W-2 vs 1099: How to correctly classify employees and contractors

There are differences between W-2 employees and 1099 contractors. Learn how to classify these workers correctly.

Written by Kari Brummond—Content Writer, Accountant, IRS Enrolled Agent. Read Kari's full bio

Published November 25 2025

Table of contents

Key takeaways

- You can hire both employees and independent contractors to work for your business.

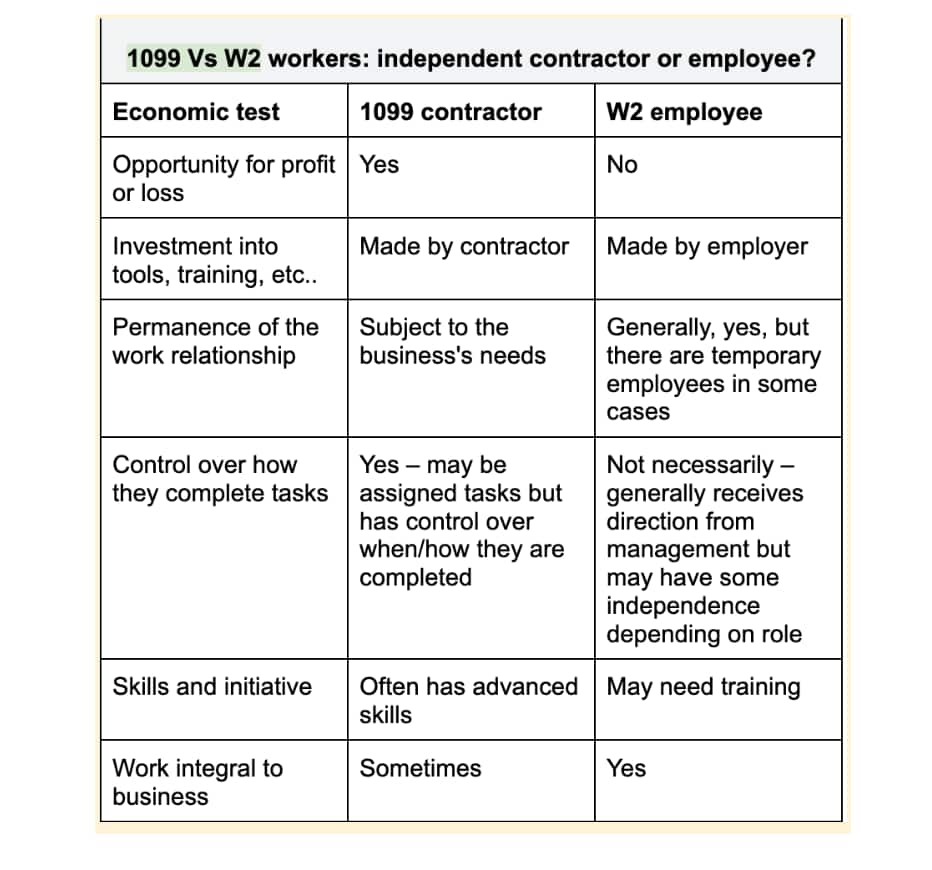

- To distinguish between employees and contractors, follow the Department of Labor’s “economic reality test” criteria.

- You must follow Department of Labor regulations and withhold taxes for employees.

- You just pay contractors, and they take care of their own taxes.

- Make sure you classify employees and contractors correctly – misclassifying employees as contractors can bring fines and other penalties.

What are employees vs independent contractors?

Both employees and independent contractors provide services for small businesses – but there are key differences between these professionals, and to avoid penalties and other consequences, you must classify them correctly.

Employees work for your company. They are:

- Entitled to certain rights on both the state and federal levels, and the business must deal with payroll taxes on their behalf

- Sometimes called “W2 workers” because that's the tax form they receive each year that documents their wages

Independent contractors, however, work for themselves. They:

- Are not entitled to the same rights as employees, and the business generally doesn't have to withhold or pay any taxes from their payments

- Receive a 1099 showing their payments for the year – which is why they're often referred to as “1099 contractors”

How to classify W2 vs 1099 workers

When classifying employees vs independent contractors, you must consider several factors, including how they manage their time and tasks.

Contractors run their own businesses, bring a specific set of skills to your business, and typically provide services based on their own timeline and processes.

But employees work for you, may need training, and must complete work based on your timeline and instructions.

The Department of Labor (DOL) uses an "economic reality" test to determine whether a worker is an employee who should receive a W2 or is a 1099 contractor.

The DOL's criteria for determining who's a 1099 vs W2 worker are nuanced, and you must take into account all the elements above when deciding between the two. A worker may fail one part of the economic reality test but meet the other criteria.

To illustrate, let's look at the permanence of the relationship test.

Some workers have decades-long relationships with businesses, but are still eligible for 1099 contractor classification. An accountant who prepares tax returns for a business but independently runs their own accounting firm is still a 1099 contractor, even though they have a somewhat permanent relationship with the business..

In contrast, a seasonal worker at a retail store must show up to work as scheduled and complete tasks their manager gives them. Because of that, they’re a W2 employee, even though they don't have a permanent relationship with the company.

The DOL has more guidelines on 1099 contractor vs W-2 employee classification.

Know the rules for employees vs independent contractors

W2 vs 1099 workers have different rights. Your obligations as an employer or payer also vary depending on whether you're working with an employee or a contractor.

Compliance: know the labor laws

Employees have certain rights under the Fair Labor Standards Act (FLSA) – but contractors don't. If you classify a worker as an employee, you must:

- Pay them at least minimum wage

- Provide overtime pay if they work over 40 hours a week or meet other criteria

- Display a poster with the FLSA rules

- Follow all labor laws in your state

Payroll

Contractor payroll is easy – you just pay them the agreed-upon amount. You don't have to withhold any taxes, except where you didn't receive a W9 or you're dealing with an international contractor.

For instance, if you hire a contractor to clean the hood fans at your restaurant, you just cut a check, give them cash, issue a payment using payroll software, or pay them with a credit card.

With W2 employees, doing payroll is trickier because you have to deal with payroll taxes. You must:

- Withhold Social Security and Medicare tax from your employees' pay as well as federal income tax, state income tax if applicable, and any required local taxes

- Make a payment to match their Social Security and Medicare contributions

- Deal with federal and state unemployment taxes

Tax forms – 1099 form vs W-2

At the end of the year, you must send all employees and most contractors a form detailing how much they were paid during the year. Contractors receive a 1099-NEC form, while employees get a W-2.

1099 form

This form usually just has one number on it: the amount you paid the contractor during the year. But if you withheld taxes, you'll include that as well. You must give a 1099-NEC to any contractor who did work for your business and was paid $600 or more – that threshold increases to $2000 in 2026.

But if you paid them with a credit card or through a payment processing service like PayPal, you don't have to generate this form.

W-2 form

The W-2 form is more detailed – you must be given to any staff member you withheld tax from during the year. On the W-2, you need to enter (at least) gross pay, Social Security, Medicare, and federal income taxes withheld. Also:

- If you live in a state with income tax, you also enter state income tax withholdings and any local income tax

- If applicable, you also need to note healthcare premiums, retirement plan contributions, and any other benefits or deductions you manage for your employee

You must give both these forms to your workers by the final day of January following the year in which you paid them. You then send a copy of the W-2s to the Social Security Administration and the 1099s to the IRS.

You may also need to send copies to your state’s revenue agency – all states with income tax require W-2s, but the rules on sending 1099 forms to the states vary. Check with your state's department of revenue to learn about the rules in your area.

Here's more on the 1099 and W-2 from the IRS.

Misclassification penalties

Misclassifying employees as 1099 contractors can lead to significant penalties and even legal consequences. You may be on the hook for:

- Back pay – to make up for hours where the worker didn't earn minimum wage

- Payroll taxes – the employer's matching payment for Medicare and Social Security payments based on the worker's wages

- Non-filing and late-filing penalties – these can each be as much as 25% of the unreported tax.

- Negligence penalties – 20% of the unreported tax payments if the IRS determines that you were negligent in failing to file

- Trust fund recovery penalty – 100% of the unpaid employee's portion of payroll taxes, which can also be assessed against individuals, not just the company

There are potentially civil and state penalties as well.

Mistakes to avoid when classifying 1099 vs W2 employees

The difference between W-2s and 1099s can get confusing, so keep these tips in mind.

- Review the DOL guidelines: check the guidelines when creating job descriptions and before recruiting talent.

- Have clear expectations: make sure your workers know whether they're classed as employees or contractors and how that affects them.

- Use contracts: both employees and contractors should have contracts that outline the scope of your relationship.

- Keep things in writing: written contracts and job descriptions are important if you're dealing with a complaint or classification review.

- Ensure managers know how to work with contractors: managers must understand the nuances of working with a contractor who manages their own schedule and processes, and an employee.

Here’s more info from the IRS on the differences between employees and independent contractors.

Track your worker pay with Xero

Xero’s clever features help you track your workers’ pay and deductions. It syncs with your payroll software, so all your records are accurate and up to date – saving you time and keeping your business compliant with tax rules.

You’ll also know just how much tax-deductible business expenses you can claim for your contractor and employee payments. That’s a win for your business!

FAQs on W2s vs 1099s

Here are common questions small business owners might have about filing w2s vs 1099s.

How does the government find out if I misclassified an employee as a contractor?

The IRS may discover issues if it conducts a payroll audit, a whistleblower contacts the agency, or if a worker asks for a classification determination. So it pays to check!

Are there penalties for misclassifying contractors as employees?

Generally, no. The penalties apply when you misclassify employees as contractors, typically not the other way around. Nevertheless, misclassifying contractors as employees may hurt your bottom line as you're on the hook for employer taxes and a more complicated (and costly) payroll process. So it pays to get it right!

What if I'm not sure how to classify a worker?

Reach out to a CPA, a business tax attorney, or a payroll specialist – they should be able to help you make the distinction. You can also file Form SS-8 to ask the IRS for a determination.

Can some workers qualify as both contractors and employees?

Yes, in rare situations a worker may qualify as both a contractor and an employee for the same company, usually when they play different roles for the company – for example, someone who is both a waiter and a graphic designer for the same restaurant.

If you have a worker that you could classify either as a contractor or an employee, use the IRS's guidelines for your analysis and make sure you have formal contracts in place.

What if the IRS decides that my contractor is in fact my employee?

You'll then have to deal with unfiled returns, back taxes, and possibly back pay. But you can appeal the IRS's decision if you disagree.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Get one month free

Sign up to any Xero plan, and we will give you the first month free.