S corp vs LLC: Key differences, tax benefits, and how to choose

Learn how S corp vs LLC impacts taxes, liability, and payroll so you pick the right structure.

Written by Joshua Poh—B2B Fintech Writer and Small Business Owner. Read Joshua's full bio

Published Friday 16 January 2026

Table of contents

Key takeaways

- Evaluate your annual profit levels to determine the optimal structure, as S corps typically provide tax savings for businesses earning $60,000+ annually through salary-plus-distribution strategies that reduce self-employment taxes.

- Consider your compliance capacity before choosing, since LLCs offer minimal ongoing requirements while S corps require board meetings, detailed record-keeping, and strict IRS compliance standards.

- Assess your ownership and growth plans carefully, as S corps limit ownership to 100 US-based individual shareholders while LLCs allow unlimited members including foreign entities and corporations.

- Prioritize tax optimization versus operational simplicity based on your business stage, choosing S corps for established profitable businesses seeking tax benefits or LLCs for startups and small businesses valuing flexibility and ease of management.

What is an LLC?

A limited liability company (LLC) is a business structure that protects your personal assets from business debts and liabilities. LLCs separate business finances from personal finances, so creditors typically cannot pursue your home, car, or personal savings if your business faces financial trouble.

Tax structure: LLCs use pass-through taxation, meaning business profits flow directly to your personal tax return. This avoids double taxation where both the business and owners pay taxes on the same income.

Key benefit: You get liability protection similar to a corporation with simpler tax reporting than traditional corporate structures.

What is an S corp?

An S corporation (S corp) is a tax election that allows small businesses to combine corporate liability protection with pass-through taxation. S corps avoid corporate-level taxes by passing profits and losses directly to shareholders' personal tax returns.

Key advantage: S corp owners can reduce self-employment taxes by taking both salary and distributions.

Key limitation: S corps have strict ownership rules; according to the IRS, an S corp can have no more than 100 shareholders, who must be US citizens or residents.

How to set up an LLC or S corp

Setting up your business structure involves a few key steps, though the specifics can vary by state. Here's a general guide to get you started.

Forming an LLC

Creating an LLC is simple. Follow these steps to get started:

- Choose a business name: Make sure your chosen name is available in your state and complies with naming rules, which often require including 'LLC' or 'Limited Liability Company'.

- File articles of organization: Submit this document to your state's business filing agency. It officially creates your LLC.

- Create an operating agreement: While not always required, this internal document outlines how your LLC will be run, including member roles and profit distribution.

- Obtain an EIN: Get an Employer Identification Number from the IRS if you plan to hire employees or have multiple members.

Forming an S corp

To become an S corp, you first need to form a C corporation or an LLC, then file for S corp status with the IRS.

- Form a corporation or LLC: Follow your state's rules to register your business as a C corp or LLC.

- File Form 2553: According to the IRS, you must submit Form 2553, 'Election by a Small Business Corporation', signed by all shareholders. This must be done by the 15th day of the third month of your tax year for the election to take effect that year.

- Meet state requirements: Some states require you to make a separate S corp election at the state level. Check with your state's tax agency to ensure you're fully compliant.

The key differences between S corps and LLCs

LLCs and S corps differ in five critical areas.

Taxation

Taxation is the primary difference between LLCs and S corps.

LLC taxation:

- All profits subject to 15.3% self-employment tax

- Pass-through structure avoids corporate-level taxation

- Simple reporting on personal tax returns

S corp taxation:

- Salary portion subject to payroll taxes

- Distribution portion exempt from self-employment taxes

- Tax savings potential for profitable businesses through salary-distribution split

Ownership

To the IRS, LLC owners are called members. LLCs can have any number of members, including individuals, corporations, foreign entities, or even other LLCs.

Because S corps are set up like regular companies, their owners are called shareholders. S corps can have up to 100 shareholders, who must be US citizens or residents and are typically individuals. S corps can only have one type of stock as well.

Keep this requirement in mind if you plan to raise money, especially from foreign or corporate investors, as it will affect your business growth plans. However, this restriction does not apply to LLCs.

Management structure

LLCs have two management options, both of which are reasonably informal.

- Member-managed: Owners are directly involved in business decisions and managing daily activities

- Manager-managed: Owners can appoint a manager for daily tasks and decisions

S corps follow a stricter structure. They must have a board of directors and keep detailed financial and business records.

Compliance

LLCs have fewer compliance requirements than S corps. While the U.S. Small Business Administration advises LLC members to keep their operating agreement and business documents up to date, these actions aren't required for businesses to keep their LLC status. But they need to meet filing requirements at state level and pay any fees on time.

S corps must follow strict IRS requirements to keep their S corp status. They need to:

- Appoint a board of directors

- Hold annual director meetings

- Keep their corporate records up to date, including yearly annual reports and meeting minutes

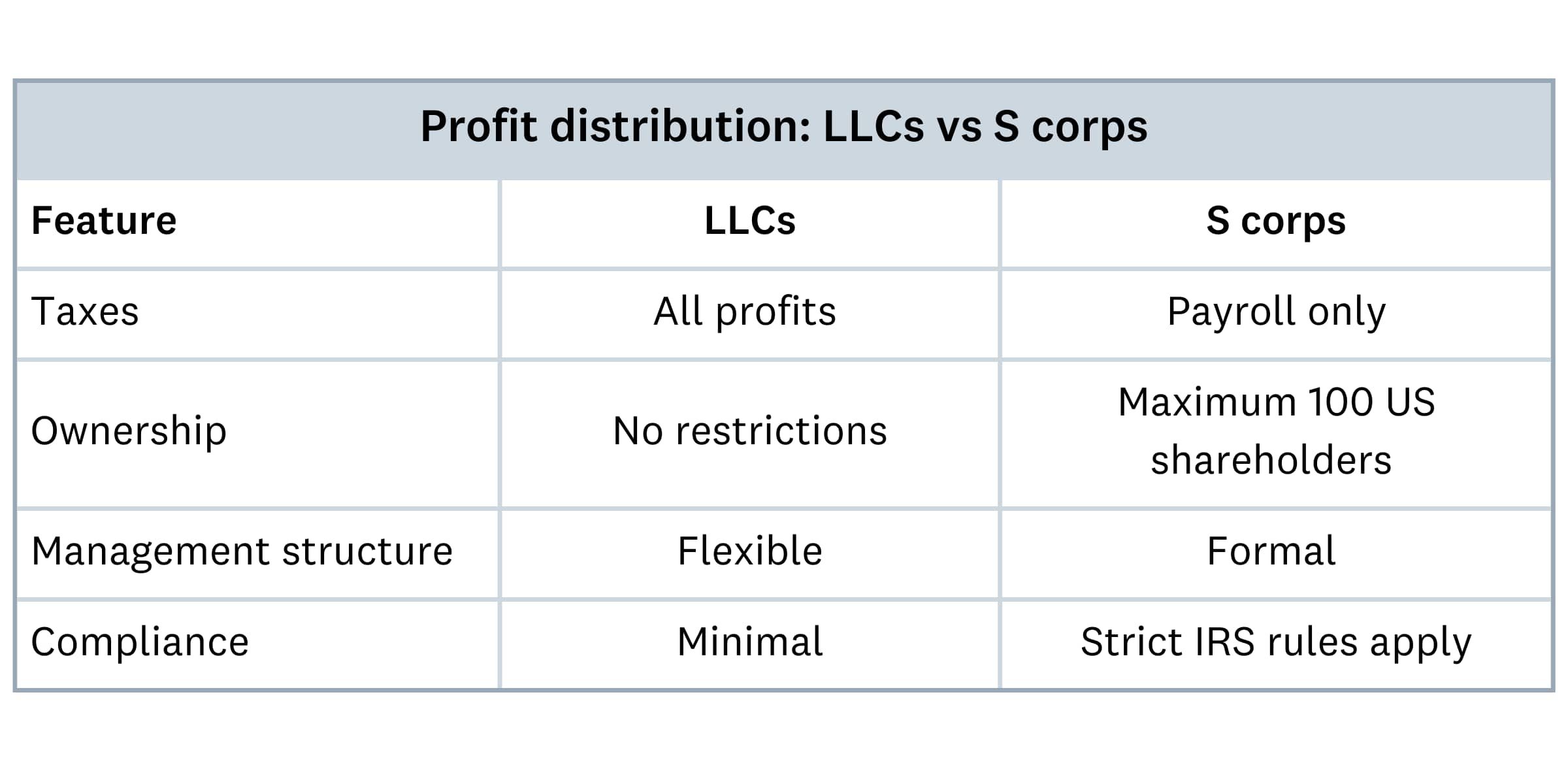

Profit distribution

LLCs can distribute profits and losses as they wish. An owner who owns 20% of the business can receive 80% of the profits.

An S corp, however, must distribute profits and losses in proportion to its ownership; for example, a person who owns 50% of the business receives 50% of the profits.

S corp vs LLC taxes: the differences

There are significant differences in the ways LLCs and S corps are taxed. Although both LLC and S corp structures allow pass-through taxation (where the business passes taxes to shareholders), they calculate profits and taxes differently.

LLC taxation

You report LLC profits on your personal tax return. All income you earn is subject to an LLC self-employment tax (levied at 15.3% in 2024).

You can also choose to have the IRS tax your LLC as an S corp or a C corp, which allows you to distribute a portion of your profits as dividends. These distributions are exempt from self-employment tax, which can lower your tax bill overall.

If the LLC has only one member, it is called a single-member LLC and is considered disregarded for federal purposes. This means all profits and losses are reported on your personal income tax return instead of in separate business tax filings. There may be different state reporting requirements.

S corp taxation

S corps can share profits with shareholders tax-free, which is a tax advantage over LLCs. While it is tax free for the S corp, the profits reported as distributions are only taxable if the distributions exceed the shareholder's basis.

An S corp owner must pay themselves a salary that is 'reasonable' for their industry. Although this salary is subject to payroll taxes, owners can then distribute the remaining profits to shareholders in the form of tax-free dividends.

This structure allows more S corp tax savings compared with LLCs. But the IRS has stricter requirements for S corps, like shareholder restrictions and compliance requirements. The IRS has more information on S corp and LLC taxes, respectively.

How S corps and LLCs calculate self-employment taxes

Self-employment tax calculation differs significantly between structures.

Example: $100,000 annual profit

LLC structure:

- Self-employment tax: $15,300 (15.3% on full $100,000)

- All profits subject to self-employment tax, though the Social Security portion of the tax only applies to the first $168,600 of earnings.

S corp structure:

- Salary: $60,000 (subject to payroll taxes)

- Distribution: $40,000 (exempt from self-employment tax)

- Tax savings: Approximately $6,120 in self-employment taxes

Key requirement: S corp owners must pay themselves a reasonable salary before taking distributions.

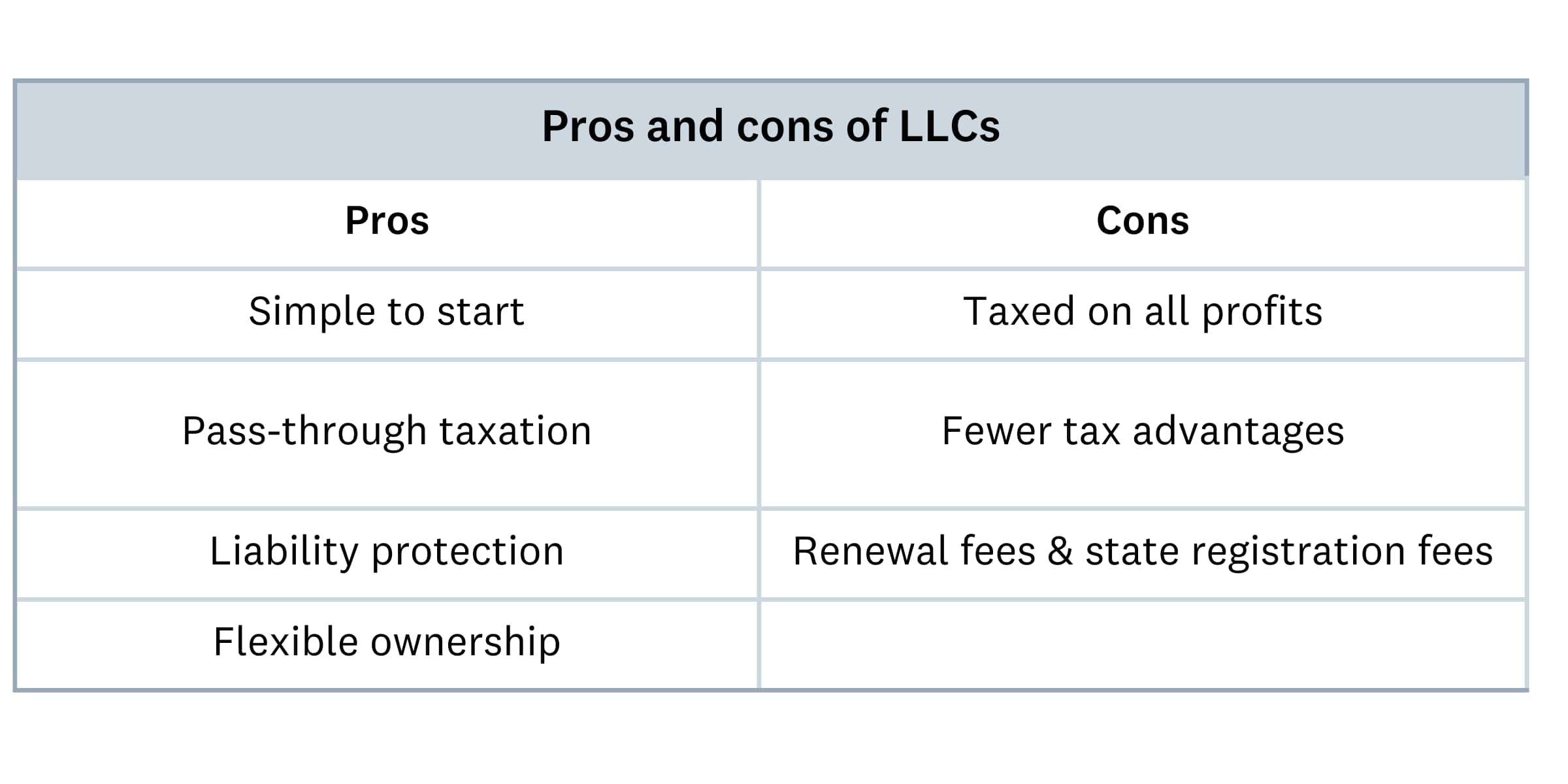

LLC vs S corp pros and cons

Pros and cons of LLCs

LLC advantages:

- Simple setup: Minimal paperwork and ongoing formalities required

- Tax simplicity: Pass-through taxation with straightforward reporting

- Liability protection: Personal assets protected from business debts

- Flexible structure: No restrictions on ownership or profit distribution

LLC disadvantages:

- Higher self-employment taxes: 15.3% tax applies to all profits

- Limited tax optimization: Fewer strategies to reduce overall tax burden

- Annual fees: State registration and renewal costs vary by location

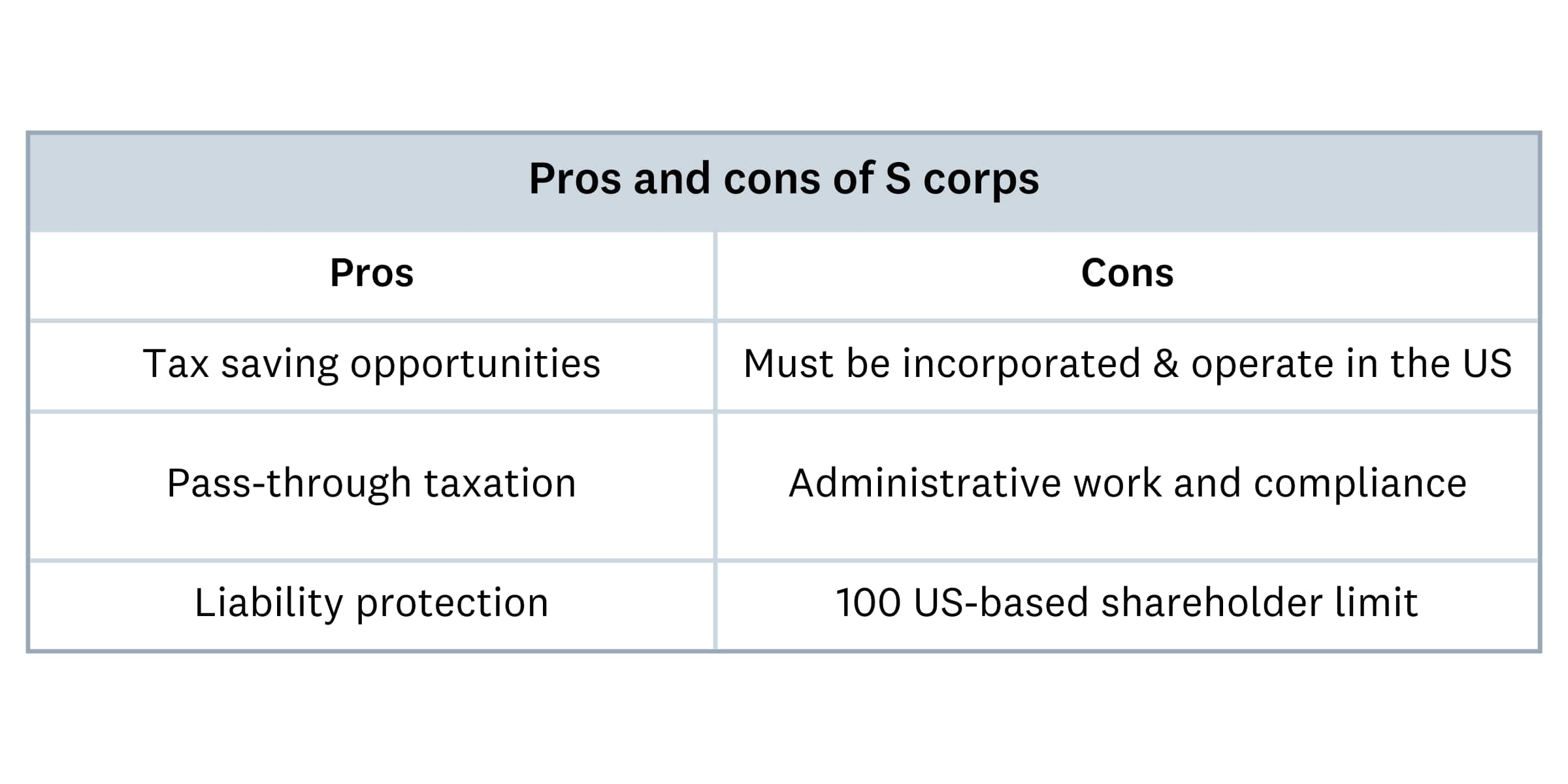

Pros and cons of S corps

Pros of choosing an S corp include:

- You may be able to reduce your total tax bill.

- You benefit from pass-through taxation.

- You have personal liability protection as an owner.

Cons of choosing an S corp:

- An S corp must be based in and operate in the US.

- Ownership is limited to 100 US-based shareholders.

- There is more ongoing admin, such as record keeping and annual meetings.

- S corp status can end if the business no longer meets IRS guidelines.

Should I choose LLC or S corp for my small business?

Choose based on your specific business situation.

Choose an LLC if you:

- Prioritize simplicity over tax optimization

- Want flexible ownership structures and profit distribution

- Prefer minimal compliance requirements and paperwork

Choose an S corp if you:

- Generate significant profits (typically $60,000+ annually)

- Want to minimize self-employment taxes through salary-distribution strategy

- Can handle additional compliance requirements and record-keeping

Next step: Consult a tax professional to analyze your specific profit levels and business goals.

Compare tax implications

If tax savings matter to you, an S corp can provide more savings for profitable businesses, as long as you meet the S corp tax rules.

Check compliance requirements and admin costs

If you're just starting out, for example, and you value simplicity and lower costs, an LLC structure might be a better bet. S corps must follow stricter IRS rules than LLCs, and you'll likely face ongoing costs and administrative tasks to meet S corp requirements.

Understand the differences in ownership requirements

If you're planning to grow your business, make sure you're aware of the S corp shareholder requirements, and potential restrictions on raising capital from investors outside the US. S corp shareholders are limited to domestic individuals, certain trusts, and estates. S corps are not allowed to have shareholders that are partnerships, corporations, or other nonresident entities.

Consider your business growth and plans

If you've been in business for a few years and want to expand, consider becoming an S corp for its tax benefits. Just make sure your business earns enough to pay you and your employees' standard salaries. But an LLC may be a better option if you're a solopreneur who likes to keep things small and flexible.

Choose the right structure for your business with Xero

Choosing between an LLC and an S corp comes down to balancing simplicity with tax strategy. An LLC offers a straightforward path with fewer rules, perfect for new or smaller businesses. An S corp requires more administrative effort but can lead to significant tax savings as your profits grow.

No matter which structure you choose, you can use Xero to manage your finances with confidence. Xero cloud accounting software simplifies bookkeeping, tracks expenses, and gives you real-time insights into your business performance.

Focus on what you do best, and let Xero handle the numbers. Get one month free to see how easy it can be.

FAQs on S corps vs LLCs

Here are answers to common questions about whether an LLC or S corp might suit your business.

Can I switch from an LLC to an S corp later?

Yes, you can elect S corp tax treatment for your LLC through a two-step process:

- File Form 8832 to elect corporate tax treatment

- File Form 2553 to request S corp status; per IRS guidelines, this election generally cannot take effect more than 75 days prior to the filing date.

- Meet S corp requirements: US ownership, reasonable salary, and compliance standards

This allows you to keep your LLC structure while gaining S corp tax benefits.

What's the difference between an S corp and a C corp?

The main difference is how they pay taxes. A C corp files its own tax returns and pays corporate tax rates on profits. S corps enjoy corporate tax advantages by having income taxed on shareholders' personal tax returns.

Which has better personal liability protection, an S corp or an LLC?

S corps and LLCs provide the same level of personal liability protection. Both business structures separate business assets from personal assets, which keeps your personal finances safe if your business faces financial trouble.

How much does it cost to set up an LLC or an S corp?

Incorporation fees vary by state, but expect to pay about $200 in initial filing fees and about the same amount again each year. And if you engage an attorney and an accounting firm to prepare your legal and financial documents, you'll need to pay their fees, too.

How are profits distributed under an LLC and an S corp?

With an LLC the rules are quite flexible – you can allocate profits and losses on almost any basis. S corps have more restrictions around this; for example, you must distribute profits and losses in proportion to ownership percentage.

What is a reasonable salary for an S corp owner?

It depends on your industry and your situation. A 'reasonable salary' might be what you'd pay an employee with a similar level of experience who performs the same tasks. Check wage estimates and consider your business's situation when deciding how much to pay yourself.

Here are some recent wage estimates from the U.S. Bureau of Labor Statistics.

How do the LLC and S corp structures affect personal taxes?

Both structures employ pass-through taxation. This means that if you're the owner, the business's income flows through to your personal tax returns.

Are there industry-specific benefits for LLCs or S corps?

Although you'll find both LLCs and S corps in many industries, one structure might suit you better, depending on the size and maturity of your business. For example, S corps might suit established professional services and family businesses that want to enjoy tax benefits. On the other hand, the simpler structure of an LLC might suit small businesses and solopreneurs just starting out.

How do I file taxes for an S corp and for an LLC?

S corps file Form 1120-S to report profits, losses, and deductions for the year. If your LLC has more than one member, you file a partnership return. If you have a single-member LLC, you use Schedule C.

Can a single-member LLC become an S corp?

Yes. Single-member LLCs are distinct entities and may choose S corp status if they fulfill all S corp criteria. To achieve this, they must prepare to follow the extra requirements associated with S corp status. They must then submit Form 2553 to the IRS to complete the conversion.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Get one month free

Sign up to any Xero plan, and we will give you the first month free.