Freelance invoicing: How to create and send invoices that get you paid

Learn how freelance invoicing helps you get paid faster, stay organized, and keep cash flow steady.

Written by Jotika Teli—Certified Public Accountant with 24 years of experience. Read Jotika's full bio

Published Friday 23 January 2026

Table of contents

Key takeaways

- Include essential invoice elements such as your business information, client details, unique invoice number, clear service descriptions, and specific payment terms to prevent delays and ensure prompt payment.

- Set shorter payment terms like Net 7 or Net 14 instead of the standard Net 30 to collect payments faster, as data shows shorter terms consistently result in quicker payment collection.

- Request a 50% deposit upfront before starting work to improve cash flow and keep clients engaged throughout the project, which has become increasingly common practice among freelancers.

- Follow up systematically on overdue invoices by sending a polite reminder email on day one after the due date, then making a phone call in week two to discuss any payment issues and identify potential problems.

Why freelancers need invoices

Professional invoicing establishes your credibility and protects your business. Here's why invoices matter for freelancers:

- Legal protection: Invoices create official payment records that protect you in disputes

- Tax compliance: Proper invoicing helps you track income for tax reporting, and the IRS requires freelancers to keep employment records for at least four years

- Cash flow management: Clear payment terms help you predict and manage income

- Professional image: Well-designed invoices build client trust and respect

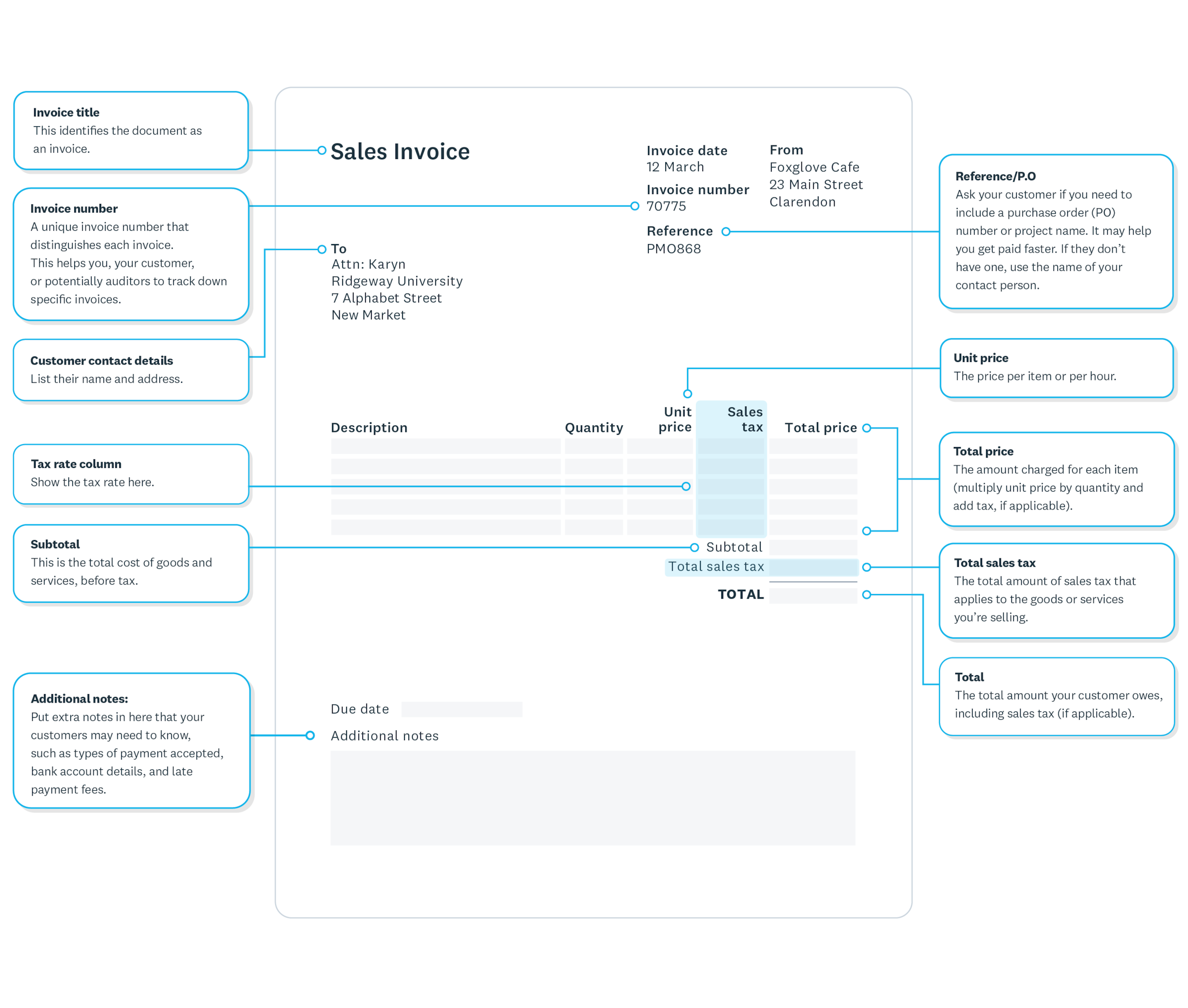

What to include in your freelance invoice

Invoice accuracy prevents payment delays caused by missing or incorrect information. A complete freelance invoice must include specific details to ensure prompt payment.

Essential invoice elements:

- Your business information: Name, address, and contact details

- Client information: Company name, billing address, and contact person

- Invoice specifics: Unique number, date issued, and payment due date

- Service details: Clear description of work completed

- Payment terms: Amount due, accepted payment methods, and late fees

Use a consistent template to avoid errors and speed up your invoicing process.

How to create a freelance invoice

Creating an invoice is straightforward once you know the steps. You can start from scratch, use a template, or use invoicing software to make the process even easier. Each method helps you create a professional document to send to your clients.

Follow these steps to create your invoice:

Step 1: Add your business details

Include your complete information so clients know exactly who to pay:

- Business or personal name: Use your legal business name

- Complete address: Street address, city, state, and ZIP code

- Contact information: Phone number and email address

Step 2: Include client information

Accurate client details ensure your invoice reaches the right person and gets processed quickly:

- Legal business name: Use the official company name, not just the brand name

- Billing address: Confirm the correct address for invoice processing

- Correct contact: Send to accounts payable, not your project contact

- Verification: Double-check all details before sending your first invoice

Step 3: Assign an invoice number

Give each invoice a unique number to help you track payments.

Step 4: List your services

Clearly describe the work you completed, breaking it down into individual line items if needed.

Step 5: Calculate the total

Add up the cost of all services and include any taxes to get the final amount due.

Step 6: Set the payment due date

This is the most critical element of your invoice. Clear deadlines drive faster payment.

Payment term options:

- Net 7: Payment due within 7 days (fastest collection)

- Net 14: Payment due within 14 days (good balance)

- Net 30: Payment due within 30 days (industry standard)

Xero data shows shorter payment terms result in faster payments. Always include both the invoice date and due date.

Freelance invoice templates and tools

You don't have to create a new invoice from scratch every time. Using templates or invoicing software can save you time, reduce errors, and give your invoices a professional look. This helps you get paid faster and spend more time on your actual work.

Consider these options:

- Invoice templates: You can download a free invoice template to ensure you have all the necessary fields. Simply fill in the details for each new job.

- Invoicing software: Tools like Xero automate the entire process. You can create and send invoices, track when they're opened, and even send automatic payment reminders.

Set clear invoice terms

Invoice terms are the payment conditions you set with clients before starting work. Clear terms prevent payment delays and disputes.

Essential terms to establish:

- Payment schedule: Weekly, monthly, or milestone-based invoicing

- Payment deadlines: Net 15, Net 30, or custom timeframes

- Accepted payment methods: Bank transfer, credit card, or check

- Late payment fees: Penalties for overdue invoices

Pro tip: For large projects, invoice monthly instead of waiting until completion to improve your cash flow.

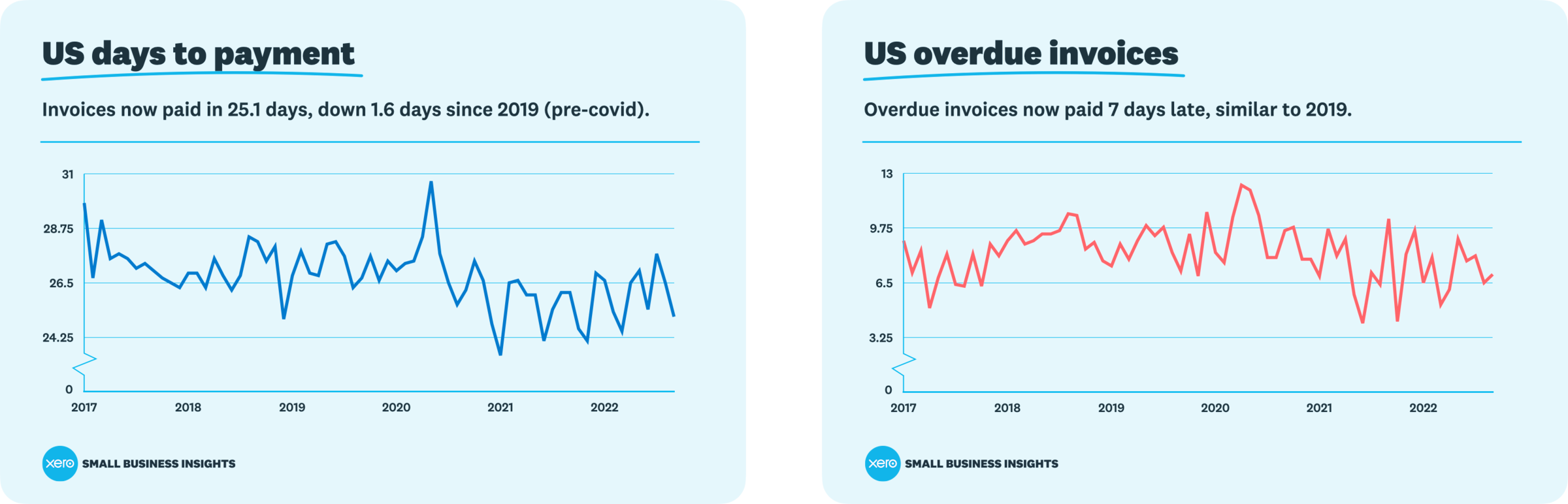

Get paid faster with shorter payment terms

Payment times have improved for US freelancers, with data showing faster collection rates.

Current payment statistics:

- US average: 25.1 days (down from 26.7 days in 2019)

- Overdue invoices: Typically paid 7-9 days late

Key insight: Shorter payment terms lead to faster payments, according to Xero data.

With Xero's Tap to Pay feature on the Xero Accounting app, small businesses can accept all types of contactless payments directly from their mobile phones. Customers can tap their credit card, debit card, or digital wallet for a fast, convenient payment experience. Powered by Stripe, it makes accepting payments simple and helps keep your cash flow moving.

How to avoid late payments

Late payment prevention requires proactive strategies that address common payment delays. Here are proven methods to get paid on time:

Eliminate avoidable delays

Timing strategies:

- Send immediately: Invoice as soon as work is complete, not end of month

- Identify decision makers: Find the accounts payable contact, not just your project contact

- Verify details: Call to confirm email addresses and requirements before first invoice

- Include contact info: Add your phone and email for quick client questions

- Track everything: Maintain records of sent, paid, and overdue invoices

Check the customer's history

Look into the credit rating of new customers, especially if it's a big job. For repeat customers, be mindful of their past payment history before booking more work.

Review payment terms

You can set shorter payment terms than 30 days if that works better for your cash flow. Many businesses now ask for payment within seven days. This ensures that clients deal with your payment quickly, rather than forgetting.

Get a payment upfront

It’s increasingly common for freelancers to charge a 50% deposit before starting work. This helps to keep clients engaged, which will keep the project moving. It also helps your cash flow, which is critical for avoiding situations where you might need to use personal funds or credit to finance day-to-day operations while waiting on client payments.

Make it easy for clients to pay

The easier it is for clients to pay your invoice, the faster you will be paid. Adopting modern methods also has other benefits; a Department of Defense study found that processing an electronic invoice can be more than five times cheaper than processing a paper one.

Tell clients what forms of payment you accept, and include your bank details. Also, consider accepting card payments. Xero's internal data reveals that payments are twice as fast if you accept online payments like a card or automated clearing house (ACH) transfer.

Send your invoice and follow up effectively

Invoice delivery starts your payment timeline immediately. Choose the method that works best for your client's payment process.

Delivery methods:

- Email: Send PDF invoices with "Invoice #[number]" in subject line

- Invoicing software: Use platforms like Xero for automated delivery and payment tracking

- Mail: Print and mail for clients who require physical invoices

Best practice: Send invoices immediately after completing work to start the payment clock.

Online invoicing from Xero allows you to send invoices from your desktop or phone as soon as the job is completed.

Following up on your invoice

Follow-up timeline ensures you collect payments without damaging client relationships. Use this systematic approach:

Day 1 (due date passed):

- Send reminder email: Polite notice that payment is overdue

- Include invoice copy: Attach original invoice for reference

Week 2:

- Make phone call: Discuss any payment issues directly

- Follow up in writing: Email summary of your conversation

- Identify problems: Check for missing purchase orders or approval issues

If an invoice is very overdue, resend it and confirm:

- They received the invoice

- It contains all the details they need to process payment

- The goods or services and prices were as expected

Work with them to resolve any disputes arising from these questions. If everything is okay but they're struggling with cash flow, see if you can work out a new payment schedule.

Automating follow-up is simple with Xero online invoicing. It shows when customers have opened your invoice and sends automatic reminders before or after the due date.

Streamline your freelance invoicing with Xero

Managing your invoices shouldn't take time away from running your business. With Xero, you can simplify the entire process, from creating professional invoices to tracking payments and sending reminders. With everything in one place, you can stay organized, improve your cash flow, and focus on what you do best.

Ready to make invoicing easy? Try Xero for free and see how it can help your freelance business.

FAQs on freelance invoicing

Here are answers to some common questions about freelance invoicing.

How do I invoice as a freelancer?

You can invoice as a freelancer by creating a professional document with your business details, client information, a list of services, the total amount due, and payment terms. Using an invoice template or accounting software like Xero can make this process simple and fast.

What is the best invoicing tool for freelancers?

The best tool depends on your needs. Many freelancers start with templates, but invoicing software like Xero offers more powerful features. It allows you to automate invoicing, track payments, send reminders, and manage all your finances in one place, saving you time as your business grows.

Do I need to charge sales tax on my freelance services?

Whether you need to charge sales tax depends on your location and the type of service you provide. Tax laws vary by state, so it's important to check your local regulations to ensure you are compliant.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Get one month free

Sign up to any Xero plan, and we will give you the first month free.