NOPAT: What Net Operating Profit After Tax means for your business

Learn how net operating profit after tax (NOPAT) helps you see core performance and make better decisions.

Written by Kari Brummond—Content Writer, Accountant, IRS Enrolled Agent. Read Kari's full bio

Published Friday 23 January 2026

Table of contents

Key takeaways

- Calculate NOPAT by multiplying your operating profit by (1 - tax rate) to measure core business performance after taxes but before interest expenses, excluding non-operating income like investment gains or rental income.

- Use NOPAT to compare businesses fairly regardless of their debt levels or financing structures, as it reveals true operational efficiency by isolating core business performance from financing decisions.

- Apply NOPAT as the foundation for Economic Value Added (EVA) calculations to determine whether your invested capital generates returns above the cost of capital by subtracting total invested capital times the cost of capital from NOPAT.

- Track operating income, expenses, and tax obligations systematically using accounting software to ensure accurate NOPAT calculations and enable consistent performance monitoring over time.

What is NOPAT?

Net Operating Profit After Tax (NOPAT) is a financial metric that measures profit from core business operations after paying taxes but before interest expenses. It excludes non-operating income and focuses solely on your main business activities.

NOPAT helps you evaluate operational performance by:

- Excluding non-operating income: Stock gains, investment returns, or side business revenue

- Excluding financing costs: NOPAT excludes financing costs like interest on loans, credit cards, or debt payments, though tax rules can set limits on how these are reported. For example, UK businesses using the cash basis method have a maximum claim for interest and related costs of £500.

- Including tax obligations: Reflects real-world tax burden on operations

NOPAT also links directly to how you value a business, as it feeds into methods such as purchase price allocation.

Why is NOPAT important?

NOPAT reveals true operational efficiency by removing financing structure bias. This metric helps you:

- Compare businesses fairly: Evaluate companies regardless of debt levels or tax jurisdictions

- Assess core performance: Focus on operational success rather than financing decisions

- Make investment decisions: Understand returns from actual business activities

Reveals true business performance

NOPAT isolates operational performance from financing decisions. This approach shows how well your business generates profit from core activities while accounting for tax obligations.

Knowing the importance of NOPAT is especially helpful for evaluating businesses with complex financial structures. The calculation can be so detailed that, as valuation experts Stern Stewart noted, for some companies 160 adjustments were made to accounting profits to arrive at NOPAT.

Focusing on operational profits helps you identify areas for improvement and make decisions about long-term growth.

Helps to standardise comparisons

NOPAT standardises comparisons between different companies in different areas. Even when a business has debt that reduces net profit and tightens cash flow, NOPAT helps you see how strong its core operations are. It also helps you compare how tax rules in different areas affect the company's bottom line; for example, in the UK, miscellaneous income of £1,000 or less is exempt from tax under the trading income allowance.

Comparison example:

- Company A: £100,000 net profit

- Company B: £80,000 net profit (but £120,000 NOPAT)

Company B's higher NOPAT reveals stronger operational performance despite lower net profit due to debt payments. This insight helps you evaluate the business's true earning potential.

Similarly, let's say you're comparing businesses in different tax jurisdictions. NOPAT shows you exactly how the tax liabilities in each of these areas affect profits.

Make better decisions

NOPAT enables Economic Value Added (EVA) calculations to measure investment performance. EVA shows whether your invested capital generates returns above the cost of capital.

EVA puts interest back into the equation, but it also takes shareholder equity into account. To determine EVA, start with NOPAT and then subtract total invested capital times the cost of the capital.

For example, imagine NOPAT is £50,000. Now, let's say the business has £100,000 in loans at 6% interest and you invested £100,000 in cash. Your capital investment is £200,000 at an average cost of 3%. That means you subtract £6,000 from £50,000, which gives you an EVA of £44,000.

In other words, the £200,000 wrapped up in this company is generating £44,000 per year. This metric becomes even more important when you're dealing with a company with a lot of shareholders. EVA helps you see how well the shareholders' investments are performing, and it's critical for guiding decisions about future investments or loans.

You can check out EVA calculation examples.

NOPAT vs net income

Key differences between NOPAT and net income:

- Net income: Includes all income, expenses, taxes, and financing costs

- NOPAT: Excludes interest expenses and non-operating items, focuses on core operations only

Net income is the bottom line because it accounts for operational expenses, interest, depreciation, amortisation, and taxes. It also includes all of the income and expenses the business earns from side activities or investments. NOPAT excludes interest and any income or expenses that are not related to the business's core operations.

To explain, let's say a bakery has £100,000 in net income, but it earns £12,000 from renting space in its parking lot to a food truck, and it pays £8,000 in interest on loans. To find its NOPAT, exclude the interest and the rent (because that's not a core business activity). That brings the NOPAT to £80,000.

NOPAT focuses on operational efficiency, while net income includes everything. However, if a business doesn't have any debt or other income streams, then its NOPAT and net income are the same.

Operating profit vs NOPAT

Operating profit and NOPAT both measure core operational earnings before interest, but differ on tax treatment:

- Operating profit: Before taxes and interest

- NOPAT: After taxes but before interest

To calculate operating profit, add the tax back into NOPAT. Say the NOPAT is £80,000 and the business's tax liability is £16,000. That means that the operating profit is £96,000.

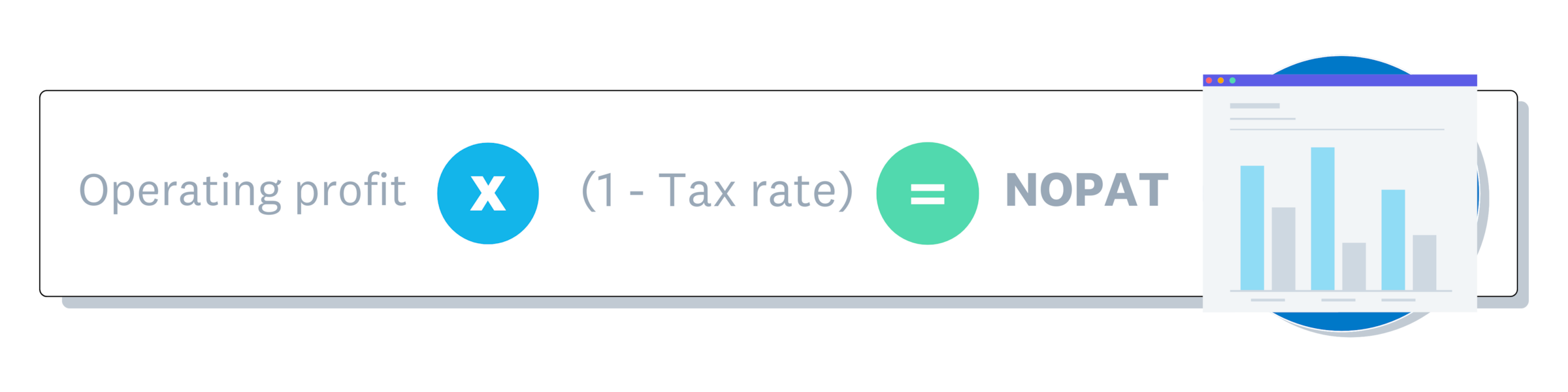

NOPAT formula explained

Let's break down the NOPAT formula:

NOPAT = operating profit × (1 - tax rate)

NOPAT calculation breakdown:

- Start with operating profit: Revenue minus all operating expenses (including depreciation and amortisation)

- Calculate tax impact: Multiply by (1 - tax rate) to determine after-tax profit

- Result: Operating profit adjusted for taxes but excluding interest

For instance, if your tax rate is 20%, multiply operating profit by 80% to get NOPAT.

Note that operating profit is often confused with EBIT, which is earnings before interest and tax. But there is a slight difference: EBIT includes all income sources, while operating profit only includes operating income (money earned from your main line of business).

How to calculate NOPAT

Here's how to calculate NOPAT using a step-by-step example.

1. Determine operating profit

Operating profit = Gross profit - Operating expenses

Where gross profit = Revenue - Cost of goods sold

Exclude any non-operating income like investment gains or asset sales.

2. Find the tax rate

Tax rate = income tax paid ÷ operating profit

Example: £20,000 tax ÷ £100,000 operating profit = 20% tax rate

If you anticipate higher earnings this year, do some calculations to determine how that may increase your effective tax rates. Check out Business taxes to estimate your rates.

3. Apply the formula

Using example figures:

- Operating profit: £50,000

- Tax rate: 25%

NOPAT = £50,000 × (1 - 0.25) = £37,500

Your business generates £37,500 in after-tax operational profit.

Streamline your NOPAT analysis with Xero

Xero simplifies NOPAT analysis by automatically tracking the financial data you need. The platform helps you:

- Track operating income and expenses: Automated categorisation for accurate calculations

- Generate financial reports: Access profit and loss statements instantly

- Monitor tax obligations: Keep tax rate calculations current and accurate

Try Xero for free to streamline your financial analysis and make NOPAT calculations effortless.

FAQs on NOPAT

Here are answers to common questions about calculating and using NOPAT.

Is NOPAT the same as EBIT?

No, they are different. NOPAT is your operating profit after you've paid taxes. EBIT, or earnings before interest and taxes, shows your operating profit before taxes are taken out. NOPAT gives you a clearer picture of your operational profitability once tax obligations are met.

How do you convert EBIT to NOPAT?

You can convert EBIT to NOPAT with a simple formula: NOPAT = EBIT × (1 - tax rate). Just multiply your EBIT by one minus your tax rate to see your net operating profit after tax.

What's the difference between NOPAT and FCFF?

NOPAT is the starting point for calculating Free Cash Flow to the Firm (FCFF). NOPAT shows your operating profit after tax, while FCFF represents the actual cash available to all investors (both debt and equity) after accounting for investments in working capital and assets.

When should small businesses use NOPAT?

Small businesses find NOPAT useful for comparing their core operational performance against competitors, without the effects of debt financing. It's also helpful when you're considering new investments or want to see how efficiently your business is running before interest costs.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.