Straight-line depreciation explained

Learn about straight-line depreciation and how to apply it when depreciating fixed assets.

Published Tuesday 07 November 2023

Depreciation means reducing the value of an asset for business and tax purposes. Most businesses have assets they need to depreciateStraight-line depreciation is a common method.

What is straight-line depreciation?

Straight-line depreciation is an uncomplicated way to calculate depreciation on your assets. Businesses choose this method because they can spread the expense over several accounting periods (or several years) to reduce their net income, and they prefer it to be a predictable expense.

In straight-line depreciation, the assets are depreciated at an equal value every year of their expected life. For example, if a computer is expected to last 5 years, it will be depreciated by one fifth of its value each year.

One of the central aspects of straight-line depreciation is the concept of “useful life.” To depreciate your assets with this method, you need a good estimate of the useful life of the asset. While it’s possible to use different methods of depreciation for different assets, you must apply the same method for the life of an asset.

Pros and cons of the straight-line method

Straight-line depreciation is popular with some accountants, but unpopular with others and with some businesses because extra calculations may be required for some industries.

Pros

One of the straight-line method’s advantages is that it’s easy to use. It simplifies accountants’ calculations, which makes them less prone to error and reduces the record-keeping needed for financial statements. The same amount is depreciated each year, so it is a predictable expense.

Cons

There are few prescribed rules for calculating the useful life and salvage value of an asset, so you need to document how you arrived at your estimates. Also, some assets lose a lot of their value in the first few years of use, so you may prefer a depreciation method that allows you to take a large write-off early on.

Other methods of depreciation

There are other depreciation methods that can be used instead. The IRS has specific guidelines for tax purposes. Nearly all businesses must use the modified accelerated cost recovery system (MACRS) or alternative depreciation system (ADS) on their income tax returns. You can use other methods for internal bookkeeping.

Some businesses are required to follow Generally Accepted Accounting Principles (GAAP) in their financial reporting. Specific principles in GAAP will guide decisions for small businesses. When deciding which method is best for your assets, you need to determine if an asset will lose more value in its early life, or lose value at the same rate every year. An accountant can tell you which method is best for you.

Here are some other depreciation methods:

- Units of production method: This method is based on the amount of work the asset does. It depreciates an asset based on its anticipated usage rather than its age. It is useful for machinery with a lot of wear and tear.

- Declining-balance method: Under this method, more depreciation is claimed on an asset early in its life, and the rate slows over this period. This method suits assets that lose value after a few years, such as phones and computers.

- Double-declining method: This method is similar to the declining method, but is accelerated by depreciating assets twice as quickly. This is for assets that lose their value quickly or become obsolete, such as high-tech items.

- Sum-of-the-years’-digits method: This is an accelerated method of calculating depreciation. With this method, you consider the expected useful life of an asset and add together the numbers for the years. For example, if an asset was expected to last 6 years, you would do this calculation: 6 + 5 + 4 + 3 + 2 + 1 = 21. Each of the numbers is divided by the sum to get the percentage of depreciation. For example, 6 ÷ 21 x 100 = 28.5%.

Calculating straight-line depreciation

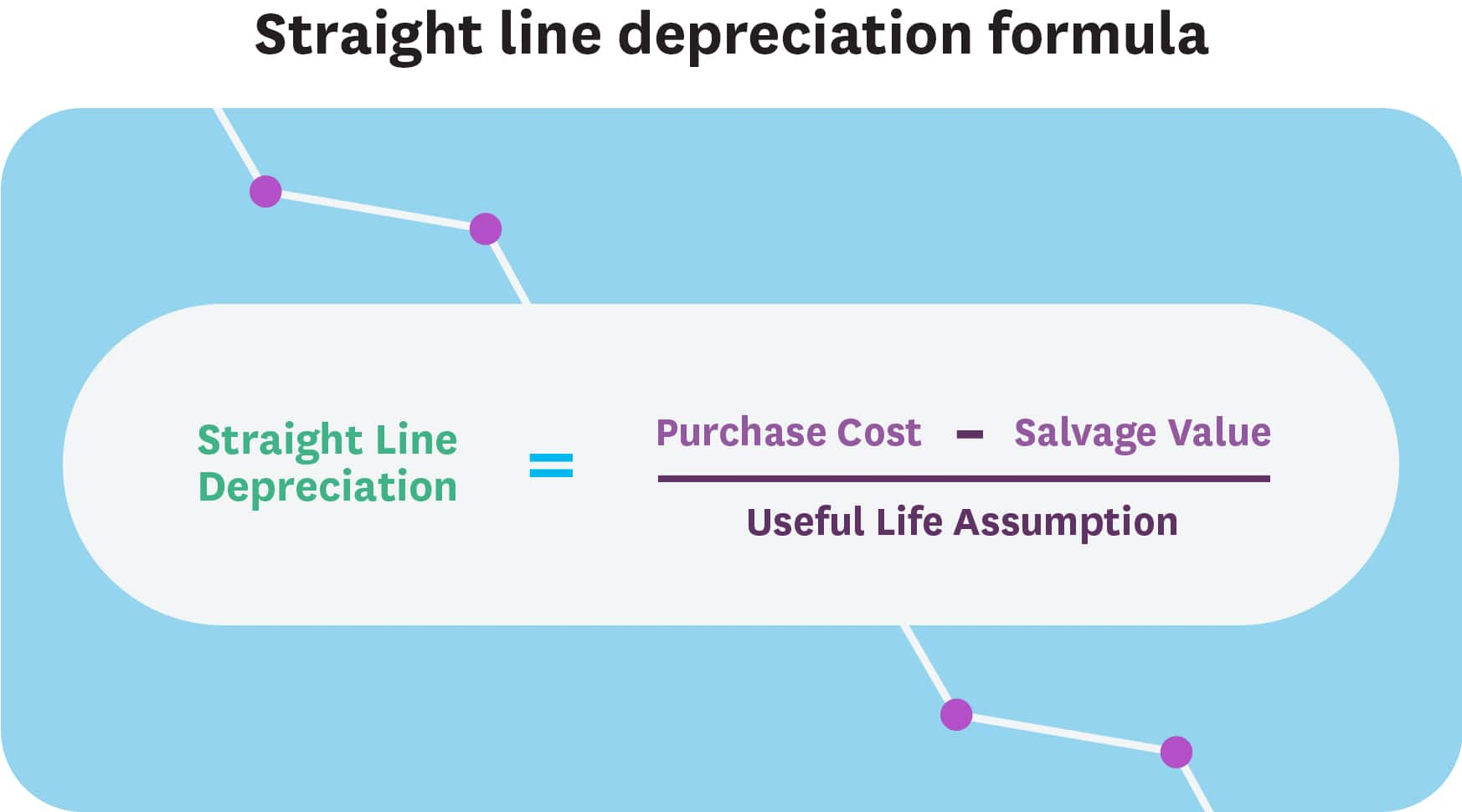

Straight-line basis calculations are straightforward:

- Determine the total cost of the asset: Purchase price + Sales tax + Any other costs, such as shipping or installation.

- Assign a salvage value to the asset: What value do you expect the item to have at the end of its useful life? This is an optional amount, as it’s not a common calculation in the US.

- Depreciation calculation: Subtract salvage value from the purchase price and multiply by the annual depreciation rate.

- Establish a monthly rate of depreciation: Divide the annual rate by 12, then you can create a depreciation schedule in your bookkeeping.

Here is an example of straight-line depreciation:

- You purchase a piece of plant machinery worth $22,000, which is expected to last 10 years, and has a salvage value of $2,000.

- To calculate, it would be: $22,000 – $2,000 = $20,000 ÷ 10 = $2,000.

- You would depreciate $2,000 for the expected 10 years of the life of the machinery.

Recording straight-line depreciation in your accounting system

It can be hard for small business owners to know which depreciation method is best and how to record it in their accounting system. It’s a good idea to hire a certified public accountant (CPA) or use accounting software like Xero to make the calculations easier.

In a double-entry bookkeeping system, there are two lines to the journal entry.

- On the debit side, you enter the amount in a depreciation expense account.

- On the credit side, it affects the accumulated depreciation account. This is a contra-asset account (an asset account with a credit balance, rather than a debit balance as would normally occur).

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.