How to develop an accounting system for your small business

Learn about the features of good accounting and the steps to get your system started.

Published Thursday 23 November 2023

An accounting system is how businesses organize and track their financial information. It can be used to create reports about that data. A sound accounting system can save you hours of administration nightmares.

Why your small business needs an accounting system

Every business benefits from establishing an accounting system. Having an accurate and full record of financial transactions for your business will help you to understand how your business is performing.

Your accounting system keeps your business financial transactions organized. This will allow you to see the financial health of your small business more easily and then do strategic planning for the future.

Being able to generate financial statements is important for communication with various stakeholders. When applying for small business loans or obtaining lines of credit, you often need these documents to show your financial status.

If your business is ever audited by the IRS, having a complete and systemic accounting system is helpful to generate the records you need.

What is a general ledger?

In a double-entry accounting system, the general ledger is the primary record in a business’s accounting system, and it is helpful for small businesses to establish early on in the life of a business. Although your ledger may not be a traditional paper book ledger, the operations are the same, whether electronic or paper-based.

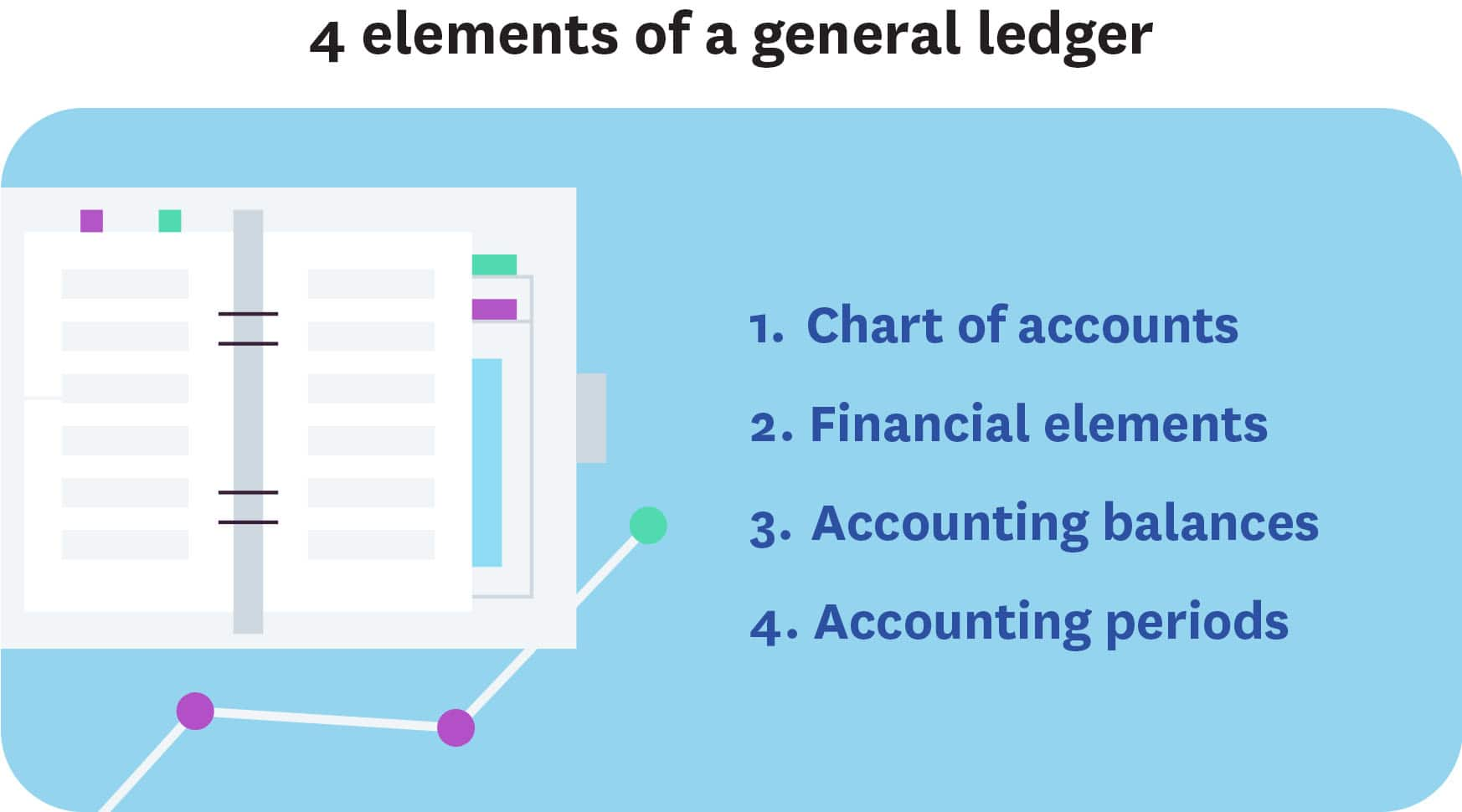

A general ledger has four elements:

- Chart of accounts: This is a list of all the accounts you use to record your financial transactions. You use it to organize your transactions and provide an overview of your business’s operations. It is made up of five main account types and various accounts within those types. The specific accounts will depend on the type of business.

- Financial transactions: These are exchanges between a buyer and seller related to the transfer of goods or services. This can also include lenders who have loaned your business money.

- Accounting balances: This is a running total after transactions are recorded.

- Accounting periods: This is the time frame used for your business financial reporting. These can vary but are often a year, quarterly or monthly.

Features of a chart of accounts

As the map of your accounting system, your chart of accounts can be tailored to the needs of your business. It is best to speak with an accounting professional to ensure you establish a system that matches your business needs.

5 primary account types

The chart of accounts is divided into five account types. Back when books were kept on paper, each of these types generally had its own ledger and this was where all financial transactions were recorded using a double-entry system. While most people now use financial software or a spreadsheet instead of a physical, handwritten ledger, the organization of the financial data can be done in a similar way:

- Asset accounts: This is where you record items that your business owns. For example, property, plants, and vehicles.

- Liability accounts: This is where the debts of your business are recorded. For example, loans, accounts payable and taxes owed.

- Revenue accounts: This is where you record any income earned by your business. For example, sales and interest from investments.

- Equity accounts: This is where you keep track of investments into the business, dividends or distributions from the business, and cumulative earnings or losses.

- Expense accounts: This is where you record costs for your business to operate. For example, utilities, cost of goods sold and salaries.

General ledger sub-accounts

Back when people kept their books with pen and paper, they would have a main account with separate subledgers, such as accounts receivable or inventory. This allowed financial reporting to be broken down further. These days, you can do a similar system when doing computerized accounting. You can tailor these accounts to your needs. If set up well, they can provide you with an overview of your business so that you can identify every area of your business that earns or spends money.

Some common accounts include:

- Asset accounts: petty cash, checking, savings, accounts receivable, and inventory.

- Liability accounts: sales tax, accounts payable, payroll tax liabilities.

- Revenue accounts: sales of goods, services revenue.

- Equity accounts: owner’s equity, retained earnings, stock.

- Expense accounts: cost-of-goods-sold, rent, insurance, supplies, equipment.

Details included on a general ledger

Although your accountant or accounting software keeps your books, it is important to know what information is in your general ledger. This can help you better understand your financial reports and the information contained in them. If you are starting out and establishing your own general ledger, create a template to standardize your ledger and accounting system.

- Account name: The name of the account.

- Account number: Not all accounting systems use account numbers. But when they are used, each account is assigned a unique number to assist with locating and identifying accounts. .

- Date: The date allows you to find transactions and track them more easily and is required for tax and most reporting purposes.

- Opening balance: The starting balance for the account. Some accounts start at $0, and some will carry over from a previous financial period.

- Customer/vendor: Name of the customer or vendor for the transaction.

- Description: This column provides space for the details about each transaction.

- Debit and credit columns: Debits will increase your assets and expenses and decrease your liabilities, revenue and equity accounts. Credits will decrease your assets and business expenses and increase your liabilities, revenue and equity accounts.

- Closing balance: The closing balance for an account at the end of the financial period.

Steps for developing your accounting system

Even if you use an accountant or accounting software to set up your system, you still have important decisions to make. You should be involved in the decision-making process, as it is essential to understand how your accounting system works, as this is where all of your financial documents will come from to aid your future financial planning and discussions with key stakeholders.

1. Create a bank account

Setting up a business bank account is important for small businesses. You need clear separation from your personal bank account. Having a business bank account will help you organize your finances and more easily identify your transactions, as well as make filing your taxes easier and do cash forecasting. It can also give you access to a credit card and a savings account.

2. Choose your accounting method

You will need to choose which accounting method will work best for your business. There are two main options. Discuss this with a professional to decide which one to choose for you:

- Cash accounting: This system is when you record transactions once the money has been received or paid. It doesn’t focus on the dates of invoices or when goods are shipped.

- Accrual accounting: Financial transactions are recorded when they occur, regardless if payment has been completed.

Some businesses use a combination of both of these methods.

3. Choose your tracking method

You will need to choose an appropriate system to track your business transactions. There are three ways to do this.

- Accounting software such as Xero.

- Use a CPA or accountant to handle it for you.

- Use an Excel template. Some small businesses may start off doing this until they are established.

4. Establish your chart of accounts

When you establish your chart of accounts, you will need to set up the accounts for your general ledger. This system is based on double-entry bookkeeping, so every transaction has a debit and credit entry.

5. Organize your records

You will need to decide how you want to keep your documents, such as receipts for transactions. Decide if you will keep soft copies or hard copies of them and then how you will organize them. However you decide to do your recordkeeping, you should be consistent, organize by type of transaction and in chronological order.

Advantages of using accounting software

Using small business accounting software can make your bookkeeping much easier and a great time-saver for busy business owners.

You can generate your financial statements, such as a balance sheet or income statement at the touch of a button. These are key for meetings with stakeholders, such as lenders and investors. Your statements will look professional.

Your accounting software can be set to sync your financial data from your bank and keep it up-to-date. Automating everything and being cloud-based means you can work from anywhere and have access to your important business information. Most accounting software companies also have an app for mobile access as well.

If you have employees, you may be able to add payroll apps or modules that will simplify your payroll and automatically deal with paying employees, payroll taxes, and tax obligations.

Accurate records are essential for tracking your business’s financial transactions. It will streamline your income tax filing during tax season because all the information you need is easily available, including details about tax deductions.

When small business owners do their financial planning and forecasting, they will have access to summary reports to inform them of trends to give a clear picture of the business finances and where money is coming from and where it is being spent. This makes it easier to get a clear overall picture of your business’s performance.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.