Faster payments start with more ways to pay

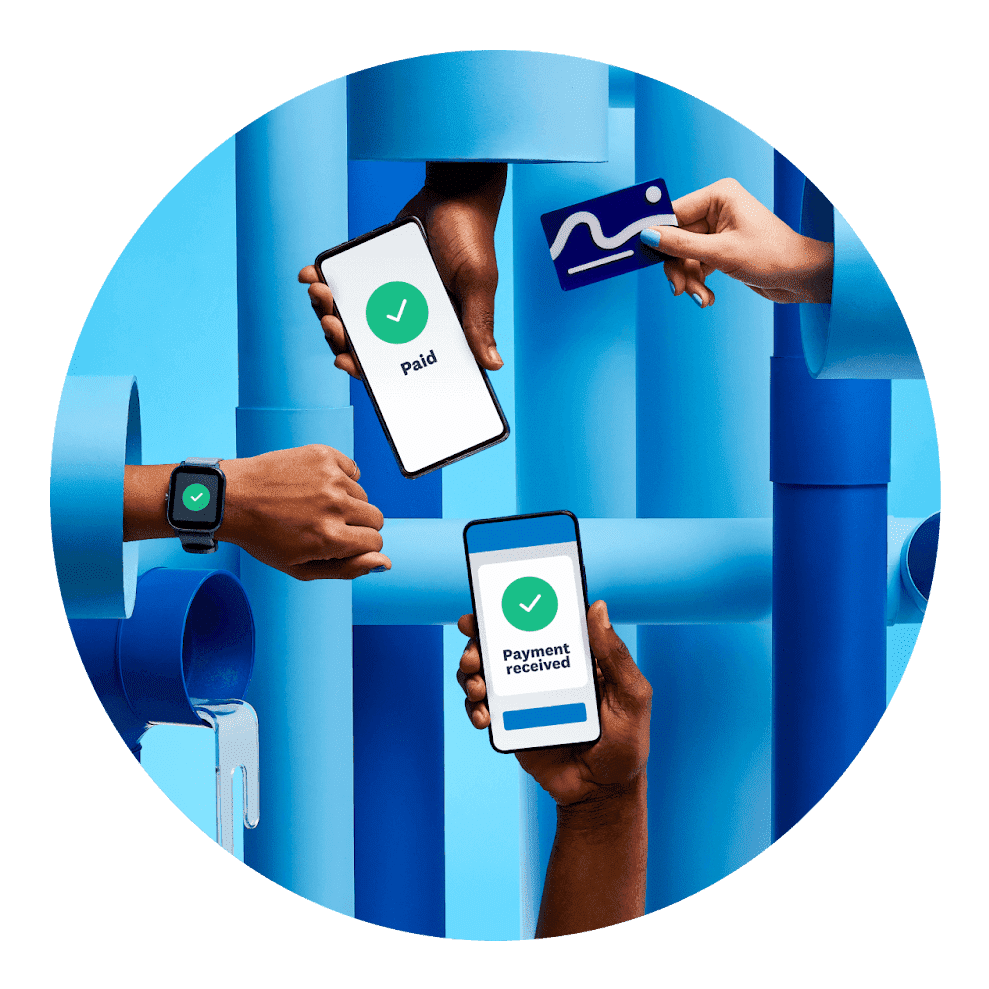

You've done the work. You shouldn't have to wait to get paid for it. When customers can pay by card, digital wallet, or ACH debit — straight from their invoice, businesses get paid up to twice as fast. Because when paying is easy, you stop wondering when you'll get paid.

Xero online payments: fast and frictionless

Xero smooths every step of your customer payments.

Give your customers minimal steps

On receiving your invoice, they just click the Pay now button to get started.

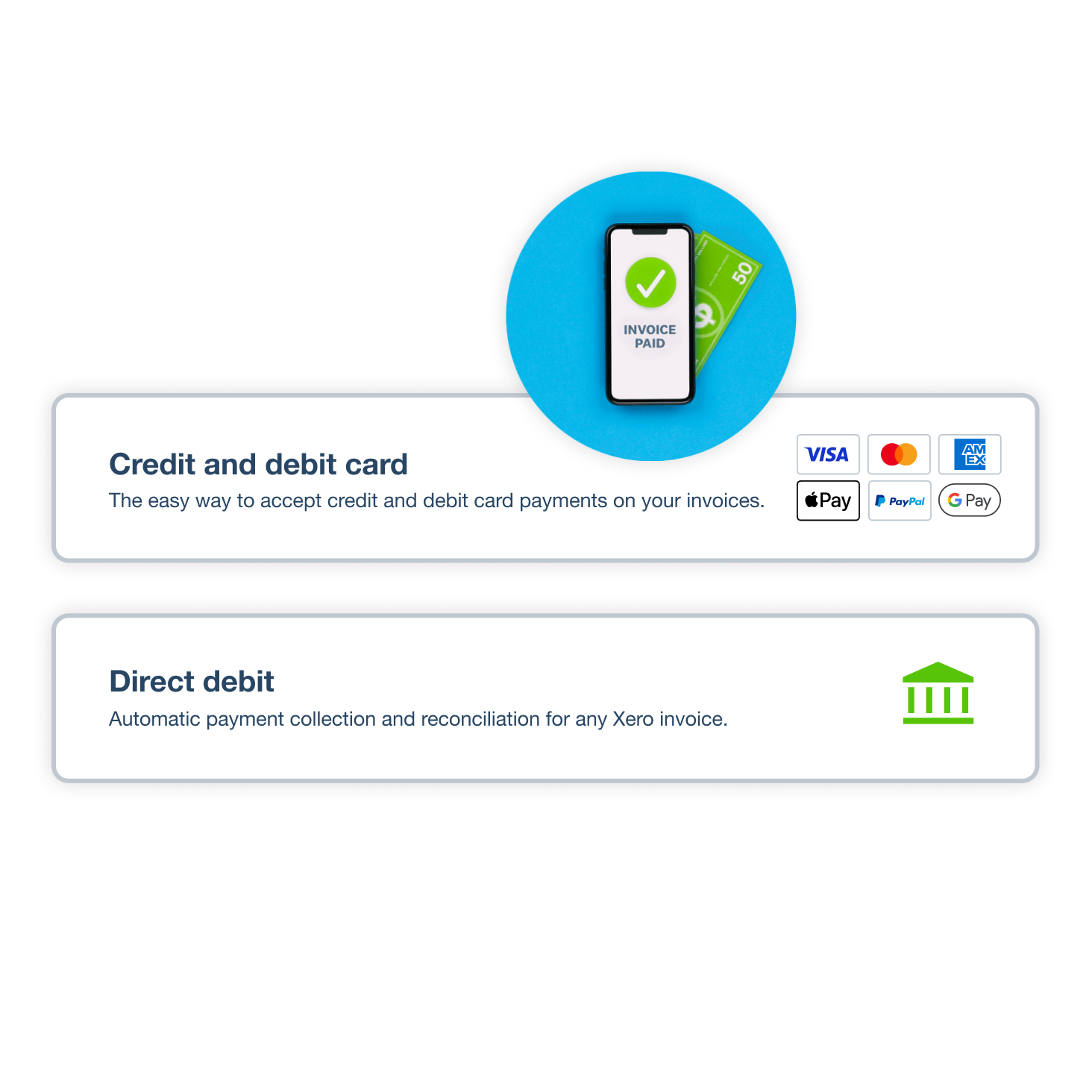

Let them choose how to pay

Credit card? Direct debit? Apple Pay? Give them the options they’re comfortable with.

Offer trusted payment providers

Customers will know they can trust secure US online payment providers, including Stripe and GoCardless.

Let customers pay the way they want

86% of customers say they prefer to pay via credit and debit card, so give your customers the choice to pay how they want. By offering online invoice payment options with Stripe or GoCardless, you're more likely to get paid faster.

- Use Stripe to accept online payments by credit and debit cards, digital wallets, Klarna, ACH Debit, and more

- Accept in-person payments on the spot, via Stripe, using your mobile and the Xero Accounting app

- Use GoCardless to automate recurring payments by ACH Direct Debit

81% of customers [say they] spend less time chasing payments using Xero

*Source: survey conducted by Xero of 104 small businesses in the US using Xero, May-June 2024

Add a Pay now button to your invoices

Set up online payments and your customers can pay you straight from their invoices. They just speed through a few quick steps while trusting in a choice of secure US payment providers. And you probably won’t need to chase them for a late payment!

- It’s easy to add the Pay now button to your online invoices

- Customers just click or tap the button to make the payment directly from the invoice

- By saving your customers time, you’ll increase their satisfaction and loyalty

Keep your online payments secure

Xero works with trusted providers to give you and your customers full confidence in the payments process.

Multi-factor authentication

Anyone accessing your Xero organization needs to go through several steps to log in.

Multiple layers of protection for your data

This includes encryption when your data is stored and transferred.

Tamper-resistant invoices

Xero’s online invoices are harder to alter than PDFs and include an audit trail.

Keep your online payments secure

Xero has the technology to give you full confidence in the payments process.

ISO 27001 security standard compliance

Xero meets the international standard for security management systems.

Multiple layers of protection for your data

This includes multi-factor authentication and encryption when your data is stored and transferred.

Take payments from your ecommerce store

If you sell on Amazon or Shopify, upgrade your Xero subscription to include Xero Inventory Plus so you sync these ecommerce sales with Xero – a streamlined way to accept secure online payments.

- Sync all your sales channels to see your numbers together in Xero

- Check your total sales and profits on your Xero dashboard

- Keep accurate records of your payments for your IRS tax reporting

Plans to suit your business

All pricing plans cover the accounting essentials, with room to grow.

Early

Usually $25

Now $3.75

USD per month

Save $127.50 over 6 months

An easy financial foundation - track cash flow with the essentials.

Growing

Usually $55

Now $8.25

USD per month

Save $280.50 over 6 months

Go beyond the basics - automate tasks and access performance dashboards.

Established

Usually $90

Now $13.50

USD per month

Save $459 over 6 months

Future proof your scaling business - with advanced tools and analytics.

Why businesses love Xero online payments

Xero simplifies your payments admin, whether it’s a one-off amount or a recurring bill.

No more paperwork

Your online quotes convert to invoices ready for you to send.

Better cash flow

Options like digital wallet payments encourage your customers to pay sooner. A win for your cash flow!

Ready to scale

Going global? Our online payment processing makes cross-border payments easy, so you reach new markets.

Accounting software for your US small business

Smoothly manage your financial admin online with Xero. Its powerful features are simple to use, from creating invoices and accepting mobile payments to reconciling your books.

- Keep all your data in one place

- Connect to your bank

- Collaborate in real time

- Grow your Xero organization with your business

Xero allows me to do what I love doing, which is creating

Xero makes Orenda Tribe run seamlessly

FAQs on Xero’s accounting system for small businesses

Choose a payment service to accept credit and debit card payments. For example, Stripe is a leading provider that works with Xero. When you sign up to Stripe (from within your Xero organization), a Pay now button appears on your invoices and customers can choose a payment method.

Choose a payment service to accept credit and debit card payments. For example, Stripe is a leading provider that works with Xero. When you sign up to Stripe (from within your Xero organization), a Pay now button appears on your invoices and customers can choose a payment method.

When your customer receives a Xero invoice, they can pay using one of the payment methods you’ve enabled. Xero then sends the payment information via an online payment gateway to the customer’s bank, which checks their identity and available funds before the payment. Xero then reconciles this amount in your books automatically, so your financial records are up to date without you doing anything.

When your customer receives a Xero invoice, they can pay using one of the payment methods you’ve enabled. Xero then sends the payment information via an online payment gateway to the customer’s bank, which checks their identity and available funds before the payment. Xero then reconciles this amount in your books automatically, so your financial records are up to date without you doing anything.

Very! Xero works with trusted payment providers like Stripe and GoCardless to look after your customer data. Xero software itself uses multiple layers of security, including multi-factor authentication, to help prevent fraud and data breaches.

Very! Xero works with trusted payment providers like Stripe and GoCardless to look after your customer data. Xero software itself uses multiple layers of security, including multi-factor authentication, to help prevent fraud and data breaches.

Yes – you can issue refunds in Xero by creating a credit note, overpayment or a prepayment transaction. You just apply a cash transaction to this before Xero reconciles the amount with your bank statement.

Here’s more on processing refunds with XeroYes – you can issue refunds in Xero by creating a credit note, overpayment or a prepayment transaction. You just apply a cash transaction to this before Xero reconciles the amount with your bank statement.

Here’s more on processing refunds with Xero

Check out the ‘I want to pay that way’ report

Learn how consumers and small businesses around the world make and collect payments.

Read the report

See how online payments give customers more ways to pay and help you get paid faster

Get paid now? Yes please.

Start accepting online payments

Here’s everything you need to know to start accepting payments from your customers and making them to your suppliers and employees.See all payments guides.

- Guide

What is an invoice? Meaning, types and how invoices work

Learn what an invoice is, why it matters, and get clear answers to seven basic questions.

- Guide

Small business payroll guide: costs, taxes, and tools

Learn how to run small business payroll, pay your team on time, and stay compliant while saving hours.

- Guide

How to build a watertight accounts receivable process

There’s one way to stay in business – you have to get paid. That’s why a good accounts receivable process is critical.

Prices are in USD and include tax. Xero reserves the right to change pricing at any time.

Xero subscriptions auto-renew monthly until they are cancelled.

If you later decide to change to a less expensive plan you can do so 1 month after upgrading.

*This offer of 85% off Xero’s then-current regular price for the first 6 months is only available to new customers in the United States purchasing their first organization on xero.com. Offer available until 11:59pm PDT on 31 March, 2026 using code DC23854633 at checkout. Discount applies to base Early, Growing, Established plan subscriptions and additional charges for add-ons and usage, and does not apply to any payment fees. After the first 6 months, Xero’s then-current regular price will apply and auto-renew monthly until cancelled. This offer cannot be used with, or exchanged for, any other offer. Xero can change or cancel this offer at any time.

†Invoice limits for the Early plan apply to both approving and sending invoices. Transactions initiated by app partners may automatically contribute to your invoice limit.

^Payment fees apply to the use of online invoice payments. See here for more information.

**Median payment times of invoices with a payment service included and sent via SMS by customers using Xero in US from 9/1/2024 to 3/31/2025 (compared to invoices sent by email and without payment service included).

a. ††Payment fees apply to the use of online bill payments. The payment fees are in addition to your Xero monthly subscription amount, and are subject to change. All fees are in US dollars and exclude applicable taxes unless otherwise specified.

b. ^Payment fees apply to the use of online invoice payments. See here for more information.

Prices are in USD and include tax. Xero reserves the right to change pricing at any time.

Xero subscriptions auto-renew monthly until they are cancelled.

If you later decide to change to a less expensive plan you can do so 1 month after upgrading.

*This offer of 85% off Xero’s then-current regular price for the first 6 months is only available to new customers in the United States purchasing their first organization on xero.com. Offer available until 11:59pm PDT on 31 March, 2026 using code DC23854633 at checkout. Discount applies to base Early, Growing, Established plan subscriptions and additional charges for add-ons and usage, and does not apply to any payment fees. After the first 6 months, Xero’s then-current regular price will apply and auto-renew monthly until cancelled. This offer cannot be used with, or exchanged for, any other offer. Xero can change or cancel this offer at any time.

†Invoice limits for the Early plan apply to both approving and sending invoices. Transactions initiated by app partners may automatically contribute to your invoice limit.

^Payment fees apply to the use of online invoice payments. See here for more information.

**Median payment times of invoices with a payment service included and sent via SMS by customers using Xero in US from 9/1/2024 to 3/31/2025 (compared to invoices sent by email and without payment service included).

a. ††Payment fees apply to the use of online bill payments. The payment fees are in addition to your Xero monthly subscription amount, and are subject to change. All fees are in US dollars and exclude applicable taxes unless otherwise specified.

b. ^Payment fees apply to the use of online invoice payments. See here for more information.