How to calculate operating profit

Operating profit (calculation)

Operating profit is gross profit minus operating costs (except interest on loans) and minus depreciation.

How to calculate operating profit

When calculating your operating profit, your accountant also makes adjustments for:

- depreciation – this will be counted as an additional cost

- interest – they will remove loan interest from your costs

Interest payments are ignored because operating profit only wants to measure the things the business can control. Interest payments are ultimately controlled by the rate your lender sets. For this reason, operating profit is also known as earnings before interest and tax (EBIT).

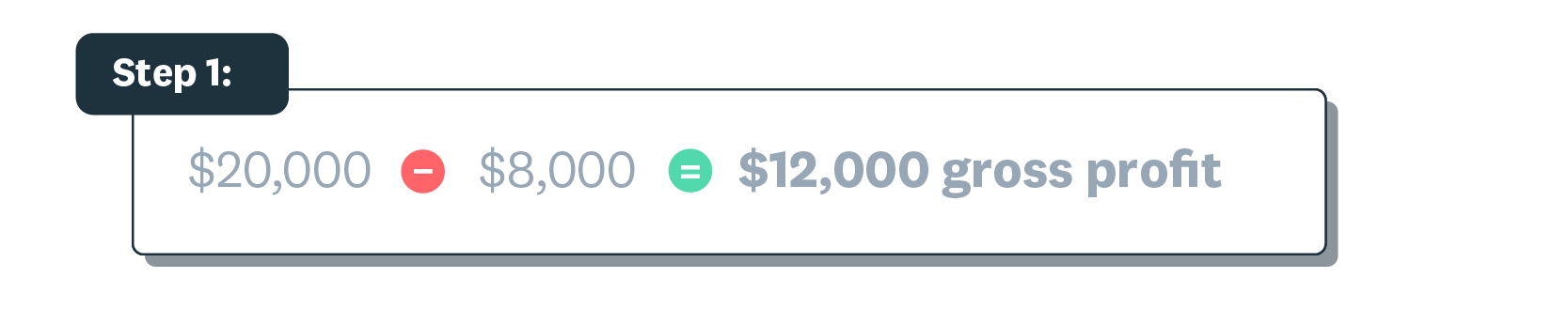

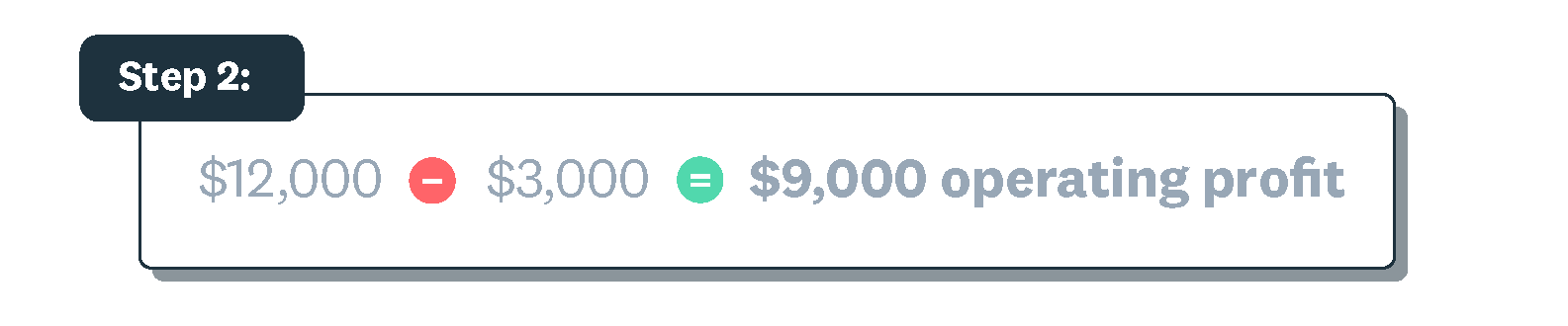

Example of an operating profit calculation

Let’s say your business sold $20,000 worth of products or services. Now imagine it cost you $8000 to provide those products and services and you paid another $3000 on things like rent, electricity and phone charges.

See related terms

Handy resources

Advisor directory

You can search for experts in our advisor directory

Income statement template

Download an income statement template to help track your profitability

Financial reporting

Keep track of your performance with accounting reports

Disclaimer

This glossary is for small business owners. The definitions are written with their requirements in mind. More detailed definitions can be found in accounting textbooks or from an accounting professional. Xero does not provide accounting, tax, business or legal advice.