Xero’s mileage tracker for businesses on the move

Make traveling for work simple with the Xero Me app. Just add your journey start and end points on your phone, then let Xero automatically calculate the distance and record this business expense. It all happens in one app for a quick, easy way to get going!

Track mileage and submit claims from your phone

The Xero Me app is simple to use – on both iOS and Android – so you and your team can whizz through your expenses admin. Log mileage, automatically capture receipts when paying for gas or electric charging, and submit expense claims on the spot. Easy!

- Photograph paper receipts to capture the key info for your financial records

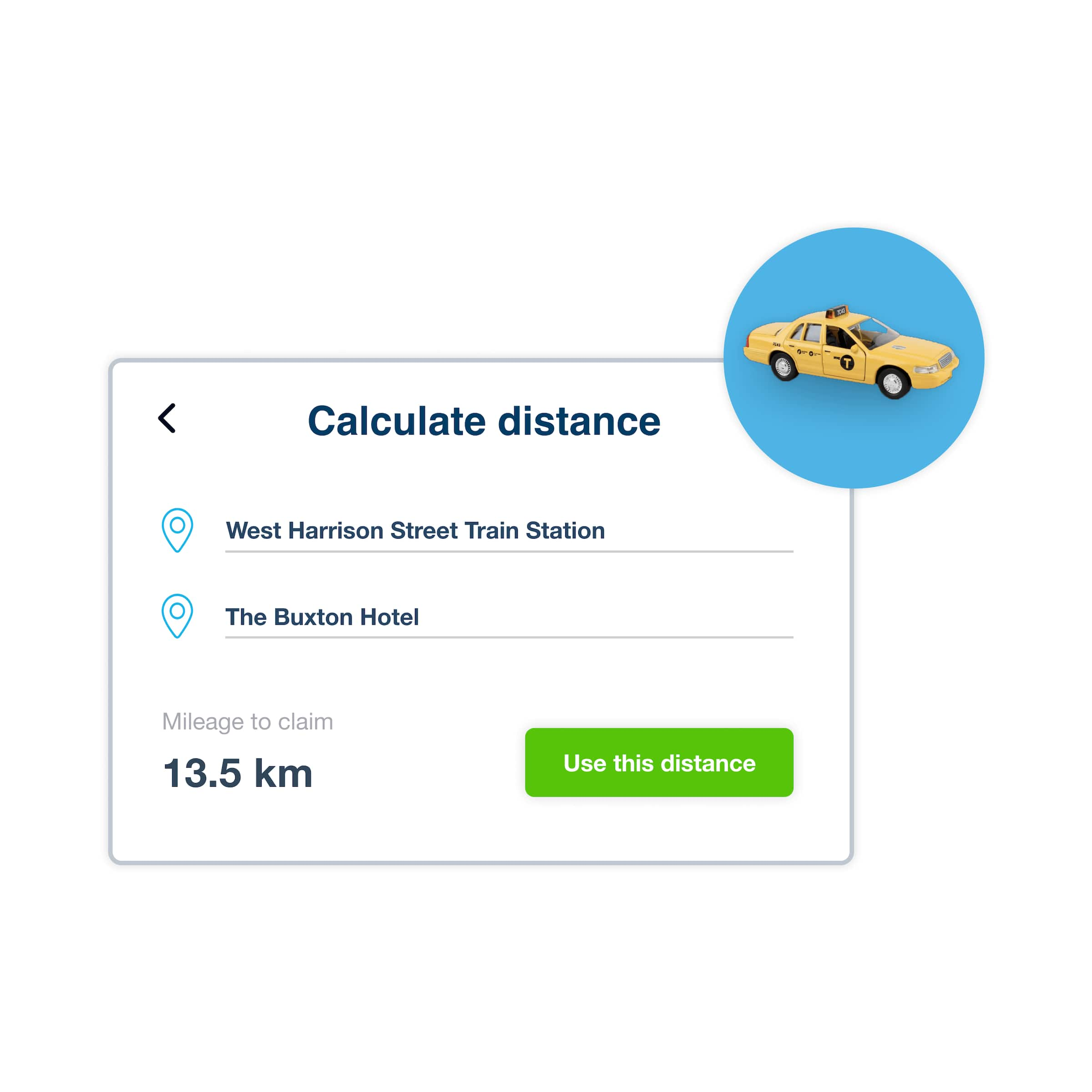

- When inputting your journey, let Xero calculate the exact mileage for you – and avoid human errors

- Submit the expense claim at the same time for a smooth process

Streamline mileage logs and expense claims

The Xero Me app gives you one smooth system for recording and managing your business mileage.

Record your mileage in the app

Enter your journey’s start and end points. Xero automatically calculates and logs the mileage for your records.

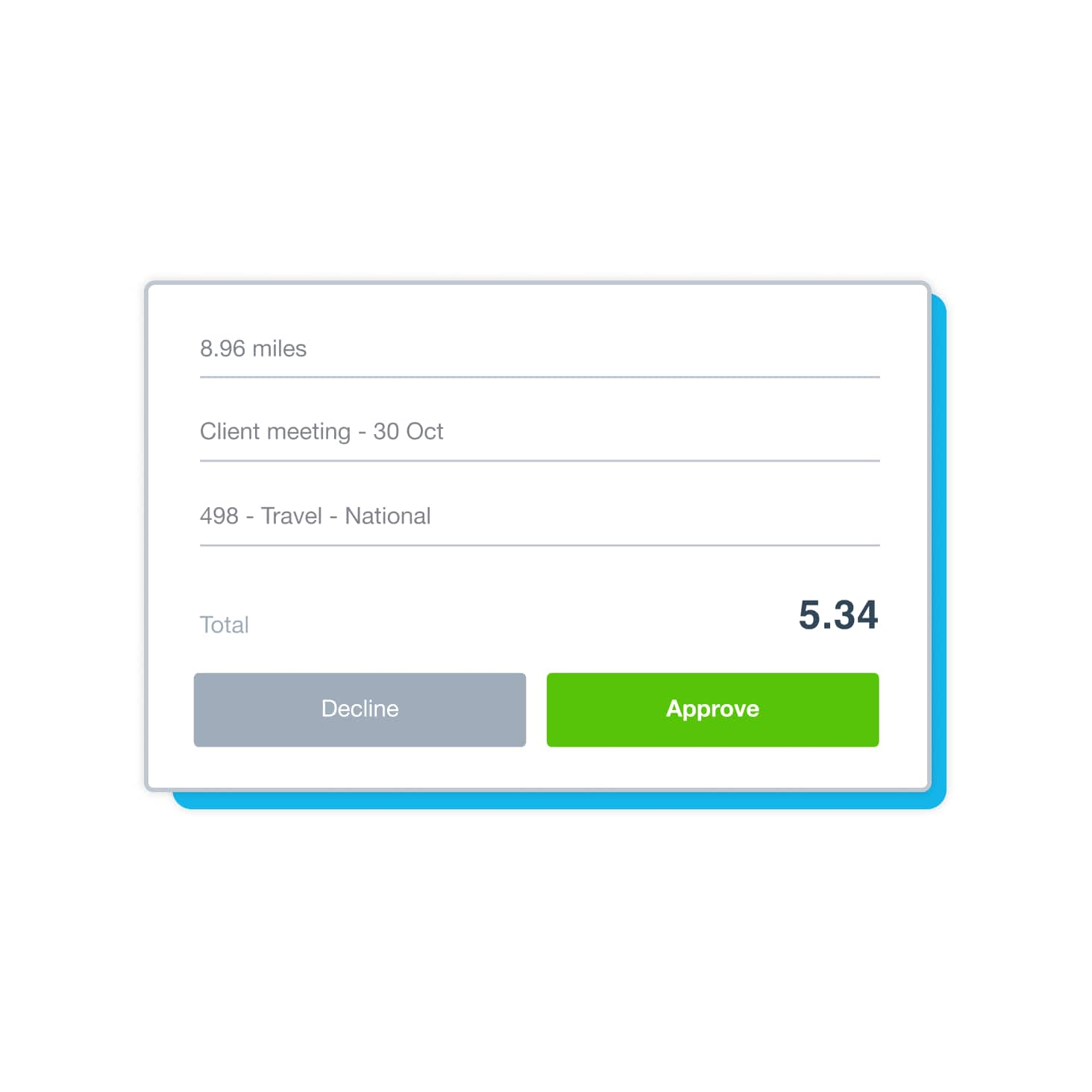

Approve expenses in a few taps

Handle expense claims from your phone to reimburse yourself and your employees with minimum fuss.

Manage your spending on work trips

Stay in control of your project costs with reports and analytics on your mileage expenses.

Track your mileage with the Xero Me app

Xero Me logs your mileage by automatically calculating the distance between the starting and ending addresses you type into the app. This information then flows into your Xero books for an effortless way to record and organize your business expenses.

- Use the Xero Me mileage tracker app on your phone or tablet

- Save time by using one system to calculate mileage and record expenses

- Keep accurate data for your financial records

Reimburse mileage expenses easily

Want to keep your team happy? Use the Xero Me app to review, approve, and pay expense claims on the go. Just tap to instantly approve an amount, then make a reimbursement in the same app. No more employees chasing you for the cash!

- See the date and category – like national travel – of every expense

- Approve business mileage claims for trips in the US or anywhere

- Give permission to other staff to review and approve employees’ expense claims

Monitor your spending on work trips

Xero mileage software tells you exactly what you and your team are spending. Get notified as soon as anyone submits a new expense claim. And see crucial information – from total amounts to the finer details in reports – to stay in control of your business expenses.

- See near real-time financial data that reflects your latest spending

- Glance at your Xero dashboard for headline info, like total cash in and out

- Zoom in on the details with data visualizations and reports on your costs and cash flow

Strengthen your IRS compliance

Xero creates full and accurate records for your reporting to the IRS. Once you’ve logged a journey or photographed a receipt, Xero stores and organizes the correct details in your books automatically. That way you follow IRS rules and face tax season with confidence. Xero mileage software:

- Calculates, captures, and stores the right info for you – saving you time and mistakes

- Applies the correct IRS mileage rate for your journeys

- Lets you quickly compile data and reports when you need them

Easier expenses, faster business

Manage business and vehicle expenses with Xero—record, reimburse, and review spending from the office.

- Take photos of receipts to capture vehicle expenses in Xero

- Handle all business and vehicle finances in one place

- Store receipts digitally in Xero cloud to comply with tax rules and prep for tax time

Plans to suit your business

All pricing plans cover the accounting essentials, with room to grow.

Early

Usually $25

Now $3.75

USD per month

Save $127.50 over 6 months

An easy financial foundation - track cash flow with the essentials.

Growing

Usually $55

Now $8.25

USD per month

Save $280.50 over 6 months

Go beyond the basics - automate tasks and access performance dashboards.

Established

Usually $90

Now $13.50

USD per month

Save $459 over 6 months

Future proof your scaling business - with advanced tools and analytics.

FAQs on Xero’s mileage tracking

Use the Xero Me app to easily track your business mileage as part of a modern digital system. When you’re setting off, enter the start and end points of your journey into the phone app. Xero calculates the distance and logs this mileage for your business expense records. It’s a streamlined process that saves you time and stores accurate data for your tax reporting to the IRS.

Use the Xero Me app to easily track your business mileage as part of a modern digital system. When you’re setting off, enter the start and end points of your journey into the phone app. Xero calculates the distance and logs this mileage for your business expense records. It’s a streamlined process that saves you time and stores accurate data for your tax reporting to the IRS.

Many small businesses choose the Xero Me app to track mileage because it integrates with the rest of Xero’s accounting software. You don’t need to manually input any data into Xero – the travel expenses information flows from the Xero Me app into your Xero organization, where Xero updates your records for you.

Many small businesses choose the Xero Me app to track mileage because it integrates with the rest of Xero’s accounting software. You don’t need to manually input any data into Xero – the travel expenses information flows from the Xero Me app into your Xero organization, where Xero updates your records for you.

Yes! You can use your phone or tablet to record your exact business mileage – and handle your expenses admin on the spot. Either enter your start and end points in the Xero Me app or integrate a third-party app, like TripLog, with Xero. This uses your phone’s GPS to automatically detect and log your trips in real time.

Here’s info on the TripLog appYes! You can use your phone or tablet to record your exact business mileage – and handle your expenses admin on the spot. Either enter your start and end points in the Xero Me app or integrate a third-party app, like TripLog, with Xero. This uses your phone’s GPS to automatically detect and log your trips in real time.

Here’s info on the TripLog appYou need to record the details of every business trip, such as the date, distance, and cost, and keep any supporting documents like receipts. Xero mileage tracker software simplifies this task.It lets you photograph travel receipts and store the right information (along with the original photograph), calculates the distances you travel, and stores your business records in one place. This makes your IRS reporting straightforward.

You need to record the details of every business trip, such as the date, distance, and cost, and keep any supporting documents like receipts. Xero mileage tracker software simplifies this task.It lets you photograph travel receipts and store the right information (along with the original photograph), calculates the distances you travel, and stores your business records in one place. This makes your IRS reporting straightforward.

The IRS mileage rate is 70 cents per mile. Make sure to check the IRS website for the latest information and rates.

Here’s more IRS info on standard mileage ratesThe IRS mileage rate is 70 cents per mile. Make sure to check the IRS website for the latest information and rates.

Here’s more IRS info on standard mileage rates

I was surprised by how easy it was

Xero gives Verdure Surf confidence to do the books

Snap receipts for mileage and other business costs

No more losing your paper receipts. Photograph your receipts with Xero Me and watch the app automatically fill in the claim form. Easy!

Track your costs with job-costing software

Will your new project make money? Xero’s job-costing software helps your track costs, including staff time and mileage, and profitability.

Resources for your small business

Already a Xero user? Need help setting up expense and mileage claims? We’ve put together some great info to get you started.

Set up Xero Expenses

Set up Xero Expenses in your organization and start creating expense and mileage claims.

Create an expense or mileage claim

Create an expense claim to reimburse spending or daily allowances.

Manage bills, purchase orders, and expenses

Learn the basics of creating and managing bills, purchase orders, expense claims, purchase reports, and more.

Why US small businesses love Xero

The Xero Me app and accounting software work together beautifully to simplify your financial admin. Wherever you are that day, hop into Xero to zip through your jobs, from managing expenses to sending invoices.

- Work from anywhere with an internet connection

- Get almost real-time information on your spending and cash flow

- Collaborate with your accountant or business advisor in the cloud-based software

Get one month free

Purchase any Xero plan, and we will give you the first month free.