HMRC starter checklist: What it is and when you need one

Learn what an HMRC starter checklist is and how it helps new employees get set up correctly.

Written by Lena Hanna—Trusted CPA Guidance on Accounting and Tax. Read Lena's full bio

Published Friday 7 November 2025

Table of contents

Key takeaways

• Obtain a completed starter checklist from any new employee who cannot provide a P45 from their previous job, as this is legally mandatory for payroll setup and tax code determination.

• Ensure your employee selects the correct statement (A, B, or C) on the starter checklist based on their employment situation, as this directly determines their tax code and prevents incorrect tax deductions.

• Process the starter checklist before your employee's first payday to assign the proper tax code, but keep the form internally rather than submitting it to HMRC.

• Retain completed starter checklists for at least three years from the end of the relevant tax year as part of your mandatory payroll record-keeping requirements.

What is a starter checklist?

A starter checklist is a form from HM Revenue and Customs (HMRC) that new employees complete when they do not have a P45 from their previous job. It replaced the P46 form in 2013.

The starter checklist gives you:

- employee details: personal information needed for payroll setup

- tax code guidance: information to assign the correct tax code

- National Insurance data: details for accurate deductions

- Employee details: Personal information needed for payroll setup

- Tax code guidance: Information to assign the correct tax code

- National Insurance data: Details for accurate deductions

Is a starter checklist the same as a P46?

The starter checklist replaced the P46 in 2013 with one crucial difference: you don't submit it to HMRC.

Key difference: The old P46 required submission to HMRC, but the starter checklist stays with you for internal payroll setup only.

Where to get a starter checklist

You can find the starter checklist on HM Revenue and Customs’ website. Your new employee can complete it online, then email it to you or print it and give you a copy.

Who fills out a starter checklist?

Your new employee completes a starter checklist when they can't provide a valid P45. This happens in three situations:

- No P45 available: First job or additional job while keeping their current role

- Incorrect P45 details: Personal information doesn't match their current circumstances

- Overseas workers: Temporarily sent to work in the UK by a foreign employer

Before you complete a starter checklist

Ask your new employee to have these details ready before they fill out the starter checklist. This helps you assign the right tax code from their first payday. Ask them to gather information about:

- Their employment situation (is this their only job?)

- Any other income they've received since the start of the tax year (from another job, a pension, or benefits)

- Any student or postgraduate loans they are repaying

Having this information ready makes the process quicker and more accurate for you and your employee.

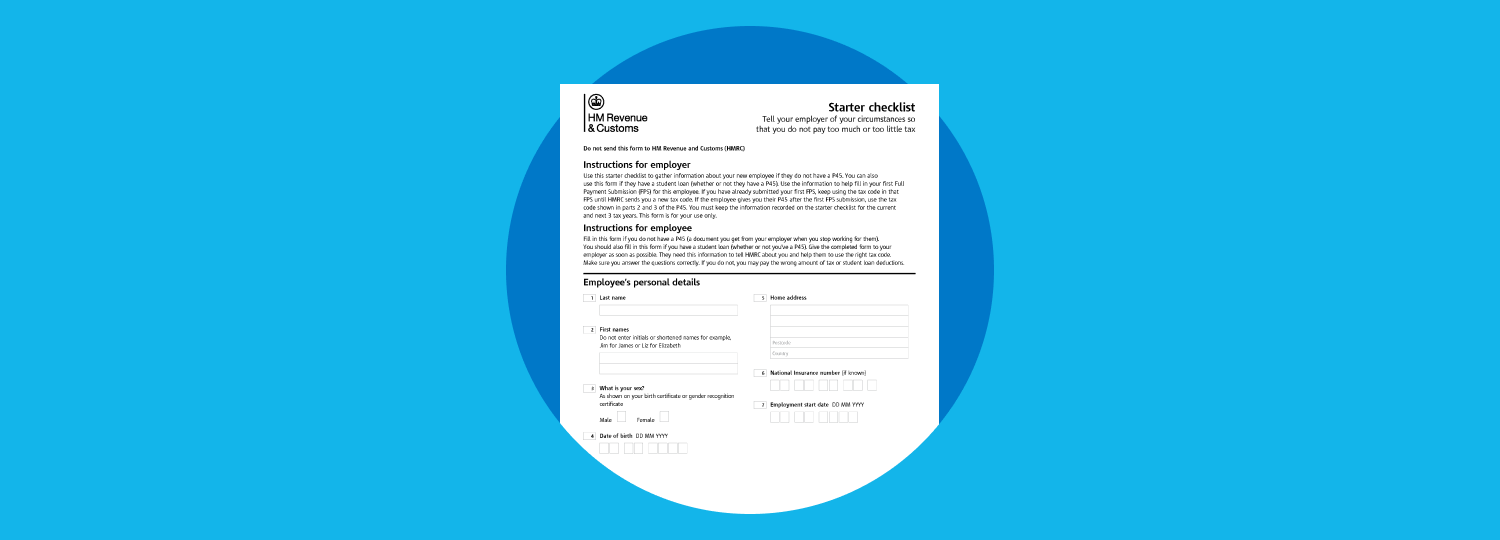

How to fill in a starter checklist

Your employee should have this information to complete the starter checklist accurately:

Personal details:

- Full name and address

- Date of birth

- National Insurance number

Employment information:

- Start date with your company

- Previous tax code (if known)

- Passport number (for overseas workers only)

Financial details:

- Student or postgraduate loan information

- Current tax year income from other jobs, pensions, or benefits

Starter checklist statements explained

Your employee’s choice of starter checklist statement determines their tax code. They choose one of three statements (A, B or C) based on their employment situation.

Why this matters: Choosing the right statement helps ensure your employee pays the correct amount of tax.

Use the statement your employee selects to assign the correct tax code in your payroll system.

Statement A

Statement A applies if it is your new employee's first job in the current tax year (since 6 April) and they've not been receiving taxable Jobseeker's Allowance, Employment and Support Allowance, taxable Incapacity Benefit, state pension or occupational pension.

Statement B

Statement B applies if this is now your new employee's only job, but they've had another job since 6 April and don't have a P45. It also applies if they've received taxable Jobseeker's Allowance, Employment and Support Allowance or taxable Incapacity Benefit since 6 April.

Statement C

Statement C applies if they have another job, and/or receive a state, works or private pension.

What does a starter checklist look like?

When to submit a starter checklist

Timeline for starter checklist submission

Employee completes: Before or on their first dayYou receive: On their start dateYou process: Before their first payday

Why the deadline matters: You need this information to set up payroll with the correct tax code before processing their first salary.

How to submit a starter checklist

Once your new employee has completed a starter checklist, they should give it to you by email, post or in person. You do not need to submit the starter checklist to HM Revenue and Customs. Use it internally for payroll setup.

Is a starter checklist mandatory?

Yes, a starter checklist is mandatory when your employee can't provide a P45 from their previous job.

Legal requirement: You can't add them to payroll without either a P45 or a completed starter checklist to determine their tax code.

Does an employee need a starter checklist if they have a P45?

If your new employee has a P45 from a previous job, they do not need to complete a starter checklist unless they left their last job before the start of the previous tax year.

Manage your payroll with ease

Xero Payroll makes it easy to manage your payroll, reduce admin and save time. You can pay employees in just a few clicks, manage workplace pensions and stay compliant with HM Revenue and Customs requirements. The employee self-service feature lets staff view payslips or request annual leave.

Try Xero for free today to get started.

FAQs on HMRC starter checklists

Find answers to common questions about the HM Revenue and Customs starter checklist below.

How do I fill out an HMRC starter checklist online?

Your new employee can fill out the starter checklist on the GOV.UK website, save it as a PDF and email it to you, or print it and give you a copy.

What happens if my employee selects the wrong statement?

Choosing the wrong statement (A, B, or C) can lead to an incorrect tax code. This might mean your employee pays too much or too little tax. While this can be corrected by HMRC later, it's best to get it right from the start to ensure accurate pay.

How long should I keep completed starter checklists?

As an employer, you must keep payroll records for three years from the end of the tax year they relate to. The starter checklist is part of these records, so you should keep it for at least this long.

Can I use a starter checklist for temporary or contract workers?

If a worker is treated as an employee for tax purposes and paid through your payroll, you'll need a starter checklist if they don't have a P45. This applies whether their contract is temporary or permanent. It does not apply to self-employed contractors who invoice you for their services.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.