Small business interest expense: What it is, how to calculate and tips to deduct it

Learn what interest expense covers, how to claim it at tax time, and keep more cash in your business.

Written by Kari Brummond—Content Writer, Accountant, IRS Enrolled Agent. Read Kari's full bio

Published Wednesday 26 November 2025

Table of contents

Key takeaways

• Track and separate all business interest expenses from personal expenses to maximize your tax deductions and avoid penalties during tax filing.

• Calculate interest expenses using the formula (principal × interest rate × time period) and record them as non-operating expenses on your profit and loss statement to accurately measure operational profitability.

• Deduct qualifying business interest expenses including loans, equipment financing, business credit cards, and commercial property mortgages to reduce your taxable income, though businesses with over $30 million in average gross receipts may face deduction limits.

• Maintain detailed documentation of all loan agreements, payment records, and monthly statements to substantiate your interest expense claims and ensure compliance with IRS requirements.

What are business interest expenses?

Business interest expenses are payments you make to lenders for borrowing money. This includes interest on business loans, credit cards, and lines of credit.

Interest expenses can affect your business in several ways. Here’s why they matter:

- Tax savings: Deductible business expenses that reduce your tax bill

- Financial tracking: Non-operating expenses that help measure true business profitability

- Cash flow planning: Recurring costs that impact your available funds

When to claim interest expenses:

- Cash basis accounting: Claim expenses in the year you pay the interest

- Accrual accounting: Claim expenses in the year the interest accrues

Here's more info on cash basis and accrual accounting

Types of interest expenses

You may have different types of interest expenses. Knowing each type helps you claim the right deductions.

Loan interest

This is interest you pay on business loans, mortgages, or equipment financing. For example, you can deduct interest on a commercial property mortgage.

Credit card interest

Credit card interest is what you pay on your business credit card balances. For example, a $10,000 balance at 25% annual interest costs about $2,500 per year.

Capitalized interest

Capitalized interest is interest added to the value of an asset instead of being deducted right away. You often see this with long-term loans for large assets, such as real estate or heavy machinery.

Bond interest

Bond interest is paid to you or your business if you buy bonds from a government or corporation. The issuer pays you interest and deducts it as an expense. You report the interest as income. Some bonds, like municipal bonds, pay tax-exempt interest.

How to calculate interest expenses

Calculating your interest expense helps you budget and plan your cash flow. Use this basic formula to estimate your interest costs:

Interest = principal × interest rate × time

Formula components:

- Principal: Amount borrowed ($35,000 loan for equipment)

- Interest rate: Lender's annual charge (10% in this example)

- Time period: Length of calculation (1 year, 1 month, etc.)

Example calculation: $35,000 × 10% × 1 year = $3,500 annual interest

To estimate the interest for the first month of the loan, change the time period in the formula:

principal ($35,000) × interest rate (10%) × time (1/12 year) = interest ($420)

For precise numbers, use an interest calculator, tax forms, and other tools

This formula gives you a simple estimate of interest for a set time period. It does not include payments you make during the period or compounding interest.

Use an interest calculator to include these factors. You can also use IRS tax forms, your monthly statements, or amortization tables from your lender.

How interest expenses appear on your financial statements

Interest expenses affect your financial statements and can influence your business decisions and tax planning.

Key impacts:

- Profit and loss statement: Interest appears as a non-operating expense, reducing net income

- Balance sheet: Only unpaid (accrued) interest appears as a liability

- Cash flow: Interest payments reduce available cash for operations

Knowing where interest appears helps you see your true operational profits compared to your financing costs.

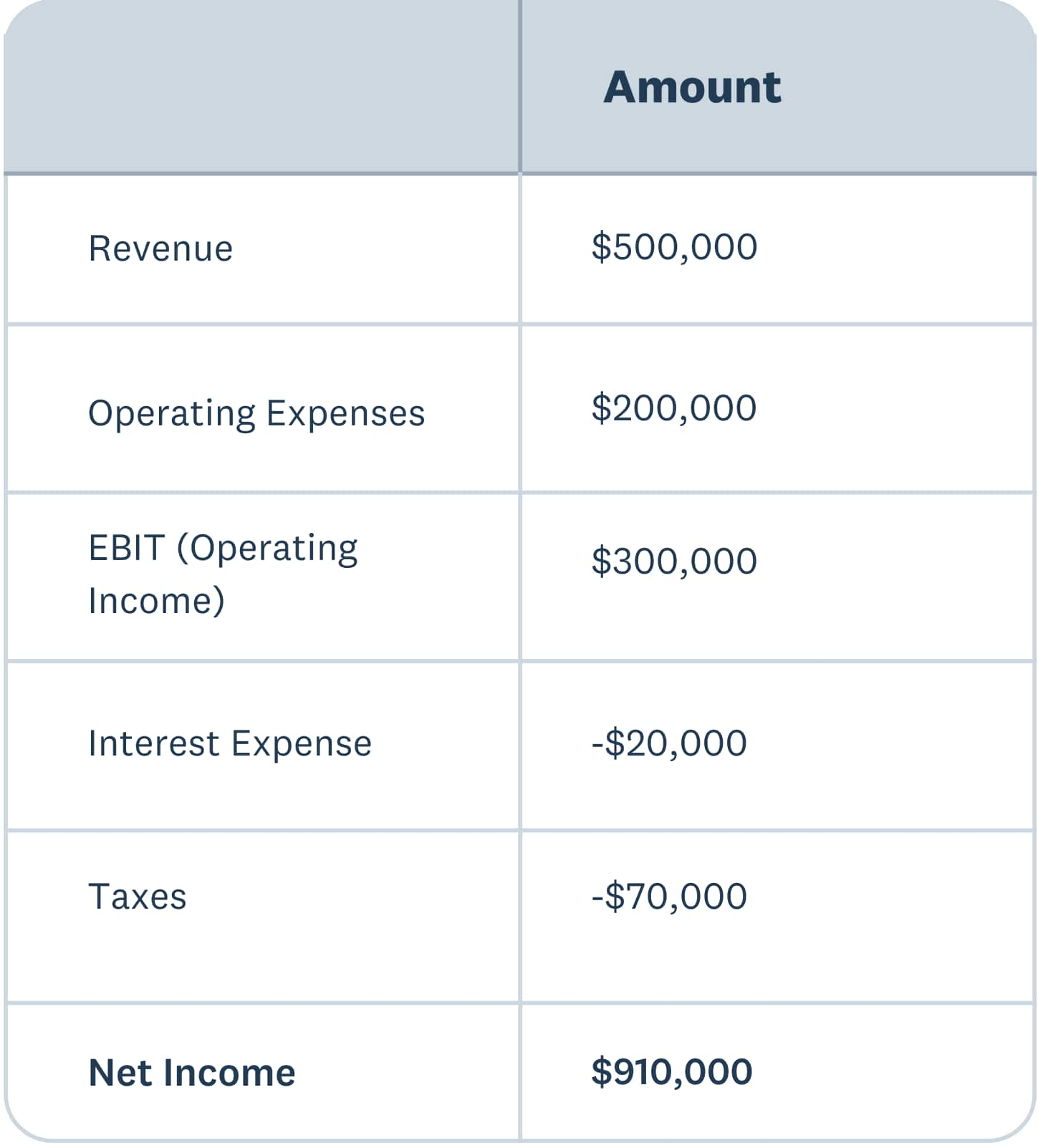

Interest expenses on your profit and loss statement (P&L)

Interest expenses appear as an expense in the non-operating expense section of your P&L.

This separation of the interest from the rest of your operating expenses:

- Lets you see how your debt loads and interest levels affect your profitability.

- Is useful if you're selling your business or bringing in investors – they get a stronger sense of your operational profits and can get a better idea of whether debt management could improve your bottom line.

Sample P&L with interest expenses:

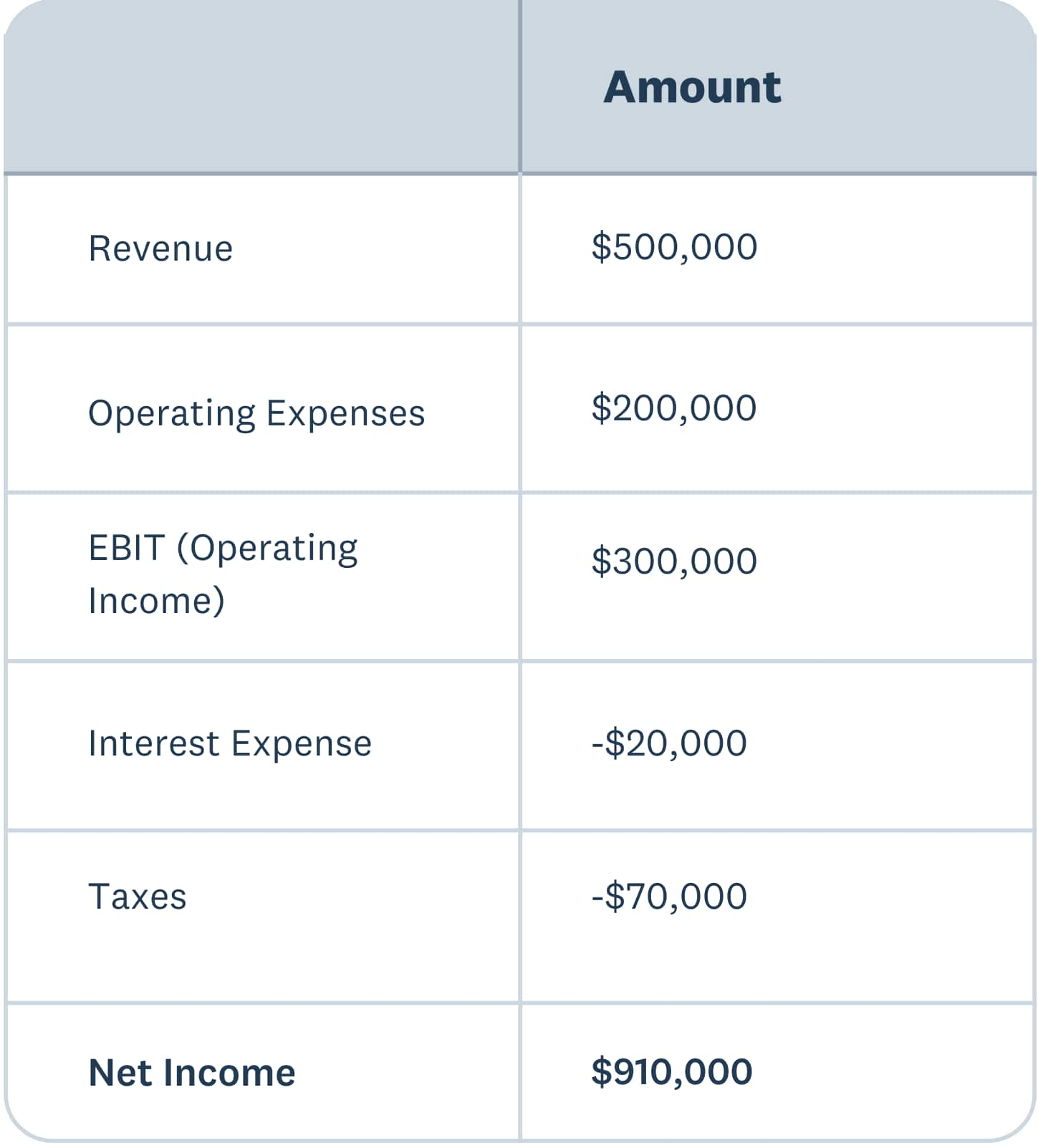

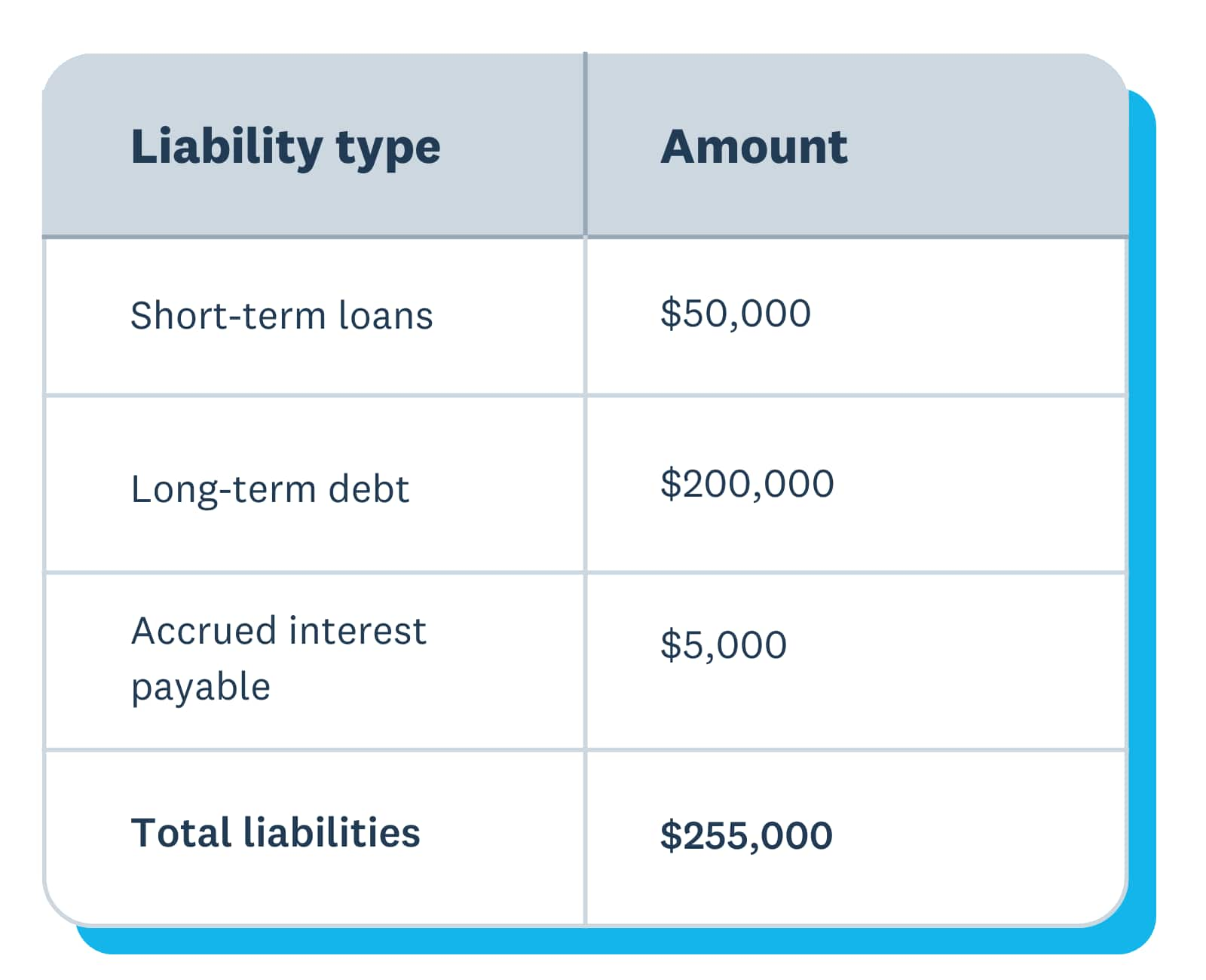

Interest expenses on your balance sheet

Your balance sheet doesn't record interest you've paid – only the interest you've accrued and not yet paid. You enter it in the liabilities section of your balance sheet.

Say you take out a long-term loan for $200,000. You don't have to make payments for the first six months of the loan, and during that time, you accrue $5,000 of interest. Your business also owes $50,000 in short-term loans.

When you look at your balance sheet six months after taking out the loan, it will show $200,000 as a long-term liability, $50,000 as a short-term liability, and $5,000 in accrued interest.

Examples: how loan payments affect your financial statements

Here are a couple of examples of how loan payments can affect your financial statements.

1. Making a loan payment

When you make a loan payment, the entire payment affects your cash flow. On your profit and loss statement, you only report the interest portion.

Say you make a $2000 mortgage payment on your commercial property – $500 is interest and $1500 goes to the mortgage principal.

- The $500 interest goes on your profit and loss statement as an expense, along with your other business expenses like wages, office supplies, and utility bills.

- The $1,500 principal payment reduces the mortgage loan on your balance sheet.

2. When your loan payments cover only some of the interest due

What if your loan payments only cover a portion of the interest due?

Say you have a loan for $200,000, the monthly interest is $2000, but you're only paying $1000 per month.

The entire $1,000 payment is posted to your profit and loss statement as interest. Since no part of the payment goes to the principal, the loan balance on the balance sheet stays the same. The $1,000 accrued interest is recorded as an expense on the profit and loss statement once paid. Any unpaid interest remains on the balance sheet as interest payable in a liability account until you pay it.

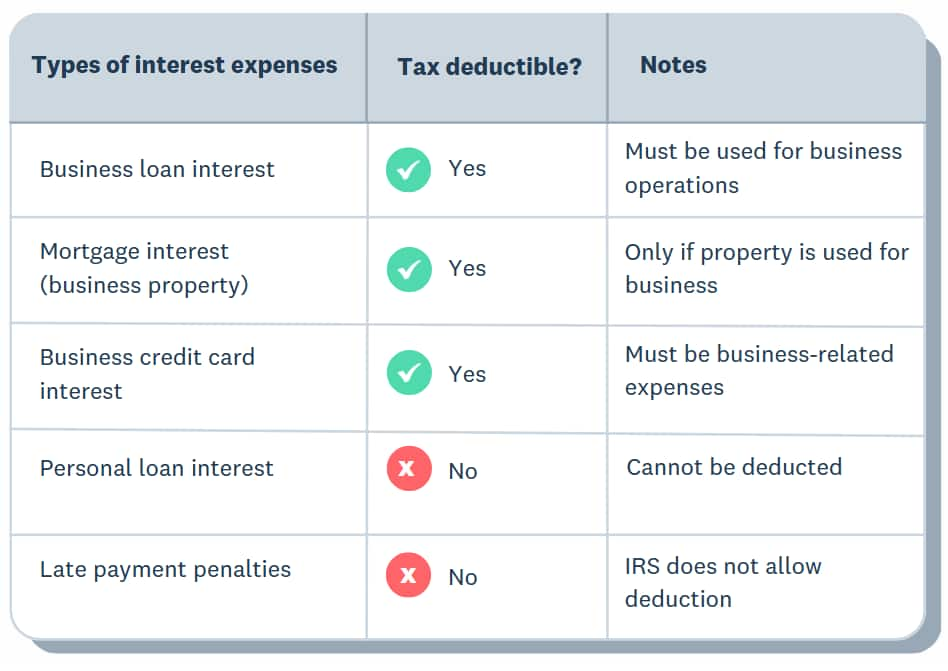

Which interest expenses you can claim as tax deductions

You can deduct business interest expenses, which reduces your taxable income and saves you money on taxes.

If your business is large, deduction limits may apply. The IRS adjusts the gross receipts threshold each year for inflation (it was $27 million for the 2022 tax year). Most small businesses can deduct all qualifying business interest expenses.

What you can claim: tax-deductible Interest expenses

In general, you can deduct interest you pay on:

- Business loans

- Mortgages on business property

- Business credit card debt

- Financing for business equipment

- Any other interest incurred for business purposes that isn't exempt (see below).

You cannot deduct late fees or interest on personal expenses. You also cannot deduct capitalized interest right away, as it is added to the value of your asset and reduces your taxable income over time.

Larger businesses might face limits on the interest they can claim

If your business had average gross receipts over $30 million in the previous three years, you might not be able to deduct interest over this threshold.

Regulations can change, so check with the IRS for the latest rules. For tax years starting after January 1, 2022, the method for calculating adjusted taxable income (ATI) changed. You can no longer add back depreciation or amortization.

How to maximize your deductions

To make sure you get full credit for your interest expenses:

- Carefully track the interest you've paid

- Use monthly statements or annual tax forms to accurately record the interest you've paid

- Separate your business and personal expenses so you don't overlook any business interest

An accountant or financial advisor can help you decide what you can claim.

Avoid common mistakes with interest expenses

If you make mistakes with interest expenses, you could miss out on deductions or face tax penalties. Here’s how to avoid common errors:

1. Incorrect classification

- Problem: Claiming non-deductible interest as business expenses

- Solution: Only deduct interest on business loans, equipment financing, and business credit cards

- Avoid: Personal interest, tax penalty interest, or capitalized interest

2. Documenting expenses poorly

Keep loan agreements and payment records so you can prove the interest expenses you're claiming for tax purposes were incurred on business expenses.

3. Ignoring deduction limits

If your business is over the gross receipts threshold ($30 million for the previous 3 years), keep the deduction limits in mind.

4. Paying too much interest

If interest payments are stretching your business finances, think about refinancing loans to keep them under control.

5. Mixing personal and business interest expense

Keep your personal and business finances separate. To prevent you from accidentally claiming personal interest as a business expense, it helps to have separate business and personal accounts and credit cards.

Manage your business finances with confidence

Understanding and managing your interest expenses is a key part of keeping your business financially healthy. By tracking costs, calculating expenses accurately, and maximizing your deductions, you can improve your cash flow and make more confident decisions.

With Xero, you get clear, real-time insights into your finances so you can focus on growing your business. Want to take control of your books?

Try Xero free for one month and see how easy it can be.

FAQs on business interest expenses

Here are common question and answers on business interest expenses.

How do interest expenses affect my cash flow?

Interest expenses reduce your available cash each month through recurring payments. High interest costs can limit your ability to cover operating expenses and invest in growth opportunities.

How do different loan structures affect interest expenses?

The business loan structures vary, but the most meaningful difference is between fixed-rate, variable-rate, and interest-only loans. With fixed-rate loans, interest rates are constant, so your interest expenses won't change much between periods.

With variable-rate loans, your interest payments can change – sometimes quite dramatically – as the rates fluctuate with the market. If you have an interest-only loan, you'll pay just the interest at first, so your payments will be lower until you start repaying the principal.

How does inflation affect my interest expenses?

Higher inflation often leads to higher interest rates, increasing borrowing costs – especially for businesses with variable-rate loans. If interest payments are biting into your cash flow, see if you can negotiate a better deal with your lender or move to an interest-only loan.

How can I manage high interest expenses for my business?

Businesses can reduce their interest expenses by refinancing to lower interest rates and by making extra payments to reduce the principal faster. You can also try to negotiate better terms with your lender.

It's always a good idea to talk with your financial advisor if you're having trouble meeting your interest expenses.

What happens if my business defaults on interest payments?

If you miss interest payments, you may face late fees and penalties from your lender. Continued missed payments can lead to legal action or foreclosure if your loan is secured by assets. Missing payments can also lower your business’s credit rating, making it harder or more expensive to borrow in the future.

How should I report my business's interest expenses for tax purposes?

Report your interest expenses on Schedule C (for sole proprietors), Form 1065 (for partnerships), Form 1120S (for S corporations), or Form 1120 (for C corporations) as a deductible business expense. Follow Internal Revenue Service (IRS) rules and limitations. Download these forms from the IRS or use tax preparation software like Xero to help you file.

What is the difference between prepaid interest and interest expense?

You pay interest expense after it accrues. Prepaid interest is paid before it accrues. You can only deduct interest as a tax expense when it accrues, not when you prepay it.

Can I carry forward interest expenses to future tax years?

Yes, but only if your business is subject to Internal Revenue Code (IRC) limitations for larger businesses. In that case, you can carry forward any disallowed interest expenses until you can deduct them in a future tax year. If this does not apply to your small business and your expenses create a net operating loss, you can roll forward the loss.

What is accrued interest and how should I record it?

Accrued interest is interest you owe but have not yet paid by the end of an accounting period. It appears as a current liability on your balance sheet. If you use accrual accounting, record the interest as an expense on your income statement. If not, note it on your profit and loss statement until you pay it.

Can I include interest expenses in the cost of inventory?

Yes. Under capitalization rules, you can include interest expenses on loans used to finance inventory production in the cost of goods sold (COGS) for tax purposes.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Get one month free

Sign up to any Xero plan, and we will give you the first month free.