MTD for Income Tax Guidance & Advice

Explore our guides outlining everything you need to know about Making Tax Digital for Income Tax (MTD for IT).

Making Tax Digital for Income Tax Explained

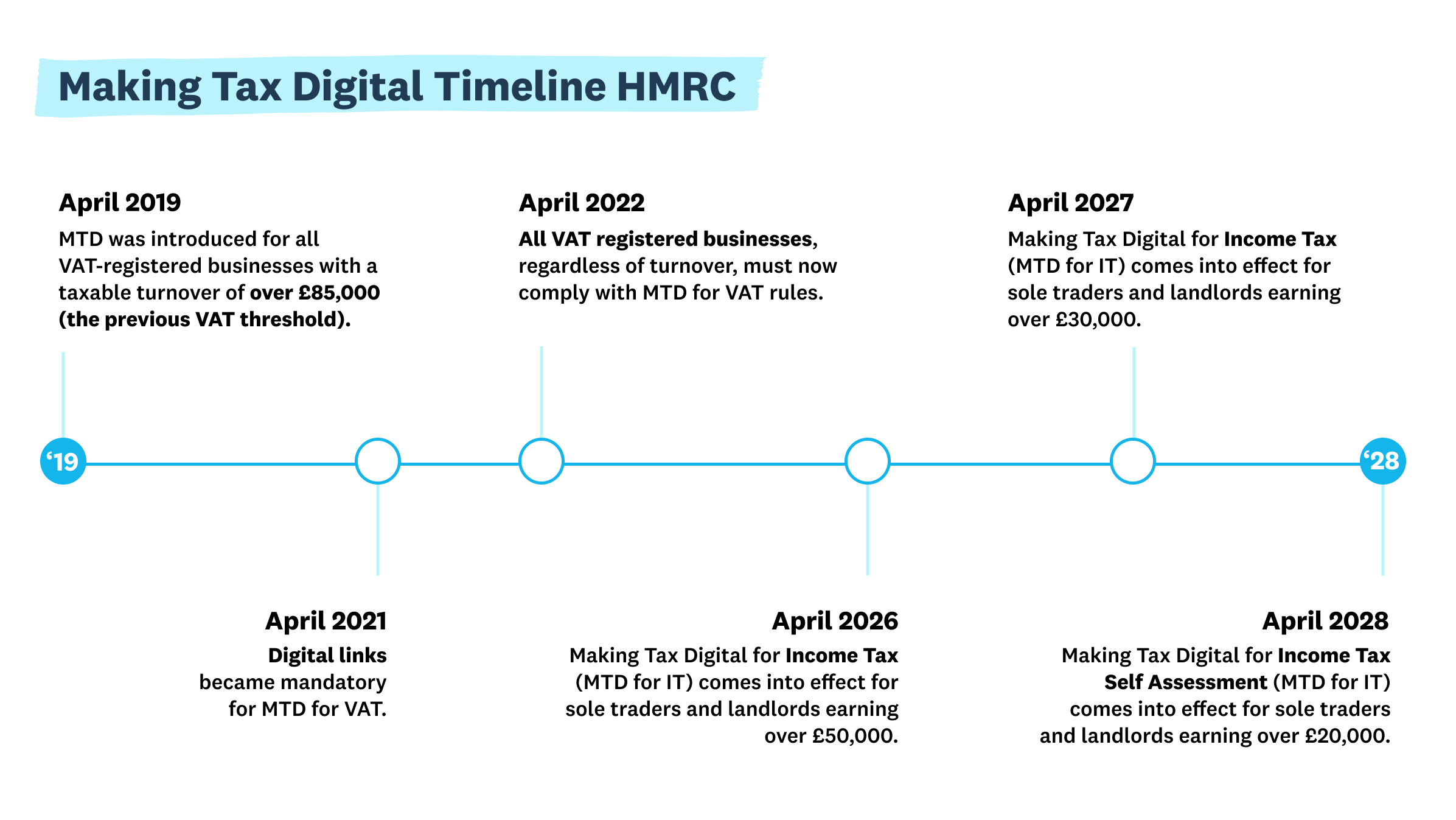

MTD deadlines and important dates

Our Making Tax Digital (MTD) timeline covers all of the key deadlines and dates for each stage of HMRC’s MTD initiative.

Making Tax Digital legislation: what exactly is it?

In this guide, we revisit the original Making Tax Digital legislation for VAT, Income Tax, and Corporation Tax.

Getting started with digital record keeping for MTD

We explore digital record keeping rules so you can make sure you’re fully compliant with MTD.

Quarterly updates for Making Tax Digital for Income Tax

Under MTD for IT, landlords and the self-employed will have to provide quarterly updates on their income and expenses.

What is a final declaration? Reporting for MTD for Income Tax

From April 2026, final declarations will be a requirement for HMRC’s Making Tax Digital for Income Tax initiative.

Making Tax Digital delay: everything you need to know

In this short guide, we’ll explain what the Making Tax Digital (MTD) delay means for businesses, accountants, and bookkeepers, and why you should still prepare for the legislation now.

How bookkeepers can support those impacted by MTD for IT

We explore how bookkeepers can support those impacted by HMRC’s MTD for IT initiative.

How bookkeepers can support with MTD for IT

Understanding Changes to Self Assessment

Making Tax Digital for The Self-Employed

We explore everything sole traders and the self-employed need to know about Making Tax Digital for IT.

How self assessment tax returns are changing: MTD for IT

From April 2026, MTD for IT will change the way the self-employed and landlords do their self assessment.

How to fill in a Self Assessment Tax Return online

This quick guide provides step-by-step instructions on how to fill in a Self Assessment Tax Return online.

Self Assessment deadlines: When to register, file and make a payment in 2025/26

Read this guide to learn when you need to register for Self Assessment, submit a return, and pay your tax bill.

The ultimate guide to self-employed tax

Our expert guide tells you everything you need to know about paying tax to HMRC when you’re self-employed, including tackling MTD for IT

Filing a self assessment tax return as a sole trader

Learn everything you need to know about filing a self assessment tax return as a sole trader.

Making Tax Digital Guides for Landlords

Landlords earning above £50,000 a year from business and property will need to sign up to MTD for IT from April 2026.

Understanding MTD for landlords

Read our FAQs exploring what Making Tax Digital means for landlords in practical terms.

A guide to Self Assessment for landlords

Here’s your complete guide to understanding how to manage Self Assessment as a landlord.

MTD Support for Accountants & Bookkeepers

Our resources will help you prepare your clients and practice for IT, outlining how to segment your clients and market your practice.

Preparing your clients & practice for IT

Read our guide outlining three steps you can take to prepare your clients and practice for MTD for Income Tax.

MTD for IT: How to segment your client base

Our quick guide walks you through how to easily segment your clients for Making Tax Digital for IT.

MTD for IT segmentation tool

Download our segment overview and workload calculator to support you with preparing for MTD for Income Tax.

How to market your practice to landlords

We explore how to market your accountancy or bookkeeping practice to landlords navigating the new MTD for Income Tax legislation.

How to market your practice to sole-traders

Learn how to market your accountancy or bookkeeping practice to sole traders navigating MTD for IT.

Hear how our partners are preparing for IT

Accountants and bookkeepers using Xero share their stories on why it’s vital to start preparing for MTD for IT early.

Hear from our partners

Understanding Basis Period Reform

Learn about HMRC’s basis period reform and how it could impact self-employed individuals and partnerships.

A guide to basis period reform.1665315386976.png)

Your MTD for IT questions answered

Making Tax Digital for Income Tax (MTD for IT) is part of the government’s plans to digitalise the UK tax system. From 2026, MTD for Income Tax will impact the way sole traders and landlords with a total business or property income above £50,000 per year manage their tax obligations. Those earning above £30,000 will follow in 2027.

Learn more about MTD for Income TaxMaking Tax Digital for Income Tax (MTD for IT) is part of the government’s plans to digitalise the UK tax system. From 2026, MTD for Income Tax will impact the way sole traders and landlords with a total business or property income above £50,000 per year manage their tax obligations. Those earning above £30,000 will follow in 2027.

Learn more about MTD for Income TaxBusinesses, self-employed people and landlords with a total income (from business or property) above £50,000 will need to follow MTD rules for IT from April 2026. Those earning more than £30,000 will need to join the MTD for IT system in 2027. Instead of using HMRC’s website to file returns, you’ll need to keep digital records and use compatible software.

Learn moreBusinesses, self-employed people and landlords with a total income (from business or property) above £50,000 will need to follow MTD rules for IT from April 2026. Those earning more than £30,000 will need to join the MTD for IT system in 2027. Instead of using HMRC’s website to file returns, you’ll need to keep digital records and use compatible software.

Learn moreFrom April 2026, landlords earning above £50,000 annually will need to change the way they record income and expenses under Making Tax Digital for Income Tax rules. Landlords earning more than £30,000 each year will follow in 2027. They will also need to change the way they submit tax returns.

Learn moreFrom April 2026, landlords earning above £50,000 annually will need to change the way they record income and expenses under Making Tax Digital for Income Tax rules. Landlords earning more than £30,000 each year will follow in 2027. They will also need to change the way they submit tax returns.

Learn moreIn the space of one tax year, you’ll need to send HMRC four cumulative quarterly updates using your MTD-compatible software. You’ll also need to send a ‘Final Declaration’ by January 31st. This replaces the current annual self-assessment.

Learn moreIn the space of one tax year, you’ll need to send HMRC four cumulative quarterly updates using your MTD-compatible software. You’ll also need to send a ‘Final Declaration’ by January 31st. This replaces the current annual self-assessment.

Learn moreMTD for Corporation Tax is unlikely to be implemented before April 2026 at the earliest.

Learn moreMTD for Corporation Tax is unlikely to be implemented before April 2026 at the earliest.

Learn moreMaking Tax Digital (MTD) for partnerships was supposed to come into force in April 2025 but, following a government announcement in December 2022, this legislation has been delayed.

Learn moreMaking Tax Digital (MTD) for partnerships was supposed to come into force in April 2025 but, following a government announcement in December 2022, this legislation has been delayed.

Learn more

Become a Xero partner

Join the Xero community of accountants and bookkeepers. Collaborate with your peers, support your clients and boost your practice.