Manage fixed assets like a pro with Xero in the US

Expertly track your fixed assets and have confidence in your bookkeeping. Xero’s asset management system calculates your assets’ depreciations and lets you collaborate freely with your accountant.

Clever asset management for your business

Xero’s asset tracking software handles all your asset value calculations so everything is accurate and in one place.

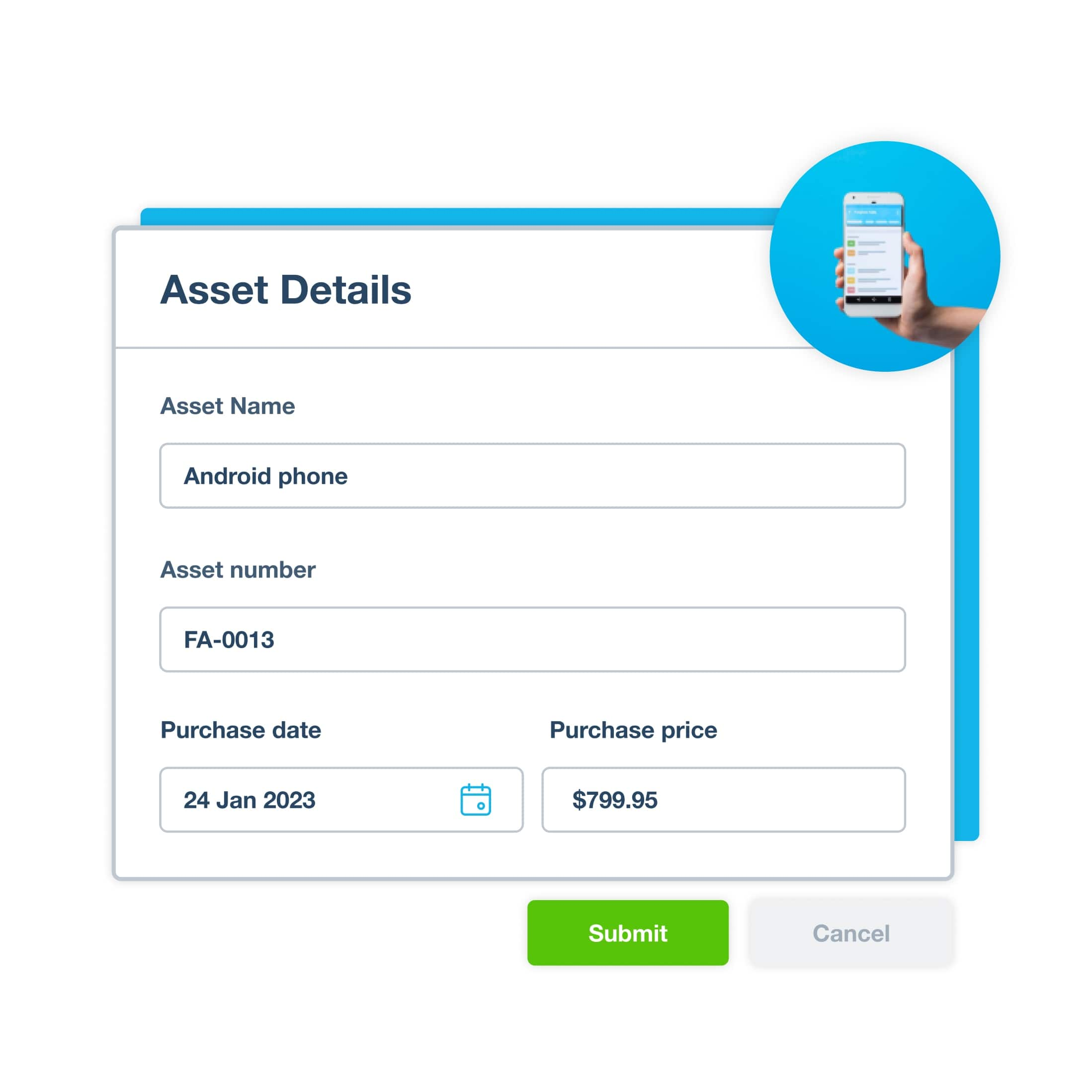

Record and update your assets

Whenever you buy an asset or see a change in an asset’s value, update your records on your mobile device or laptop.

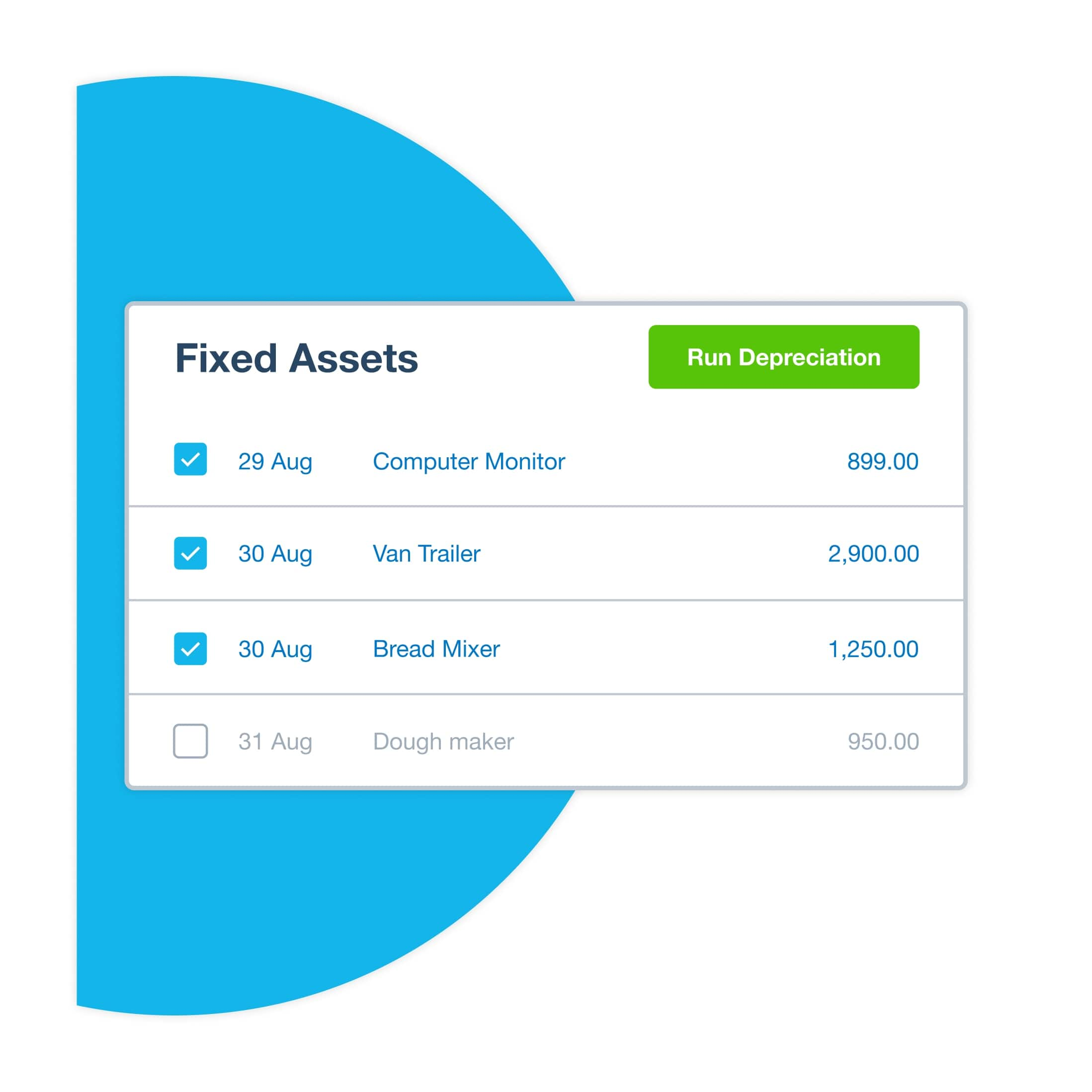

Get a full picture of your assets

Run reports on the value of your fixed assets and better understand how your business is doing.

Collaborate with your financial advisor

Review the same data together in Xero’s cloud-based asset management system – no more confusion between sets of numbers.

87% of customers agree Xero helps improve financial visibility

*Source: survey conducted by Xero of 271 small businesses in the US using Xero, May-June 2024

Record and update your assets

Effortlessly manage all your US business’s assets – including your vehicles, machinery, and office equipment – with Xero’s fixed assets management software. It works on your mobile device or laptop so you can update your asset register whenever – and wherever – you need to.

- Import all your fixed assets into your new register in one go

- Add a new fixed asset directly or create one from a bill

- Update your fixed asset types, depreciation methods, and default accounts whenever you like

- Keep your records up to date so they’re ready for tax time and audits

Collaborate with your financial advisor

Working with your accountant or bookkeeper is straightforward when you’re both looking at data in the cloud. There’s no confusion between separate sets of numbers – just a single digital record that’s up to date and ready for discussion.

- Choose the depreciation method and rate that best suits each fixed asset type

- Run or adjust depreciation calculations whenever you need to

- Minimize errors with Xero’s automatic depreciation calculations

- Identify assets to dispose of

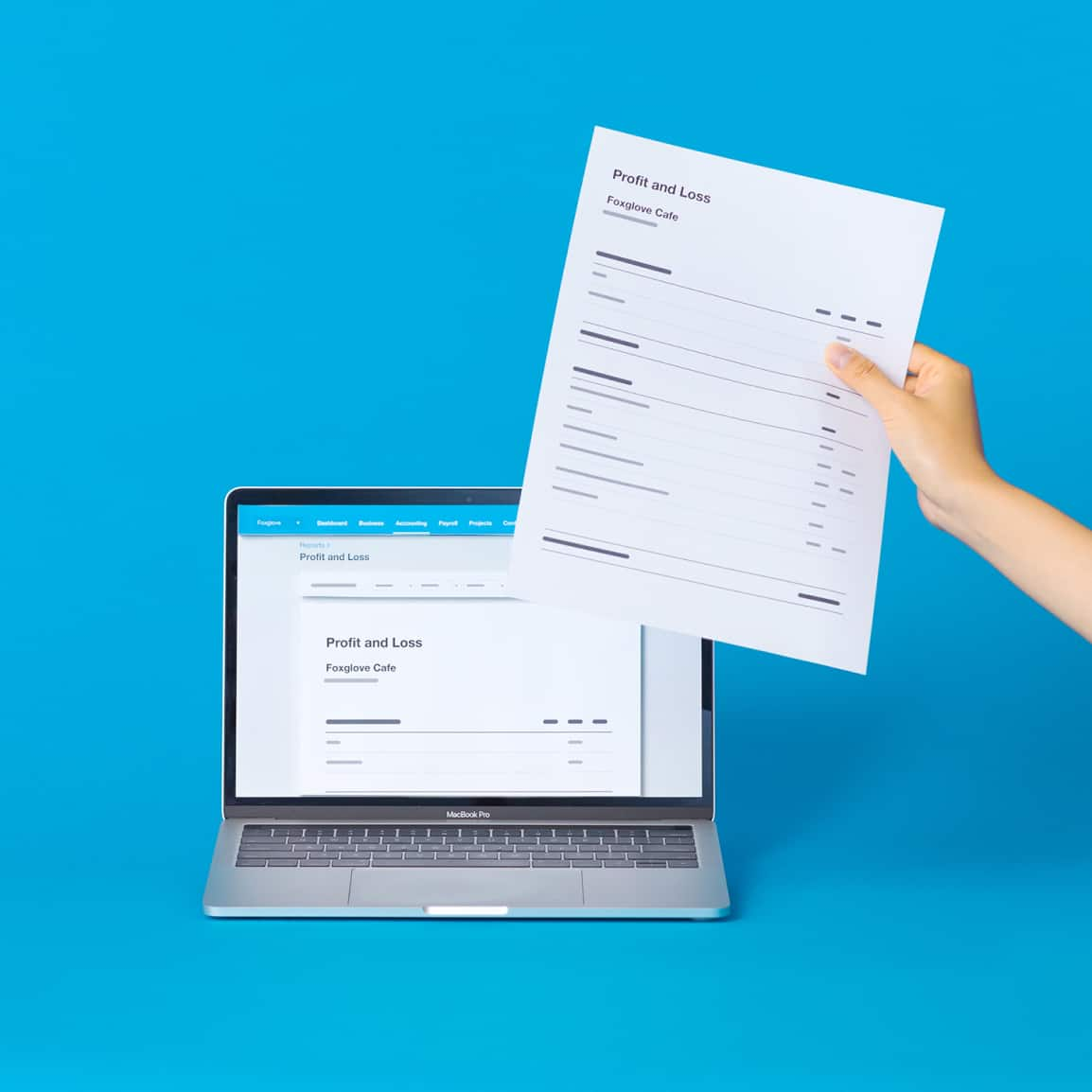

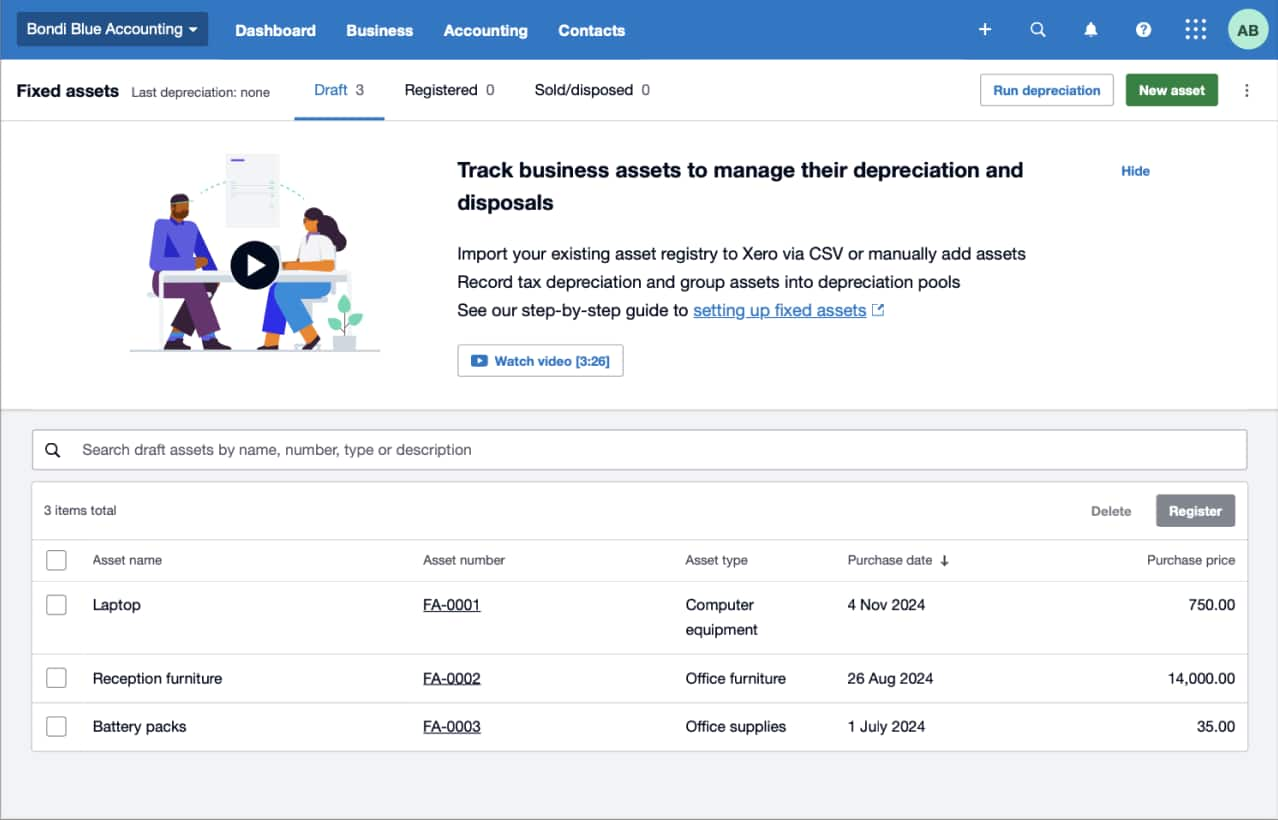

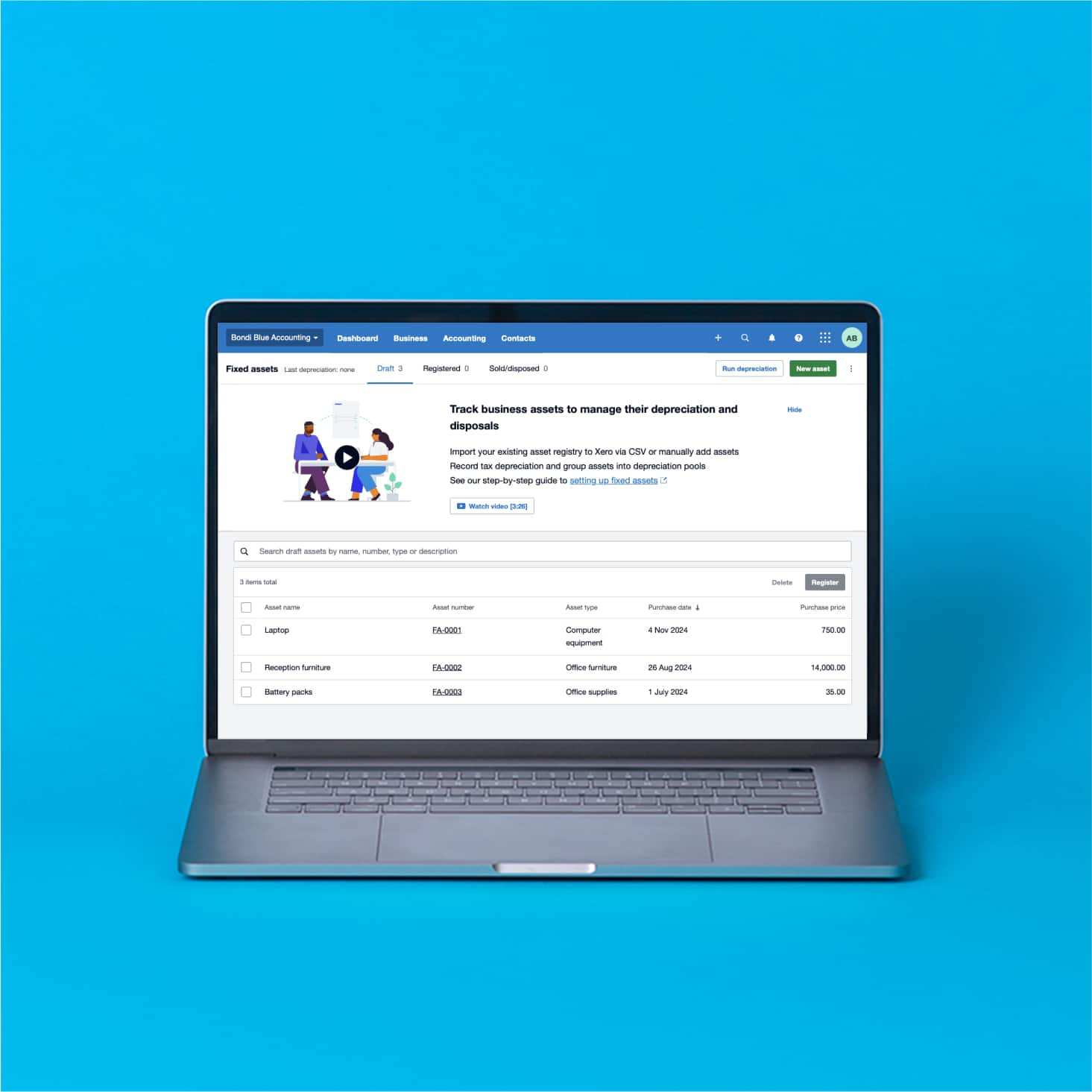

Get a full picture of your assets

Xero’s asset tracking software gives you a complete view of what your physical assets are worth. Make informed decisions on what’s right for your business, such as which assets to replace and when.

- Run depreciation schedules to track the loss of asset value

- Run disposal reports to show information on assets you’ve sold or disposed of

- See detailed reports on asset gains and losses, and the depreciation recovered from assets you’ve disposed of

Accounting software for your US small business

Run your business accounting online with Xero. Easy-to-use accounting software, designed for your small business.

- Everything in one place

- Connect to your bank

- Collaborate in real time

- Customize to suit your needs

Getting Xero made the whole business more efficient. It made accessing the accounts so much easier.

Xero lets Sidonie from Papersmiths focus on other parts of her business

FAQs on Xero’s asset tracking software

An asset is a resource your business owns. These can be both tangible items (physical assets like computers, equipment, inventory, which help your business operate each day), and intangible assets like trademarks and other intellectual property. The more your assets are worth compared with your liabilities (money owed), the greater the value of your business.

See Xero’s glossary page on assetsAn asset is a resource your business owns. These can be both tangible items (physical assets like computers, equipment, inventory, which help your business operate each day), and intangible assets like trademarks and other intellectual property. The more your assets are worth compared with your liabilities (money owed), the greater the value of your business.

See Xero’s glossary page on assetsA fixed asset is usually a physical asset your business is likely to own for at least a year, and which isn’t easy to liquidate or sell. Fixed assets are usually used to generate income for the business, and are typically referred to as ‘property, plant and equipment’ on a balance sheet.

See Xero’s glossary page on fixed assetsA fixed asset is usually a physical asset your business is likely to own for at least a year, and which isn’t easy to liquidate or sell. Fixed assets are usually used to generate income for the business, and are typically referred to as ‘property, plant and equipment’ on a balance sheet.

See Xero’s glossary page on fixed assetsA fixed asset register is a list of all the physical resources your business owns, such as land, buildings, vehicles, and office equipment. It has information on each asset’s original cost, location, life expectancy, and other relevant details. Maintain an accurate register so your business can keep track of its assets’ values.

A fixed asset register is a list of all the physical resources your business owns, such as land, buildings, vehicles, and office equipment. It has information on each asset’s original cost, location, life expectancy, and other relevant details. Maintain an accurate register so your business can keep track of its assets’ values.

A fixed asset register gives you an accurate, detailed account of what your assets are worth. It’ll help you make business decisions about your assets – like which to service or dispose of. You also need a fixed asset register for compliance: to fill out your tax returns, to be ready for audits, and more generally to practice sound bookkeeping.

A fixed asset register gives you an accurate, detailed account of what your assets are worth. It’ll help you make business decisions about your assets – like which to service or dispose of. You also need a fixed asset register for compliance: to fill out your tax returns, to be ready for audits, and more generally to practice sound bookkeeping.

Xero’s asset management software makes it easy to create a fixed asset register for your business. All your data live in a single central location in the cloud, ready for you to update it whenever you need to. You can upload all your assets to Xero in one go, too, so it’s quick to get started.

Xero’s asset management software makes it easy to create a fixed asset register for your business. All your data live in a single central location in the cloud, ready for you to update it whenever you need to. You can upload all your assets to Xero in one go, too, so it’s quick to get started.

Small business accounting tips and guides

In the early days of starting your business? Here’s essential advice on how to get going.

- Guide

How to start your own business in the US

Starting a business requires the right legal structure and financial footing. Here are the steps to take to get started.

- Chaptered guide

Growing your business

Are you ready to drop the hammer and take your business to the next level? Let’s look at how to grow.

- Chaptered guide

How to do bookkeeping

Bookkeeping includes everything from basic data entry to tax prep. Let’s look at the core jobs and see how they’re done.

Plans to suit your business

All pricing plans cover the accounting essentials, with room to grow.

Early

Usually $20

Now $2

USD per month

Save $54 over 3 months

Growing

Usually $47

Now $4.70

USD per month

Save $126.90 over 3 months

Established

Usually $80

Now $8

USD per month

Save $216 over 3 months

Manage fixed assets: your starter guides

We’ve put together some nuts and bolts information on how to manage your fixed assets.

Set up your fixed assets

Create a register and start detailing each of your fixed assets.

Add or copy a fixed asset

Add a fixed asset directly to the register or create one from a purchase transaction.

Run fixed asset reports

Run a depreciation schedule, a disposal schedule, or a fixed asset reconciliation report.

FAQs about Xero in the US

Yes, Xero’s reporting and analytics capabilities help you easily prepare and submit your returns so you never miss a deadline. Your numbers will be accurate and all stored in one secure place.

See tax information for businesses from the IRS.Yes, Xero’s reporting and analytics capabilities help you easily prepare and submit your returns so you never miss a deadline. Your numbers will be accurate and all stored in one secure place.

See tax information for businesses from the IRS.Yes – Xero partners with Gusto for a full-service payroll solution. Gusto saves you time on all aspects of your payroll – including calculating employee pay and deductions – thanks to its clever automations.

Check out payroll with GustoYes – Xero partners with Gusto for a full-service payroll solution. Gusto saves you time on all aspects of your payroll – including calculating employee pay and deductions – thanks to its clever automations.

Check out payroll with GustoThe best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plans.The best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plans.No – Xero is based in the cloud, so all you need is an internet connection. But you need a multi-factor authentication (MFA) app to log in to Xero. MFA extra layer of security by checking that it’s really you when you log in.

Learn about data protection with Xero.No – Xero is based in the cloud, so all you need is an internet connection. But you need a multi-factor authentication (MFA) app to log in to Xero. MFA extra layer of security by checking that it’s really you when you log in.

Learn about data protection with Xero.Yes, the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business in the USA.

Check out the Xero App Store.Yes, the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business in the USA.

Check out the Xero App Store.

Get one month free

Purchase any Xero plan, and we will give you the first month free.