NOPAT: Net Operating Profit After Tax formula and uses

Discover how net operating profit after tax NOPAT helps you compare performance, budget better, and grow profit.

Written by Kari Brummond—Content Writer, Accountant, IRS Enrolled Agent. Read Kari's full bio

Published Wednesday 7 January 2026

Table of contents

Key takeaways

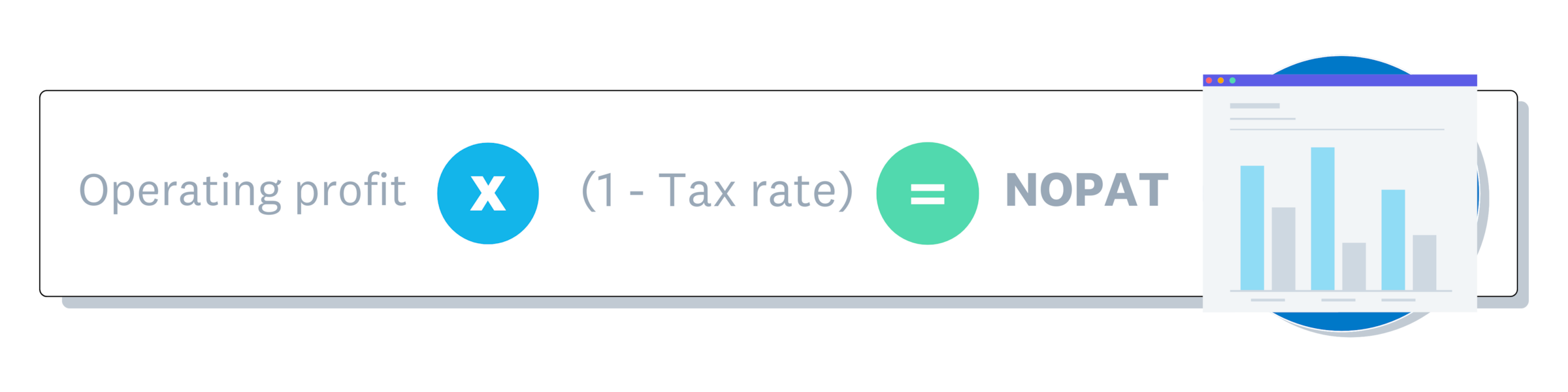

- Calculate NOPAT using the formula: operating profit × (1 − tax rate) to measure your core business profitability after taxes while excluding financing costs and non-operating income.

- Use NOPAT instead of net income when comparing businesses with different debt levels or financing structures, as it reveals true operational performance without the bias of financing decisions.

- Apply NOPAT calculations to determine Economic Value Added (EVA) by subtracting total invested capital times cost of capital from NOPAT, helping you assess how effectively your invested money generates returns.

- Focus on NOPAT trends over time rather than absolute numbers to evaluate whether your core operations are becoming more profitable and compare your performance against industry benchmarks.

What is NOPAT?

Net Operating Profit After Tax (NOPAT) measures how much profit your business earns from core operations after paying taxes but before interest expenses.

NOPAT focuses only on your main business activities. It excludes non-operating income like investment gains and financing costs like loan interest.

NOPAT helps you evaluate operational performance by excluding:

- Non-operating income: Investment gains, asset sales, or other side activities

- Interest expenses: Loan payments, credit card interest, or debt costs

- Financing decisions: How you fund your business operations

NOPAT shows your return on invested capital by measuring how efficiently your business operations generate profit regardless of how you finance them.

Why is NOPAT important?

NOPAT reveals operational efficiency regardless of debt levels or financing structure. This metric helps you:

- Compare businesses: Evaluate companies across different industries or regions

- Assess performance: Measure operational success without financing bias

- Calculate returns: Determine how well invested capital generates profit

Reveals true business performance

NOPAT isolates operational performance from financing decisions. You get a clear view of how well your core business generates profit after taxes, separate from debt management choices.

NOPAT analysis helps you:

- Identify improvement opportunities: pinpoint operational inefficiencies

- Make growth decisions: evaluate expansion based on core performance

- Assess complex businesses: compare companies with different financial structures

Helps to standardize comparisons

NOPAT enables fair business comparisons by removing the impact of financing choices and local tax differences:

- Debt impact: A profitable business may show low net income due to high interest payments

- Geographic differences:Compare operational efficiency across different tax jurisdictions

- Investment decisions: Evaluate acquisition targets based on core performance

Example: You're comparing two businesses for acquisition:

- Company A: $100,000 net profit, low debt

- Company B: $80,000 net profit, high debt

Company B's NOPAT reveals $120,000 in operational profit. The NOPAT calculation shows Company B's true earning potential once you address its financing structure.

Similarly, let's say you're comparing businesses in different tax jurisdictions. NOPAT shows you exactly how the tax liabilities in each of these areas affect profits.

Improved decision-making

NOPAT also helps you make better decisions because it shows you how the money invested in a business is performing. It does this by helping you calculate Economic Value Added (EVA).

EVA puts interest back into the equation, but it also takes shareholder equity into account. To determine EVA, start with NOPAT and then subtract total invested capital times the cost of the capital.

For example, imagine NOPAT is $50,000. Now, let's say the business has $100,000 in loans at 6% interest and you invested $100,000 in cash. Your capital investment is $200,000 at an average cost of 3%. That means you subtract $6,000 from $50,000, which gives you an EVA of $44,000.

In other words, the $200,000 wrapped up in this company is generating $44,000 per year. This metric becomes even more important when you're dealing with a company with a lot of shareholders. EVA helps you see how well shareholders' investments are performing and guides decisions about future investments or loans.

You can find more EVA calculation examples in this guide to calculating value added.

NOPAT vs net income

NOPAT vs net income differs in scope and focus:

- Net income: Includes all income, expenses, taxes, and financing costs

- NOPAT: Excludes interest expenses and non-operating activities

Key difference: NOPAT focuses purely on operational performance after taxes.

Net income components:

- Operating costs: Expenses, depreciation, amortization

- Financing costs: Interest on loans and debt

- Non-operating items: Investment income, asset sales

- All taxes: Complete tax burden

NOPAT components:

- Operating costs: Core business expenses only

- Operating taxes: Taxes on business operations

- Excludes: Financing costs and non-operating activities

To explain, let's say a bakery has $100,000 in net income, but it earns $12,000 from renting space in its parking lot to a food truck, and it pays $8,000 in interest on loans. To find its NOPAT, exclude the interest and the rent (because that's not a core business activity). That brings the NOPAT to $80,000.

NOPAT focuses on operational efficiency, while net income includes everything. However, if a business doesn't have any debt or other income streams, then its NOPAT and net income are the same.

Operating profit vs NOPAT

Operating profit vs NOPAT both measure core business performance but handle taxes differently:

- Operating profit: Earnings before taxes and interest (EBIT)

- NOPAT: Earnings after taxes but before interest

- Both exclude: Non-operating income and financing costs

Calculate operating profit from NOPAT:

operating profit = NOPAT + tax liability

Example: NOPAT of $80,000 + $16,000 taxes = $96,000 operating profit.

NOPAT vs EBIT

While NOPAT and EBIT both measure profitability before interest, they aren't the same. The main difference is that EBIT can include non-operating income, like gains from investments.

NOPAT, on the other hand, focuses strictly on a company's core operational performance. To calculate NOPAT, you start with operating profit, which excludes any non-operating income, and then account for taxes. This makes NOPAT a purer measure of how well the main business is running.

NOPAT formula explained

Let's break down the NOPAT formula:

NOPAT = operating profit × (1 − tax rate)

Step 1: Find your operating profit

Operating profit equals revenue minus all operating expenses (including depreciation and amortization) but before taxes and interest.

Step 2: Calculate your after-tax multiplier

Subtract your tax rate from Step 1.

Example: 20% tax rate = 0.80 multiplier (1 - 0.20).

Example calculation: 20% tax rate means you multiply operating profit by 0.80 to get NOPAT.

Operating profit vs EBIT distinction:

- Operating profit: Only main business income

- EBIT: Includes all income sources (operating + non-operating)

How to calculate NOPAT

To nail down the formula, let's see how it relates to a net operating profit after tax example.

1. Determine operating profit

First, determine your operating profit: your earnings before tax and interest (EBIT) without including non-operating income. Calculate this number by subtracting operating expenses from gross profit (revenue minus cost of goods sold).

2. Find the tax rate

Calculate your effective tax rate:

effective tax rate = income tax paid ÷ operating profit

Example: $20,000 taxes ÷ $100,000 operating profit = 20% tax rate.

Use this rate for your NOPAT calculations and business planning.

3. Apply the formula

Apply the NOPAT formula:

Given:

- Operating profit: $50,000

- Tax rate: 25%

Calculation: $50,000 × (1 - 0.25) = $37,500

Result: Your core business operations generate $37,500 annually after taxes, excluding financing costs.

Track your financial performance with Xero

NOPAT analysis helps you make better business decisions by revealing true operational performance. Track your financial metrics and calculate NOPAT easily with automated bookkeeping and reporting.

Ready to streamline your financial analysis? Get one month free and see how Xero simplifies business financial management.

FAQs on NOPAT

Still have questions about NOPAT? Here are answers to some common queries.

Is NOPAT the same as EBIT?

No, they are different. EBIT can include non-operating income, while NOPAT is based only on operating profit. This makes NOPAT a more focused measure of a company's core operational efficiency after taxes.

When should I use NOPAT instead of net income?

Use NOPAT when you want to compare the operational performance of different companies without the influence of their debt levels or financing structures. Net income is a complete picture of profitability, but NOPAT is better for an apples-to-apples comparison of core operations.

Can NOPAT be higher than net income?

Yes, NOPAT can be higher than net income. This usually happens when a company has significant interest expenses or non-operating losses, which are included in the net income calculation but excluded from NOPAT.

What's a good NOPAT for a small business?

A “good” NOPAT is less about a specific number and more about a positive trend over time. You want to see your NOPAT growing, as this shows your core operations are becoming more profitable. You want to see your NOPAT growing over time, as this indicates your core operations are becoming more profitable. Comparing your NOPAT to industry benchmarks can also give you a sense of how you're performing against competitors.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Get one month free

Sign up to any Xero plan, and we will give you the first month free.