Gearing ratio: What it is, how to calculate, and why it matters

Learn how your gearing ratio guides funding choices, reduces risk, and supports growth.

Written by Shaun Quarton—Accounting & Finance Content Writer and Growth Marketer. Read Shaun's full bio

Published Friday 23 January 2026

Table of contents

Key takeaways

- Calculate your gearing ratio using the debt-to-equity formula (Total Debt ÷ Total Equity × 100) to understand how much your business relies on borrowed funds versus your own investment.

- Maintain a gearing ratio between 30-50% for most small businesses, as this range provides a healthy balance of growth capital through debt while preserving financial stability through equity.

- Monitor your gearing ratio monthly or quarterly to make informed borrowing decisions and spot financial vulnerabilities before they become serious problems.

- Recognize that high gearing (above 70%) accelerates growth but increases financial risk, while low gearing (below 30%) provides stability but may limit expansion opportunities.

Gearing ratio definition

Gearing measures the balance between debt and equity your business uses for funding operations.

Key components include:

- Debt: borrowed money like loans and credit lines that must be repaid with interest

- Equity: your investment in the business, including retained earnings and share capital

A gearing ratio compares your total debt to total equity. This shows how much you rely on borrowed funds versus your own investment.

Why gearing ratios matter:

- Lenders use them to assess your creditworthiness before approving loans

- Investors analyze them to evaluate financial risk and growth potential

- Higher ratios signal more debt reliance, increasing risk but potentially boosting returns

- Lower ratios show stronger equity positions, reducing risk but possibly limiting growth

Why does your gearing ratio matter?

Your gearing ratio reveals your business's financial health and guides critical funding decisions.

Key benefits of monitoring your gearing ratio:

- Borrowing decisions: judge whether you can take on more debt without straining cash flow

- Investor appeal: balanced ratios signal financial stability to potential funders

- Strategic planning: align your debt structure with growth goals for expansion or stability

- Cash flow management: lower ratios free up cash for reinvestment, higher ratios increase debt payments

- Risk prevention: regular monitoring spots financial vulnerabilities before they become problems

Types of gearing ratios

Four main gearing ratios help measure how much debt your business uses and how much risk you take on:

- Debt-to-equity ratio: compares total debt to total equity, showing how much creditors versus owners fund your business

- Debt-to-capital ratio: measures what percentage of total capital comes from debt rather than equity

- Equity ratio: shows what portion of total assets you finance through equity rather than borrowing

- Times Interest Earned ratio: assesses whether your pre-tax earnings can comfortably cover interest payments

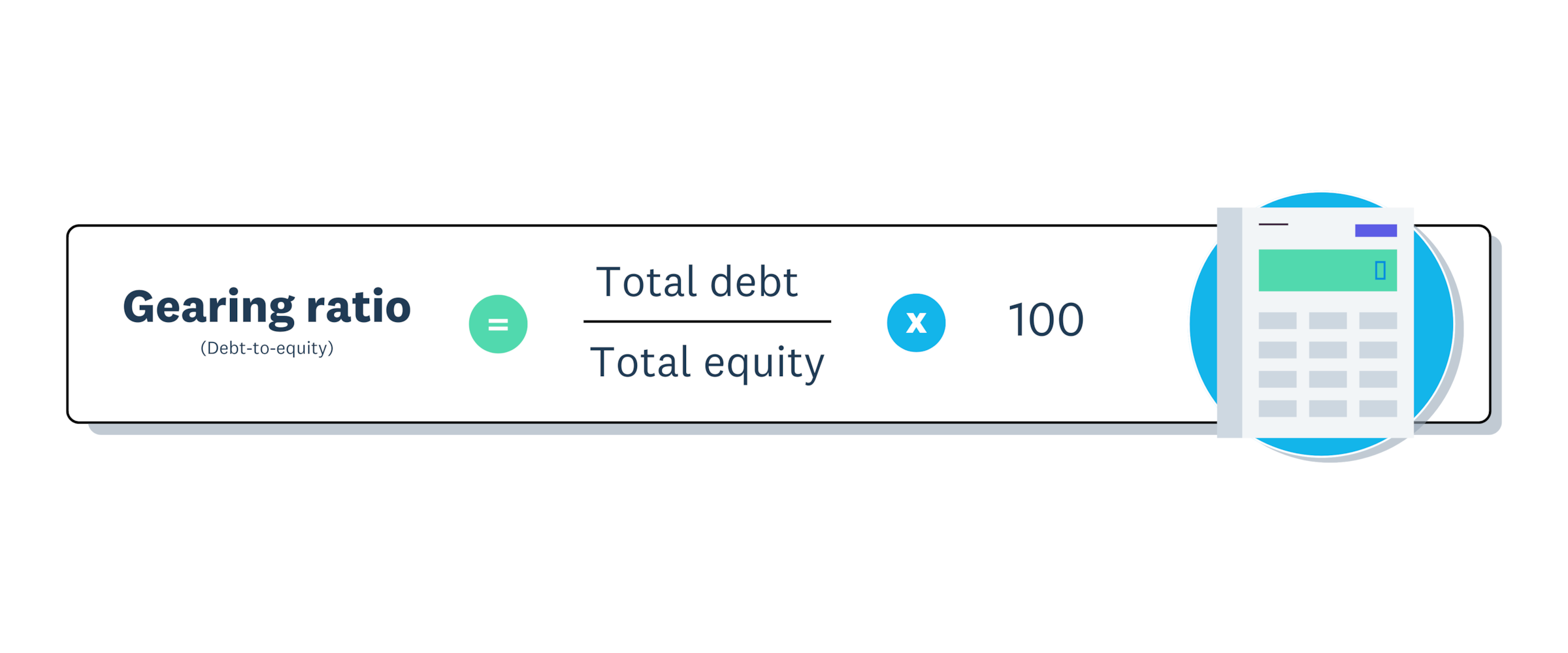

How to calculate the gearing ratio

Follow these steps to calculate your gearing ratio:

1. Calculate total debt: include all loans, bonds, credit lines, and financial liabilities

2. Determine total equity: add retained earnings and share capital for total owner investment

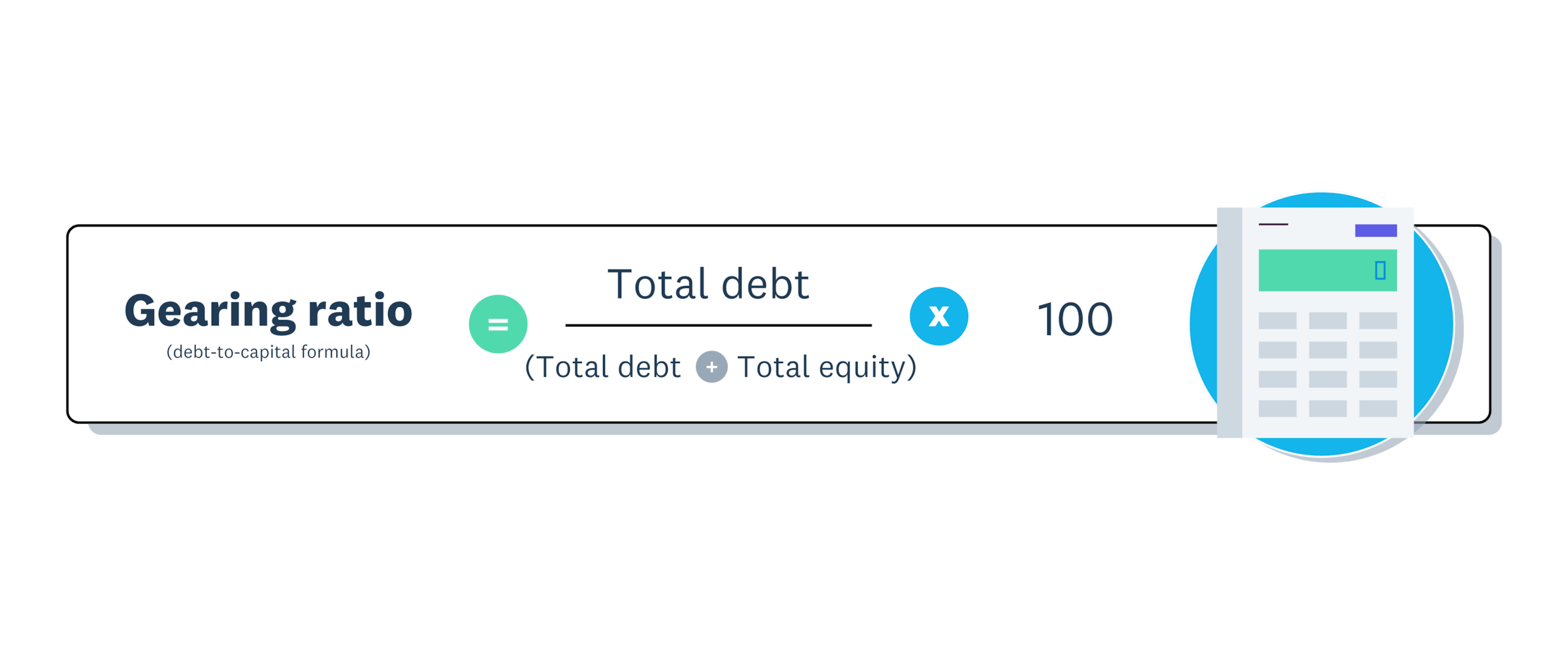

3. Apply the formula: choose one of these calculations:

- Debt-to-equity: (Total Debt ÷ Total Equity) × 100

- Debt-to-capital: (Total Debt ÷ (Total Debt + Total Equity)) × 100

4. Interpret results:

- Higher percentages: indicate greater debt reliance and increased financial risk

- Lower percentages: show stronger equity positions and reduced borrowing dependence

Example gearing ratio calculations

Here are a couple of practical examples of how to calculate a gearing ratio:

- Total debt: $50,000

- Total equity: $100,000

Using the debt-to-equity formula:

- Gearing ratio = (Total debt / Total equity) × 100

- Gearing ratio = ($50,000 / $100,000) × 100 Gearing ratio = 50%

Using the debt-to-capital formula:

- Gearing ratio = (Total debt / (Total debt + Total equity)) × 100

- Gearing ratio = ($50,000 / ($50,000 + $100,000)) × 100

- Gearing ratio = ($50,000 / $150,000) × 100

- Gearing ratio = 33.3%

What is a good gearing ratio?

A "good" gearing ratio depends on your industry, business size, and growth stage. There isn't a single number that fits everyone, but some general guidelines can help you understand where you stand.

- Below 25%: This is considered low gearing. It suggests your business relies more on equity than debt, which means lower risk but potentially slower growth.

- Between 25% and 50%: This range is often seen as a healthy balance for many small businesses. It shows you're using debt to fuel growth without taking on excessive risk.

- Above 50%: This is high gearing. It indicates a strong reliance on debt, which can increase financial risk. While it can accelerate growth, it also means a larger portion of your cash flow goes to debt repayments.

Ultimately, the best ratio for your business is one that aligns with your financial goals and risk tolerance.

Gearing ratio analysis

Gearing ratio interpretation helps you assess your business's financial health and risk level.

Standard gearing ratio ranges:

- Low gearing (below 30%): strong equity position with lower risk but potentially limited growth

- Moderate gearing (30-50%): balanced approach suitable for most small businesses

- High gearing (above 70%): heavy debt reliance with increased risk but higher growth potential

Industry context matters. Most small businesses maintain 30-50% gearing ratios, using debt to fuel growth while maintaining equity for stability. Your ideal ratio depends on your industry, growth stage, and risk tolerance.

High vs low gearing: what's the difference?

High versus low gearing represents different funding strategies with distinct benefits and risks.

High gearing strategy:

- Definition: Relying more on debt than equity to fund operations

- Example: A retail store takes large loans for inventory and renovations. In a real-world Securities and Exchange Commission (SEC) filing, industrial firm Gallatin Materials LLC reported a gearing ratio of 1.36, meaning its debt was 136% of its equity.

- Benefits: Accelerates growth when sales increase, maximizes expansion potential

- Risks: Vulnerable to revenue drops and interest rate increases, which can lead to major losses. For instance, in the lead-up to the 2008 financial crisis, ten large banks and securities firms recorded over $64 billion in writedowns in a single quarter.

- Best for: Businesses with stable cash flow or high-growth industries

Low gearing strategy:

- Definition: Using more equity and less debt for business funding

- Example: Family cafe expanding through saved profits rather than borrowing

- Benefits: Minimizes financial risk, protects credit rating, ensures long-term stability

- Risks: Slower growth compared to debt-funded expansion

- Best for: Businesses prioritizing security or operating in unstable markets

The right balance depends on your industry, cash flow stability, and growth goals.

Manage your business finances with confidence

Smart financial management starts with understanding your gearing ratio and maintaining healthy debt-to-equity balance.

Xero helps you monitor and manage your gearing ratio through:

- Automated calculations: track debt and equity changes in real-time

- Financial reporting: generate balance sheets and financial statements instantly

- Cash flow visibility: monitor how debt payments impact your available funds

- Share reports with lenders and investors: give them clear, professional financial reports when they need them

Ready to take control of your business finances? Get one month free and see how Xero simplifies financial management for growing businesses.

FAQs on gearing ratios

Here are answers to common questions about gearing ratios and their impact on your business.

What is the best gearing ratio for small businesses?

You might aim for a gearing ratio between 30–50%. This can give you growth capital through debt while still keeping a stable equity base.

Is a high or low gearing ratio better?

Each approach has different benefits, depending on your goals and risk tolerance. High gearing accelerates growth but increases risk, while low gearing provides stability but may limit expansion opportunities.

Is 50% gearing considered high?

50% gearing is moderate, not high. It represents balanced financing suitable for most established small businesses with stable cash flows.

How often should I monitor my gearing ratio?

Check your gearing ratio monthly or quarterly, especially before major financial decisions like loan applications or expansion plans.

Can I improve my gearing ratio quickly?

You can improve ratios by paying down debt or increasing equity through retained earnings or additional investment. For example, following the 2008 financial crisis, U.S. banks and securities firms reduced their reliance on debt by raising more than $200 billion in new capital.

Get one month free

Sign up to any Xero plan, and we will give you the first month free.