Solvency vs liquidity: Key differences and how they work for your business

Learn the difference between solvency and liquidity to manage risk, protect cash flow, and fund growth.

Written by Lena Hanna—Trusted CPA Guidance on Accounting and Tax. Read Lena's full bio

Published Tuesday 23 December 2025

Table of contents

Key takeaways

- Solvency measures your business's ability to meet long-term financial commitments

- Liquidity shows how easily you can pay short-term bills and obligations

- Both metrics are essential for understanding your complete financial health

- Track both regularly to make informed decisions about growth and stability

What does solvency mean in business?

Solvency refers to how well a business can meet its long-term financial commitments. A solvent business maintains – your total assets exceed your total liabilities.

Key characteristics of a solvent business:

- Assets exceed liabilities: Your business owns more than it owes

- Long-term stability: Can pay debts over months and years

- Positive equity: Maintains financial cushion for unexpected challenges

Steps to maintain solvency

Three essential steps to maintain solvency:

- Stay profitable: Generate consistent profits to keep total assets exceeding total liabilities

- Manage debt strategically: Negotiate lower repayments and understand collateral loan terms if payments become difficult

- Optimise asset use: Ensure your inventory and equipment generate enough returns to cover debt obligations

What is solvency vs profitability?

Solvency and profitability are different financial measures:

Profitability measures how much money you make relative to costs. If you earn more than you spend producing goods or services, your business is profitable.

- The connection: Profitable businesses boost their solvency chances. However, poor debt management can still lead to insolvency.

- Warning sign: Taking new loans without paying existing ones can push total liabilities above assets, creating insolvency risk.

Read more in our guide on profitability

How does solvency affect your business growth?

If you stay solvent, you can more easily:

- Borrow money from banks and lenders who'll feel more confident that you can pay them back

- Attract potential investors to bring more resources and expertise to your business

- Get better deals with suppliers by using your cash reserves to buy in bulk, and therefore lower your cost per unit

- Keep your business running smoothly and make plans for the future

What does liquidity mean in business?

Liquidity measures your business's ability to pay bills and loan repayments in the coming months. It compares current assets against current liabilities.

How liquidity works:

- Current liabilities: Amounts owed within the coming year

- Current assets: Cash, inventory, payments due, and quickly sellable assets

- Common ratios: Cash ratio, quick ratio, and current ratio

Other liquidity ratios

Three main liquidity ratios for small businesses:

- Current ratio: Most common method comparing all current assets to current liabilities

- Quick ratio (acid test): Uses only assets convertible to cash within three months

- Cash ratio: Compares only cash and cash equivalents to current liabilities

Learn more in our guide on liquidity ratios.

How liquid are your assets?

Asset liquidity ranking from highest to lowest:

Highly liquid assets:

- Cash: Physical currency and immediately withdrawable savings

- Accounts receivable: Invoices owed to you (liquidity decreases with longer payment terms)

Table of the difference between solvency and liquidity

Less liquid assets:

- Physical assets: Buildings and equipment that take months to sell

Liquidity vs other financial concepts

Liquidity vs related financial concepts:

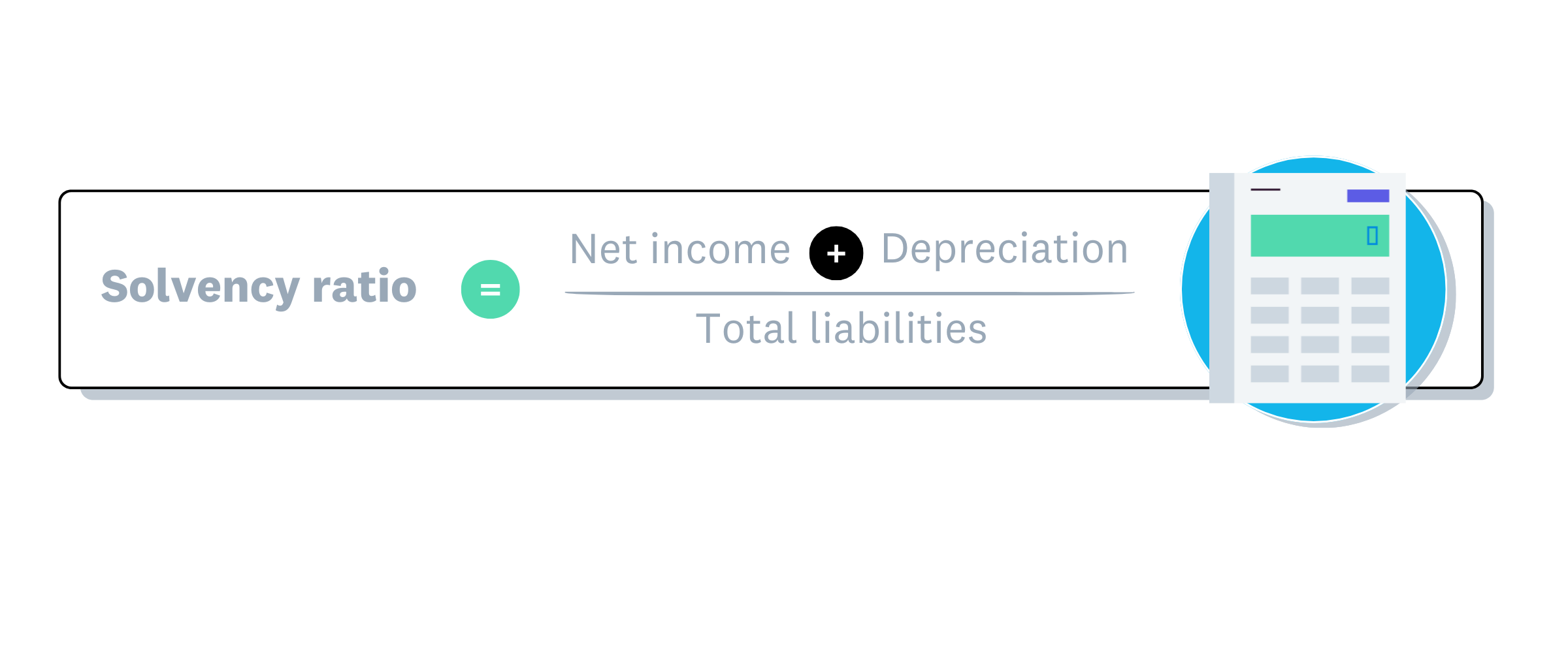

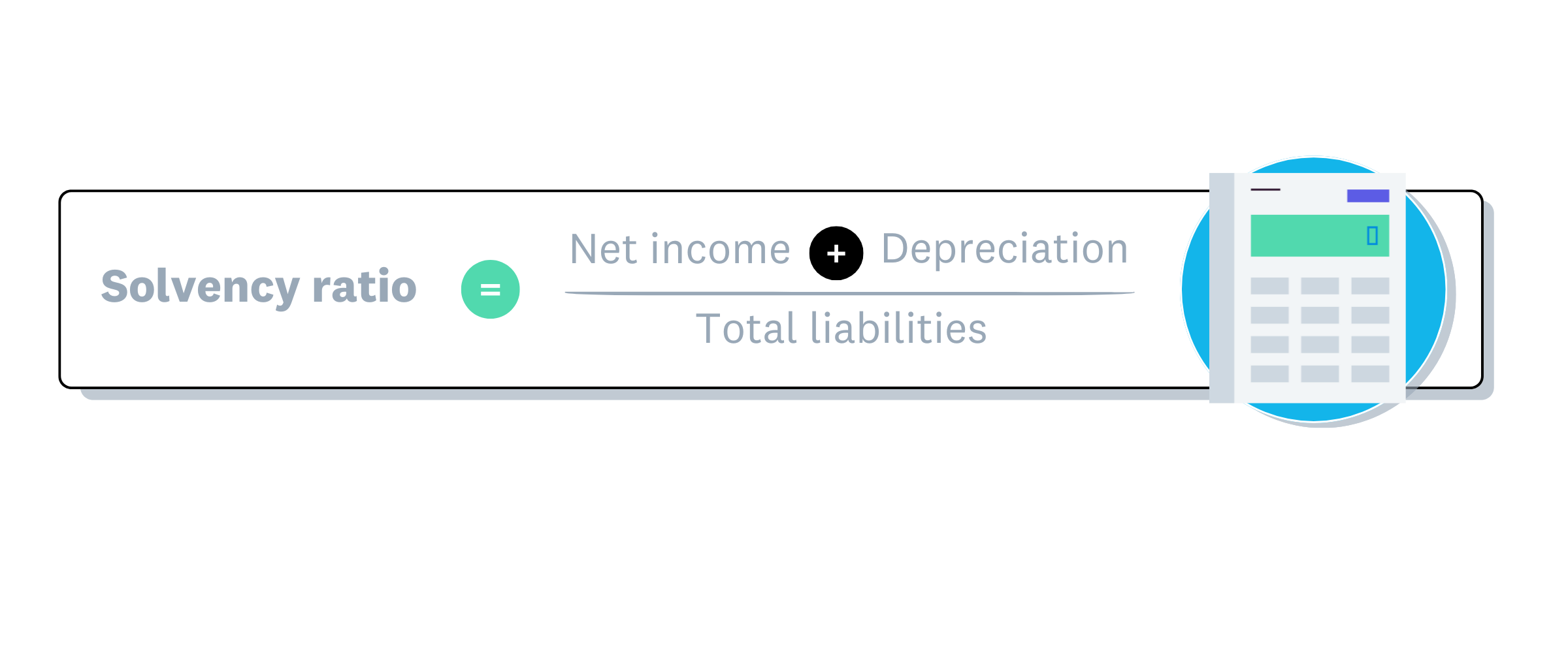

Solvency ratio formula

- Liquidity: How easily you can cover upcoming costs

- Cash flow: General availability of cash moving in and out

- Working capital: Money remaining after covering upcoming costs

- Free cash flow: Cash remaining after capital investments

The main differences between solvency and liquidity

Solvency takes a long-term view of your financial health, while liquidity focuses on the short term. This table outlines other differences.

Keep a steady eye on both your business's liquidity and solvency to stay on top of its financial picture.

How to measure solvency and liquidity in your business

To calculate the solvency ratio, start by looking at the key ratios that measure your solvency and liquidity.

Solvency ratio formula

Solvency ratio formula

A solvency ratio calculation example

Martha owns a cafe that has:

- A net income of £50,000

- Asset depreciation* of £10,000

- Total liabilities of £300,000

To work out her solvency, she divides 60,000 (50,000 + 10,000) by 300,000, which equals 20%. Many lenders and advisers view a ratio of 20% or more as healthy, so Martha’s business is well placed to pay its debts over the years.

*Depreciation is the decrease in the value of your assets over time from normal wear and tear. On your balance sheet, it shows as a deduction from the asset’s value.

Liquidity ratio formula

Several ratios measure liquidity, including the cash ratio, quick ratio, and working capital ratio, which can help you assess liquidity over a longer period.

Here's the formula for the working capital ratio:

A liquidity ratio calculation example

Sadiq runs a sports shop that has:

- Current assets of £120,000

- Current liabilities of £80,000

To work out his liquidity using the current ratio, he divides 120,000 by 80,000 to get 1.5. Since Sadiq's ratio is above 1.0, his liquidity is good. While some suggest a target ratio should exceed 2.0 for safety, acceptable current ratios vary by industry, and many companies operate safely with a ratio below that level, making it likely he can meet his short-term financial commitments.

Why solvency and liquidity matter for your small business

Why both metrics matter for your business:

Solvency benefits:

- Financial stability: Manage risks like unpaid invoices

- Growth capacity: Use resources for expansion

- Stakeholder confidence: Keep shareholders satisfied

Liquidity benefits:

- Operational continuity: Pay staff and suppliers on time

- Risk protection: Handle unexpected costs and market changes

- Cash availability: Maintain funds for daily operations

The consequences of poor financial health:

- Poor liquidity: Struggle to pay immediate obligations

- Poor solvency: Difficulty meeting long-term debts

- Insolvency: When a business cannot meet its debts and may face formal insolvency procedures. In late 2023, more than 47,000 UK companies were reported to be in ‘critical’ financial distress, so monitoring your position early is vital.

For more detail, read the UK government guidance on liquidation and insolvency.

Tips to improve your financial solvency and liquidity

Strategies to improve your financial position:

Improve solvency:

- Attract investors: Bring in new capital to strengthen your balance sheet

- Restructure debt: Renegotiate, refinance or consolidate loans, particularly if gearing becomes too high – for example, when your debt is high relative to equity. You can read more about managing business debt.

- Optimise operations: Consider business restructuring if necessary

Improve liquidity:

- Monitor cash flow: Track and plan payments regularly (here's how to track your cash flow)

- Benchmark performance: Compare your ratios against industry standards, as this can reveal sector-specific risks. For example, recent analysis showed that sectors such as construction and real estate accounted for nearly 30% of all businesses in serious financial distress.

- Accelerate collections: Make invoice payments easier for customers with online invoice payment options

- Build reserves: Maintain cash cushion for unexpected expenses

Use Xero to track your solvency and liquidity

With Xero accounting software, you know exactly what's happening with your numbers. Maybe you want to scrutinise your daily spending with real-time information, or you need an overview of your long-term solvency based on financial reports. Either way, let Xero give you the full financial picture.

Learn more about Xero's financial reports for your business

FAQs on solvency and liquidity

Here are some common questions small businesses ask about solvency and liquidity.

What does it mean to provide liquidity?

Providing liquidity means ensuring your business has enough cash to pay short-term bills and obligations. You can improve liquidity by accelerating cash flow, such as offering early payment discounts to customers.

Can my business have good solvency but poor liquidity?

Definitely. Your business might struggle with liquidity if its cash flow is weak (there's not much cash in the bank), yet it's solvent because it has valuable fixed assets, like land and buildings. It can therefore pay its long-term debts.

Is solvency good or bad?

Solvency is good. It means you can meet your long-term financial obligations.

What is a good solvency ratio for my small business?

It depends on your industry. In general, a ratio of 20% or more indicates you can meet your long-term financial obligations.

Published Tuesday 23 December 2025

Table of contents

Key takeaways

- Solvency measures your business's ability to meet long-term financial commitments

- Liquidity shows how easily you can pay short-term bills and obligations

- Both metrics are essential for understanding your complete financial health

- Track both regularly to make informed decisions about growth and stability

What does solvency mean in business?

Solvency refers to how well a business can meet its long-term financial commitments. A solvent business maintains – your total assets exceed your total liabilities.

Key characteristics of a solvent business:

- Assets exceed liabilities: Your business owns more than it owes

- Long-term stability: Can pay debts over months and years

- Positive equity: Maintains financial cushion for unexpected challenges

Steps to maintain solvency

Three essential steps to maintain solvency:

- Stay profitable: Generate consistent profits to keep total assets exceeding total liabilities

- Manage debt strategically: Negotiate lower repayments and understand collateral loan terms if payments become difficult

- Optimise asset use: Ensure your inventory and equipment generate enough returns to cover debt obligations

What is solvency vs profitability?

Solvency and profitability are different financial measures:

Profitability measures how much money you make relative to costs. If you earn more than you spend producing goods or services, your business is profitable.

- The connection: Profitable businesses boost their solvency chances. However, poor debt management can still lead to insolvency.

- Warning sign: Taking new loans without paying existing ones can push total liabilities above assets, creating insolvency risk.

Read more in our guide on profitability

How does solvency affect your business growth?

If you stay solvent, you can more easily:

- Borrow money from banks and lenders who'll feel more confident that you can pay them back

- Attract potential investors to bring more resources and expertise to your business

- Get better deals with suppliers by using your cash reserves to buy in bulk, and therefore lower your cost per unit

- Keep your business running smoothly and make plans for the future

What does liquidity mean in business?

Liquidity measures your business's ability to pay bills and loan repayments in the coming months. It compares current assets against current liabilities.

How liquidity works:

- Current liabilities: Amounts owed within the coming year

- Current assets: Cash, inventory, payments due, and quickly sellable assets

- Common ratios: Cash ratio, quick ratio, and current ratio

Other liquidity ratios

Three main liquidity ratios for small businesses:

- Current ratio: Most common method comparing all current assets to current liabilities

- Quick ratio (acid test): Uses only assets convertible to cash within three months

- Cash ratio: Compares only cash and cash equivalents to current liabilities

Learn more in our guide on liquidity ratios.

How liquid are your assets?

Asset liquidity ranking from highest to lowest:

Highly liquid assets:

- Cash: Physical currency and immediately withdrawable savings

- Accounts receivable: Invoices owed to you (liquidity decreases with longer payment terms)

Table of the difference between solvency and liquidity

Less liquid assets:

- Physical assets: Buildings and equipment that take months to sell

Liquidity vs other financial concepts

Liquidity vs related financial concepts:

Solvency ratio formula

- Liquidity: How easily you can cover upcoming costs

- Cash flow: General availability of cash moving in and out

- Working capital: Money remaining after covering upcoming costs

- Free cash flow: Cash remaining after capital investments

The main differences between solvency and liquidity

Solvency takes a long-term view of your financial health, while liquidity focuses on the short term. This table outlines other differences.

Keep a steady eye on both your business's liquidity and solvency to stay on top of its financial picture.

How to measure solvency and liquidity in your business

To calculate the solvency ratio, start by looking at the key ratios that measure your solvency and liquidity.

Solvency ratio formula

Solvency ratio formula

A solvency ratio calculation example

Martha owns a cafe that has:

- A net income of £50,000

- Asset depreciation* of £10,000

- Total liabilities of £300,000

To work out her solvency, she divides 60,000 (50,000 + 10,000) by 300,000, which equals 20%. Many lenders and advisers view a ratio of 20% or more as healthy, so Martha’s business is well placed to pay its debts over the years.

*Depreciation is the decrease in the value of your assets over time from normal wear and tear. On your balance sheet, it shows as a deduction from the asset’s value.

Liquidity ratio formula

Several ratios measure liquidity, including the cash ratio, quick ratio, and working capital ratio, which can help you assess liquidity over a longer period.

Here's the formula for the working capital ratio:

A liquidity ratio calculation example

Sadiq runs a sports shop that has:

- Current assets of £120,000

- Current liabilities of £80,000

To work out his liquidity using the current ratio, he divides 120,000 by 80,000 to get 1.5. Since Sadiq's ratio is above 1.0, his liquidity is good. While some suggest a target ratio should exceed 2.0 for safety, acceptable current ratios vary by industry, and many companies operate safely with a ratio below that level, making it likely he can meet his short-term financial commitments.

Why solvency and liquidity matter for your small business

Why both metrics matter for your business:

Solvency benefits:

- Financial stability: Manage risks like unpaid invoices

- Growth capacity: Use resources for expansion

- Stakeholder confidence: Keep shareholders satisfied

Liquidity benefits:

- Operational continuity: Pay staff and suppliers on time

- Risk protection: Handle unexpected costs and market changes

- Cash availability: Maintain funds for daily operations

The consequences of poor financial health:

- Poor liquidity: Struggle to pay immediate obligations

- Poor solvency: Difficulty meeting long-term debts

- Insolvency: When a business cannot meet its debts and may face formal insolvency procedures. In late 2023, more than 47,000 UK companies were reported to be in ‘critical’ financial distress, so monitoring your position early is vital.

For more detail, read the UK government guidance on liquidation and insolvency.

Tips to improve your financial solvency and liquidity

Strategies to improve your financial position:

Improve solvency:

- Attract investors: Bring in new capital to strengthen your balance sheet

- Restructure debt: Renegotiate, refinance or consolidate loans, particularly if gearing becomes too high – for example, when your debt is high relative to equity. You can read more about managing business debt.

- Optimise operations: Consider business restructuring if necessary

Improve liquidity:

- Monitor cash flow: Track and plan payments regularly (here's how to track your cash flow)

- Benchmark performance: Compare your ratios against industry standards, as this can reveal sector-specific risks. For example, recent analysis showed that sectors such as construction and real estate accounted for nearly 30% of all businesses in serious financial distress.

- Accelerate collections: Make invoice payments easier for customers with online invoice payment options

- Build reserves: Maintain cash cushion for unexpected expenses

Use Xero to track your solvency and liquidity

With Xero accounting software, you know exactly what's happening with your numbers. Maybe you want to scrutinise your daily spending with real-time information, or you need an overview of your long-term solvency based on financial reports. Either way, let Xero give you the full financial picture.

Learn more about Xero's financial reports for your business

FAQs on solvency and liquidity

Here are some common questions small businesses ask about solvency and liquidity.

What does it mean to provide liquidity?

Providing liquidity means ensuring your business has enough cash to pay short-term bills and obligations. You can improve liquidity by accelerating cash flow, such as offering early payment discounts to customers.

Can my business have good solvency but poor liquidity?

Definitely. Your business might struggle with liquidity if its cash flow is weak (there's not much cash in the bank), yet it's solvent because it has valuable fixed assets, like land and buildings. It can therefore pay its long-term debts.

Is solvency good or bad?

Solvency is good. It means you can meet your long-term financial obligations.

What is a good solvency ratio for my small business?

It depends on your industry. In general, a ratio of 20% or more indicates you can meet your long-term financial obligations.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.