Bank reconciliation made easy in the US

Keep your financials and bank account balances in sync. Easily code and compare your transactions against a bank statement and close the period. Create a report as a lasting record.

Spend less time on bank reconciliation

Focus on running your business with bank account reconciliation software that saves you time and helps you keep accurate accounting records.

Code transactions regularly

Keep ahead by regularly reviewing your AI-powered and bank rule-driven transaction matches.

Match bank transactions in bulk

Use bank rules and code bank transactions in bulk (on Growing or Established plans) to save time and improve accuracy.

Reconcile a period against a bank statement

Double-check transactions against a bank statement and create a reconciliation report for the balanced period.

89% of customers [say they] save time using Xero

*Source: survey conducted by Xero of 271 small businesses in the US using Xero, May-June 2024

Code transactions regularly

Set up bank feeds and keep ahead by reviewing and accepting Xero’s AI-powered and bank-rule-driven suggested matches regularly. This helps you access up-to-date account balances, financial records and cash flow reports.

- Do bank reconciliation from any device

- Match items from your bank account to invoice or bill payments

- Set up bank rules, and use handy search and filter tools to save time

- Manually import bank statements if your bank doesn’t connect to Xero

Reconcile bank transactions in bulk

When there are many unreconciled bank transactions to code, you can code them in one go for fast account reconciliation (except on Early plans).

- Sort and group transactions, then code them in bulk to save time

- Apply a bank rule to a group of bank transactions

- Receive alerts for suggested matches to invoices or bills

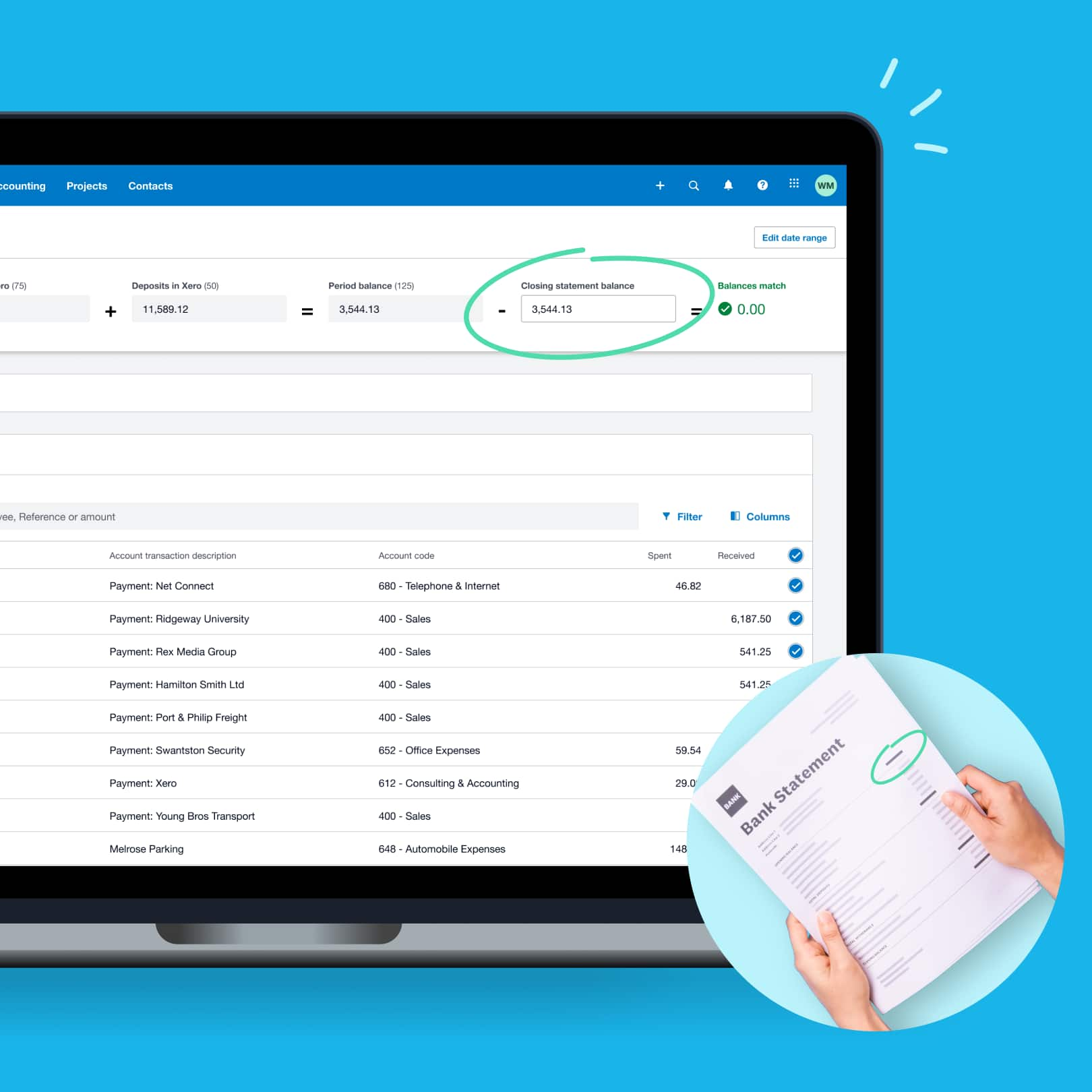

Reconcile a period against a bank statement

If you want to, you can perform an additional check of your Xero transactions against your bank statement to confirm they’re complete and correct, and create a report for your records. Your transactions will be protected from future changes.

- Review transactions that are grouped according to your period dates

- Use easy search and filter tools to find transaction discrepancies

- Create a report for your balanced period as a lasting record

More information on bank reconciliation

Get set up for bank reconciliation by adding your bank accounts in Xero, connecting to your bank to receive automated bank feeds, and setting opening balances.

Get set up for bank reconciliation by adding your bank accounts in Xero, connecting to your bank to receive automated bank feeds, and setting opening balances.

As your bank transactions automatically flow into Xero, reconcile all your accounts regularly so your financial records are accurate and up to date. When you reconcile your accounts, you match your bank statement lines to transactions in Xero, such as invoices, bills and other payments.

As your bank transactions automatically flow into Xero, reconcile all your accounts regularly so your financial records are accurate and up to date. When you reconcile your accounts, you match your bank statement lines to transactions in Xero, such as invoices, bills and other payments.

Review and match bank transactions over your morning coffee or in any free moment using the Xero accounting app.

Review and match bank transactions over your morning coffee or in any free moment using the Xero accounting app.

Easily manage your bank accounts from the Xero dashboard. Each account has its own panel which shows the bank statement balance, the balance in Xero, and the number of statement lines to be reconciled.

Easily manage your bank accounts from the Xero dashboard. Each account has its own panel which shows the bank statement balance, the balance in Xero, and the number of statement lines to be reconciled.

View your bank account balances, cash flow, unpaid invoices, monthly profit and more when your bank account reconciliation is up to date. See reconciled bank transactions and receive alerts about unreconciled transactions on the Xero dashboard.

See how to view and customize the Xero dashboardView your bank account balances, cash flow, unpaid invoices, monthly profit and more when your bank account reconciliation is up to date. See reconciled bank transactions and receive alerts about unreconciled transactions on the Xero dashboard.

See how to view and customize the Xero dashboardWhen you reconcile, Xero alerts you if your actual bank balance and the balance of the bank account in Xero aren’t the same. If they don't match, the bank reconciliation summary makes it easy to check for missing, deleted, or duplicated bank transactions.

See how to run a bank reconciliation summary reportWhen you reconcile, Xero alerts you if your actual bank balance and the balance of the bank account in Xero aren’t the same. If they don't match, the bank reconciliation summary makes it easy to check for missing, deleted, or duplicated bank transactions.

See how to run a bank reconciliation summary report

Accounting software for your US small business

Running a small business is hard enough without complex financial admin taking up your time. With Xero, completing tasks like bank reconciliation is a fast and simple process. Xero gives you the tools to manage your finances so these don’t become another full-time job.

See how Xero can help your small business

Check out our small business guides

Bank reconciliation is just one piece of the puzzle. Here are some guides on key topics for business owners.

What is bank reconciliation?

Let’s take it back to basics. Once you understand bank reconciliation, you can get it right every time.

How to do bank reconciliation

Making sure every transaction is accounted for isn’t just about compliance – it’s about financial confidence.

Growing your business

Ready to scale up? Here are some ways you can achieve healthy business growth.

Get one month free

Purchase any Xero plan, and we will give you the first month free.

It’s something I’m going to be able to teach my future employees

Xero gives John a better idea of his cash flow at Horsetooth Hotsauce

FAQs about Xero in the US

Yes, Xero’s reporting and analytics capabilities help you easily prepare and submit your returns so you never miss a deadline. Your numbers will be accurate and all stored in one secure place.

See tax information for businesses from the IRS.Yes, Xero’s reporting and analytics capabilities help you easily prepare and submit your returns so you never miss a deadline. Your numbers will be accurate and all stored in one secure place.

See tax information for businesses from the IRS.Yes – Xero partners with Gusto for a full-service payroll solution. Gusto saves you time on all aspects of your payroll – including calculating employee pay and deductions – thanks to its clever automations.

Check out payroll with GustoYes – Xero partners with Gusto for a full-service payroll solution. Gusto saves you time on all aspects of your payroll – including calculating employee pay and deductions – thanks to its clever automations.

Check out payroll with GustoThe best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plans.The best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plans.No – Xero is based in the cloud, so all you need is an internet connection. But you need a multi-factor authentication (MFA) app to log in to Xero. MFA extra layer of security by checking that it’s really you when you log in.

Learn about data protection with Xero.No – Xero is based in the cloud, so all you need is an internet connection. But you need a multi-factor authentication (MFA) app to log in to Xero. MFA extra layer of security by checking that it’s really you when you log in.

Learn about data protection with Xero.Yes, the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business in the USA.

Check out the Xero App Store.Yes, the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business in the USA.

Check out the Xero App Store.

See how bank transactions flow securely into Xero

This video will make you hungry.