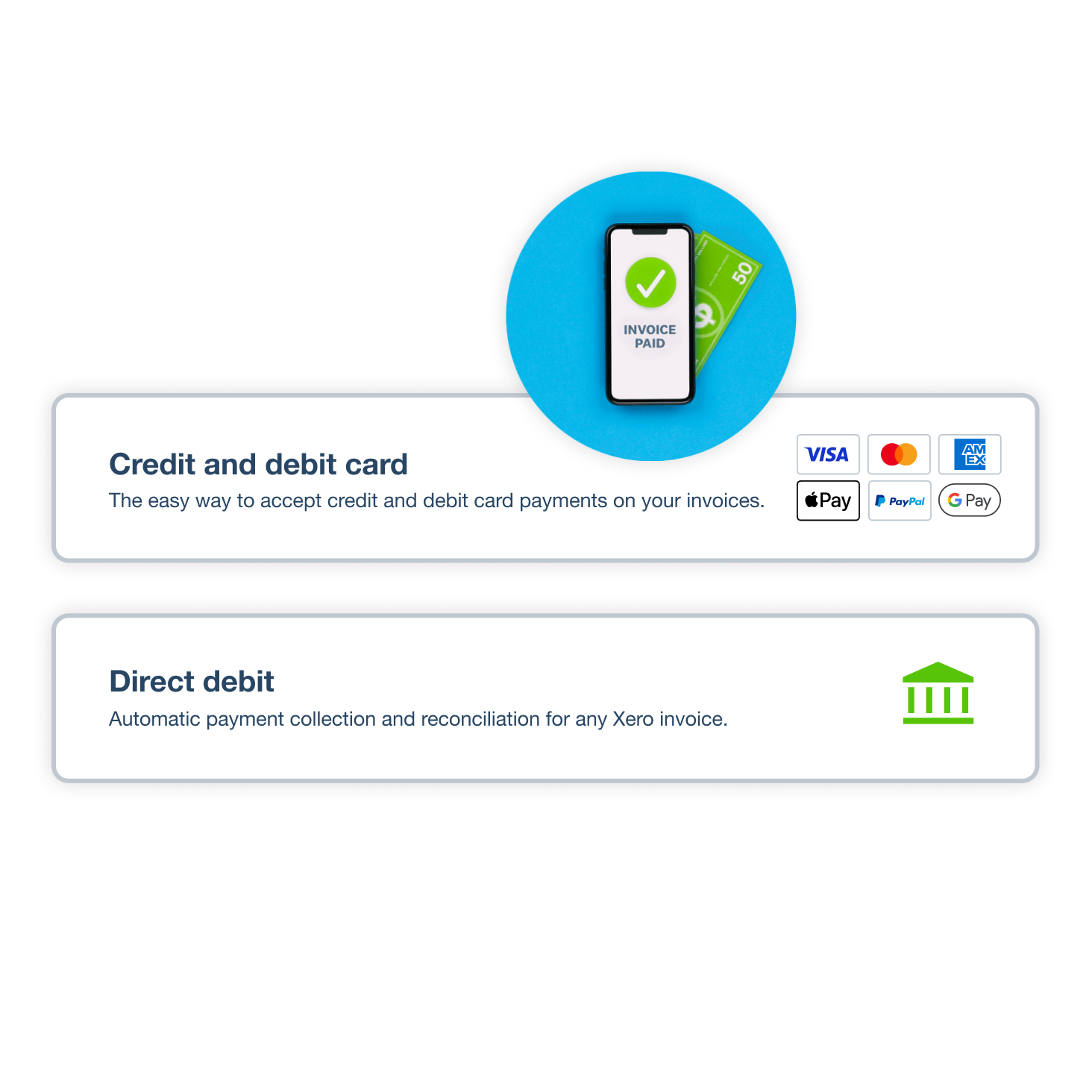

Payment options that work the way you do

Accept payments by credit and debit cards, direct debit, and more using trusted payment services.

Make it easy for customers to pay

Customers can pay the way they want, in fewer steps, for effortless payments every time.

81% of customers [say they] spend less time chasing payments using Xero

*Source: survey conducted by Xero of 104 small businesses in the US using Xero, May-June 2024

Let customers pay the way they want

86% of customers say they prefer to pay via credit and debit card, so give your customers the choice to pay how they want. By offering online invoice payment options with Stripe or GoCardless, you're more likely to get paid faster.

- Accept online payments by credit and debit cards, digital wallets, Klarna, ACH Debit, and more using Stripe

- Accept in-person payments on spot, via Stripe, using your mobile phone and the Xero Accounting App

- Automate recurring payments by ACH Direct Debit with GoCardless

Did you know:

81% of customers agree Xero’s online payments help them get paid on time

Start accepting online payments in minutes

Setting up online payments in Xero is easy. With just a few steps, you can connect a trusted payment service to your invoices, allowing your customers to securely pay online while reducing the time you spend chasing payments.

- Connect a payment processor to online invoices in Xero for free

- No subscription costs

- Only pay a transaction fee when customers pay online, then choose to pass on some or all of the fee to them

Add click-to-pay to online invoices

Boost your US small business profile with professional-looking invoices that offer secure options for paying online. Xero’s Pay Now option lets you seamlessly receive online payments, speeding up the payment process.

- Set up invoice templates to personalize your invoices with your logo, a custom message, and a Pay Now button

- Let customers pay straight from the invoice, reducing steps to pay and your time chasing payments

- Send professional, friendly reminders to customers for upcoming or overdue invoices

Accept payments while staying protected from fraud

Xero online invoices and payments gives you more protection from fraud. Trusted payment providers use fraud detection tools, while multi-factor authentication keeps your data secure. Online invoices help prevent tampering or unauthorized changes so you can receive payments with confidence.

- Payment services that connect to Xero have robust security protections and strong encryption

- Unlike PDFs, online invoices are hard to tamper with

- Xero protects your data with multiple layers of security

Plans to suit your business

All pricing plans cover the accounting essentials, with room to grow.

Early

Usually $20

Now $2

USD per month

Save $54 over 3 months

Growing

Usually $47

Now $4.70

USD per month

Save $126.90 over 3 months

Established

Usually $80

Now $8

USD per month

Save $216 over 3 months

Why businesses love Xero online payments

We all want the same thing: fast, frictionless ways to pay and get paid. Here’s how Xero’s online payment features can help.

Less time chasing payments

Features like sending your invoices by SMS mean less time spent chasing your customers for payment.

Happy customers

If you save people time, chances are they’ll come back for more.

Ready to scale

Going global? Our online payment services make cross-border payments easy, so you reach new markets.

Accounting software for your US small business

Run your business accounting online with Xero. Easy-to-use accounting software, designed for your small business.

- Everything in one place

- Connect to your bank

- Collaborate in real time

- Customize to suit your needs

Xero allows me to do what I love doing, which is creating

Xero makes Orenda Tribe run seamlessly

FAQs about accepting payments

Use online payments so your business can automatically accept payments from customers. For example, you can use GoCardless to automatically take direct debits or bank-to-bank payments from a customer on each due date, or use Stripe to take payments via credit card, debit card, Apple Pay or Google Pay. (Note that GoCardless and Stripe are not available in some countries.)

See how to add a payment serviceUse online payments so your business can automatically accept payments from customers. For example, you can use GoCardless to automatically take direct debits or bank-to-bank payments from a customer on each due date, or use Stripe to take payments via credit card, debit card, Apple Pay or Google Pay. (Note that GoCardless and Stripe are not available in some countries.)

See how to add a payment serviceStripe helps customers pay online in many ways, like credit and debit cards, digital wallets, and buy now, pay later options. Plus, you can accept in-person contactless payments straight from the Xero Accounting app with Tap to Pay. Stripe also lets you accept multiple payment types with a single signup, and feeds the transactions to Xero for you to reconcile them.

Learn more about accepting online payments with Stripe and XeroStripe helps customers pay online in many ways, like credit and debit cards, digital wallets, and buy now, pay later options. Plus, you can accept in-person contactless payments straight from the Xero Accounting app with Tap to Pay. Stripe also lets you accept multiple payment types with a single signup, and feeds the transactions to Xero for you to reconcile them.

Learn more about accepting online payments with Stripe and XeroSmall businesses can accept in-person, contactless payments with physical cards, digital wallet, or wearable devices like smartwatches. This can be done straight from the Xero Accounting app on a mobile phone, powered by Stripe, once an invoice has been raised.

Learn more about accepting payments with Tap to PaySmall businesses can accept in-person, contactless payments with physical cards, digital wallet, or wearable devices like smartwatches. This can be done straight from the Xero Accounting app on a mobile phone, powered by Stripe, once an invoice has been raised.

Learn more about accepting payments with Tap to PayThe link below has step-by-step instructions for setting up Stripe. You can then accept payments by multiple methods, including credit and debit cards, Apple Pay and Google Pay, and buy now, pay later options.

See how to add Stripe as a payment serviceThe link below has step-by-step instructions for setting up Stripe. You can then accept payments by multiple methods, including credit and debit cards, Apple Pay and Google Pay, and buy now, pay later options.

See how to add Stripe as a payment serviceMinimize late payments by automatically debiting your customer’s bank account on the due date of your Xero invoice. GoCardless integrates with Xero, so scheduling and reconciling payments is easy.

Learn more about accepting payments with GoCardless and XeroMinimize late payments by automatically debiting your customer’s bank account on the due date of your Xero invoice. GoCardless integrates with Xero, so scheduling and reconciling payments is easy.

Learn more about accepting payments with GoCardless and XeroClick the link below for step-by-step instructions on how to set up GoCardless payments. Customers can then pay your online invoices by direct debit.

See how to add GoCardless as a payment serviceClick the link below for step-by-step instructions on how to set up GoCardless payments. Customers can then pay your online invoices by direct debit.

See how to add GoCardless as a payment serviceUse a payment service provider to accept card payments. Stripe, for example, is a leading provider that works with Xero. When you sign up to Stripe, a pay now button is added to your invoices and customers can choose a payment method.

Use a payment service provider to accept card payments. Stripe, for example, is a leading provider that works with Xero. When you sign up to Stripe, a pay now button is added to your invoices and customers can choose a payment method.

When your customer receives a Xero invoice, they can pay according to the payment methods you've enabled. Xero then sends payment information via an online payment gateway to their bank, which checks their identity and available funds before payment.

When your customer receives a Xero invoice, they can pay according to the payment methods you've enabled. Xero then sends payment information via an online payment gateway to their bank, which checks their identity and available funds before payment.

Check out the ‘I want to pay that way’ report

Learn how consumers and small businesses around the world make and collect payments.

Read the report

FAQs about Xero in the US

Yes, Xero’s reporting and analytics capabilities help you easily prepare and submit your returns so you never miss a deadline. Your numbers will be accurate and all stored in one secure place.

See tax information for businesses from the IRS.Yes, Xero’s reporting and analytics capabilities help you easily prepare and submit your returns so you never miss a deadline. Your numbers will be accurate and all stored in one secure place.

See tax information for businesses from the IRS.Yes – Xero partners with Gusto for a full-service payroll solution. Gusto saves you time on all aspects of your payroll – including calculating employee pay and deductions – thanks to its clever automations.

Check out payroll with GustoYes – Xero partners with Gusto for a full-service payroll solution. Gusto saves you time on all aspects of your payroll – including calculating employee pay and deductions – thanks to its clever automations.

Check out payroll with GustoThe best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plans.The best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plans.No – Xero is based in the cloud, so all you need is an internet connection. But you need a multi-factor authentication (MFA) app to log in to Xero. MFA extra layer of security by checking that it’s really you when you log in.

Learn about data protection with Xero.No – Xero is based in the cloud, so all you need is an internet connection. But you need a multi-factor authentication (MFA) app to log in to Xero. MFA extra layer of security by checking that it’s really you when you log in.

Learn about data protection with Xero.Yes, the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business in the USA.

Check out the Xero App Store.Yes, the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business in the USA.

Check out the Xero App Store.

See how online payments give customers more ways to pay and help you get paid faster

Get paid now? Yes please.

Start accepting online payments

Here’s everything you need to know to start accepting payments from your customers and making them to your suppliers and employees.See all payments guides.

- Guide

7 basic invoicing questions you were afraid to ask

Want to know more about invoicing? What to put on them? Which type to send? What invoice accounting is? It’s all here.

- Guide

Getting your head around small business payroll

Starting to employ people? Here’s your introduction to the basics of pay, deductions, and dealing with the tax office.

- Guide

How to build a watertight accounts receivable process

There’s one way to stay in business – you have to get paid. That’s why a good accounts receivable process is critical.