What is an EIN used for and does my small business need one?

Most businesses need an EIN – even if you don't need one, there are still benefits to having one.

Written by Kari Brummond—Content Writer, Accountant, IRS Enrolled Agent. Read Kari's full bio

Published 25 November 2025

Table of contents

Key takeaways

- EINs are federal tax ID numbers for businesses.

- You must have an EIN to hire employees, pay excise taxes, file partnerships or corporate returns, and open a business bank account.

- Sole props without employees don't need an EIN, but you can get one if you want to – it helps keep your details private.

- To get an EIN, you must register your business with the state and then request the EIN from the IRS.

- You can get an EIN online, through the mail, or by working with a tax professional.

What is an EIN?

An EIN is an employer identification number – your business tax ID number that goes on federal payroll tax forms. It's used for a lot of other purposes as well, such as filing other tax forms and opening business bank accounts.

If you run a sole proprietorship without employees, you don't necessarily need an EIN. But it’s still worth getting one for privacy reasons – if you're issuing a 1099 form to a contractor, you won’t have to put your Social Security Number on the form if you have an EIN.

This number isn't just for businesses – it's also used by nonprofits, trusts, estates, and state/local government agencies.

Check out the IRS's guide to EINs.

Does your business need an EIN?

Your business needs an EIN if you want to do any of the following:

- Hire employees: this only applies if you're hiring employees, not independent contractors

- Pay excise or alcohol, tobacco, and firearms taxes: for example, if you're opening a brewery or a distillery, or if you operate heavy trucks over a certain weight

- Open a business bank account: the bank needs your business's EIN on the application

- Form a corporation or partnership: you need an EIN to identify the business on your partnership or corporate tax returns

- Buy a business: make sure you get a new EIN if you buy a business, or you could inherit tax debts related to the previous owner's EIN

- Change your type of organization: for example, changing a partnership to a corporation or electing to have your sole-member LLC taxed as an S-corp

If you’re not in these categories, you typically use your Social Security Number as your business tax ID.

For example, if you're a sole proprietorship without employees, you just put your Social Security Number on your annual tax return instead of an EIN.

You’d then also use your Social Security Number to apply for state sales tax accounts or to open an account with Square, PayPal, or another payment processing entity.

However, if you want to keep your Social Security Number private, you may want to request an EIN.

Your state may also give you a unique tax ID number to file state tax returns. The SBA has more resources on business tax ID numbers.

How to apply for an EIN

Applying for an EIN for a small business is pretty straightforward – if you have the right details, you can do it on the IRS's website in about 15 minutes. If you're worried about the process, ask an accountant or a business attorney to help you – the fees are tax deductible.

Let's check the 5 steps of the EIN application process.

1. Form your business

Unless you’re a sole proprietor, you must form your business before you apply for an EIN. Register corporations and limited liability companies with the Secretary of State in your state.

You don't need to register sole proprietorships with the state. Most states don't require general partnerships to register, but some do – so check the rules in your area. If you plan to operate under a fictitious name, you need to register the name with the Secretary of State or your county clerk, depending on the rules in your state.

2. Name a responsible person

You need to name a responsible party – someone the IRS can send correspondence to – and note their tax ID number and address on the EIN application. Listing someone as a responsible party does not affect their tax obligations.

The responsible party must have some control over the business, and they must be an individual, not an entity. Here's who you should list as the responsible party based on your business structure:

- Sole prop – the owner

- Partnership – one of the general partners

- Corporation – one of the principal officers

If you're getting an EIN for an LLC, you should list a general partner (for multi-member LLCs) or the owner (for single-member LLCs) as the responsible person.

3. Decide how you're going to apply

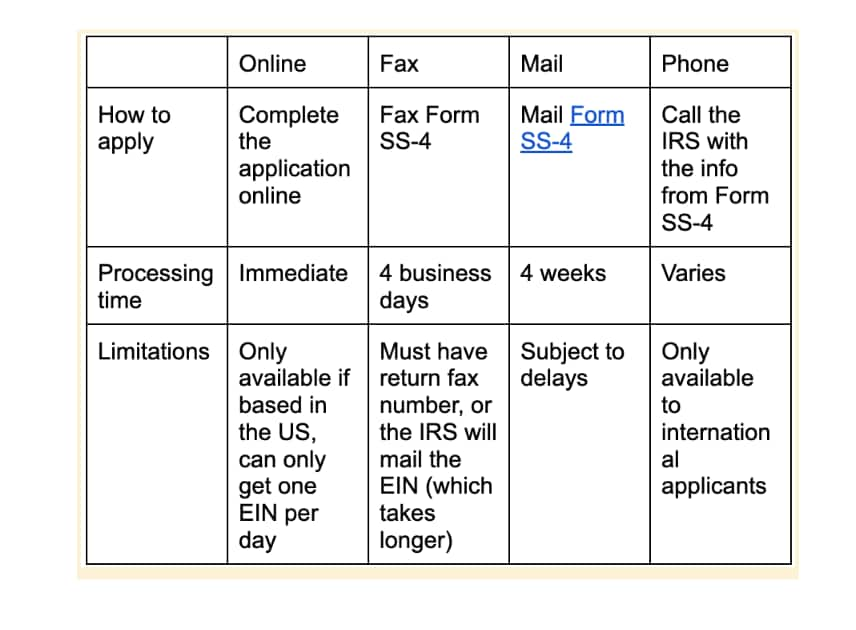

You can apply for an EIN online, by fax, or through the mail. The fastest option is to apply on the IRS's online EIN tool, but here's a breakdown of each of the application methods.

4. Complete the application

To complete the application, you need:

- Your business name, address, and phone number

- A responsible party as explained above.

- To note the type of entity (for instance, sole prop, partnership, or corporation)

- The reason you're applying for an EIN

LLCs must note their date of registration, if they were registered in the United States, and their number of members. Corporations must state where they were incorporated.

Finally, you need to share your industry, your anticipated number of employees, and if any of your employees are agricultural or household employees.

5. Start using your number

If you apply online, you'll get your number right away. Otherwise, it can take up to 4 weeks to get the EIN. You can start using the number immediately for most purposes – like opening a business bank account or applying for a state sales tax license – although you’ll have to wait two weeks to e-file federal tax returns or make payroll deposits.

Let Xero help with your business finances

Once you have an EIN, you're ready to roll – and Xero is right here alongside you. Xero small business accounting software is easy to use, and has powerful features and clever automations to help you smooth your financial admin and bring you insights into your growing business.

And if you need niche features, Xero connects with all kinds of apps to streamline everything from sales tax to payroll.

FAQs on applying for EINs

Here are answers to some of the most common questions new business owners have about EINs.

Do I need an EIN to form an LLC?

No, you don’t need an EIN to form an LLC – but you'll need one if you want to hire employees, open a bank account in the business's name, or choose to be taxed as an S-corp. And if your LLC is a multi-member LLC, you’ll need an EIN to file a partnership return with the IRS and your state.

Do I need an EIN to get a sales tax account?

That depends on the structure of your business and the rules in your state. Most states don't require an EIN if you're a sole proprietorship without employees, but you likely need one for any other business structure. Check with your state's department of revenue.

What if I need to file a tax return before I get my EIN?

Unfortunately, you'll have to file on paper if you're still waiting for your EIN. In the spot on your tax return where you're supposed to write your EIN, note "Applied for" followed by the date you sent in the application.

What if I need to make a tax payment before I get my EIN?

Send your tax payment to the service center address for your state. Make sure the check shows the same business name and address you noted on your EIN application. Then, in the memo line, write the type of tax, the period the tax payment relates to, and the date you applied for the EIN. This IRS page has links to the service addresses based on the type of payroll return you're filing.

Are EINs just for businesses?

No – EINs are also used to identify nonprofit organizations, trusts, pension plans, estates, and state and local agencies. If you're forming any of these types of organizations or administering a deceased person's estate, you'll also need to apply for an EIN.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Get one month free

Sign up to any Xero plan, and we will give you the first month free.