Simple payroll software for your UK small business

Pay yourself and your team faster with Xero’s online payroll software. Xero automates your payroll calculations for accurate payroll figures, fuss-free compliance, and more time to do what you love.

Simplify your payroll accounting

Running your payroll online is a cinch with cloud payroll accounting.

Easier HMRC compliance

Simplify HMRC compliance and reporting with payroll software

Automated payroll

Let Xero calculate payroll tax, pension contributions, and employee leave for you

Self-service for employees

Give employees access to Xero Me so they can see their payslips, request leave, and submit timesheets online

92% of customers [say they] run payroll faster using Xero

*Source: survey conducted by Xero of 254 small businesses in the UK using Xero, May 2024

Meet your HMRC requirements effortlessly

Xero’s HMRC-recognised software is designed to comply with all the latest legislation. Manage your payroll by letting Xero take the workload off your plate. Xero’s automated calculations, simple-to-use software, and secure storage of your data in one place give you a stress-free tax season.

- No more manual RTI (real-time information) submissions – Xero automates the process for speed and accuracy.

- Xero sends your payroll details to HMRC after each pay run, so you file on time, every time.

- Need to make a change? Any adjustments are easy.

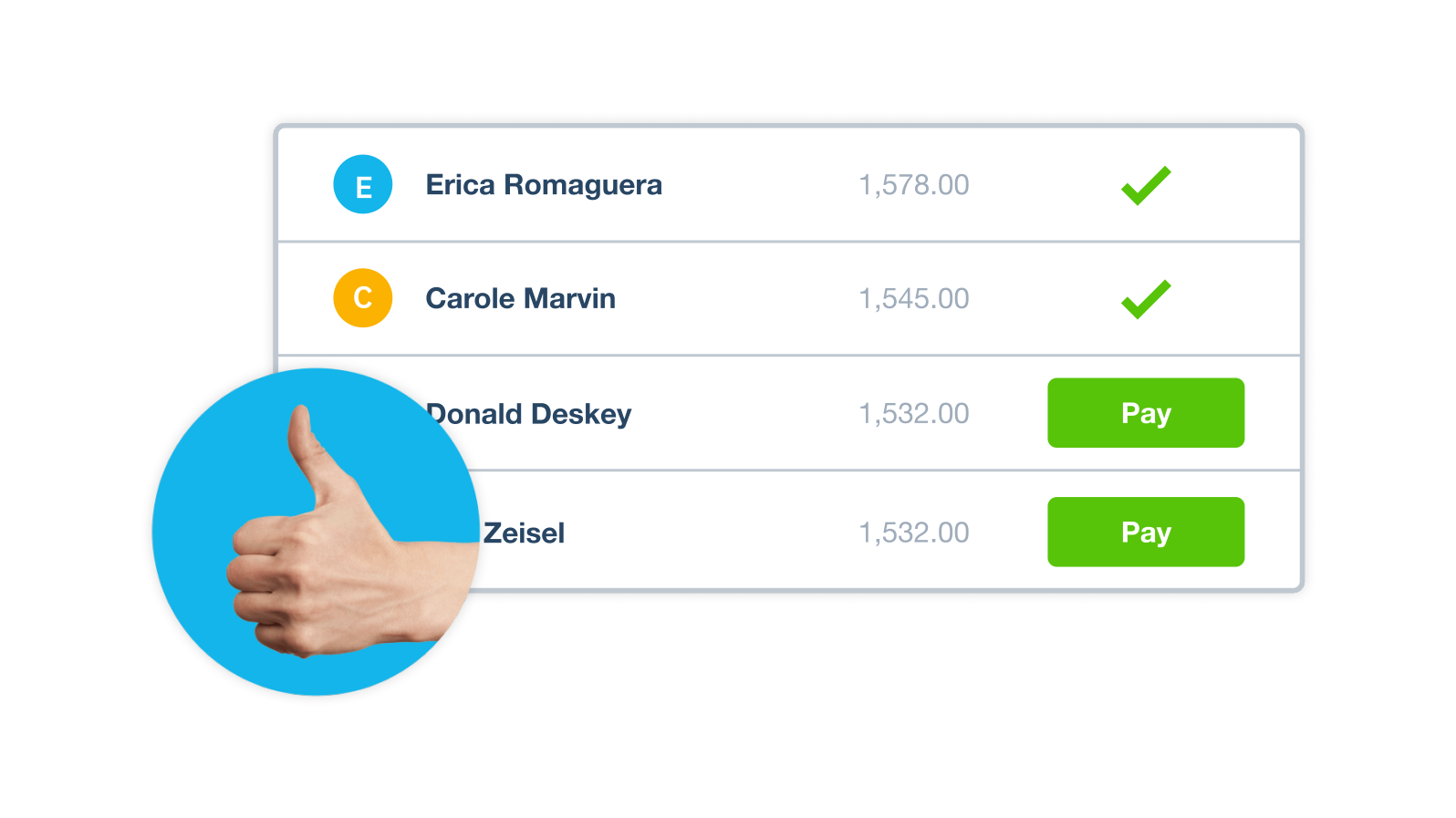

Streamline payroll with automated calculations

The payroll process is smoother when there’s less manual work. Pay your team in just a few clicks and, thanks to automation, everything is updated across the software automatically. And your on-screen experience is so much better thanks to Xero’s user-friendly design and intuitive features.

- Taxes, pensions, and leave are automatically calculated for accuracy and huge time savings

- Customisable pay calendars and rates suit your unique business needs

- Employees can access their payslips through the Xero Me app anytime, or receive them securely by email

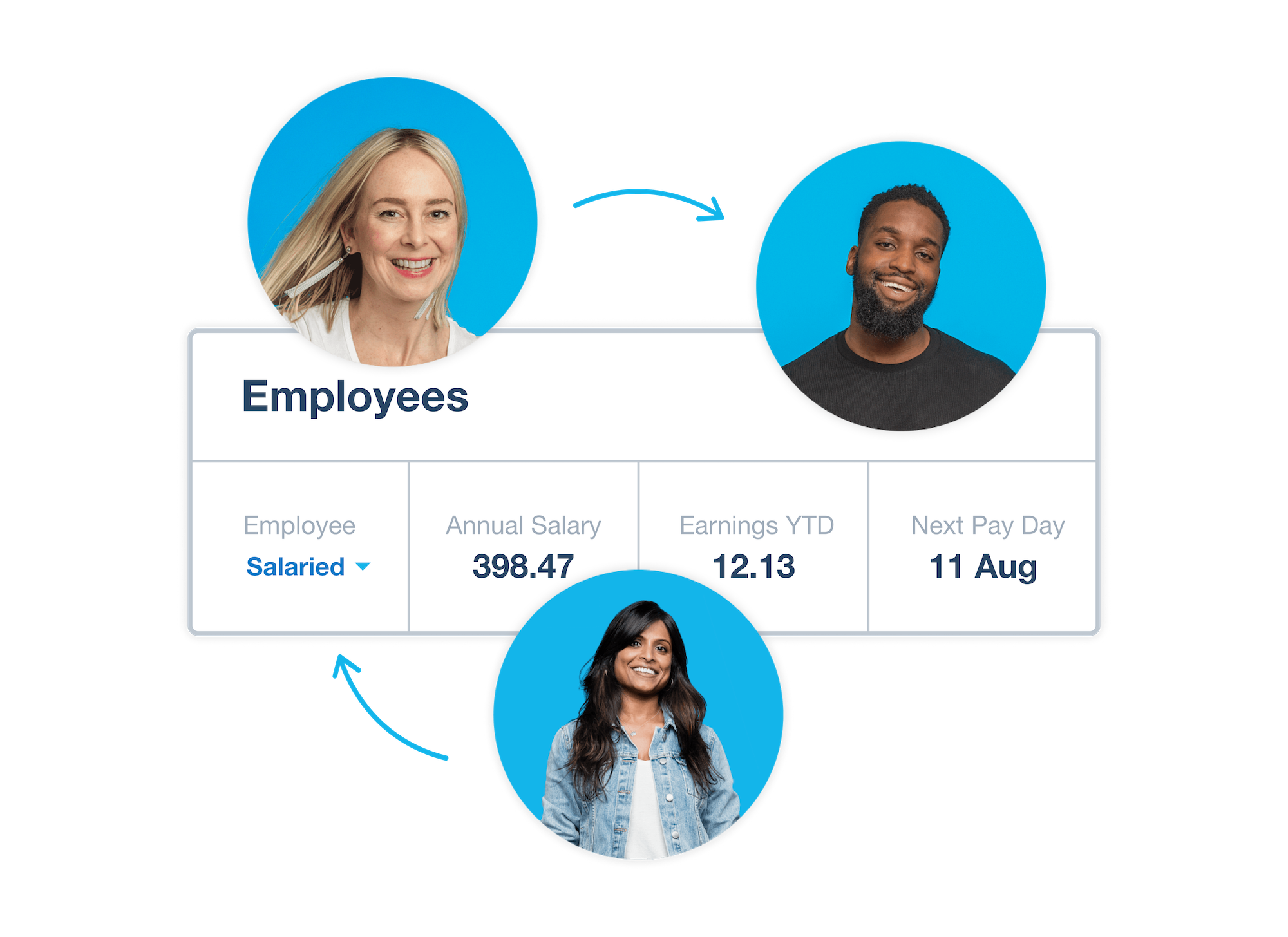

Empower your team with self-service access

Want to win back some precious hours? The Xero Me payroll app is payroll software for your team. It gives them control over their working lives, saving you time and hassle.

- Instant access to payslips anytime, from anywhere

- Authorised employees can review and approve their leave requests and timesheets

- Simple self-service tools can be accessed from any device

Improve your pension re-enrolment process

Xero payroll software is built to help you comply with your UK pension re-enrolment obligations. Imagine: no more worrying about deadlines or mistakes on your assessments.

- Cyclical reminders mean less chance of missed deadlines and penalties

- Automatic assessment and enrolment for employees help you to stay compliant

- Secure integration with pension providers allows for safe and seamless processing

Make CIS scheme deductions simple

Using the Construction Industry Scheme (CIS) is straightforward with Xero accounting software. You can streamline the whole process and save time.

- Automated CIS calculations for your invoices

- File your monthly returns directly from Xero to HMRC

- All data is taken from one secure place

- You can verify subcontractors online

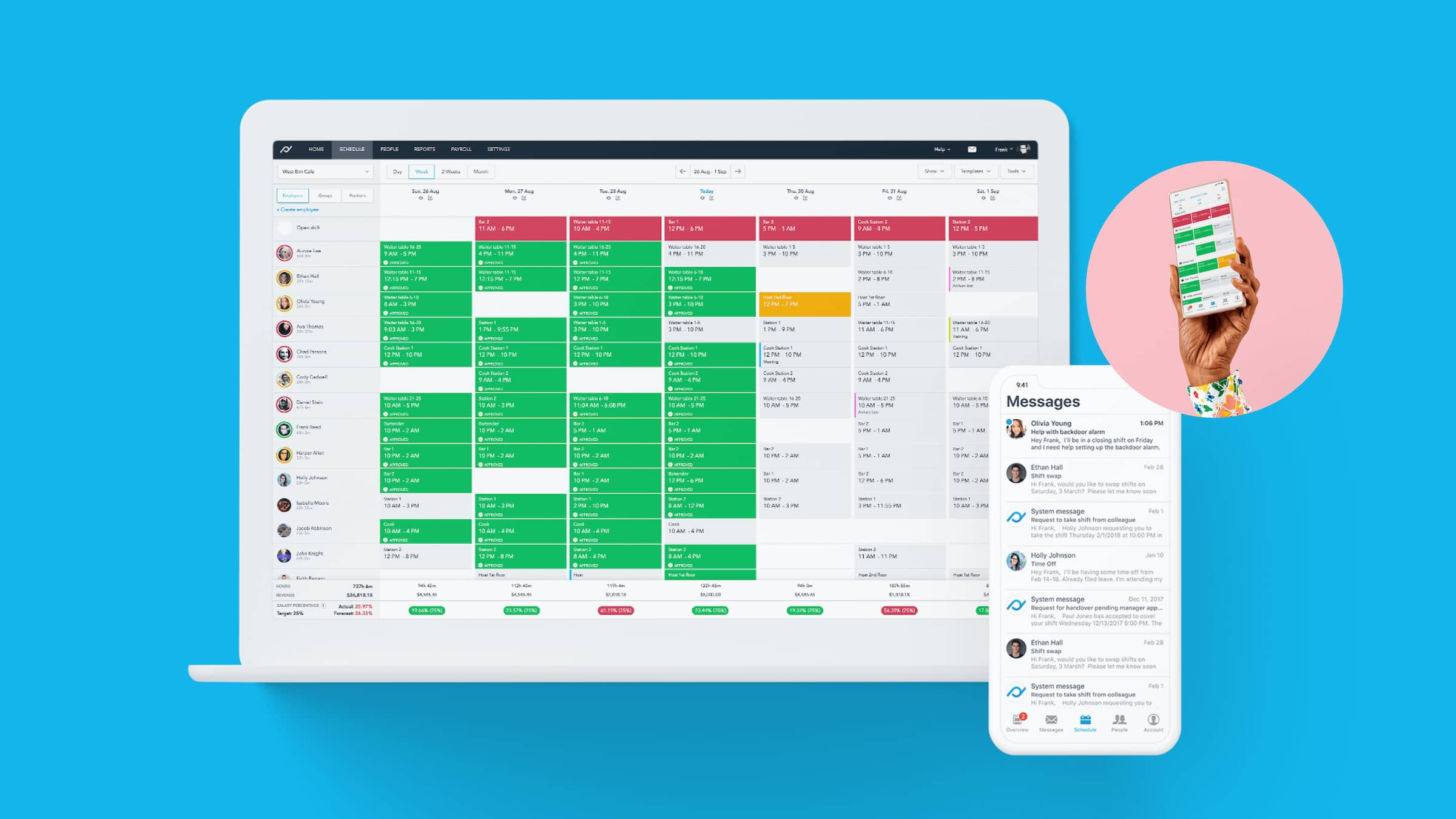

Supercharge payroll with Planday from Xero

It just got easier to manage your staff. Planday is a workplace management tool that gives you access to integrated time-tracking, payroll, and scheduling – from anywhere.

- Easy management of your employee rotas

- Accurate staff pay and less time using spreadsheets

- Compliance with legislation on hours and pay

- Free trial for 30 days

Simplify your entire business with Xero

Xero doesn’t just simplify your payroll – it eases all your financial admin, from invoicing and receiving payments to meeting HMRC rules and managing cash flow. Xero’s accounting software integrates beautifully with Xero Payroll to lighten your workload, so you have more time to build your business.

See how Xero can help your UK small business

Frequently asked questions about Xero payroll software

Payroll in Xero helps streamline, automate, and manage a whole range of payroll tasks. Click the link below for a comprehensive list of everything Xero’s cloud payroll system can do to make running your UK small business easier.

See features of Xero PayrollPayroll in Xero helps streamline, automate, and manage a whole range of payroll tasks. Click the link below for a comprehensive list of everything Xero’s cloud payroll system can do to make running your UK small business easier.

See features of Xero PayrollYes – when you enable automatic enrolment and re-enrolment in Xero, eligible employees are enrolled in your workplace pension and their contributions are automatically calculated against their earnings. Xero connects directly to Nest and to the People’s Pension so you can submit your contributions electronically, or download a file to send to another provider.

Learn more about automating workplace pensionsYes – when you enable automatic enrolment and re-enrolment in Xero, eligible employees are enrolled in your workplace pension and their contributions are automatically calculated against their earnings. Xero connects directly to Nest and to the People’s Pension so you can submit your contributions electronically, or download a file to send to another provider.

Learn more about automating workplace pensionsXero automatically adjusts employee leave balances when a leave request is submitted and approved. Xero Payroll software comes with all the standard leave types, so you can easily manage sick leave, and maternity, paternity, shared, adoption, and bereavement leave. You can set up custom leave types, too.

Xero automatically adjusts employee leave balances when a leave request is submitted and approved. Xero Payroll software comes with all the standard leave types, so you can easily manage sick leave, and maternity, paternity, shared, adoption, and bereavement leave. You can set up custom leave types, too.

Yes, you can. Once employee hours are entered into timesheets, Xero automatically calculates employee earnings. The time entered on project tasks also flows into payroll timesheets.

Yes, you can. Once employee hours are entered into timesheets, Xero automatically calculates employee earnings. The time entered on project tasks also flows into payroll timesheets.

Yes. Give your employees access to Xero Me so they can view their own payslips, request leave, and submit timesheets.

Learn more about Xero MeYes. Give your employees access to Xero Me so they can view their own payslips, request leave, and submit timesheets.

Learn more about Xero MeYou can view a wide range of payroll reports to get valuable data and information on payroll activity, transactions, remuneration, and pension contributions. Payroll is included in the Xero Grow, Comprehensive and Ultimate plans for the UK. Each plan allows for a different number of active users each month. You can see full details on the pricing plan page.

See the Xero UK pricing plansYou can view a wide range of payroll reports to get valuable data and information on payroll activity, transactions, remuneration, and pension contributions. Payroll is included in the Xero Grow, Comprehensive and Ultimate plans for the UK. Each plan allows for a different number of active users each month. You can see full details on the pricing plan page.

See the Xero UK pricing plans

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

Ultimate pricing plan

The Ultimate plan simplifies payroll for your business. It handles everything from complex pay structures to multiple employee types.

Why small businesses choose Xero

Xero accounting software works perfectly with Xero Payroll to lighten your workload, so you can spend more time building your business.

Plans to suit your business

All pricing plans cover the accounting essentials, with room to grow.

Simple

A new plan with features designed for sole traders and landlords, supporting MTD for Income Tax

Simple

Usually £7

Now £0.70

GBP per month

Save £37.80 over 6 months

- Send quotes and 10 invoices†

- MTD for Income Tax Ready

- Reconcile bank transactions

- Capture bills and receipts with Hubdoc

- Short-term cash flow and business snapshot

- Automate CIS calculations and reports

Payroll resources for small businesses

Strengthen your payroll process with our tools, templates, and expert advice to help your business flourish.

Getting to grips with small business payroll

Starting to employ people? Here are the basics of pay, deductions, and dealing with the tax office.

Best practices for payroll processing

We show you best practices in payroll processing for UK small businesses.

Pay your staff accurately and on time

Xero’s payroll and expenses features reduce your admin and help you pay staff correctly.

Already a Xero user and need help setting up Payroll?

Xero Central is a knowledge base filled with helpful articles to get you started.

Set up an employee's leave entitlements

Staff off on holiday? Make sure you get your employees’ wages right.

Add or edit an employee timesheet

Submit employee timesheets for the current pay period and approve them before you process the pay run.

Learn about payroll and employees

Articles and discussion on employee compensation and tax, including timesheets, pensions, and payroll reports.

I’ve gone from zero control to Xero control

Made by the Forge uses Xero to make quick decisions

FAQs about Xero in the UK

Yes, you can connect your Xero account with HMRC to more easily prepare and submit your returns so you never miss a deadline. HMRC recognises Xero’s software, which is also compliant with Making Tax Digital (MTD).

Find out more on running a business at GOV.UKYes, you can connect your Xero account with HMRC to more easily prepare and submit your returns so you never miss a deadline. HMRC recognises Xero’s software, which is also compliant with Making Tax Digital (MTD).

Find out more on running a business at GOV.UKXero payroll offers a range of reports for internal use and helps you meet HMRC requirements each month. You can give your employees self-service access so they can view payslips, request leave, and submit timesheets directly from Xero.

See HMRC rules for running payrollXero payroll offers a range of reports for internal use and helps you meet HMRC requirements each month. You can give your employees self-service access so they can view payslips, request leave, and submit timesheets directly from Xero.

See HMRC rules for running payrollThe best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plansThe best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plansNo – Xero is based in the cloud, so all you need is an internet connection. But you need a multi-factor authentication (MFA) app to log in to Xero. MFA adds an extra layer of security by checking that it’s really you when you log in.

Learn about data protection with XeroNo – Xero is based in the cloud, so all you need is an internet connection. But you need a multi-factor authentication (MFA) app to log in to Xero. MFA adds an extra layer of security by checking that it’s really you when you log in.

Learn about data protection with XeroYes – the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business in the UK.

Check out the Xero App StoreYes – the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business in the UK.

Check out the Xero App Store

See how online payroll streamlines tasks

Simplify pay runs with Xero payroll