Calculate and report sales tax more easily with auto sales tax

With automated sales tax, powered by Avalara, sales tax is automatically calculated on invoices, while detailed reports help you prepare returns. Save time now and help avoid a compliance headache later.

Fast, self-guided setup

Quickly set up sales tax in Xero for all the states you're registered to collect sales tax in.

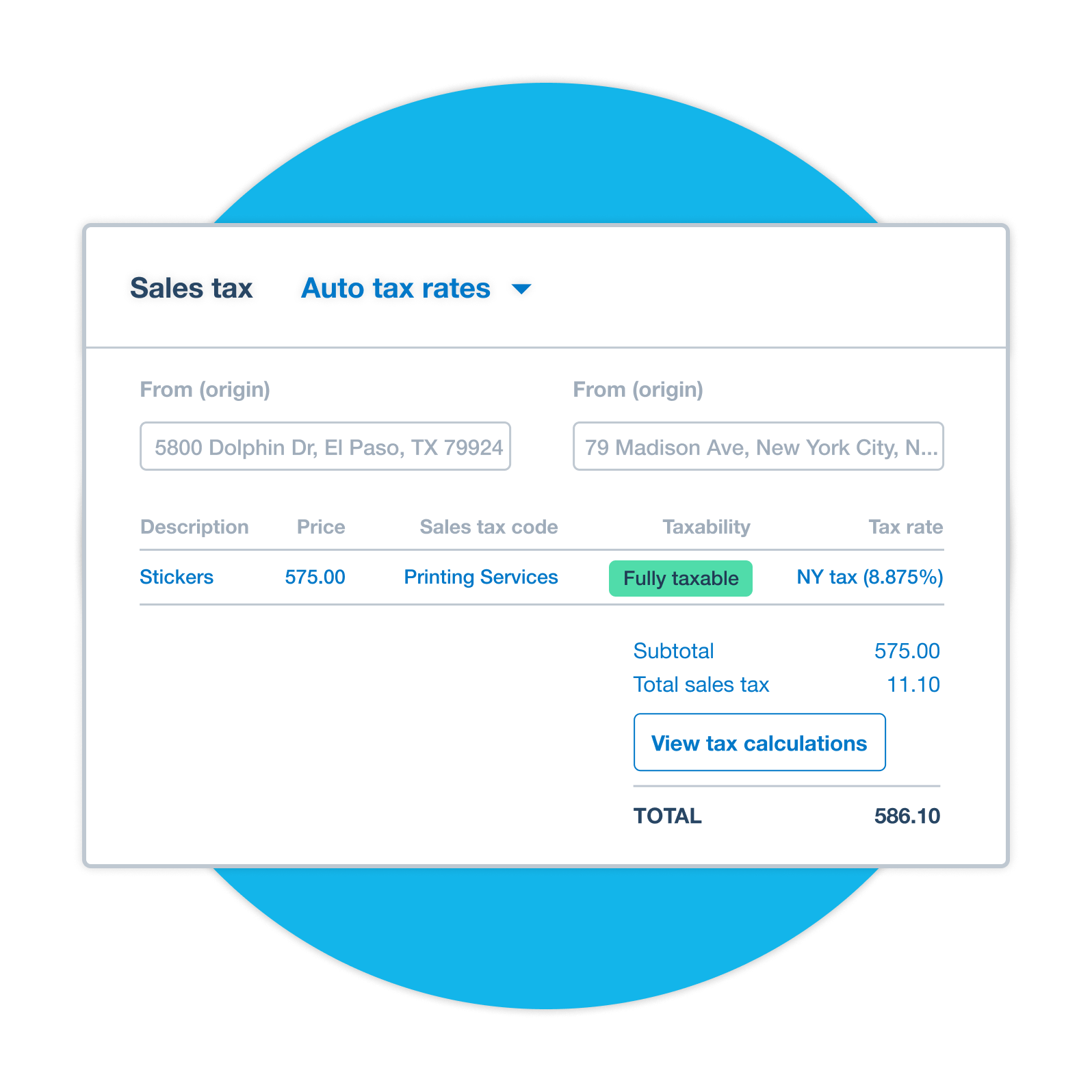

Automated sales tax calculations

Sales tax is automatically calculated for any state or jurisdiction.

Comprehensive sales tax reporting

Use automatically created reports to track upcoming payments due and previously filed reports.

“Until now, I haven’t taken on goods-based businesses across multiple states because the sales tax is just too hard. I can now expand my services to more complex goods-based businesses.”

What accountants and bookkeepers are saying about it…

Fast, self-guided setup

Setting up automated sales tax is simple. Enter your contact information, business location and tax details to get set up in all states you’re currently registered to collect sales tax in.

- Avalara covers all US states and more than 13,000 tax jurisdictions

- Manage sales tax attributes for your products and services

Automated sales tax calculations

Get automated sales tax calculations on invoices without the guesswork when you use Xero’s new invoicing option.

- Taxes are automatically calculated based on where you’re selling from, where you’re selling to, whether an item is taxable according to state rules, and whether your customer is exempt from sales tax

- Avalara automatically updates with the latest rates and rules about what’s taxable

- Automated sales tax is not yet available on credit notes, repeating invoices, find and recode, and quotes, but you can use manual tax rates in these cases

Comprehensive sales tax reporting

View enhanced, jurisdiction-based sales tax reports to make filing easier.

- View automatically created state reports broken down by jurisdiction for each filing period

- Get a summary, breakdown, or transaction view of sales tax totals that distinguishes between taxable and non-taxable sales transactions by jurisdiction

- Set and view payment deadlines and previously filed reports

Accounting software for your small business

Run your business accounting online with Xero. Easy-to-use accounting software, designed for your small business.

- Everything in one place

- Connect to your bank

- Collaborate in real time

- Customize to suit your needs

Get one month free

Purchase any Xero plan, and we will give you the first month free.

Are you an accountant or bookkeeper?

Automated sales tax is just one way that Xero can help you to support your clients and expand your services. Learn more about how Xero can help your practice grow.

Become a Xero partner