Step confidently into Making Tax Digital for Income Tax

Whether you're a sole trader, a landlord, or both - this page is your simple guide to Making Tax Digital for Income Tax. We'll show you how to confidently make a start and turn a compliance requirement into better control of your business finances.

What is Making Tax Digital for Income Tax, really?

Making Tax Digital (MTD) for Income Tax is a UK government initiative that’s changing how sole traders and landlords report their income tax. Instead of doing one big Self Assessment tax return each year, you’ll:

- Keep digital records: Use software like Xero to track your income and expenses digitally as you go

- Send quarterly updates: You’ll send a simple summary of your income and expenses to HMRC four times a year, directly from your software. Think of them as quick financial check-ins, not full tax returns

- Submit a final tax return: Once a year, you’ll finalise your tax position with one final declaration, replacing your current annual income tax return

Who is impacted and when?

You will need to follow MTD for Income Tax rules if you are an individual registered for Self Assessment and get income from self-employment or property, or both.

If you're a sole trader

You’ll need to record all your sales and business expenses digitally and send four summaries to HMRC each year.

If you are a landlord

You’ll need to record all your rental income and allowable property expenses digitally and send four summaries to HMRC each year.

If you’re a sole trader and a landlord

Your mandatory start date is determined by the combined total of your income from both your sole trade and your property business.

Mandatory start dates

This change is being rolled out in phases, based on your total annual income (from self-employment and/or property rental):

- While the changes are phased, we recommend starting now to comfortably build better digital habits.

Phase 1: Above £50,000

6 April 2026

Phase 2: Above £30,000

6 April 2027

Phase 3: Above £20,000

6 April 2028

Beyond compliance: How going digital gives you better control

We understand that adopting new digital habits requires an initial investment of time. However, this shift to MTD is your opportunity to upgrade your financial management and unlock something far more valuable than compliance: Better control.

- With Xero, you don't just get through MTD, you change the way you see it. It’s an opportunity to transform messy records into a powerful tool for business growth and confidence.

No surprises:

See your estimated tax bill as you go, so you can save ahead and avoid last-minute stress.

Less admin, more accuracy:

Your transactions flow in automatically — no manual data entry. Instantly capture receipts, fix errors, and store documents online.

Get paid faster:

Send invoices with built-in payment options, so clients can pay instantly — helping you get paid faster and keep cash flowing.

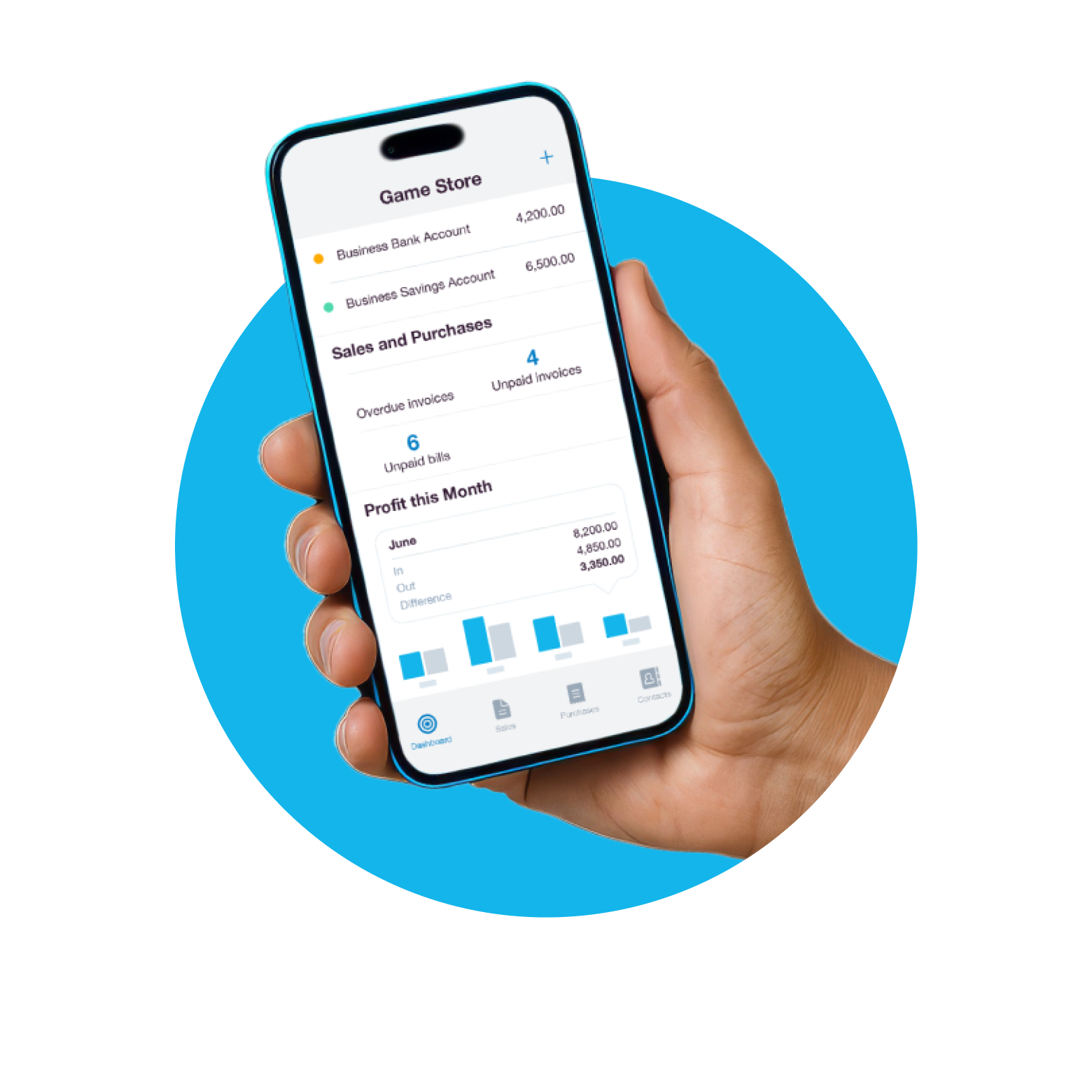

Real-Time insight:

Know what you’ve earned, what you’re owed, and where to save — so you can make better decisions, faster.

Track property performance:

See your portfolio’s performance in real time to spot underperformers and get the full financial picture.

Meet Xero: Compliance and control, simplified

Xero is trusted by millions and recognised by HMRC. It handles MTD rules effortlessly, so you can focus on business — not paperwork.

HMRC-recognised and trusted by millions

Be confident your MTD submissions are accurate and compliant with Xero’s trusted software.

Everything you need, in one place

Go beyond bridging tools with an end-to-end solution. Keep digital records and submit to HMRC, all in Xero.

Stay in control, wherever you are

Track income and expenses on the go with simple, easy to use software that keeps you organised.

Introducing Xero Simple: Perfect for starting out

Xero offers a range of plans for all your business needs — all of which are HMRC-recognised and MTD ready. However we know that some sole traders and landlords just need a straightforward, budget-friendly option to go digital and get ahead of the changes.

Learn more about Xero Simple

Plans to suit your business

All pricing plans cover the accounting essentials, with room to grow.

Simple

A new plan, specifically for non VAT businesses, with features designed for sole traders and landlords.

Simple

Usually £7

Now £0.35

GBP per month excluding VAT

Save £39.90 over 6 months

- Send invoices and quotes

- Accept online invoice payments^

- MTD for Income Tax ready

- Reconcile bank transactions

- Capture bills and receipts with Hubdoc

- View real-time reports

- Automate subcontractor CIS calculations and reports

Your three steps to MTD readiness

Under Making Tax Digital, your biggest priority is shifting your tax process from annual paperwork to ongoing, digital habits. Here’s a simple action plan for both sole traders and landlords to get you MTD-ready with Xero today.

- Quick Tip: HMRC will look at your most recent tax return to see if you hit the threshold. If you think you're close, it’s best to get set up early.

Know your deadline

Check your total combined income from self-employment and property. This confirms when you need to start MTD for Income Tax.

Choose Xero to go digital

Pick your HMRC-recognised plan and start logging income and expenses now. Starting early will make the process smoother.

Sign up with HMRC

Once you’re set up on Xero, sign up with HMRC for MTD for Income Tax - it’s not automatic, so you or your advisor must do it.

Read HMRC's guidance on signing up

Get support every step of the way

The easiest way to be MTD ready is to start now. Our tools and experts help you get compliant and in control of your business finances.

Webinar: Making Tax Digital for Income Tax

Get a clear, jargon-free overview of MTD for Income Tax and see a live demo of how easy Xero makes it.

Find an accountant or bookkeeper near you

If you need a helping hand, find a Xero-certified expert who can get you set up and handle the process for you.

Explore MTD for IT resources

Understand the upcoming MTD for IT changes and make the move to HMRC-recognised software with expert help and guidance.

MTD for Income Tax FAQs

Yes, for sole traders and landlords who reach the turnover threshold. Instead of one annual tax return, you’ll submit four quarterly updates and one final declaration using your HMRC-recognised software. It’s the same information, just spread out through the year.

Yes, for sole traders and landlords who reach the turnover threshold. Instead of one annual tax return, you’ll submit four quarterly updates and one final declaration using your HMRC-recognised software. It’s the same information, just spread out through the year.

Not to comply with MTD. All your records must be kept and submitted digitally via HMRC-recognised software. You can upload receipts and data into Xero, but the data itself needs to flow through the MTD-compatible software.

Not to comply with MTD. All your records must be kept and submitted digitally via HMRC-recognised software. You can upload receipts and data into Xero, but the data itself needs to flow through the MTD-compatible software.

HMRC will combine your total qualifying income from all your sole trader businesses and property income. If the combined amount is above the MTD for Income Tax threshold, you’re in. You’ll need to submit separate quarterly updates for each business or property income source — for example, a sole trader who also has a property business could submit eight quarterly updates a year — but you’ll only submit one final declaration that covers all your income sources. The good news is that with Xero you don't need to pay for multiple subscriptions should you have multiple income streams. You can stay compliant with MTD within one Xero organisation, keeping the cost impact of MTD for Income Tax down.

Learn more about how Xero simplifies managing multiple incomesHMRC will combine your total qualifying income from all your sole trader businesses and property income. If the combined amount is above the MTD for Income Tax threshold, you’re in. You’ll need to submit separate quarterly updates for each business or property income source — for example, a sole trader who also has a property business could submit eight quarterly updates a year — but you’ll only submit one final declaration that covers all your income sources. The good news is that with Xero you don't need to pay for multiple subscriptions should you have multiple income streams. You can stay compliant with MTD within one Xero organisation, keeping the cost impact of MTD for Income Tax down.

Learn more about how Xero simplifies managing multiple incomesHMRC will check your last tax return against the threshold, so if you think you’re close, it's best to get set up now to ensure compliance. The real benefit is greater control of your business finances: get quarterly visibility to avoid year-end tax panic, improve accuracy with auto-data entry, and enhance cash flow management.

HMRC will check your last tax return against the threshold, so if you think you’re close, it's best to get set up now to ensure compliance. The real benefit is greater control of your business finances: get quarterly visibility to avoid year-end tax panic, improve accuracy with auto-data entry, and enhance cash flow management.

The upcoming MTD for Income Tax rules require much more than just a submission—they mandate digital record-keeping for all your income and expenses throughout the year. Bridging software is a basic tool that only connects spreadsheet totals to HMRC, making it a short-term fix. Xero is built to handle the entire process seamlessly, offering better value by automating tasks like receipt capture and bank reconciliation.

The upcoming MTD for Income Tax rules require much more than just a submission—they mandate digital record-keeping for all your income and expenses throughout the year. Bridging software is a basic tool that only connects spreadsheet totals to HMRC, making it a short-term fix. Xero is built to handle the entire process seamlessly, offering better value by automating tasks like receipt capture and bank reconciliation.

It comes down to ease and control. Bridging software relies on you manually maintaining, formatting, and uploading data from spreadsheets, which adds time and increases the risk of manual errors. Xero automates the record-keeping and linking process from day one, giving you real-time financial insights and confidence in the accuracy of your quarterly updates. This improved visibility helps you manage cash flow and avoid year-end tax surprises.

It comes down to ease and control. Bridging software relies on you manually maintaining, formatting, and uploading data from spreadsheets, which adds time and increases the risk of manual errors. Xero automates the record-keeping and linking process from day one, giving you real-time financial insights and confidence in the accuracy of your quarterly updates. This improved visibility helps you manage cash flow and avoid year-end tax surprises.

Both are part of HMRC's initiative to move tax reporting fully digital, but their scope and timing differ. MTD for VAT is already mandatory for all VAT-registered businesses (including Limited Companies) and requires quarterly VAT Returns. MTD for Income Tax is being phased in (starting April 2026), applying to eligible sole traders and landlords with income over the threshold, requiring quarterly Income & Expense updates and an annual Final Declaration (replacing Self Assessment).

Both are part of HMRC's initiative to move tax reporting fully digital, but their scope and timing differ. MTD for VAT is already mandatory for all VAT-registered businesses (including Limited Companies) and requires quarterly VAT Returns. MTD for Income Tax is being phased in (starting April 2026), applying to eligible sole traders and landlords with income over the threshold, requiring quarterly Income & Expense updates and an annual Final Declaration (replacing Self Assessment).