Margin of safety formula: How your small business can calculate and use it

Learn the margin of safety formula to gauge risk, set targets, and protect cash flow.

Written by Shaun Quarton—Accounting & Finance Content Writer and Growth Marketer. Read Shaun's full bio

Published Tuesday 23 December 2025

Table of contents

Key takeaways

• Calculate your margin of safety by subtracting your break-even sales from current sales, then dividing by current sales to determine what percentage your revenue can drop before reaching break-even.

• Monitor your margin of safety regularly (monthly or quarterly) and recalculate whenever significant business changes occur, such as shifts in fixed costs, supplier price changes, or new pricing strategies.

• Use your margin of safety percentage to guide critical business decisions including setting performance targets, adjusting pricing strategies, controlling costs, and evaluating new product launches.

• Combine margin of safety analysis with other financial metrics like cost-volume-profit analysis to gain a comprehensive view of your business's profitability and risk tolerance.

What is the margin of safety?

Margin of safety is the percentage by which your current sales exceed your break-even point. It shows how far sales can drop before your business starts making a loss – where revenue equals costs and you make neither profit nor loss.

Your margin of safety shows how much sales can fall, or costs can rise, before your business starts to make a loss. The wider this margin, the better protected your business is from unexpected changes.

What is the margin of safety formula?

The margin of safety formula calculates what percentage your sales can drop before reaching break-even:

Margin of safety = (Current sales - Break-even sales) ÷ Current sales

- Current sales: Your business's total revenue from selling goods and services over a specific period

- Break-even sales: The exact revenue needed to cover all fixed and variable costs where your business makes zero profit and zero loss

Here's a quick margin of safety example.

Let's say a business has current sales of £50,000 and needs £30,000 in sales to break even.

Margin of safety = (£50,000 – £30,000) / £50,000 = 0.4 (40%)

This means the business's sales could drop by 40% before it hits its break-even point. Any further sales drop would result in a loss.

The margin of safety calculation is set out in more detail below.

The importance of the margin of safety for your small business

The margin of safety is essential for assessing your business's financial risk, though empirical studies find that this type of risk management is often undertaken by larger firms and not by the smaller companies, making it a key opportunity for small businesses. It reveals how much your sales can drop before you start losing money.

- High margin of safety: Your risk is low and your business can absorb market shifts without disruption

- Low margin of safety: Your risk is high as you're operating close to break-even with little room for error

Consider how an external shock (like a jump in supplier prices) would affect your business. This increase in variable costs pushes up your break-even point, eating into your margin of safety and leaving your business exposed to further cost increases or falling sales.

Your margin of safety also supports smarter financial decisions across your business. Use your margin of safety to guide decisions across your business, from pricing to cost control and growth plans.

How to calculate margin of safety

Now let's break down the margin of safety calculation.

1. Find your current sales

The first step is to determine your current sales – whether they're actual or forecasted.

You can usually find your current sales figures quickly in your existing sales tools.

Sales forecasting helps you predict future revenue using data analysis and industry insights. Use these four methods to build accurate forecasts:

- Historical data: Analyse past sales trends and seasonal patterns from your point-of-sale (POS) system, e-commerce platform, or accounting software like Xero

- Market research: Study your target market, industry trends, and competitor performance to understand market conditions

- Qualitative forecasting: Gather insights from your sales team or industry experts based on their experience

- Quantitative forecasting: Apply statistical methods to historical and market data for more precise predictions

The best approach for you depends on your business type and the data available to you. For example, a craft business uses a POS system to track monthly sales. Last month, sales were £5,000. This figure is used in future steps of the margin of safety calculation.

2. Calculate your break-even sales revenue point

Break-even sales calculation: To work out your break-even sales, divide your total fixed costs by the contribution to sales ratio. For margin of safety, you need this as a revenue figure, not unit sales.

Break-even sales = Fixed costs ÷ ((Sales price - Variable cost) ÷ Sales price)

Fixed costs: Expenses that stay the same regardless of sales volume, such as salaries and rent

Variable costs: Expenses that change with sales volume, such as raw materials and sales commission

More information on variable costs and how they differ from fixed costs. Your accountant can also help you distinguish between them.

To demonstrate, let's say the craft business has:

- Fixed costs of £2,000

- Variable costs of £5 per unit

- A sales price of £25 per unit

Therefore:

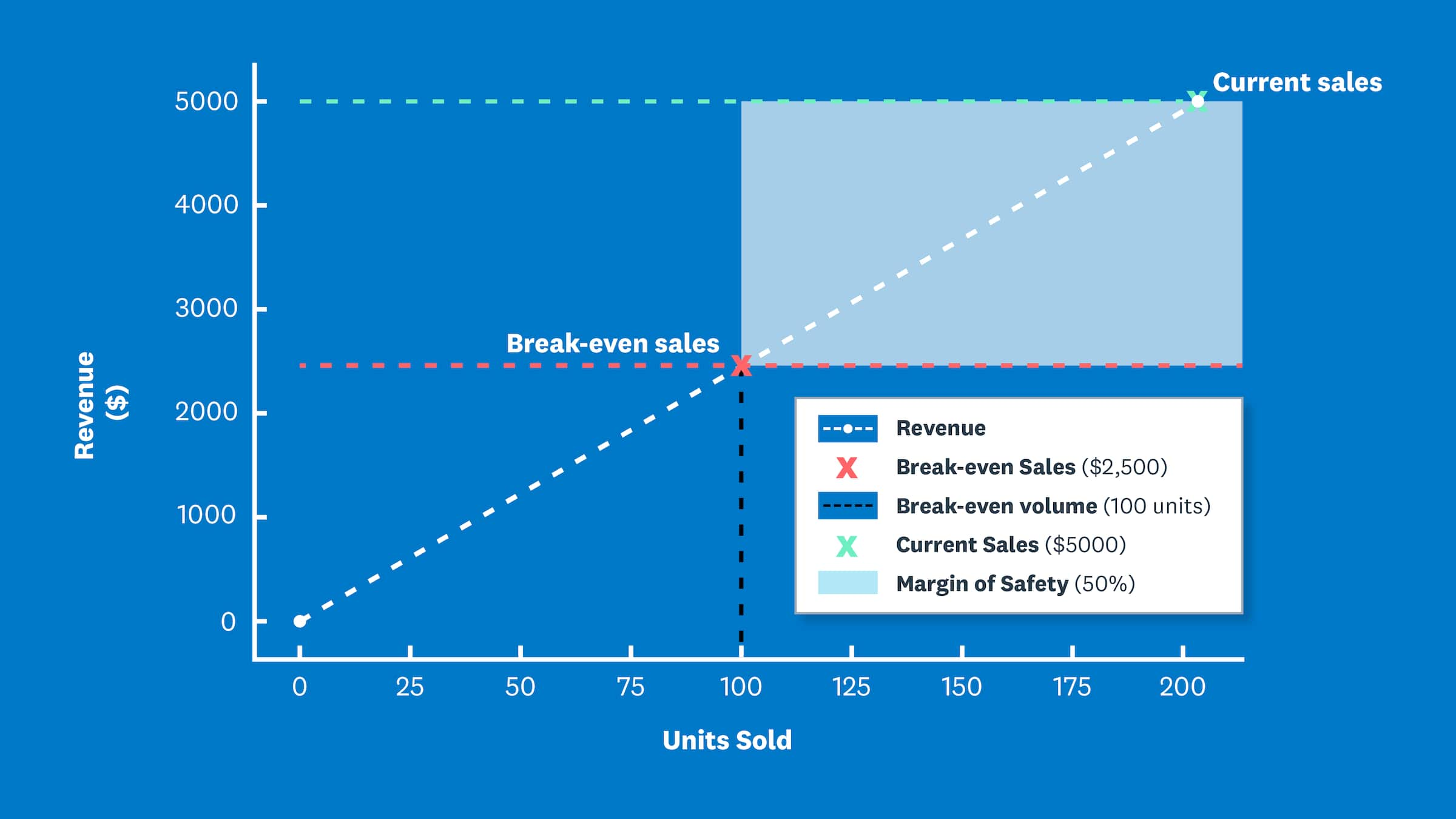

2,000 ÷ ((25 – 5) ÷ 25) = Break-even sales revenue = 2,000 ÷ (20 ÷ 25) = 2,000 ÷ 0.8 = £2,500

So with a sales price of £25, you need revenue of £2,500 (100 sales units) to break even.

Learn more about your break-even point.

3: Apply the margin of safety formula

Finally, apply the margin of safety formula:

(Current sales – Break-even sales) ÷ Current sales = Margin of safety

The result is your margin of safety ratio – the percentage by which sales can fall before your business starts operating at a loss.

Let's apply the formula to the craft business example, where current sales are £5,000 and the break-even point for sales revenue is £2,500:

(£5,000 – £2,500) ÷ £5,000 = Margin of safety = 2,500 ÷ 5,000 = 0.5 = 50%

The craft business has a 50% margin of safety, meaning sales could fall by half before they reach the break-even point.

How the margin of safety supports your business decisions

Margin of safety guides critical business decisions by showing your financial risk tolerance. Use it to make smarter choices in these areas:

- Performance targets: Set achievable sales targets above your break-even point to ensure profitability

- Pricing strategy: Adjust prices when your margin shrinks to ensure each sale covers costs adequately

- Cost control:Cut expenses when your margin is low to protect your financial buffer

- Product launches: Evaluate how new products affect your margin before investing in development

Use margin of safety alongside other key metrics

The margin of safety is most effective as an input into your business decisions when used with other key financial metrics.

You can also use your margin of safety with other analysis tools in your planning. For example, when used with cost–volume–profit (CVP) analysis, it can help guide your planning and calculate the sales revenue required to achieve a target profit, giving you a clearer view of your profitability and risk.

Master your margin of safety with Xero

Manual margin of safety calculations waste valuable time tracking figures across spreadsheets and reports. This takes focus away from running your business.

Xero automates the data collection and reporting you need for accurate margin of safety calculations. Access real-time financial data and generate reports instantly, so you can make confident business decisions faster.

Ready to simplify your financial management? Try Xero for free and see how easy margin of safety calculations can be.

FAQs on margin of safety

Here are answers to common questions to help you get the most out of this metric.

What is a good margin of safety ratio?

There's no single 'good' ratio, as it depends on your industry and business stability. However, a higher margin is always safer. Many businesses aim for 20% or more, which provides a healthy buffer. If your industry is volatile, you might want an even wider margin to protect against unexpected changes.

When should I recalculate my margin of safety?

It's a good idea to check your margin of safety regularly, perhaps quarterly or monthly. You should also recalculate it any time there's a significant change in your business, such as a shift in your fixed costs, a change in supplier prices (variable costs), or a new pricing strategy.

Can margin of safety be negative?

Yes. A negative margin of safety means your sales are below your break-even point and your business is making a loss. You need to act quickly to lift sales or reduce costs so you move back above break-even. If losses continue, your accountant or auditor may question whether your business can keep trading and may refer to this as a ‘going concern’ issue.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.