General ledger basics: Why it’s essential for tracking your business finances

A general ledger records all your financial transactions. Learn why it's the foundation of double-entry accounting.

Written by Kari Brummond—Content Writer, Accountant, IRS Enrolled Agent. Read Kari's full bio

Published 25 November 2025

Table of contents

Key takeaways

- The general ledger records all of a business's financial transactions. It's the foundation of double-entry accounting.

- The general ledger sorts transactions by their accounts into subledger accounts.

- After you make a journal entry, make a corresponding entry into the ledger.

- The ledger helps you find mistakes and generate financial reports.

What is a general ledger?

A general ledger in accounting is a record of a company's past financial transactions. It shows the date, amount, and details of each transaction, and it organizes all the transactions into accounts. The general ledger includes all the info you need to generate financial reports, like balance sheets and profit-and-loss statements.

In the past, the general accounting ledger was a physical book. Now, accounting software (like Xero) creates it in the background as you enter transactions.

The SBA has more info on managing business finances.

General ledger accounts

The general ledger includes all the accounts (called subledgers or subsidiary ledger accounts) in your chart of accounts. The accounts fall into the following categories:

- Income

- Expenses

- Assets

- Liabilities

- Equity

There may be just one or two accounts in each category, or dozens. For instance, your business could have the following subledger accounts in each category:

- Income: sales, interest on savings accounts, gains on stocks

- Expenses: rent, utilities, wages, and so on

- Assets: inventory, equipment, real estate, cash

- Liabilities: credit cards, bank loans, accounts payable, say

- Equity: owner's equity, shareholders' equity, owners' draws, among others

Depending on the complexity of your business, your ledger accounts can be broken down even further – for instance, you might have Amex, Chase, and Bank of America accounts as subcategories of your credit card liabilities.

In the past, to see a subledger account , you flipped to the part of the general ledger that contained the subaccount. For instance, if you wanted to see the transactions in your utilities account, you'd go to that page of the general ledger.

Now, you click on the name of the account in various places of the software, and that takes you to the ledger for that account.

How to do a general ledger

First, you note the transaction in the journal, and then you note it in the general ledger. Every transaction requires two entries in both the journal and the ledger, which is why it's called double-entry bookkeeping.

Here’s an example.

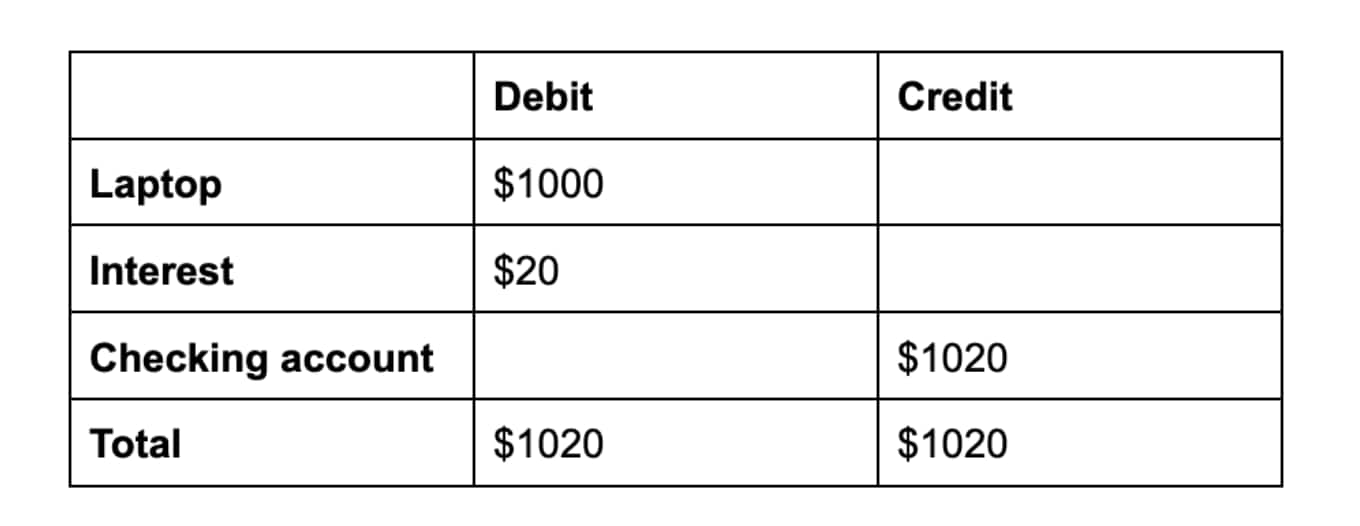

Say you buy a laptop for $1000 using your Amex credit card. First, you make a journal entry as illustrated below. The Amex company then sends you a bill with interest a few weeks later, so you record the interest due. Two weeks later, you pay off the debt with money from your bank account.

Here's how all of that gets recorded in the journal.

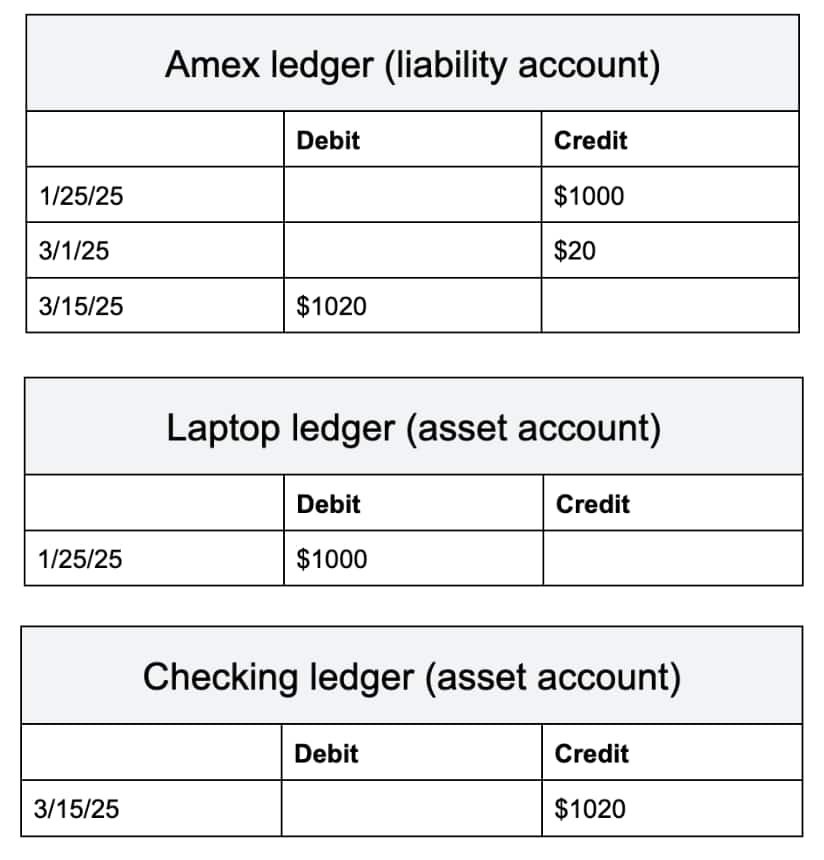

Then, you transfer these numbers over to the relevant parts of your general ledger accounts. As you can see, each account is labeled to indicate if it's an income, expense, asset, liability, or equity account.

If you're doing things the traditional way, you record all of this in a physical book – you can still find ledger books in office supply stores. Each ledger should have its own page or section of the book. You note the page at the beginning of the book or stick a tab on the side of the page so you can find the account.

You can also use digital spreadsheets with separate pages or columns for each subledger account. Or if you’re using accounting software, you can simply enter the transaction into the software and it creates the ledger as you go along.

The SBA small business guide has more advice for running your small business.

The purpose of general ledger accounting

General ledger accounting aims to find and eliminate mistakes in the accounting records. To do that, you take all the totals from your ledger accounts, sort them into debits and credits, and then make sure the debits and credits balance.

This is called creating a trial balance.

If the credits and debits aren't equal, you need to return to the journals and look for errors. Perhaps you forgot to record a transaction, put in the wrong number, or classified a credit as a debit.

Once you find the error, run another trial balance. If the credits and debits balance, great – you don't have any errors and you now have the right numbers to create your financial reports, like profit-and-loss statements and balance sheets.

How to create a trial balance

Let's continue with the general ledger example above to create a trial balance. To do that, note the totals from each account and whether they're a debit or a credit. The total balance for the Amex account is $0, so we won't include that.

In this example, the debits match up with the credits, so you're ready to move on. If they didn't match, look back on your records to find the error.

If you use cash accounting – where you record transactions as they occur – you're ready to generate financial reports from this info.

But if you use accrual accounting – where you record transactions when agreed upon – you need to make adjustments for deferrals and accruals.

- Accruals include income that has been earned but not received and expenses that have been incurred but not paid.

- Deferrals are the opposite – they include revenue that has been received but not earned, and expenses that have been paid but not incurred.

Once you have the adjusted trial balance, you can create financial statements.

Here’s more on the differences between cash and accrual accounting.

How to create financial reports with the general ledger

Creating reports with your general ledger is possible – but it's also fairly advanced accounting. Accounting software like Xero makes this much easier, but if you're curious about the process, let's look at the two most important financial reports: profit and loss reports and balance sheets.

Profit and loss

To create the profit and loss report, take all the income and expense accounts from your general ledger, find the totals, and enter them into the report (income goes at the top and expenses come next). Then, subtract the expense from the income to calculate your profit.

Balance sheet

For the balance sheet, note the totals of all your asset, liability, and equity accounts (assets go at the top, liabilities in the middle, and equity at the bottom). The equity should be the difference between the assets and liabilities – if not, check your trial balance for errors.

Wondering which reports you need? Check out the IRS's tips on recordkeeping for small businesses.

Simplify your accounting with Xero

The days of big books, confusing spreadsheets, and manual accounting processes are over – Xero accounting software reduces manual entry errors, streamlines your financial workflows , and generates accurate, up-to-date financial reports using your latest data.

And don't worry about the general ledger – Xero does it all for you automatically.

FAQs on general ledger basics

This is a complicated topic – but the right answers can help you a lot. Check out these FAQs to learn more.

Do I need a general ledger?

Yes – if you're doing accounting by hand, a general ledger helps you spot mistakes and summarizes the details you need to create financial reports. And if you use accounting software, you don't really have to worry about it – when you enter transactions, the software keeps track of the ledger automatically.

What's the difference between the general journal and the general ledger?

The general journal is where all transactions get recorded in order by date, while the general ledger sorts all transactions by account. You make the journal entry first, then the entry in the ledger.

What’s the difference between the chart of accounts and the ledger accounts?

The chart of accounts determines which accounts appear in the ledger. It also lists the categories you can use when classifying transactions in the journal. The ledger accounts, however, refer specifically to the accounts in the ledger.

Is a trial balance the same as a balance sheet?

No – the trial balance includes the totals for all the accounts in your chart of accounts. Balance sheets only include asset, liability, and equity accounts. Also, the initial trial balance may contain mistakes. Once it's correct and adjusted, its information is used to create the balance sheet.

When did accountants start using general ledgers?

The double-entry method of bookkeeping has been around since the 1400s – and it was influenced by older accounting systems that date back thousands of years. For centuries, bookkeepers painstakingly made at least two entries for every transaction in their ledgers – but now, software simplifies and even automates that process.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Get one month free

Sign up to any Xero plan, and we will give you the first month free.