Cash Flow Forecast: How to Predict and Manage Your Cash

Learn how a cash flow forecast helps your small business plan bills, fund growth, and make smarter decisions.

Written by Kari Brummond—Content Writer, Accountant, IRS Enrolled Agent. Read Kari's full bio

Published Wednesday 11 February 2026

Table of contents

Key takeaways

- Create cash flow forecasts to predict your future cash position and prevent costly shortages by estimating all incoming money (sales, loans, grants) and outgoing expenses (rent, payroll, loan payments) over specific time periods.

- Choose the appropriate forecasting timeframe based on your business needs: use short-term forecasts (days to 3 months) for immediate cash management, medium-term (3-12 months) for annual planning, and long-term (1-5 years) for major business decisions like expansion or loan applications.

- Utilize accounting software instead of manual spreadsheets to automate data collection and updates, which saves time and provides more accurate projections as your business grows and transaction volumes increase.

- Update your forecasts regularly with actual results to improve accuracy over time, and build conservative estimates by projecting lower income and higher expenses to account for unpredictable business fluctuations.

What is a cash flow forecast?

Cash flow projection is a financial tool that predicts how much money your business will have at specific future dates. It estimates incoming and outgoing cash to show your expected cash position.

This forecasting provides crucial visibility into your business's future financial health. You can plan spending, avoid cash shortages, and make informed decisions about growth investments.

A cash flow projection is different from a cash flow statement. While a statement looks back to past cash flows, a projection looks forward.

What goes into a cash flow forecast

A complete cash flow projection includes:

- Starting balance: Current cash in your business accounts

- Cash inflows: Expected money coming in from sales, loans, grants, and other sources

- Cash outflows: Planned expenses, loan payments, owner draws, and other costs

- Ending balance: Projected cash position at the end of your forecast period

- The forecast should include all the cash coming into your business, both from sales and other sources like loans, grants, tax refunds, or owner contributions.

- Outgoing cash should include expenses, loan payments, owner draws (money the owner takes out of the business that isn't wages), and cash that's going out of your business for any other reason.

Two main methods exist for creating cash flow projections, though the use of the direct method in public filings has been decreasing through time, according to SEC analysis.

- Direct method: Gather and list individual cash transactions (sales receipts, bill payments, loan payments) to build your forecast piece by piece

- Indirect method: Use existing financial statements (income statement and balance sheet) to estimate future cash flows

You can learn more about these methods and their differences in the steps to creating a forecast in the next section.

The more accurate your estimates are, the more accurate your forecast will be. Learn more about cash flow forecasts from the US Treasury.

Components of a cash flow forecast

A cash flow forecast has three main parts that work together to show you the full picture of your money. Understanding them helps you see where your business stands.

- Cash inflows: This is all the money coming into your business. It includes revenue from sales, payments from customers, loans you receive, and any other cash you get.

- Cash outflows: This is all the money going out. Think of expenses like rent, payroll, inventory costs, loan repayments, and marketing.

- Net cash flow and closing balance: Your net cash flow is the difference between your inflows and outflows for a period. Add this to your starting cash balance, and you get your closing balance – the amount of cash you expect to have at the end of the period.

Benefits of a cash flow forecast

Cash flow forecasting helps you maintain financial control and avoid costly surprises. Key benefits include:

- Prevent cash shortages: Spot potential shortfalls early and secure financing or delay expenses

- Evaluate growth plans: Determine if you can afford new equipment, staff, or expansion projects

- Identify financial trends: Quickly detect rising expenses or declining income patterns

- Solve cash flow problems: Address issues like slow-paying customers or impractical payment terms

- Plan owner compensation: Ensure sufficient cash flow to pay yourself regularly, keeping in mind the IRS sets the SE tax rate on net earnings at 15.3% for Social Security and Medicare.

Learn more from Washington BizFair about how cash flow forecasts can help you make business decisions.

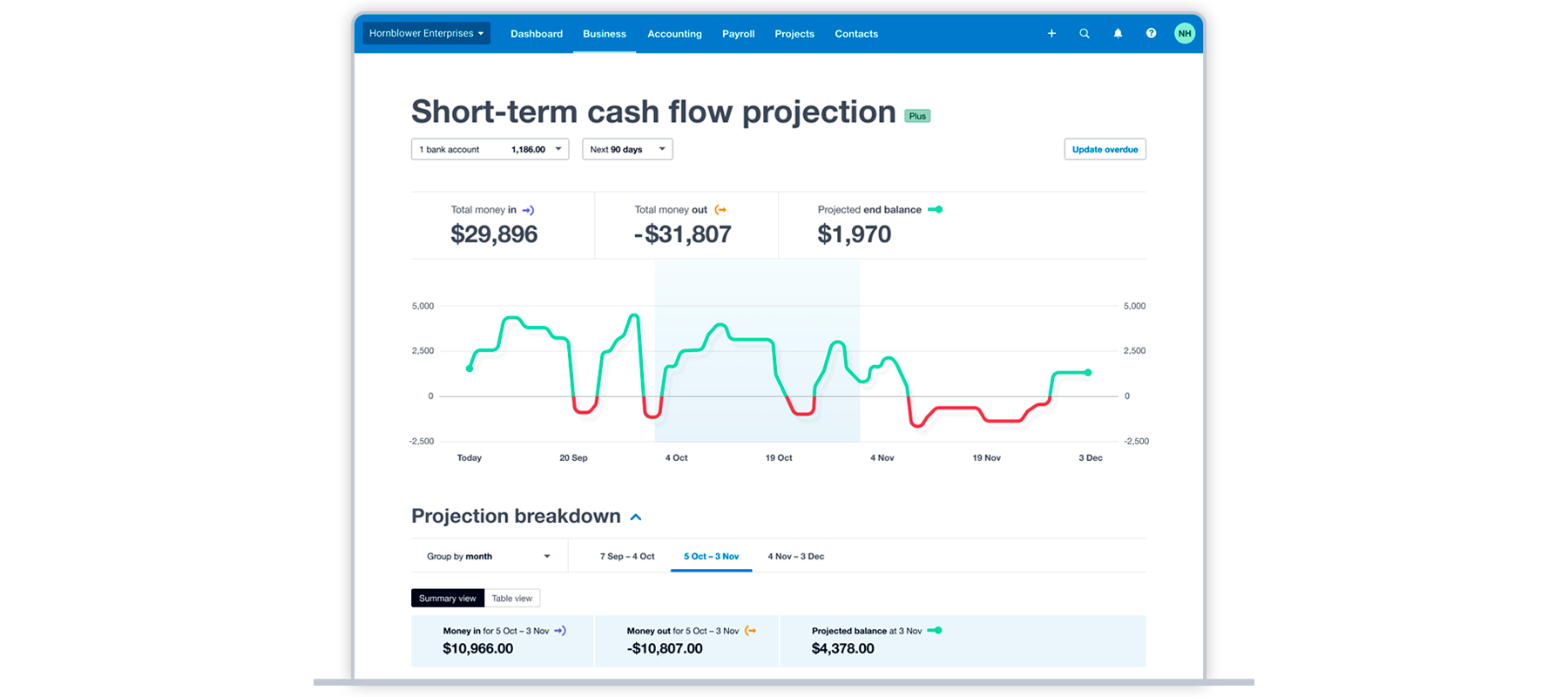

A cash flow dashboard shows how cash balances will rise and fall in response to expected transactions.

A cash flow dashboard shows how cash balances will rise and fall in response to expected transactions.

Types of cash flow forecasting periods

Cash flow forecasting periods determine how far into the future you predict your cash position. Different timeframes serve different business planning needs.

Short-term forecasts

Short-term forecasts cover cash flow over the next few days to 3 months. These projections focus on immediate cash availability.

Use short-term forecasts to avoid overdrawing your account, plan inventory purchases, or prepare for urgent expenses.

Medium-term forecasts

Medium-term forecasts project cash flow over 3 to 12 months ahead. These reports help with annual planning and major business decisions.

Common uses for medium-term forecasts include planning for seasonal cash flow changes, budgeting for equipment purchases, and preparing for off-season revenue drops.

Long-term forecasts

Long-term forecasts project cash flow 1 to 5 years into the future. These strategic reports guide major business planning decisions.

Use long-term forecasts for:

- Loan applications and financing decisions

- Business expansion planning, which can be informed by IRS definitions for small business taxpayers based on average annual gross receipts

- Preparing for economic challenges or market changes

Mixed-period forecasts

A mixed-period report helps you set goals and budget. A forecast with mixed time frames lets you test different scenarios, such as:

- How short-term expenditures affect long-term cash flows

- How improving short-term cash flow makes it possible to invest in growth over the long term

Learn more about financial management, including cash flow budgeting strategies, with the FDIC's small business resources.

How to forecast your cash flow

Cash flow forecasting involves estimating when money will come in and go out of your business, then calculating your expected cash position at specific future dates.

You can create forecasts using spreadsheets or specialized software. Here's a cash flow projection template to simplify the process.

1. Set clear forecasting goals

Define your forecasting purpose before building your projection. Clear goals determine your forecast timeframe and level of detail.

Here are some examples of common forecasting goals:

- Ensuring sufficient cash for payroll and immediate expenses

- Planning major equipment purchases or facility improvements

- Evaluating financing needs for business expansion

2. Choose your forecasting time frame

Choose a time frame that lines up with your goals. Urgent questions require a short-term forecast, but if you're thinking about the future, you need a medium, long, or mixed-term report.

3. Choose a forecasting method

There are two cash flow forecasting methods: direct and indirect. The choice between them comes down to how far into the future you're forecasting, how you want to create your forecast (manually or with software), and how accurate your past cash transactions are to your projected future transactions.

- The direct method, as described above, is when you note all your expected incoming and outgoing cash to predict how much cash you'll have on hand at a certain point in the future.

- The indirect method is the same concept, but it uses income (profit and loss) statements and the balance sheet to create the forecast. Generally, you don't need special cash flow forecasting software to do this; these capabilities are built into most bookkeeping software.

You start an indirect cash flow forecast with the cash on hand noted on your balance sheet. Then, use the income and expenses from your profit and loss reports over a certain period to make predictions about the future.

4. Collect data for your forecast

To do a direct cash flow forecast, make a list of all of your upcoming cash inflows and outflows.

- Create sales flows (cash inflows) based on past sales reports for the same period. Adjust them if you think sales will be higher or lower than previous periods. If you invoice clients, make a list of the outstanding invoices (accounts receivable) and the dates they're likely to get paid. Remember to account for future income that hasn't been invoiced yet.

- For outflows, look at your bills (accounts payable) and upcoming loan payments, but also include any unusual expenses that may be coming up, like repairs, incidentals, or staff bonuses.

To gather the numbers, use old sales reports, invoices, bank statements, or accounting records. A cash flow calculator like this one can help you estimate how much cash you'll have after accounting for your inflows and outflows over a certain period.

Cash flow forecasting with spreadsheets or software

Two main tools help create cash flow forecasts: spreadsheets and specialized software. Each tool has different benefits and is best for different business needs.

Spreadsheet forecasting:

- Benefits: Complete control over data entry and customization

- Best for: Small businesses with simple cash flows and time for manual updates

Software forecasting:

- Benefits: Automatic data import and faster updates

- Best for: Businesses with many transactions or complex cash flows

Software from the financial technology (fintech) sector helps you create a projection with a few taps on your computer, and the growing importance of this sector has led to government reports on the fintech industry. The process is fast and works well even as your business and transaction volumes grow. Auto-generated forecasts are limited to past performance, but if your business is changing, you can manually adjust for additional cash inflows or outflows to create a more realistic forecast than you can with historical data alone.

How to do a cash flow projection with a spreadsheet

Follow these tips for completing a cash flow projection with a spreadsheet:

- Choose a forecast period and note how much cash you have at the beginning of that period.

- List and date all your expected cash income for the forecast period, including sales receipts and things like grants, tax refunds, or incoming financing that will impact your accounts.

- List and date your outflows, too. Besides familiar business costs, capture less regular items like annual fees or taxes that might come due, or repairs you need to make during the period.

- Take your starting balance and run through the forecasting period, adding incoming amounts and subtracting outgoing amounts. This will show how much cash you'll have at a given point in time.

Here's an illustrated example of this approach.

Forecasting cash flow with software

Accounting software like Xero makes it easy to generate a cash flow projection as it's designed to track business incomings and outgoings, which means it can create a projection with a few clicks.

Xero accounting software also integrates with other apps to provide robust, long-term projections. Popular forecasting apps on the Xero App Store include Fathom and Calxa.

Other ways to carry out your cash flow forecasting

You can also generate cash flow projections from your balance sheet and income statement. These typically provide longer term cash flow guidance rather than daily or weekly projections.

But you'll need accounting knowledge, so ask an accountant if you want to know more. You can find one in Xero's advisor directory.

An example of cash flow forecasting

The finance manager of Tiny Construction wants to assess whether the business's cash flow is enough to buy a new piece of equipment in the next month. The equipment costs $20,000.

Based on its current bank balances and bank reconciliations, Tiny Construction has a starting balance of $45,000. Outstanding invoices and sales forecasts estimate that incoming payments from sales in the next 30 days will be $90,000. There are no other incoming payments for the month.

So the "money in" part of the cash flow projection looks like this:

The "money out" part of the cash flow projection looks like this:

With incoming sales receipts of $90,000 and outgoings of $65,000, the company would have added $25,000 in net cash flow for the period. Adding that to the $45,000 of existing cash means the business will have $70,000 left in its bank account at the end of the month. This would become their starting balance the following month.

But if they buy the equipment with surplus cash, their starting balance for the next month would reduce to $50,000. This example shows how businesses can use cash flow projections to make investment decisions and estimate whether they would be able to afford it or would have to consider financing it.

Cash flow forecasts help you manage your business finances

Strong cash flow makes it easier to run your business. A cash flow projection helps you improve your cash flow planning and take control of your business's finances.

To reduce the time you spend collecting and updating cash flow data, you can automate the process with accounting software like Xero. If you're not ready for software, you can start by downloading a free cash flow projection template.

FAQs on cash flow forecasting

How do you analyze a cash flow projection?

Analyze your cash flow projection by reviewing three key metrics:

- Closing balance: Expected cash remaining at the end of each forecast period

- Net cash flow: Total change in cash reserves (positive means cash increased, negative means cash decreased)

- Forecast accuracy: Compare projected amounts to actual results to improve future forecasts

If your projection was off, find out what you overestimated or underestimated. Doing this will help make your next projection more accurate and may highlight patterns in your business you had not noticed before.

How often should I make cash flow projections?

Update frequency depends on your business size and complexity:

- Small businesses: Quarterly or annually for basic planning

- Growing businesses: Monthly for better cash management

- Large businesses: Monthly or weekly for detailed control

Create forecasts whenever you need to make cash-dependent decisions:

- Planning inventory purchases

- Evaluating equipment investments

- Timing major expenses or expansion

What's the best way to handle irregular or unpredictable income in cash flow forecasting?

Handle unpredictable income by building conservative estimates into your forecasts:

- Estimate conservatively: Use low projections for income and high estimates for expenses

- Include irregular transactions: Account for seasonal variations, one-time expenses, and variable income

- Update regularly: Refresh forecasts with actual results to improve accuracy over time

Then, update your projections with the actual numbers in real-time. That way, you can check the accuracy of your projections and adjust future reports as needed. If you run a 12-month projection with a column for each month, say, you might refresh it at the end of each month. Drop the last month off, add another month to the end, and check all the projections in between to see if anything needs updating.

Also, think about doing scenario analysis to see how different events may affect your cash reserves. Just use your imagination to assess different scenarios. For instance, how would an unexpected repair, a natural disaster, or losing a key employee affect your cash flow?

How do I incorporate seasonal trends and market fluctuations into a cash flow forecast?

Historical data can help you identify seasonal changes in your cash flow, like when you can expect recurring income or expenses. But your data has to be right – if you generate a projection for this month based on last month, it won't work if last month was the busy season and this month is the slow season. So use time periods that correlate with your seasonal highs and lows, and you might need to adjust your forecasts based on seasonal patterns or changing industry trends.

How can I forecast cash flow during periods of rapid growth or expansion?

If your business is changing rapidly, factor in revenue growth but also consider how that increases costs like payroll and inventory purchases. To keep your forecasts accurate, use short-term or rolling forecasts.

Rolling forecasts are continuously updated as time goes along. For instance, on a 12-month forecast, you add a new month every time one drops off. Traditional projections, in contrast, are static: they look at a set period of time, and as time passes, the forecast gets shorter. For example, on month 3 of a 12-month static forecast, you only see the remaining 9 months.

Update your reports based on actual cash flows, then modify future forecasts based on the accuracy of your previous estimates.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Get one month free

Sign up to any Xero plan, and we will give you the first month free.