Colorado sales tax guide for small businesses

If you sell tangible goods in Colorado, you must collect and remit sales tax. Look at rates, rules, and how to register.

Written by Kari Brummond—Content Writer, Accountant, IRS Enrolled Agent. Read Kari's full bio

Published 25 November 2025

Table of contents

Key takeaways

- Colorado state sales tax is 2.9%. Local governments may add additional tax.

- You must register for a sales tax account to sell taxable items or services.

- The state collects sales tax for many local governments – but if you're in a home-rule municipality, you'll have to file and pay local sales tax separately.

- Remote sellers only need to remit Colorado sales tax if they have over $100,000 in sales in the state.

- Paying or filing late can lead to significant penalties.

What is Colorado sales tax?

Colorado sales tax is a consumption-based tax on the sale of tangible goods. Consumers pay this tax when buying items from businesses, which then file a return and send the tax to the Colorado Department of Revenue (DOR) or their local government agency.

The DOR has a sales tax guide to help you get started.

Items subject to sales tax in Colorado

All tangible items sold in the state are subject to sales tax, except some seed, plants, farm equipment, and certain types of food.

Although you don’t pay sales tax on most groceries, carbonated water, soft drinks, gum, candy, deli trays, and cold sandwiches are taxed unless they're purchased with food stamps. Sales tax also applies to food sold from restaurants, coffee shops, and so on, and to hot prepared foods.

These exemptions only apply to state sales tax. – your county and municipality may add their own sales taxes. For example, in Huerfano County, groceries are subject to county and city sales tax but not state sales tax.

Are services subject to Colorado state sales tax?

No, there is no sales tax on services in Colorado, except intrastate telephone and telegraph services, and gas and electricity for commercial consumption.

How much is sales tax in Colorado?

As of 2025, the Colorado sales tax rate is 2.9% on the state level.

But because municipalities and counties can add their own sales tax, total sales taxes vary quite widely. The average combined rate of sales tax in the state is just under 8%.

- The highest rate in the state is 11.2% in Winter Park, which includes the 2.9% Colorado state sales tax.

- The lowest rate is 3.9% in the little town of Manassa, which includes 2.9% for the state.

How to calculate Colorado sales tax

To calculate sales tax, simply multiply the price of the item by the applicable sales tax rate. For instance, if you're selling something for $100 and the sales tax rate is 8%, you calculate the sales tax as $100 x 0.08 = $8.

To help you calculate the rate, the DOR has updated rates.

Who needs to collect sales tax in Colorado?

Any business with a physical presence in the state that sells taxable items must collect sales tax. If you don't have a physical presence in the state but you sell to customers in Colorado, check the rules for marketplace sellers, remote sellers, and marketplace facilitators.

Marketplace seller rules

Note that iIf you're a marketplace seller, you do not have to collect sales tax yourself. Instead, you rely on the facilitator to handle it for you.

Rules for remote sellers and marketplace facilitators

A remote seller is any business that sells products to Colorado customers but does not have a physical presence in the state. Marketplace facilitators are online companies that act as intermediaries for marketplace sellers – for instance, Amazon or Etsy.

Remote sellers and marketplace facilitators must register for a sales tax account if they have $100,000 or more in Colorado sales. You must register for a Colorado sales tax license by the first day of the first month within 90 days of reaching this threshold. But:

- f the year ends before this time, you must register and collect sales tax starting the first day of the next calendar year

- If your sales are over $100,000 in the previous calendar year, you collect Colorado sales tax for the entire following year

Multi-channel sellers

If you sell taxable goods through multiple channels, you need to keep multiple rules in mind. For instance, say you have a brick-and-mortar store in Denver and you sell through Etsy. In that case, you collect sales tax as usual in your brick-and-mortar store, but you don't have to collect sales tax for your Etsy sales since that will be handled by the facilitator.

The DOR has more info for online sellers, including marketplace sellers and facilitators, and multi-channel sellers.

How to get a Colorado business sales tax license

Getting a Colorado sales tax license is pretty straightforward. If you do it online, you can complete the entire process the same day.

1. Register your business with the state

You need to register limited liability companies (LLCs), corporations, and limited partnerships with the state. You don't have to register general partnerships or sole proprietorships, but if you want to operate under a name other than your own, you must register a "doing business as" name.

You can do all of this on the Colorado Secretary of State website.

2. Get an EIN

All businesses, except for sole proprietors with no employees, need an employer identification number (EIN) to get a state sales tax license. Sole props can use their Social Security Number on the sales tax application, but even if you're not required to get an EIN, you may want to get one to keep your social Security Number private.

You can get an EIN on the IRS website.

3. Apply for a sales tax account

Once you’ve set up your business and you have a tax ID number, you can apply for a sales tax account with the state. Do this online at MyBizColorado or through the mail by filing Form CR-0100.

- There's a $16 fee, which may be prorated if you apply in the middle of the year, plus a $50 deposit that gets refunded as soon as your business pays at least $50 in sales tax.

- If you apply online, you'll get your sales tax account number immediately, and the state will mail a paper certificate within 2–3 weeks. Mailed applications typically take 2–3 weeks to process.

- State sales tax accounts last 2 years and expire on the last day of December in odd-numbered years.

The DOR has a video about how to apply for a sales tax license.

4. Check if you're in a home-rule municipality

A home-rule municipality is a county or city that collects its own sales tax. If you're in a home-rule municipality, you need a sales tax certificate from your county or municipality, and then, you should file a return with these entities in addition to your state sales tax return.

If you're not in a home-rule municipality, you should file a consolidated sales tax return with the state. Then, the DOR will send the local sales tax to your county and/or municipality.

Check out the DOR's rules for local government sales tax.

How to file sales tax returns in Colorado

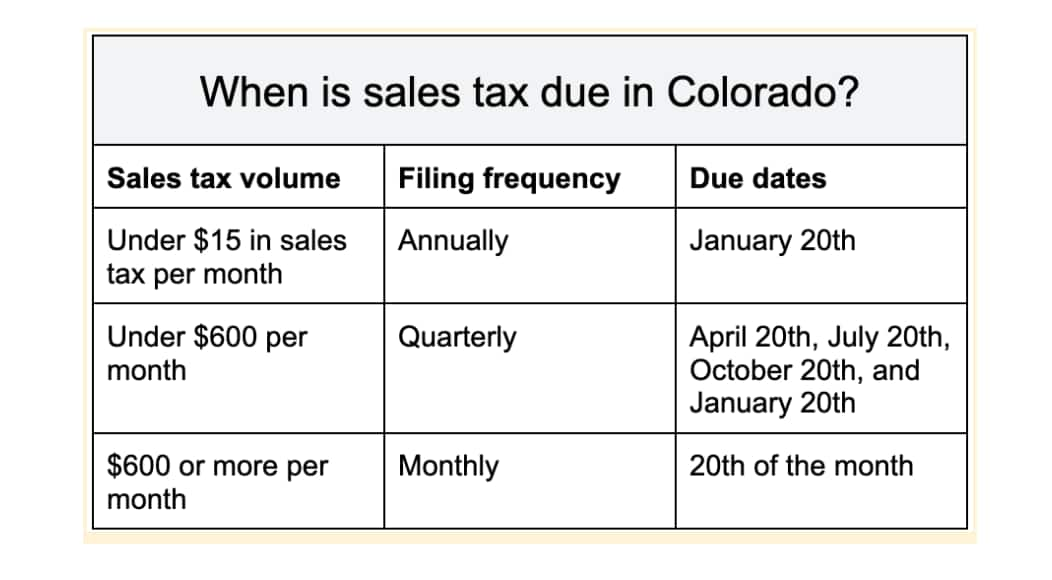

You can file sales tax returns online through the DOR’s Revenue Online service, or by mailing Form DR 0100. On the form, note all your taxable sales and any exemptions. The online form automatically calculates your tax due based on your entries, but you must do manual calculations if you file on paper.

If you pay over $75,000 in sales tax annually, you should still file monthly, but you must pay online or with an Electronic Funds Transfer.

The penalty for filing or paying late is 10% of the unpaid tax, and penalties and interest accrue over time.

The DOR has links to sales tax forms.

Mistakes to avoid when getting a sales tax license

You can’t sell taxable goods in Colorado without a sales tax license.

To protect yourself, keep these tips in mind:

- Choose your business structure carefully: If you change your mind, you'll need to get a new license from the state – for example, if you switch from an LLC to a sole prop.

- Remember to check if you're in a home-rule municipality Many cities, including Denver, Colorado Springs, Aurora, and Fort Collins, collect their own sales tax, so you must register with them directly. Do your research and apply early to avoid delays.

- Apply for your sales tax license before local permits–

Although there's no general state business license in Colorado, you usually need your sales tax license before you can get your local license.

- Check if you have nexus in the state

Keep tabs on your Colorado sales so you immediately know if you have nexus in the state. If you sell items in Colorado without collecting sales tax, you're supposed to notify the buyer that they should pay sales tax directly to the state – note that in this case, sales tax is referred to as "use tax". The DOR has more info on use tax.

- Use software to help you calculate the sales tax rate – calculating sales tax can be tricky, especially when you're dealing with multiple rates, different locations, or a combination of exempt and unexempt items. But the right software can automate everything.

Streamline your sales tax with Xero

Xero helps you stay on top of your Colorado sales tax. It automatically calculates sales tax on your invoices and makes it easy to track the tax you’ve collected and to file returns.

FAQs on Colorado sales tax

Staying compliant with sales tax is tricky – especially if you operate in multiple states. Here are answers to some of business owners' most pressing questions.

What is “use tax” and when do I pay it?

Use tax applies where you don't pay sales tax when you buy taxable items. For instance, if you buy an item in a state with no sales tax or with a lower rate, you pay use tax to the DOR.

Do short-term rental businesses need to collect sales tax?

Yes, if you operate a short-term rental, you need to collect sales tax and meet any requirements set by your local government.

What happens during a sales tax audit?

If you're selected for an audit, you'll need to back up the information on your sales tax returns to the DOR auditor. They may also ask you to provide sales reports, bank account statements, or other details.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Get one month free

Sign up to any Xero plan, and we will give you the first month free.