Accumulated depreciation: Definition, calculation and examples for your small business

See if accumulated depreciation is an asset and learn how to calculate it to keep your balance sheet accurate.

Written by Jotika Teli—Certified Public Accountant with 24 years of experience. Read Jotika's full bio

Published Wednesday 26 November 2025

Table of contents

Key takeaways

• Calculate accumulated depreciation by tracking the total depreciation expense recorded since you purchased an asset, which reduces the asset's original value on your balance sheet to show its current book value.

• Recognize that accumulated depreciation is a contra asset account that reduces asset values without being a liability or true asset, helping provide lenders and investors with an accurate view of your assets' current worth.

• Apply the straight-line depreciation method using the formula (asset cost − salvage value) ÷ useful life to determine annual depreciation, then add each year's depreciation to calculate the running total of accumulated depreciation.

• Utilize depreciation as a tax strategy since it reduces your taxable income without affecting cash flow, allowing you to pay less tax while maintaining accurate asset valuations for better financing opportunities.

What is accumulated depreciation?

Accumulated depreciation is the total amount of depreciation expense recorded for an asset since you purchased it. This running total reduces the asset's original value on your balance sheet.

Why it matters: Tracking accumulated depreciation helps you see the book value of your assets – their current worth after wear and tear. The formula is simple: asset cost minus accumulated depreciation equals book value.

Here are two examples to show how accumulated depreciation works:

- Office furniture cost $5000, with $1000 depreciation each year. After 3 years it has depreciated by $3000, leaving a book value today of $2000.

- Machinery cost $25,000, with $2500 depreciation each year. After 6 years it has depreciated by $15,000, leaving a book value today of $10,000.

Depreciation vs accumulated depreciation

Depreciation is the annual expense that reduces your asset's value each year. Accumulated depreciation is the total depreciation recorded since you bought the asset.

Key difference: Depreciation happens each period, while accumulated depreciation grows over time as you add each period's depreciation expense.

Here's more information about depreciation

Is accumulated depreciation an asset or a liability?

Accumulated depreciation is neither an asset nor a liability – it's a contra asset account.

Here's what that means:

- Not a liability: You don't owe money or have obligations to repay

- Not an asset: It doesn't provide future economic benefits

- Contra asset: It reduces the value of assets on your balance sheet

How it works: Contra asset accounts reduce the original cost of your assets. This shows the current value of your assets after depreciation.

How does accumulated depreciation affect financial statements?

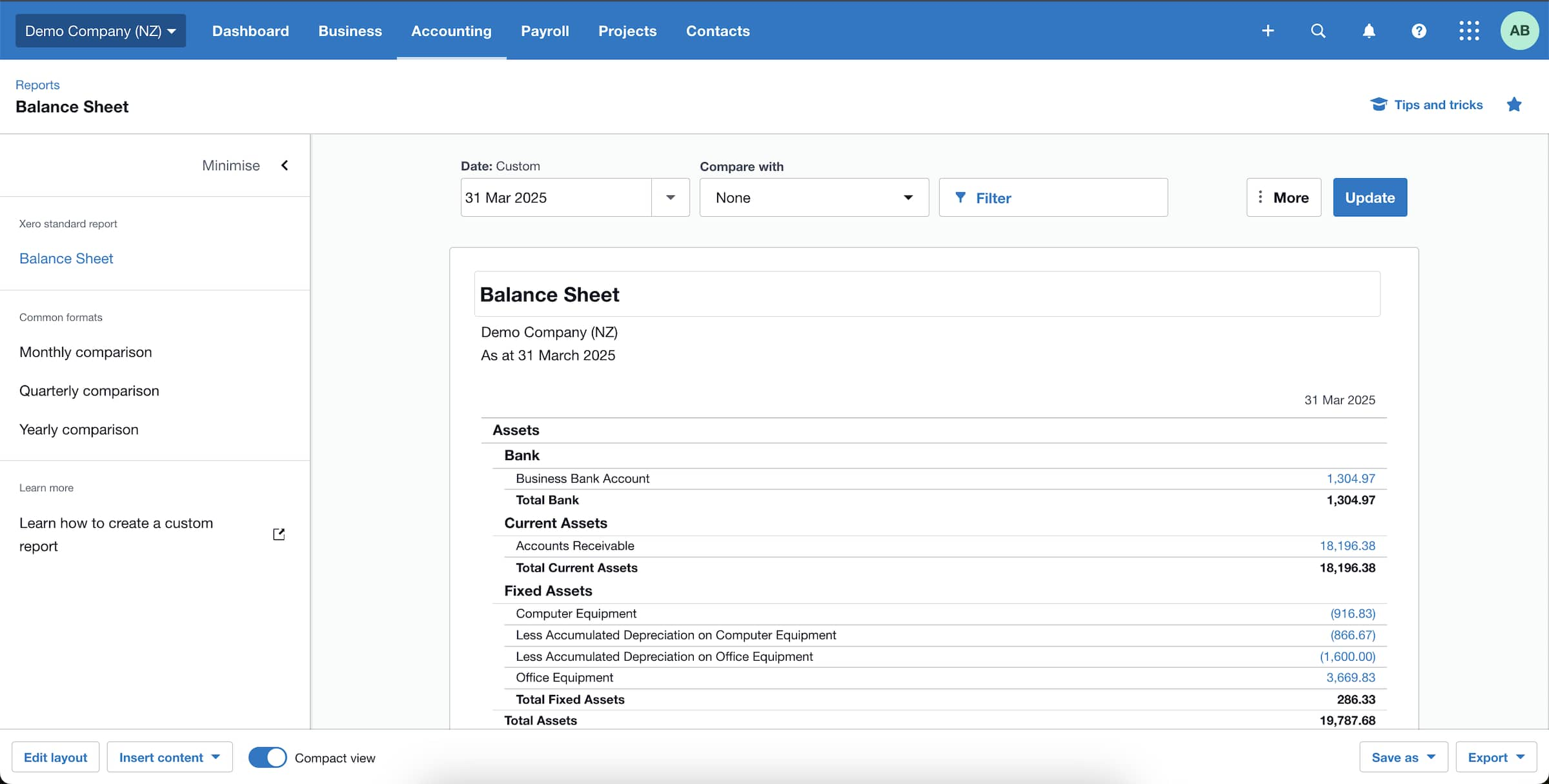

Accumulated depreciation on the balance sheet

Accumulated depreciation reduces an asset's book value on the balance sheet.

Balance sheet impact: Accumulated depreciation reduces your asset values from their original purchase price to their current book value. This gives lenders and investors a clear view of what your assets are worth today. The Securities and Exchange Commission (SEC) has even required some companies to provide detailed schedules of accumulated depreciation.

Accumulated depreciation on the income statement

Depreciation is recorded as an expense, so it reduces your taxable income.

As a non-cash expense, it lowers your profits without affecting cash flow.

Accumulated depreciation on the cash flow statement

Depreciation doesn't affect cash flow, so you add it back to net income on the cash flow statement.

This adjustment reflects that depreciation is an accounting expense, not a cash outflow.

Check with your local tax authority to understand how depreciation affects you.

How to calculate accumulated depreciation

This guide explains the straight-line depreciation method, a formula many small businesses use. For tax purposes, the Internal Revenue Service (IRS) generally requires the Modified Accelerated Cost Recovery System (MACRS) for property placed in service after 1986.

The straight line depreciation calculation

Straight-line depreciation formula:Annual depreciation expense = (asset cost − salvage value) ÷ useful life

Formula components:

- Asset cost: Original purchase price

- Salvage value: Estimated resale or scrap value when no longer useful

- Useful life: Expected years of use before replacement. According to the IRS, to be depreciable, an asset must be expected to last more than one year.

Calculate straight line depreciation

Example calculation: Asset costs $1,000, useful life of five years, salvage value of $100.

Step 1: Calculate annual depreciation($1,000 − $100) ÷ 5 = $180 per year

Step 2: Track accumulated depreciation by year

- Year 1: $180 accumulated

- Year 2: $360 accumulated

- Year 3: $540 accumulated

- Year 4: $720 accumulated

- Year 5: $900 accumulated

Step 3: Calculate book valueBook value = asset cost − accumulated depreciationAfter three years: $1,000 – $540 = $460 book value

Why understanding accumulated depreciation matters for your business

Business planning: Track asset values over time so you can plan replacements, upgrades, and maintenance before equipment fails.

Tax savings: Depreciation expenses reduce your taxable income, so you pay less tax and keep more cash in your business. For example, the Internal Revenue Service (IRS) lets you elect a special depreciation allowance of up to 80 percent for certain qualified properties.

Better financing: Accurate asset values on your balance sheet improve your chances of getting approved for loans and attracting investors.

Simplify your accounting with Xero

Managing depreciation, adjusting entries, and calculating accumulated depreciation can get complicated – especially as your business grows.

Xero accounting software simplifies these tasks by streamlining your accounting processes and helping you manage and track your assets. You can create detailed depreciation schedules to get a clear view of fixed asset values and improve your financial reporting.

Learn how Xero accounting software supports your business

Frequently asked questions about accumulated depreciation

Here are some common questions about accumulated depreciation.

How does accumulated depreciation affect cash flow?

Accumulated depreciation doesn't affect cash flow directly – it's a non-cash expense that doesn't involve money leaving your business.

Indirect cash benefit: Depreciation reduces your taxable income, which lowers your tax bill and keeps more cash in your business.

What happens to an asset's accumulated depreciation when you sell it?

You remove an asset's accumulated depreciation from the balance sheet when you sell it.

The asset's book value at the time of disposal (asset cost – accumulated depreciation) is compared with the sale price to determine a net gain or loss.

Do I record accumulated depreciation as a debit or a credit?

Record accumulated depreciation as a credit on the balance sheet because it's a contra asset – an account type that reduces the value of an asset.

Since assets typically have debit balances on the balance sheet, accumulated depreciation is credited against the depreciating asset to reflect its falling value over time. This lowers the asset's book value without affecting cash flow.

Is accumulated depreciation a current liability?

No – accumulated depreciation is not a current liability. It's recorded on the balance sheet as a contra asset – an account type that reduces the value of an asset.

Current liabilities are short-term debts due within 12 months. Accumulated depreciation lowers the book value of an asset over time – it isn't an amount you owe or have to repay.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Get one month free

Sign up to any Xero plan, and we will give you the first month free.