Solvency vs liquidity: differences and ratios explained

Learn solvency vs liquidity to protect your cash flow and manage debt. Make smarter funding and growth decisions.

Written by Lena Hanna—Trusted CPA Guidance on Accounting and Tax. Read Lena's full bio

Published Friday 13 February 2026

Table of contents

Key takeaways

- Monitor both solvency and liquidity ratios regularly to maintain a complete picture of your financial health, as solvency measures your ability to pay long-term debts while liquidity shows whether you can cover short-term bills.

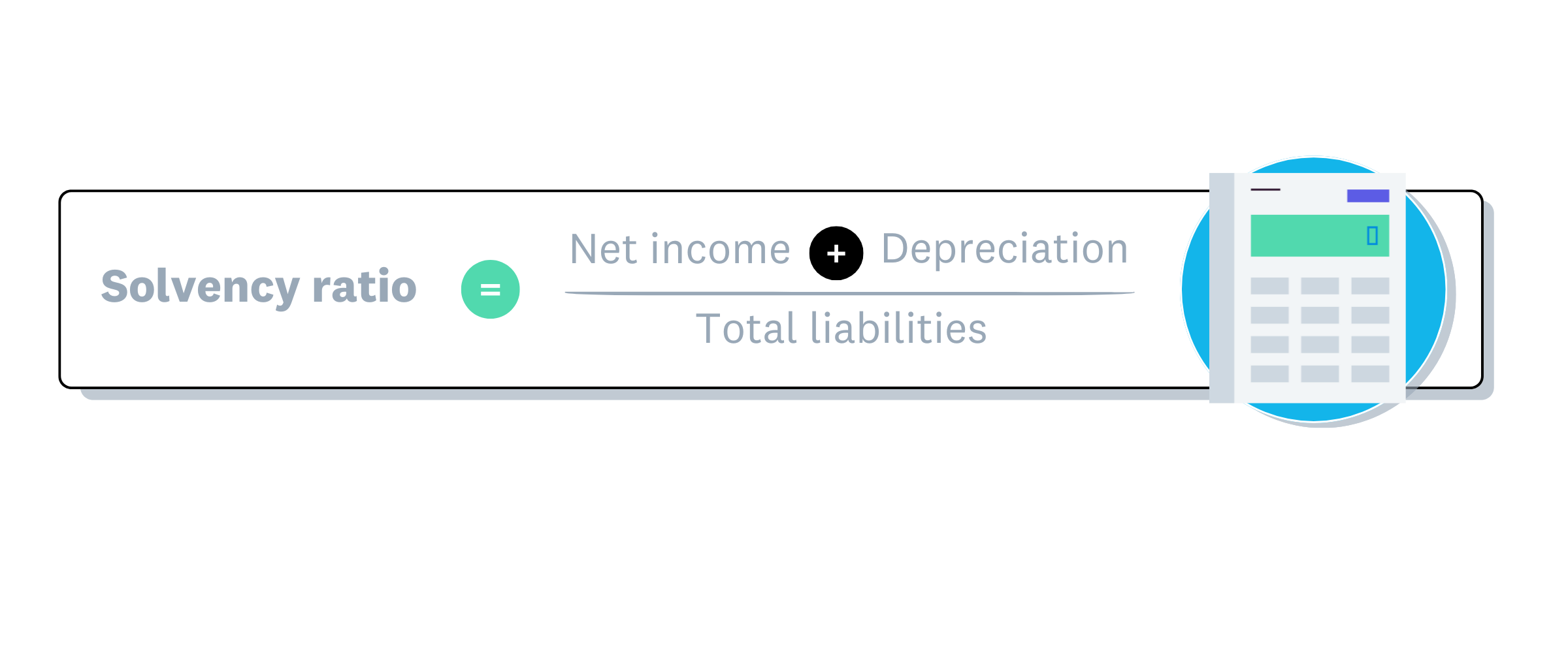

- Calculate your solvency ratio by dividing net income plus depreciation by total liabilities, aiming for 20% or higher to demonstrate your business can meet long-term financial obligations.

- Use the current ratio (current assets divided by current liabilities) to measure liquidity, targeting a ratio above 1.0 to ensure you have enough short-term assets to cover immediate debts.

- Improve liquidity by speeding up customer collections, monitoring cash flow regularly, and maintaining cash reserves for unexpected expenses, while boosting solvency through strategic debt management and consistent profit generation.

What does solvency mean in business?

Solvency is your business's ability to meet long-term financial commitments. A solvent business has positive net equity, meaning total assets exceed total liabilities.

If your assets are worth more than what you owe, your business is considered solvent and can sustain operations over time. This aligns with the concept of long-run solvency, defined as the ability to pay all business costs, including long-term obligations.

What factors affect your solvency?

To keep your business solvent:

- Maintain consistent profits: Generate enough revenue to keep total assets above total liabilities on your balance sheet.

- Manage debt strategically: Negotiate lower repayments and understand the terms of collateral loans before signing.

- Optimize asset use: Track inventory and other assets to maximize returns and minimize waste.

What is solvency vs profitability?

Solvency measures your ability to pay debts over time. Profitability measures how much you earn compared to your costs.

Strong profits boost your chances of staying solvent. However, poor debt management can lead to insolvency even if you're profitable.

For example, taking out new loans without paying off existing ones can push your total liabilities above your assets.

Learn more about profitability

How does solvency affect your business growth?

Staying solvent helps you:

- Secure financing: Borrow from banks and lenders who trust your ability to repay

- Attract investors: Bring in partners with resources and expertise

- Negotiate supplier terms: Buy in bulk to lower your cost per unit

- Plan for growth: Keep operations stable and focus on long-term strategy

What does liquidity mean in business?

Liquidity measures your ability to pay bills and loan repayments in the coming months. It compares current assets (cash, inventory, receivables) against current liabilities (debts due within a year).

Liquidity is commonly expressed as a ratio, such as the current ratio, quick ratio, or cash ratio. For example, federal regulators established a minimum liquidity coverage ratio for large banking organizations, requiring them to hold enough high-quality liquid assets to cover total net cash outflows for 30 days.

How liquid are your assets?

Liquid assets can be quickly converted to cash. Here's how different assets compare:

- Cash: Your most liquid asset. Includes physical currency and funds you can withdraw immediately.

- Accounts receivable: Invoices owed to you. Generally liquid, but longer payment terms reduce liquidity.

- Inventory: Moderately liquid. Can be sold, but timing varies.

- Physical assets: Buildings and equipment are least liquid. Selling them can take months.

Liquidity ratios and metrics

Small businesses commonly use three liquidity ratios:

- Current ratio: Current assets divided by current liabilities. Shows overall short-term financial health.

- Quick ratio (acid test): Cash, short-term investments, and receivables divided by current liabilities. Excludes inventory for a stricter measure.

- Cash ratio: Cash and cash equivalents divided by current liabilities. The most conservative liquidity measure.

Learn more in our guide on liquidity ratios.

How does liquidity affect business growth?

Strong liquidity helps you:

- Seize opportunities: Launch new products or hire staff when the timing is right

- Handle emergencies: Cover unexpected costs like equipment repairs or property damage

- Maintain stability: Avoid scrambling to find cheaper suppliers or new lenders

The main differences between solvency and liquidity

Solvency takes a long-term view of your financial health, while liquidity focuses on the short term. Here are the key differences:

- Time horizon: Solvency looks at years; liquidity looks at weeks or months

- What it measures: Solvency compares total assets to total liabilities; liquidity compares current assets to current liabilities

- Key question: Solvency asks "Can I pay debts over time?" Liquidity asks "Can I pay bills right now?"

The following table outlines additional differences. Track both metrics to maintain a complete picture of your financial health.

Why solvency and liquidity matter for your small business

Tracking both solvency and liquidity helps you make better decisions for daily operations and long-term planning.

Why solvency matters:

- Financial stability: Manage risks like clients not paying

- Growth capacity: Use resources to expand your business

- Stakeholder confidence: Keep investors and shareholders satisfied

Why liquidity matters:

- Operational continuity: Pay staff and suppliers on time

- Risk protection: Handle slow periods, market changes, or unexpected costs

- Cash flow health: Avoid disruptions from late customer payments

A business with poor solvency may struggle to pay long-term debts and could face bankruptcy. Learn about bankruptcy basics from the US Courts.

How to measure solvency and liquidity in your business

You can measure solvency and liquidity using simple ratio formulas. The following formulas and examples show you how to calculate each metric for your business.

Solvency ratio formula

Solvency ratio formula

Example: Martha's cafe

Martha's cafe has:

- Net income: $50,000

- Asset depreciation: $10,000

- Total liabilities: $300,000

Calculation: ($50,000 + $10,000) ÷ $300,000 = 20%

What this means: A solvency ratio of 20% or above is generally healthy. Martha's cafe has a good chance of paying its debts over time.

Note: Depreciation is the decrease in asset value from normal wear and tear, recorded on your balance sheet.

Liquidity ratio formula

There are several liquidity ratios, like the cash ratio, quick ratio, and the working capital ratio (also known as the current ratio), which is a useful long-term measure of liquidity.

Here's the formula for the working capital ratio:

Example: Sadiq's sports shop

Sadiq's sports shop has:

- Current assets: $120,000

- Current liabilities: $80,000

Calculation: $120,000 ÷ $80,000 = 1.5

What this means: A current ratio above 1.0 indicates good liquidity. Sadiq has $1.50 in current assets for every $1 of current liabilities, so he can likely meet his short-term obligations.

Tips to improve your financial solvency and liquidity

Use these practical ways to strengthen your financial position.

To improve solvency:

- Attract investors: Bring in new capital to boost your asset base

- Restructure debt: Renegotiate, refinance, or consolidate loans to reduce liabilities. Learn more about managing debt.

- Review operations: Identify cost-cutting opportunities, including staffing adjustments if needed

To improve liquidity:

- Monitor cash flow: Track inflows and outflows regularly. Learn how to track your cash flow.

- Benchmark performance: Compare your liquidity ratios against industry standards. Keep in mind that implementing systems to track these metrics can add operational costs, as seen when new information systems for calculating the Liquidity Coverage Ratio were projected to cost certain banking institutions $391 million.

- Speed up collections: Make it easier for customers to pay their invoices.

- Build reserves: Maintain a cash buffer for unexpected expenses

Use Xero to track your solvency and liquidity

With Xero accounting software, you know exactly what's happening with your numbers. Track daily spending with real-time dashboards, or review long-term solvency through detailed financial reports. Learn more about Xero's financial reports for your business.

Get one month free and see the full financial picture with Xero.

FAQs on solvency and liquidity

Find answers to common questions about solvency and liquidity.

What does it mean to provide liquidity?

Providing liquidity means ensuring your business has enough cash to cover short-term bills. You can improve liquidity by speeding up collections, such as offering early payment discounts.

Can my business have good solvency but poor liquidity?

Yes. A business can be solvent (assets exceed liabilities) while struggling with liquidity (limited cash on hand). For example, you might own valuable property but lack cash to pay this month's bills.

Is solvency good or bad?

Solvency is good. It means your business can meet long-term financial obligations. Higher solvency makes it easier to secure loans, attract investors, and weather economic downturns.

What is a good solvency ratio for my small business?

A solvency ratio of 20% or higher is generally healthy. However, ideal ratios vary by industry, so compare your results against businesses similar to yours.

What happens if my business has poor solvency or liquidity?

Poor solvency can lead to difficulty securing loans, strained investor relationships, and in severe cases, bankruptcy. Poor liquidity can cause missed payments, supplier issues, and cash flow crises. If you notice warning signs, take action quickly by reviewing your debt structure, speeding up collections, or seeking professional financial advice.

Get one month free

Sign up to any Xero plan, and we will give you the first month free.