Financial goals for a business: how to set and achieve them

Learn how to set financial goals for a business that grow your profit, cash flow, and confidence.

Written by Shaun Quarton—Accounting & Finance Content Writer and Growth Marketer. Read Shaun's full bio

Published Wednesday 7 January 2026

Table of contents

Key takeaways

- Apply the SMART framework (Specific, Measurable, Achievable, Relevant, Time-bound) when setting financial goals to transform vague objectives like "boost profits" into clear, actionable targets with defined metrics and deadlines.

- Focus on six core financial goal categories (revenue growth, profit margins, expense reduction, cash flow management, debt reduction, and operational expansion) to ensure comprehensive coverage of your business's financial health.

- Implement a systematic six-step process starting with reviewing your current financial position, then breaking long-term vision into smaller goals, applying SMART criteria, creating action plans, and scheduling regular progress check-ins.

- Utilize essential financial tools including budgeting software, accounting platforms, goal-tracking apps, and financial dashboards to monitor key metrics like revenue, profit margins, and cash flow in real-time.

Why are financial goals so important?

Financial goals are specific, measurable targets that guide your business decisions and resource allocation. They provide the foundation for a solid small business financial strategy.

Without clear goals, your decisions lack focus and direction. Your small business is less likely to succeed when operating without defined targets, a principle reflected in federal funding programs where recipients must certify they have obligated at least 80 percent of a funding tranche before receiving the next.

Clear, well-defined financial goals dramatically improve your chances of success. For example, setting a goal to increase annual revenue by 20% focuses your attention on specific strategies like:

- Retaining more customers by starting loyalty programs

- Launching new products into market gaps to attract buyers

- Running targeted marketing campaigns to boost sales

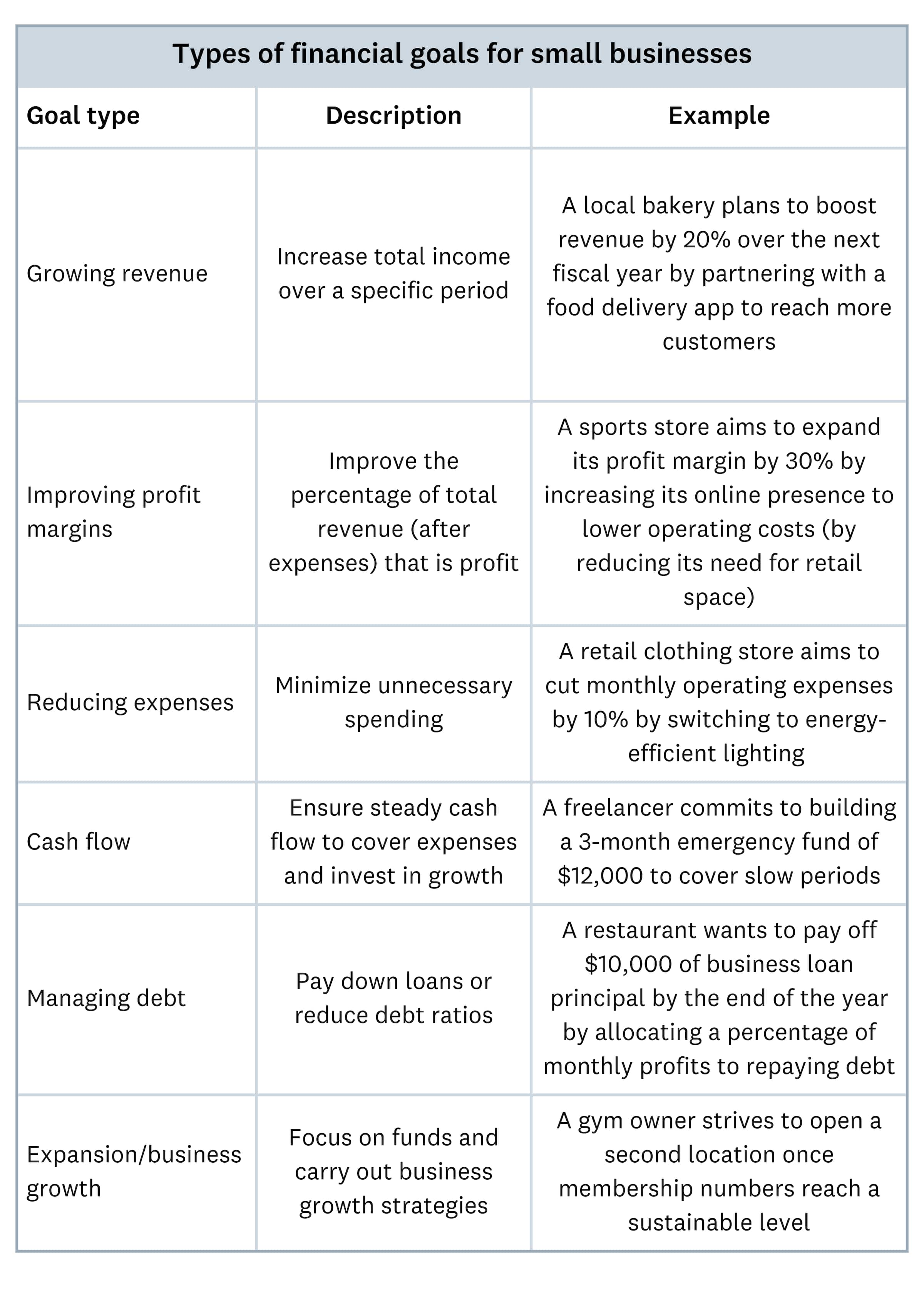

Types of financial goals for small businesses

Financial goal types fall into six core categories that directly impact your business's financial health. Each category includes specific metrics you can track and measure.

These financial areas directly relate to your business’s overall wellbeing. The metrics in each category help you track progress and make informed decisions.

Key benefits of focused financial goals:

- Identify growth opportunities: Pinpoint specific areas with the highest potential

- Track measurable progress: Monitor your business’s financial health in real-time

- Make data-driven decisions: Use concrete metrics to guide strategic choices

- Foster continued success: Build momentum through achievable, targeted objectives

Financial goal examples for small businesses

Seeing how goals work in practice can make them easier to set. Here are a few examples of financial goals for different types of small businesses to give you some ideas.

- For a retail store: Increase online sales by 15% in the next quarter by running targeted social media ads and offering a limited-time discount

- For a construction company:Improve project profitability by reducing material waste by 10% on all jobs over the next six months

- For a freelance consultant: Maintain a cash reserve of at least three months of operating expenses by the end of the year to improve financial stability

- For a cafe: Reduce overhead costs by 5% within two quarters by renegotiating with suppliers and optimizing staff schedules

Set SMART financial goals for your business

SMART goals are financial targets that are Specific, Measurable, Achievable, Relevant, and Time-bound. This framework transforms vague objectives into actionable plans.

Vague goals like “boost profits” lack the clarity you need to succeed, especially when specific financial thresholds determine a company’s official status. For example, the US Securities and Exchange Commission (SEC) defines some smaller companies as those having less than $100 million in annual revenue. You need clear, tangible targets that define exactly what you’re working toward, how you’ll get there, and what success looks like.

SMART goals provide this clarity:

- Specific: Define your goals clearly; for example, increase monthly revenue by 10% by selling more of your best-selling product

- Measurable: Include clear numbers to track progress; for example, monitor weekly revenue from each product line

- Achievable: Set goals that fit your current resources; for example, launch one new product line in Q2

- Relevant: Align your goals with your wider business objectives; for example, focus on high-margin products to increase profitability

- Time-bound: Set deadlines so you stay accountable, for example; achieve a 10% revenue increase by the end of Q3

How to set SMART financial goals

Apply the SMART framework using this formula:

“I want to [specific goal] by [timeframe] so that [relevant outcome]. I will measure success by [metric].”

Real-world example:

“I want to boost profits by 15% within 1 year so I can invest in a new factory to significantly boost my capacity. I will measure success by tracking monthly profit margins, reducing my operating costs by 10%, and increasing high-margin product sales by 20%.”

Looking at it through the SMART lens, the goal is:

- Specific: Boost profits by 15%

- Measurable: Profit margins will be tracked monthly

- Achievable: Cutting costs and focusing on high-margin products seems like a good way to drive a 15% profit increase

- Relevant: Aligns with the business’s broader goal of building a new factory to expand production (see more tips for growing your business)

- Time-bound: Has a clear 1-year deadline

This goal meets all the criteria of the SMART framework.

Once you’ve developed your goals using SMART, you’ll have clear targets that are easy to track. You can link each goal to key performance indicators (KPIs) that show how your business is doing.

How to set financial goals in 6 steps

Ready to set your own goals? Follow this simple, step-by-step process to create a clear plan for your business.

- Review your current financial health. Look at your profit and loss statement, balance sheet, and cash flow statement to understand where you stand.

- Brainstorm your long-term vision. Think about where you want your business to be in three to five years. Do you want to expand, hire more staff, or increase your personal income? Achieving these long-term goals often needs significant capital, so you may also explore funding options to support your growth plans.

- Break your vision into smaller goals. Turn your big vision into more immediate, actionable goals for the next year, quarter, or month.

- Apply the SMART framework. Make sure each goal is specific, measurable, achievable, relevant, and time-bound.

- Create a clear action plan. Outline the specific tasks you need to complete to reach each goal and assign responsibilities if you have a team.

- Schedule regular check-ins. Set aside time weekly or monthly to review your progress, celebrate wins, and adjust your plan as needed.

Tools to help you achieve your financial goals

Financial goal tools provide the data and tracking capabilities you need to make informed business decisions and stay on track toward your targets.

Choose tools from these four essential categories:

- Budgeting software: Allocate resources effectively and keep spending on track

- Accounting platforms: Track cash flow in real time and collaborate with your accountant through cloud-based systems

- Goal-tracking apps: Break down financial targets into manageable steps and monitor progress using tools like Asana and Trello

- Financial dashboards: Visualize key metrics like revenue, profit margins, and cash flow through simple graphs and charts

Xero’s cloud-based accounting software lets you track your progress against the key metrics you choose. Its advanced tools give you the data to support your goal setting, then track your progress against your goals on your own personalized dashboard.

Track your financial goals with Xero

Setting clear financial goals is the first step toward building a more resilient and profitable business. With the right plan and tools, you can stop guessing and start making decisions with confidence. Xero gives you real-time visibility into your finances, making it easy to track your progress and stay focused on what matters most.

See how Xero can help you run your business, not your books. Get one month free.

FAQs on setting financial goals

Check out these FAQs to help you more easily set and achieve your financial goals:

How will my financial goals affect the growth of my business?

Financial goals directly drive business growth by guiding strategic decisions and resource allocation, such as pursuing capital for expansion. Clear goals help you measure progress, improve cash flow management, and spot opportunities to expand. Clear goals help you measure progress, improve cash flow management, and identify expansion opportunities. Without defined targets, you’ll struggle to make decisions that move your business forward.

What’s the difference between short-term and long-term financial goals?

Short-term goals are achievable within a few months to one year. Long-term goals extend beyond one year and can span several years.

Use short-term goals for:

- Quick wins and immediate focus

- Breaking down larger objectives into manageable steps

Use long-term goals for:

- Strategic planning and direction

- Working toward major business ambitions

Should I change my financial goals over time?

Keep your financial goals flexible, and be ready to adjust them if your business’s situation changes or the market shifts.

How often should I review my financial goals?

You can reassess them as often as you like. Ideally, you should review them at least quarterly so you can monitor performance and adjust to changes in your business or the broader market.

What are common mistakes to avoid when setting financial goals?

Quite simply, the biggest mistake is setting goals that aren’t SMART. Vague goals with unrealistic expectations that don’t relate to your business circumstances and failing to track progress can lead to poor decisions.

You and your team are much more likely to achieve goals that are SMART: specific, measurable, achievable, relevant, and time-bound.

How can I involve my team in achieving our financial goals?

It’s all about communication, engagement, and tracking progress. First, be clear with your team about the specific objectives you’ve set, why you’ve set these goals, and how you plan to achieve them (this is much easier if you’ve used the SMART formula to set clear, achievable goals). Then assign specific responsibilities to your team members with your goals in mind. Finally, monitor your team’s performance to keep everyone engaged and moving in the same direction.

How do I set financial goals during uncertain economic times?

When times are tough, it’s best to put your business’s financial stability first, so set goals that focus on maintaining and managing your cash flow. Make sure you’re not investing in any long-term costs that are not essential. This will ensure you’re not taking away from any positive cash flow until the hard times have passed. Have a look at your existing financial goals, too; you might need to rethink them if changing economic conditions have made them unrealistic, say.

What metrics should I use when tracking financial goals?

Essential metrics for most businesses include:

- Revenue growth

- Profit margins

- Cash flow

- Cost reduction results

Customization factors depend on your business nature, specific goals, industry, and market conditions. Your financial advisor or accounting professional can help identify the most relevant metrics for your situation.

Do I need a professional to help me set financial goals for my small business?

It’s not required, but it can help to work with a financial advisor or accountant to set realistic goals for your small business. A financial advisor or accountant has expertise and experience that can help you set goals that are realistic and achievable for your business.

Are there tools to help me track progress against my financial goals?

Yes. Accounting software like Xero is a great option. It gives you tools to measure your financial performance, and analytics to help you forecast your performance against your financial goals. It also helps you streamline your business admin, and set and manage your budgets.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Get one month free

Sign up to any Xero plan, and we will give you the first month free.