Connect bank feeds in Xero for better bookkeeping

Xero users in the UK save 5.5 hours* a week using bank feeds and automated transaction matching for faster reconciliation and up to date finances. Get bank data into Xero from over 21,000 financial institutions around the world.

Bank feeds: all your transactions in Xero, easily

Xero’s automatic bank feeds mean less admin for you. Xero pulls in your transaction data so you don’t need to upload bank statements.

Get bank transactions into Xero

Set up bank feeds and watch transactions flow into Xero automatically – without any effort from you.

Stay up to date with your finances

Get an up- to-date view of your finances and make bookkeeping easier by matching transactions as they come into Xero.

Keep your data safe

Your data is protected every step of the way – bank transactions feed into Xero via a secure, encrypted connection.

90% of customers [say they] reduce business admin using Xero

*Source: survey conducted by Xero of 858 small businesses in the UK using Xero, May 2024

Get bank data into Xero with bank feeds

Depending on your bank, you can feed transactions into Xero via bank feeds. With automated bank feeds, transactions flow directly into Xero from your bank accounts on a regular basis.

- Set up feeds from multiple banks

- Get feeds from any number of bank accounts

- Import up to 12 months of historical data when you first connect.

Export bank data manually and upload to Xero

If your bank doesn’t support bank feeds, easily export and upload your bank data to Xero, which can be more ideal if you’re unable to connect bank accounts or set up bank feeds. Xero accepts data files from your bank in multiple formats, so the process to import bank data into Xero is simple:

- Export bank data from your online banking in OFX, QIF, QBO, QFX, or CSV formats

- Upload the exported file into Xero to import bank data

- Review your transactions in Xero, where the system automatically checks for and excludes any duplicates

- Adjust the data if you're using a CSV file, ensuring everything is correct before finalizing the import

Bank feeds give you an up-to-date view of your finances

With bank feeds, your bank transactions flow into Xero regularly, so you can reconcile transactions in just a few minutes each day for an accurate, up-to-date view of the money coming in and going out of your business.

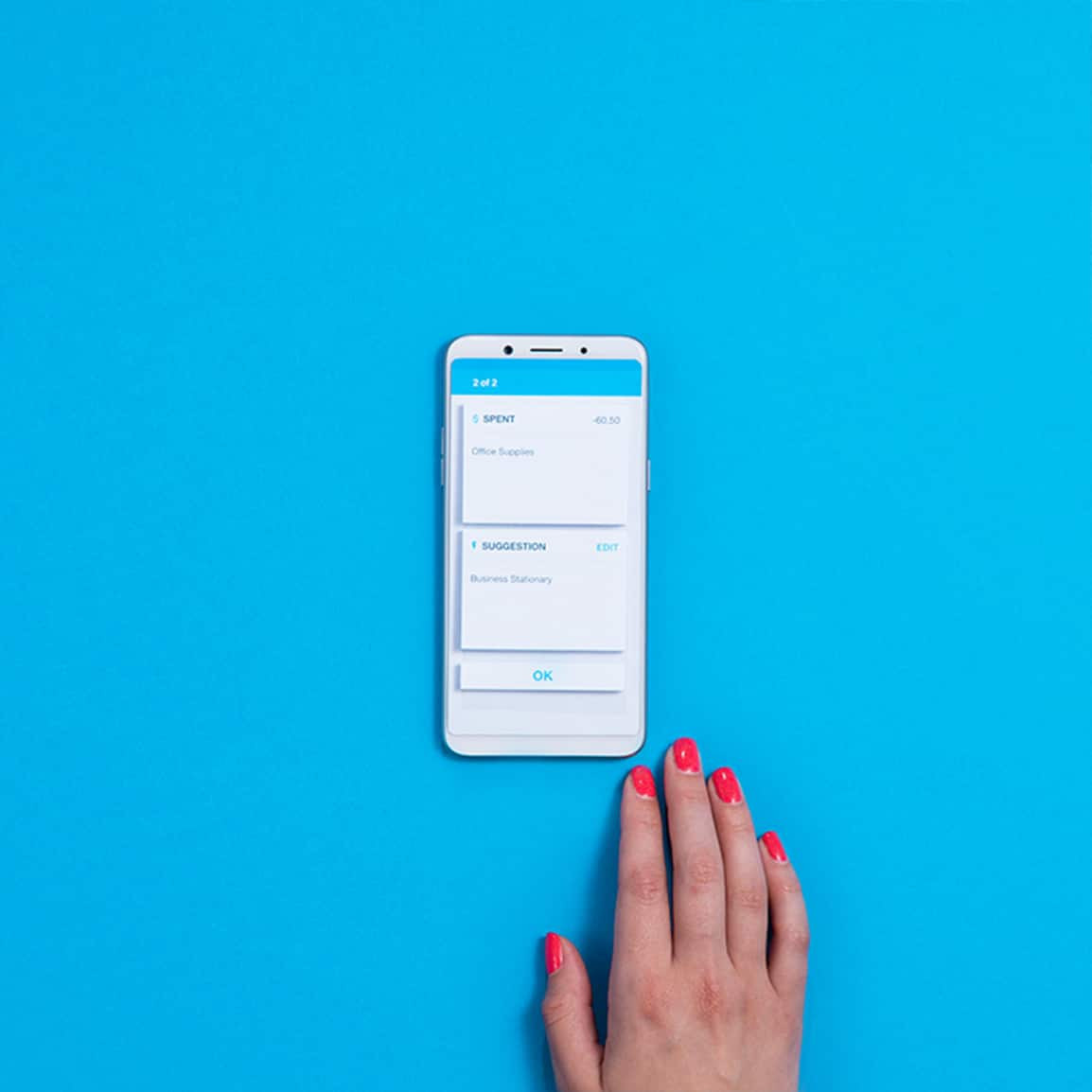

- Complete reconciliations faster with suggested transaction matches based on memorisations and AI technology

- Set up bank rules for recurring transactions so Xero categorises them for you – just click ‘okay’ to approve

- See an up-to-date view of your finances on the Xero dashboard once transactions are reconciled

Keep your data safe

Connecting your bank account is a safe way to get data into Xero. Encrypted connections protect your data while it’s on its way to Xero. Once your data is in Xero, it’s protected by multiple layers of security.

- With bank feeds, transactions are shared only between your bank, Xero, and any other party you choose

- Xero can’t make payments or move money from your accounts through your bank feed connection

- Only people you give access to can see your bank feed data in Xero

The thing I love most about Xero is the great integration with all the major platforms I use. So Shopify, Stripe – everything works seamlessly.

Monique Malcolm, Tiny Action

Plans to suit your business

Simple

A new plan with features designed for sole traders and landlords, supporting MTD for Income Tax

Simple

£7

GBP per month

- Send quotes and 10 invoices†

- MTD for Income Tax Ready

- Reconcile bank transactions

- Capture bills and receipts with Hubdoc

- Short-term cash flow and business snapshot

- Automate CIS calculations and reports

Need help with bank feeds as a Xero user?

Xero Central is our comprehensive knowledge base, filled with articles to help you get the best out of Xero.

Connect your bank

Connect bank accounts and get data into Xero automatically. Refresh the feed to load your latest transactions.

Set up bank feeds

Bank feeds automatically pull in transactions from a bank, or a payment provider like Stripe or PayPal.

Get help if your bank feeds are disrupted

If bank feeds aren’t working as they should, find a solution or workaround.

FAQs about bank feeds

Bank feeds are a speedy, secure, accurate way to get transaction data into Xero without manual uploads or data entry. Connecting Xero with your bank account lets transactions flow securely into the software, ready for you to review and reconcile.

Bank feeds are a speedy, secure, accurate way to get transaction data into Xero without manual uploads or data entry. Connecting Xero with your bank account lets transactions flow securely into the software, ready for you to review and reconcile.

Bank feeds can give you time back by importing transactions for you. It’s one less task on your to-do list, and because transactions come directly from your bank, you can be sure they’re accurate.

Bank feeds can give you time back by importing transactions for you. It’s one less task on your to-do list, and because transactions come directly from your bank, you can be sure they’re accurate.

One way to see if an automated bank feed exists for your bank, is to sign up for a 30-day free trial of Xero and select Accounting>Bank accounts>Add bank account. Another way is to look up the list of UK banks that offer bank feeds.

Look up the list of UK banks that offer Xero bank feedsOne way to see if an automated bank feed exists for your bank, is to sign up for a 30-day free trial of Xero and select Accounting>Bank accounts>Add bank account. Another way is to look up the list of UK banks that offer bank feeds.

Look up the list of UK banks that offer Xero bank feedsIf your bank or financial institution doesn’t yet offer Xero bank feeds, don’t worry – it's quick and easy to regularly upload a file of your most recent bank transactions instead. Just export them from your online banking in OFX, QIF, QBO, QFX or CSV format or download a PDF, then upload the file into Xero – it should only take half a minute or so to upload the file.

See how to manually import bank statementsIf your bank or financial institution doesn’t yet offer Xero bank feeds, don’t worry – it's quick and easy to regularly upload a file of your most recent bank transactions instead. Just export them from your online banking in OFX, QIF, QBO, QFX or CSV format or download a PDF, then upload the file into Xero – it should only take half a minute or so to upload the file.

See how to manually import bank statementsSimply set up your bank account in Xero, then connect the Xero account to your bank to automatically import transactions. To set up an automated bank feed, your bank needs to be a participating institution and you must be registered for online banking.

See how to add a bank account in XeroSimply set up your bank account in Xero, then connect the Xero account to your bank to automatically import transactions. To set up an automated bank feed, your bank needs to be a participating institution and you must be registered for online banking.

See how to add a bank account in XeroSimply set up a direct feed from Stripe, Wise or PayPal to automatically import your most recent transactions into Xero.

Find out more about bank accounts and feedsSimply set up a direct feed from Stripe, Wise or PayPal to automatically import your most recent transactions into Xero.

Find out more about bank accounts and feedsOnce your bank transactions are showing in Xero regularly, you can reconcile them each day, either at your desk or on the move with the Xero Accounting app, so you know where your business stands. Choose to categorise each transaction in Xero yourself, or just confirm what Xero suggests.

More about bank reconciliation in XeroOnce your bank transactions are showing in Xero regularly, you can reconcile them each day, either at your desk or on the move with the Xero Accounting app, so you know where your business stands. Choose to categorise each transaction in Xero yourself, or just confirm what Xero suggests.

More about bank reconciliation in XeroThere’s no limit on the number of bank account connections you can have. Set up as many bank accounts in Xero as you need, and feed in the transactions from any number of banks or financial institutions. You can bring all your accounts together online in one place.

There’s no limit on the number of bank account connections you can have. Set up as many bank accounts in Xero as you need, and feed in the transactions from any number of banks or financial institutions. You can bring all your accounts together online in one place.

When setting up an automated bank feed in Xero, you’ll be given the option to pull historical transaction data from the past 90 days or up to 2 years, depending on the bank.

When setting up an automated bank feed in Xero, you’ll be given the option to pull historical transaction data from the past 90 days or up to 2 years, depending on the bank.

Accounting software for your UK small business

Run your business accounting online with Xero. Easy-to-use accounting software, designed for your small business.

- Everything in one place

- Connect to your bank

- Collaborate in real time

- Customise to suit your needs

FAQs about Xero in the UK

Yes, you can connect your Xero account with HMRC to more easily prepare and submit your returns so you never miss a deadline. HMRC recognises Xero’s software, which is also compliant with Making Tax Digital (MTD).

Find out more on running a business at GOV.UKYes, you can connect your Xero account with HMRC to more easily prepare and submit your returns so you never miss a deadline. HMRC recognises Xero’s software, which is also compliant with Making Tax Digital (MTD).

Find out more on running a business at GOV.UKXero payroll offers a range of reports for internal use and helps you meet HMRC requirements each month. You can give your employees self-service access so they can view payslips, request leave, and submit timesheets directly from Xero.

See HMRC rules for running payrollXero payroll offers a range of reports for internal use and helps you meet HMRC requirements each month. You can give your employees self-service access so they can view payslips, request leave, and submit timesheets directly from Xero.

See HMRC rules for running payrollThe best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plansThe best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plansNo – Xero is based in the cloud, so all you need is an internet connection. But you need a multi-factor authentication (MFA) app to log in to Xero. MFA adds an extra layer of security by checking that it’s really you when you log in.

Learn about data protection with XeroNo – Xero is based in the cloud, so all you need is an internet connection. But you need a multi-factor authentication (MFA) app to log in to Xero. MFA adds an extra layer of security by checking that it’s really you when you log in.

Learn about data protection with XeroYes – the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business in the UK.

Check out the Xero App StoreYes – the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business in the UK.

Check out the Xero App Store

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

See how online bank feeds simplify admin

Press play. All will be revealed.

*Xero customers save 5.5 hours a week using this feature

Data based on August 2023 survey average across 180 customers.