How to develop a cash flow forecast: Simple guide for small businesses

Learn how a cash flow forecast helps you plan ahead, avoid surprises, and keep your small business on track.

Written by Kari Brummond—Content Writer, Accountant, IRS Enrolled Agent. Read Kari's full bio

Published Wednesday 26 November 2025

Table of contents

Key takeaways

• Create a cash flow forecast by listing your starting balance, estimating when money will come in from customers, scheduling when bills and expenses are due, then calculating your running cash balance to predict future financial positions.

• Update your cash flow forecast monthly by removing completed periods, adding new months ahead, and comparing actual results to predictions to improve accuracy and maintain useful financial planning.

• Use cash flow forecasting as an early warning system to spot potential cash shortages weeks or months in advance, giving you time to secure funding, delay expenses, or negotiate payment terms before problems arise.

• Distinguish between cash flow forecasts and budgets since forecasts focus on timing of money movements to ensure bill payment capability, while budgets set spending targets and financial goals over longer periods.

What is a cash flow forecast?

Cash flow forecasting is a financial planning tool that predicts how much money will move in and out of your business over a specific period. It shows your future financial position so you can make informed decisions about spending, investments, and growth.

How cash flow forecasts differ from statements and projections:

- Cash flow forecast vs cash flow statement: Forecasts predict future money movements, while cash flow statements record past transactions

- Forecast vs projection: Forecasts typically cover shorter periods (weeks to months), while projections extend further into the future

Why is cash flow forecasting important?

Cash flow forecasting helps you avoid financial surprises by showing when money will come in and go out of your business. This visibility lets you pay bills on time, ensure you can pay yourself, and plan for potential cash shortages before they happen.

Cash flow forecasting during uncertain times

- Rising costs make cash planning essential

- Predicts financial gaps before they become problems

- Enables proactive decision-making about spending and investments

Benefits of a cash flow forecast

Cash flow forecasting gives you financial control by revealing your future money position before problems arise. This forward-looking approach delivers measurable benefits:

- Early warning system: Spot cash shortages weeks or months ahead, giving you time to secure funding, delay expenses, or negotiate extended payment terms

- Growth planning: Determine if you can afford new equipment, staff, or expansion without risking cash flow problems

- Owner pay protection: Ensure you can consistently pay yourself while covering business expenses

- Trend identification: Quickly spot rising expenses or declining income before they threaten your business

- Solve problems: Find issues like slow-paying customers, poor payment terms or seasonal cash gaps

- Manage proactively: Build contingency plans for predicted cash flow dips

Cash flow forecasts vs budgets - what's the difference?

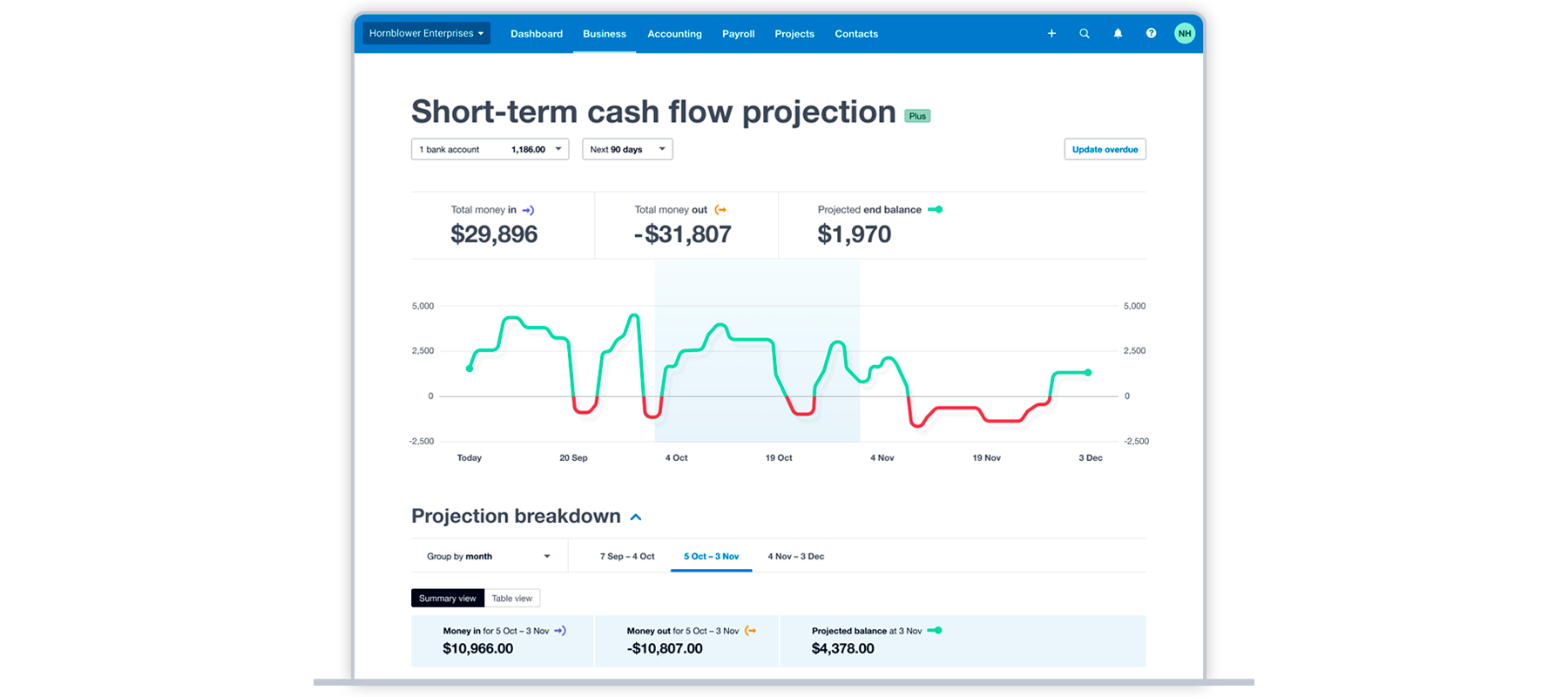

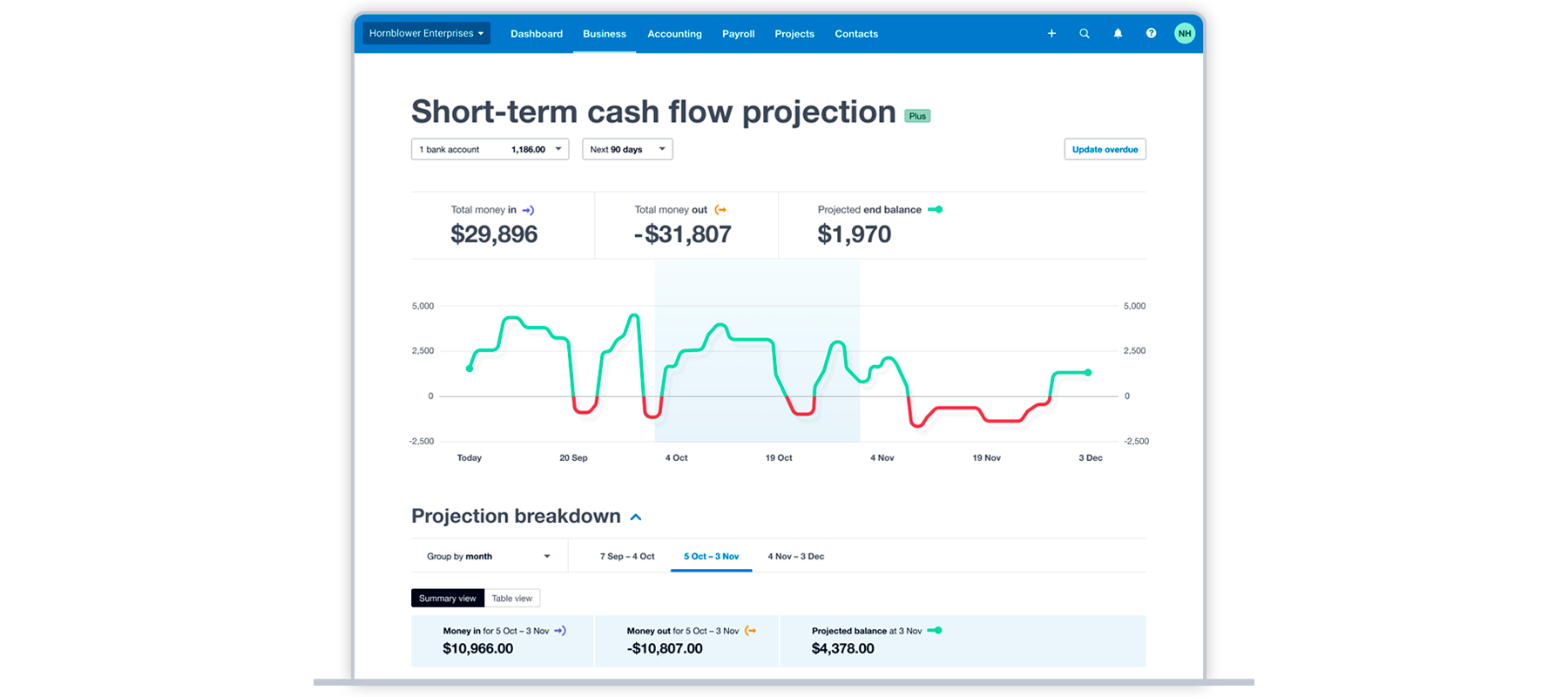

A cash flow dashboard shows how cash balances will rise and fall in response to expected transactions.

Cash flow forecasts and budgets help you in different ways when planning your finances, and both are essential for your small business success.

Cash flow forecasts:

- Focus: When money moves in and out of your business

- Purpose: Ensure you have enough cash to pay bills and avoid shortfalls

- Timeframe: Usually weekly or monthly for the next 3-12 months

- Key question: Will I have enough money when I need it?

Budgets:

- Focus: How much you plan to earn and spend over a period

- Purpose: Set financial goals and control spending

- Timeframe: Typically annual with monthly or quarterly reviews

- Key question: Am I staying on track with my financial goals?

Why you need both: Budgets help you set financial targets, while cash flow forecasts help you pay your bills on time. Having both gives you a stronger foundation for your business planning.

What are the key components of a cash flow forecast?

Cash flow forecasts track five key parts of your business finances:

- Starting balance: How much cash you have at the beginning of the forecast period

- Money coming in: Expected income from sales, loans, grants, or asset sales during the period

- Money going out: All planned expenses including bills, payroll, loan payments, and purchases

- Net cash flow: Whether your cash position improved or declined (money in minus money out)

- Ending balance: How much cash you'll have at the end of the period

Creating a cash flow forecast shows you exactly when money will come in and go out of your business, so you can plan accordingly. You can create a cash flow forecast for any period, from a week to a year.

A cash flow dashboard shows how cash balances will rise and fall in response to expected transactions.

The basic approach:

- List when bills and expenses are due

- Calculate your running cash balance day by day or month by month

- Use spreadsheets or accounting software to track everything

For longer forecasts: Review previous quarters or years to make your estimates more accurate.

Creating a cash flow forecast spreadsheet

Choose your forecast period. Write down how much cash you have at the start. You can forecast for a month or a year.

List and date all expected cash income for the period. Include sales receipts, grants, tax refunds and any incoming finance.

List and date your outgoings. Include regular business costs and infrequent expenses, such as annual fees, taxes or repairs.

Add your incoming amounts to your starting balance and subtract your outgoings. This shows how much cash you will have at any point.

See an illustrated example of this approach.

If you have incoming sales of £90,000 and outgoings of £65,000, you will add £25,000 in net cash flow for the period. If you started with £45,000, you will have £70,000 left at the end of the month. This becomes your starting balance for the next month.

If you buy equipment with surplus cash, your starting balance for the next month will be £50,000. This shows how you can use cash flow forecasts to decide if you can afford new equipment or need to consider financing it.

Cash flow projection example

Suppose you are planning a new service launch. You need to know how much cash will be available over the next 12 months to support it.

Tiny Construction has a starting balance of £45,000. The firm has two consecutive projects lined up for the next 12 months. The outstanding invoices and sales forecasts show that incoming payments will be £70,000 per month for the first six months, and £65,000 per month for the following six months. Tiny Construction is also expecting a government grant payment of £30,000 in six months' time.

So the 'money in' part of the projected cash flow will look like this:

The 'money out' part of the cash flow forecast will look like this:

If you have £840,000 coming in and £550,000 going out over 12 months, you will add £290,000 in net cash flow. With a starting balance of £45,000, you will have £335,000 left at the end of the year. You can use this information to build an annual budget for your new service.

How do you analyse a cash flow forecast?

Analysing your cash flow forecast reveals patterns and problems that help you make better financial decisions. Focus on three key areas:

Ending cash position: Check if you'll have enough money in reserve at the end of each period to cover unexpected expenses

Cash flow trends: See whether your cash position is improving or declining over time, and identify the main drivers

Forecast accuracy: Compare your predictions to actual results to spot patterns in your estimates and improve future forecasts

How often should cash flow forecasts be done?

You can forecast cash flow for any period. The further ahead you look, the harder it is to predict. Update your forecast regularly to keep it useful.

Keep your forecasts current by updating them regularly – this ensures they remain useful for decision-making.

Monthly update process:

- Remove the completed month from your forecast

- Add a new month to the end

- Update any changed assumptions for the remaining months

- Compare actual results to your predictions

Tools to help: Use cash flow templates from accounting software or online resources. You can also track liquidity ratios like your quick ratio to monitor cash availability.

If you find it overwhelming, ask your accountant or bookkeeper for help with cash flow projections. They can create forecasts for you and explain the details. Once you have a reliable forecast, use it to plan for costs and growth.

Who is responsible for creating a cash flow forecast?

Many small business owners do their own cash flow forecasting, even though most have no formal financial training. You can use a spreadsheet or accounting software. Or you can ask a bookkeeper or accountant to help. They can do it quickly and give you advice on cash flow management. Find a Xero-ready accountant or bookkeeper in our directory.

Cash flow forecasting for small businesses

Cash flow forecasting puts you in control of your business finances by showing you what's coming before it happens. This visibility helps you make confident decisions about spending, growth, and day-to-day operations.

Getting started:

- Use accounting software: Automate data collection and updates to save time

- Start with templates: Download a free cash flow forecasting template if you're not ready for software

- Begin simple: Even basic forecasting is better than flying blind

You can find more expert guides and articles in the cash flow resource hub to help you maintain healthy cash flow.

FAQs on cash flow forecasting

Find answers to common questions about cash flow forecasting below.

What is the formula for forecasting cash flow?

The basic formula is your starting cash balance, plus your expected cash inflows, minus your expected cash outflows. This gives you your ending cash balance for the period.

How far ahead should a small business forecast cash flow?

It's helpful to have both a short-term and long-term view. A 12-week forecast helps you manage day-to-day cash, while a 12-month forecast is great for bigger picture planning, like budgeting and applying for loans.

What's the difference between a cash flow forecast and a cash flow statement?

A cash flow forecast predicts future cash movements, helping you plan ahead. A cash flow statement shows what has already happened, using historical data to report the cash that moved in and out of your business in the past.

Can I create a cash flow forecast without accounting software?

Yes, you can use a spreadsheet. However, accounting software like Xero automates much of the process by pulling in real-time data from your bank accounts and invoices, which saves time and improves accuracy.

How accurate should my cash flow forecast be?

A forecast is an estimate, so it won't be perfect. The goal is to be as realistic as possible by using solid data from past performance and known future income and expenses. Your forecasts will become more accurate as you get into the habit of creating and reviewing them.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.