What is FUTA and how does it affect your small business payroll?

Most employers file and pay tax under the Federal Unemployment Tax Act (FUTA). Learn how to file and pay FUTA.

Written by Kari Brummond—Content Writer, Accountant, IRS Enrolled Agent. Read Kari's full bio

Published 2 December 2025

Table of contents

Key takeaways

- FUTA is the federal unemployment tax.

- Most employers must pay this tax.

- Deposits are due annually or any quarter where your liability exceeds $500, and returns are due annually.

- Payroll software can automate your FUTA calculations and filing

What is FUTA tax?

FUTA is the federal unemployment tax paid by most employers under the terms of the Federal Unemployment Tax Act (FUTA). The funds go into the Federal Unemployment Trust Fund, which provides money to states for unemployment compensation. The fund also covers half of extended unemployment payments.

If you have employees, you probably need to pay this tax and file Form 940 each year. Employers pay FUTA tax – you don’t withhold it from employees' wages like many other payroll taxes.

You can claim a tax deduction for FUTA tax on your business tax return.

What is the FUTA tax rate?

FUTA is 6.0% of the first $7,000 of wages or up to $420 per employee. However, the IRS gives employers a 5.4% credit, making the effective FUTA rate 0.6%.

But if you have employees in a state that owes a loan for unemployment payments to the federal government, the credit gets reduced by 0.3% per year until the state pays its loan in full. This means your FUTA rate is higher in that state – for instance, if your state is 2 years behind, the IRS reduces your credit to 4.8%, meaning your FUTA rate in that state is 1.2%.

The IRS has more info on credit reduction states.

FUTA filing requirements

You must pay and file FUTA payroll tax if any of the following apply:

- You pay $1500 or more in employee wages during a calendar quarter

- You have at least one employee for at least part of the day during 20 or more weeks in a calendar year

- You meet the filing requirement as a household or agricultural employer

For other workers, the thresholds are different:

- For household workers, you must file if you pay them $1000 or more during any calendar quarter.

- For agriculture employees, you file if you pay them $20,000 or more in a calendar quarter or if you employ 10 or more workers in 20 different calendar weeks in the current or preceding year.

How to pay and file FUTA payroll tax

To stay compliant with payroll tax requirements, you must pay FUTA tax and file the return annually. Taxes are due in any quarter where your FUTA liability exceeds $500. The balance continues to roll forward until your liability exceeds that threshold.

If you owe less than $500 for the full year, you can pay when you file your annual FUTA tax return.

1. Determine whether you owe quarterly tax

You need to do a few calculations to determine if you owe FUTA payroll tax for the quarter.

First, check the wages under $7000 that you paid to each employee for the quarter – reduce that number by any wages you’ve already paid FUTA tax on, and don't include employees who've passed the $7000 threshold in a previous quarter.

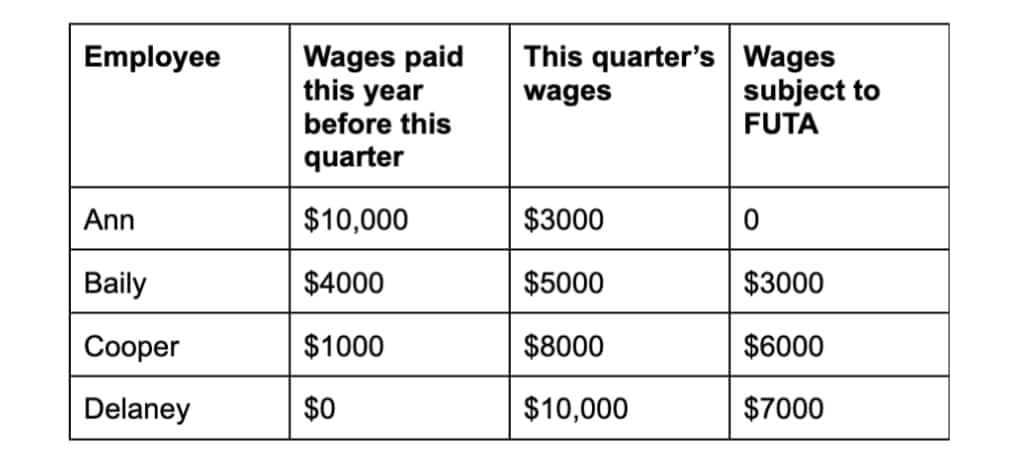

Here's an example.

As you can see:

- Ann passed the $7000 threshold in the previous quarters, so none of her wages are subject to FUTA.

- Bailey earned $5000 this quarter, but in previous quarters, his employer paid FUTA on $4000 of his wages, so only $3000 of this quarter's wages are subject to FUTA.

- Only $6000 of Cooper's wages were subject to FUTA, as $1000 of his wages were paid in a previous quarter.

Then, add up the wage base. Here, that's $3000 + $6000 + $7000 = $16,000.

Now, multiply by the credit-adjusted rate. If you're not in a rate reduction state, that's 0.6%: $16,000 x 0.6% = $96.

Because your FUTA payroll tax liability is under $500, you can roll that to the next quarter. Online payroll software will calculate all this for you automatically.

2. Pay your FUTA taxes

Once you reach the $500 threshold, you must pay the tax by the final day of the month following the quarter in which you paid the wages. For instance, say that your FUTA liability exceeds $5000 in the first quarter, then your payment is due on the last day of April.

To make a payment, use your EFTPS account. If you owe less than $500 for the year, you can mail in the payment with your return.

Here's a link to the EFTPS – Electronic Federal Tax Payment System.

3. File the FUTA tax return

You only have to file your FUTA return annually. To file this return (Form 940), you need your business name, EIN, and contact details. On the form, list the state or states where you pay state unemployment taxes.

The form guides you through calculating your taxable wage base. Then, you:

- Multiply the taxable amount by 6%

- Calculate the credit based on whether or not you're in a credit reduction state

- Note on the form all FUTA taxes deposited during the year and the amount owed, if any

The IRS has more details about Form 940.

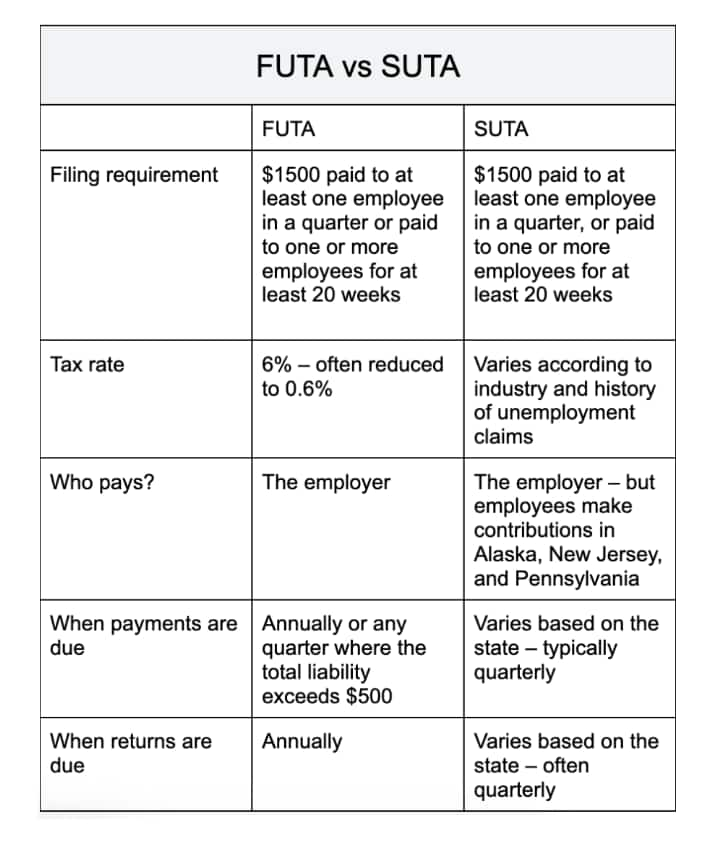

FUTA vs SUTA

While FUTA is unemployment tax at federal level, SUTA refers to state unemployment taxes. States use a variety of names for this tax program – you might hear about state unemployment insurance, contribution tax, unemployment benefits tax, and so on.

Here's a breakdown of the differences between these two taxes.

The SBA has more information on business taxes.

Mistakes to avoid with FUTA tax

Small business payroll can be tricky – and late payments put you at risk of penalties, interest, and scrutiny from the IRS.

To stay compliant, remember these points.

- Assess your liability quarterly: although you only file annually, you have to pay quarterly.

- Make deposits with other payroll taxes: consider depositing FUTA taxes at the same time as your other payroll taxes, so you don't forget. Most payroll taxes are due on the 15th of the month or semi-weekly, which is often earlier than the deadline for quarterly FUTA deposits.

- Use payroll software to reduce errors: payroll software can help you calculate the wage base, easily work out monthly payments, and file your returns. It can often automate these processes, too.

Stay on top of your payroll with Xero

Don't get behind on payroll taxes – use payroll software to streamline the process. Xero can help you track payroll, file returns, and make deposits.

FAQs on FUTA

Have more questions on FUTA or how to do payroll? Here are the answers to employers' most common questions.

What is FUTA?

FUTA is the Federal Unemployment Tax Act. It created the federal unemployment tax.

I’m self-employed. Do I have to pay FUTA tax?

No. If you're self-employed, you don't have to pay FUTA tax on your wages. There's one exception: if you operate as a corporation or S-corp and pay yourself as an employee, you must pay FUTA tax on your wages.

Do employees pay FUTA?

No – only their employers pay FUTA.

Are FUTA and UI the same?

No – UI (unemployment insurance) includes both federal and state unemployment taxes.

How much is FUTA per year per employee?

FUTA is up to $42 per employee per year unless you're in a credit-reduction state. Then, it's up to $63 per employee if the state is one year behind on payments, up to $84 in the second year the state is in arrears, and may go up from there.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Get one month free

Sign up to any Xero plan, and we will give you the first month free.