How to calculate sales tax: Step-by-step guide for your small business

Learn how to calculate sales tax for your small business, charge the right rate, save time, and stay compliant.

Written by Lena Hanna—Trusted CPA Guidance on Accounting and Tax. Read Lena's full bio

Published Friday 5 December 2025

Table of contents

Key takeaways

• Calculate sales tax by multiplying the item price by the tax rate (converted to decimal), then add the resulting tax amount to the original price to determine the total cost.

• Apply the combined tax rate that includes both state and local components, as rates vary significantly by location and can change frequently throughout the year.

• Track different tax laws and exemptions when selling across multiple states, keeping accurate records of all transactions and required documentation like exemption certificates.

• Automate your sales tax calculations using integrated software solutions to reduce manual errors, ensure current rates are applied, and maintain compliance with changing regulations.

What is sales tax and why does it matter to your business?

Sales tax is a consumption tax added to the price of goods and services at the point of sale. State and local governments levy this tax as a percentage of the sale price.

Your business acts as a tax collector. You add sales tax to customer purchases and remit the collected tax to the appropriate government agencies.

Here's how to calculate sales tax on a $10 purchase with a 6% tax rate:

- Multiply the price by the tax rate: $10 × 0.06 = $0.60 sales tax

- Add the tax to the price: $10 + $0.60 = $10.60 total cost

Tax exemptions vary by state but commonly include:

- Medical supplies: prescription drugs and medical equipment

- Food items: groceries and basic food products

- Utilities: electricity, gas, and water services

Online sales tax applies when you have nexus (business presence) in a state, including physical storefronts, employees, or significant sales volume.

Sales tax calculation formula

Calculating sales tax is a two-step process. First, you find the tax amount, and then you add it to the original price to get the final cost.

Here are the simple formulas you'll need:

- Sales tax amount = item price x sales tax rate

- Total cost = item price + sales tax amount

Before you can use these formulas, you'll need to convert the sales tax percentage into a decimal. You can do this by dividing the rate by 100. For example, a 7% sales tax rate becomes 0.07.

How to calculate sales tax step by step

Sales tax calculation follows a simple three-step process that helps you collect the right tax on every transaction.

Follow these steps:

1. Find the sale price

Find the price of the product or service before you apply any taxes.

2. Apply the correct tax rates

Combined tax rates include both state and local taxes. For example, a New York business combines:

- State rate: 4%

- Local rate: varies by location

- Total rate: state + local = combined rate for all transactions

3. Calculate the total sales tax

Use the formulas in the sales tax calculation formula section to work out the tax amount and total cost. Convert the percentage to a decimal by dividing the rate by 100 (for example, 6% ÷ 100 = 0.06).

Example sales tax calculations

Example calculation with a 6.5% tax rate:

- Convert the percentage to a decimal: 6.5% ÷ 100 = 0.065

- Calculate the tax: $100 × 0.065 = $6.50

- Add the tax to the price: $100 + $6.50 = $106.50 total

Additional examples:

- 7% tax: $100 × 0.07 = $7.00 tax, $107.00 total

- 8% tax: $100 × 0.08 = $8.00 tax, $108.00 total

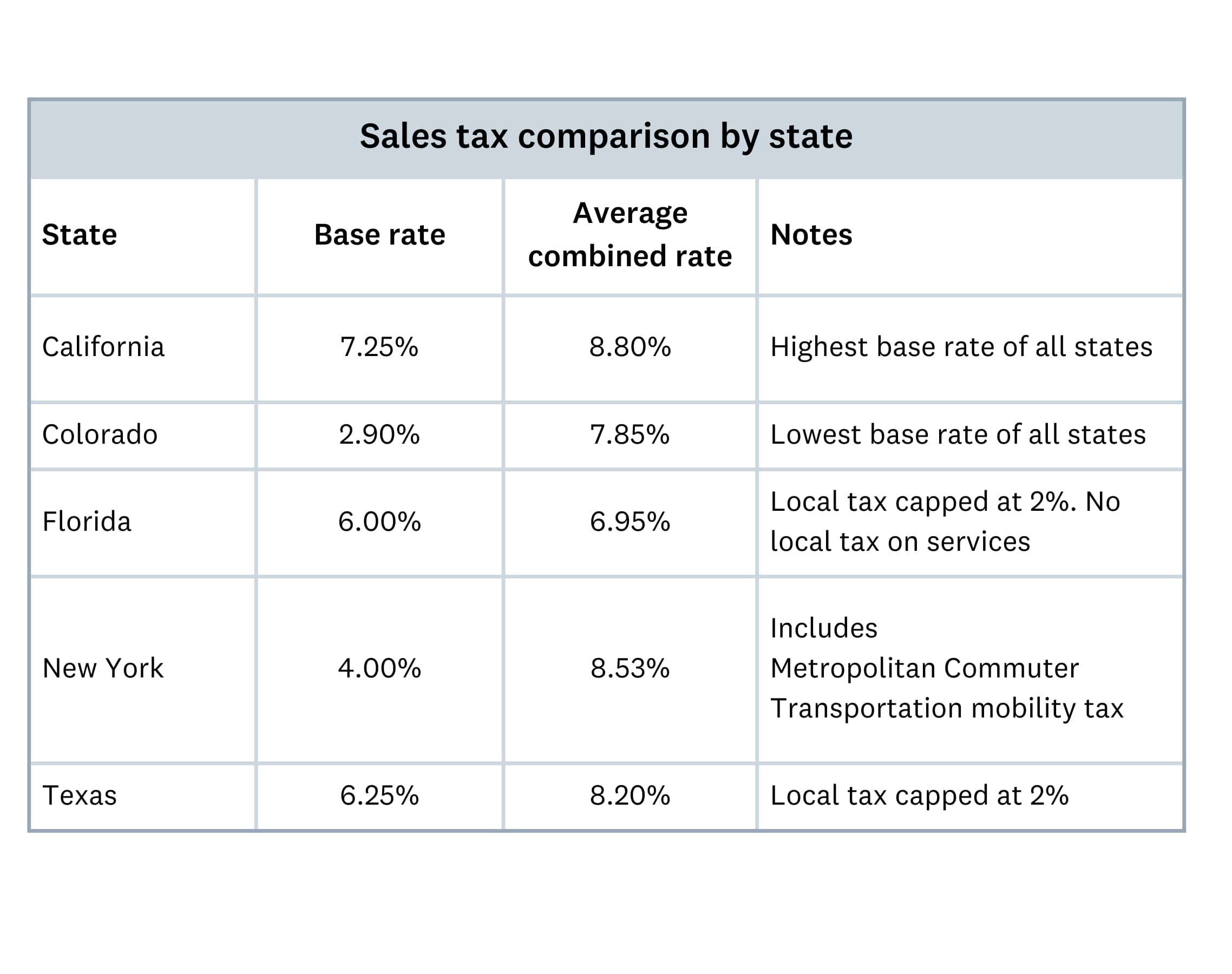

Sales tax rates by state and locality

Sales tax rates vary significantly by location and combine state and local components.

States with combined rates:

- State tax: base rate set by state government

- Local tax: additional rates from cities, counties, or districts

- Combined rate: state + local = total tax rate

States without state sales tax:

- Alaska, Delaware, New Hampshire (local taxes may still apply)

Multi-state businesses must track different rates for each location where they have sales tax obligations.

You can find sales tax and average combined rates for each state in this resource:

View current state and average combined sales tax rates on the Tax Foundation site

Simplify your sales tax calculations with Xero

Automating your sales tax calculations reduces manual errors and saves you time on compliance tasks. It also helps you stay up to date with rate changes, make accurate calculations, and file on time.

Xero and Avalara automate your entire sales tax process, from calculation to compliance reporting. This integration provides:

- Automated rate updates: apply current tax rates for any location automatically

- Invoice integration: calculate and add sales tax to invoices without manual input

- Compliance reporting: generate detailed tax reports with exemptions and filing deadlines

See how Xero and Avalara can simplify your sales tax calculations

Whether you handle single-state or multi-state sales tax, Xero has the tools you need to streamline your tax process. Get one month free and see how much easier managing your business finances can be.

FAQs on calculating sales tax

Here are answers to common questions about calculating sales tax for your business.

What's the difference between state and local sales taxes?

State sales tax is set by state governments and applies uniformly across the entire state. Local sales tax is imposed by cities, counties, or districts and varies by specific location within the state.

How often should I update my sales tax rates?

Check for rate updates quarterly at minimum, as tax rates change frequently throughout the year. Automated tools like Xero update rates automatically, eliminating manual tracking and ensuring compliance.

What happens if I collect the wrong sales tax amount?

Under-collecting makes your business liable for the tax difference plus potential penalties. Over-collecting requires refunding customers or remitting excess amounts to tax authorities. Regular rate updates prevent both scenarios.

How do I handle sales tax for tax-exempt products or services?

Check if your business is eligible for exemption and collect the right documentation, such as resale or exemption certificates. Save these records in case of an audit.

Do I have to collect sales tax on my online transactions?

It depends on where your customers are. Many states have nexus laws, which oblige you to collect sales tax in the state even if you don't have a physical presence there.

Can I include sales tax in my pricing?

Yes – but you must clearly disclose this to your customers by stating so on your product or service pricing. Some businesses prefer tax-inclusive pricing because it simplifies transactions, but you still need to report and remit the right amount to the correct state or local taxing agency.

How do I calculate sales tax for bundled products or services?

If items in the bundle have different tax obligations (such as for exempt goods or services), make sure you are adding the state tax rate to the appropriate items. Some states let you apply a single rate while others require you to itemize each transaction's taxes – so check your state's regulations to make sure your business complies with them.

What records should I keep for sales tax reporting?

Keep copies of invoices, receipts, exemption certificates, and tax filings. These records will help you at tax time – they'll take some of the stress out of your preparation and make it easier to report your taxes accurately.

I've moved my business. How do I register to collect sales tax in a new state?

You can register your business online by visiting your state's tax department website and applying for a sales tax permit. Once you're registered, you need to start collecting and remitting sales taxes based on the state's regulations.

Get one month free

Sign up to any Xero plan, and we will give you the first month free.