How to calculate profit margin: formula and examples

Learn how to calculate profit margin so you can price smarter, control costs, and grow profit.

Written by Jotika Teli—Certified Public Accountant with 24 years of experience. Read Jotika's full bio

Published Wednesday 18 February 2026

Table of contents

Key takeaways

- Calculate your profit margin by dividing profit by revenue and multiplying by 100, which gives you a percentage that shows how much money you keep from each pound of sales.

- Focus on three key margin types to understand your business health: gross profit margin (revenue minus cost of goods sold), operating profit margin (after production costs but before taxes), and net profit margin (after all expenses and taxes).

- Improve your profit margins by controlling costs through regular expense audits, increasing operational efficiency with automation and streamlined workflows, and adjusting your pricing strategy based on value and market conditions.

- Track your margin trends monthly to spot whether your financial health is improving or declining, and compare your performance against industry benchmarks to identify opportunities for growth.

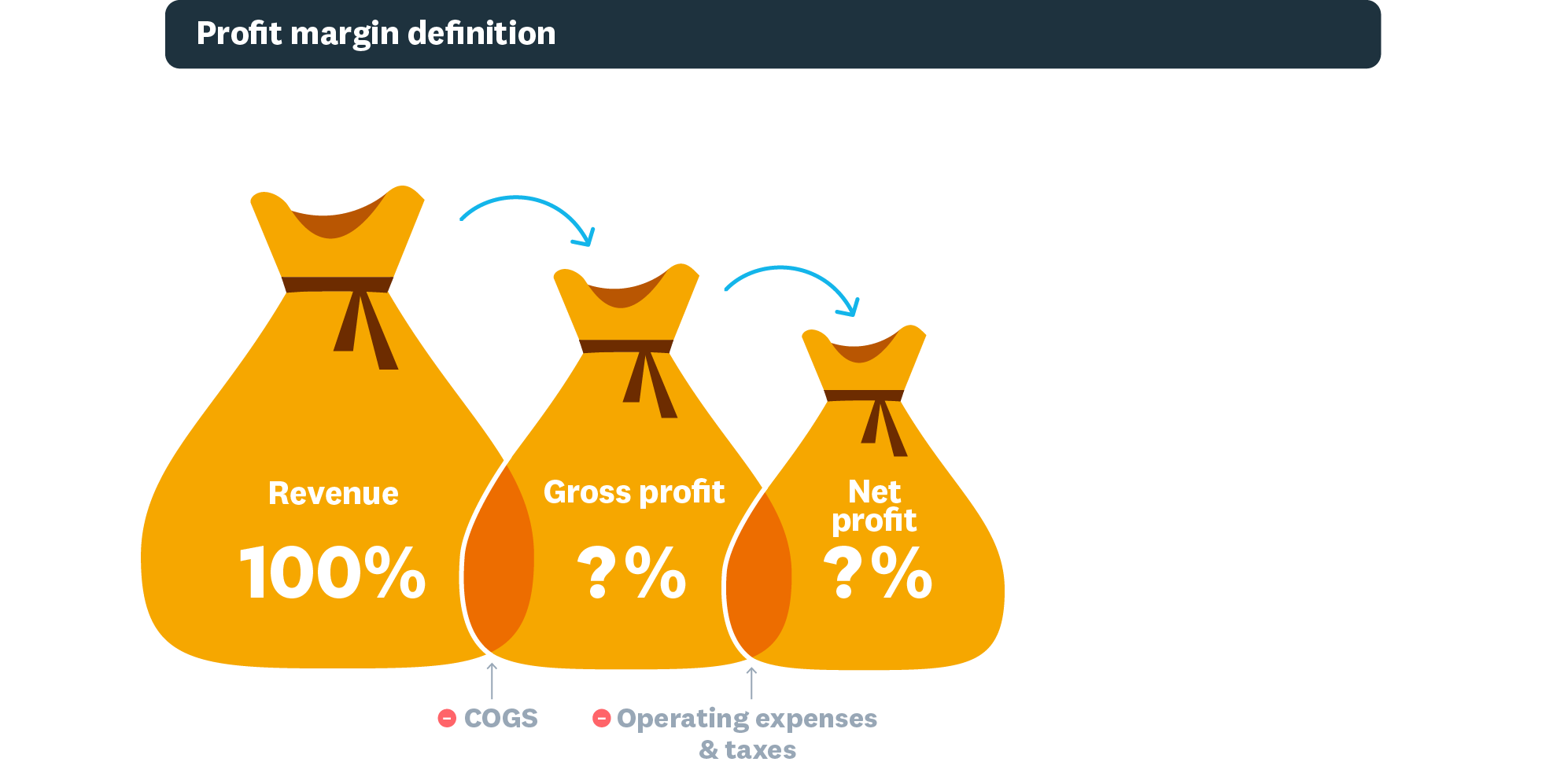

What is a profit margin?

Profit margin is the percentage of revenue your business keeps after paying expenses. You calculate it by dividing profit by revenue, then multiplying by 100. The higher the percentage, the more money you retain from each sale.

A strong profit margin signals financial health. It shows your business:

- covers costs effectively: revenue exceeds expenses with room to spare

- identifies performance gaps: highlights which products or services deliver the best returns

- guides cost decisions: reveals where to cut spending without hurting growth

Profit margins vs net profit

Net profit is a pound amount: the actual income left after deducting all expenses from revenue.

Profit margin is a percentage: it shows what proportion of each pound earned you keep as profit. This makes margins easier to compare across time periods or against other businesses, regardless of size.

Types of profit margins

There are three main types of profit margins:

- Gross profit margin: The percentage of revenue remaining after subtracting the cost of goods sold (COGS). Use it to set pricing, spot inefficiencies, and compare performance across periods.

- Operating profit margin: The percentage of revenue left after paying production costs (wages, materials, operations) but before taxes and interest. Use it to measure how profitable your core business operations are.

- Net profit margin: The percentage of revenue remaining after all costs and taxes. Use it to assess overall financial health, as it accounts for every expense. Learn more about net profit margin.

How to calculate profit margins

The profit margin formula: Divide profit by revenue, then multiply by 100.

Expressing margin as a percentage makes it easy to compare your performance across different time periods or against competitors, regardless of business size.

Gross profit margin calculation

Gross profit margin formula: (Revenue − Cost of goods sold) ÷ Revenue × 100

Example: Your cleaning business earns £20,000 in revenue. It costs £8,000 to deliver those services.

- Gross profit: £20,000 − £8,000 = £12,000

- Gross profit margin: £12,000 ÷ £20,000 × 100 = 60%

This means you keep 60p of every pound earned after covering direct costs. HMRC guidance shows that even a small omission in sales figures can create a noticeable difference in gross profit.

Try our gross profit margin calculator.

Net profit margin calculation

Net profit margin formula: Net profit ÷ Revenue × 100

Example (continuing from above): After paying £4,000 in taxes, your net profit is £8,000.

- Net profit margin: £8,000 ÷ £20,000 × 100 = 40%

This means you keep 40p of every pound earned after all expenses and taxes.

Try our net profit margin calculator.

Operating profit margin calculation

Operating profit margin formula: Operating profit ÷ Revenue × 100

Example (continuing from above): You spend £3,000 on operating expenses (rent, utilities, admin). Subtracting this from your £12,000 gross profit leaves £9,000 operating profit.

- Operating profit margin: £9,000 ÷ £20,000 × 100 = 45%

Note: This example assumes operating expenses are separate from COGS. Your operating profit shows efficiency before taxes and interest.

Why do profit margins matter?

Profit margins reveal your business's financial health by showing how much income you retain relative to expenses. They help you:

- set pricing: determine if your prices cover costs and deliver adequate returns

- control costs: identify where spending cuts would have the biggest impact

- allocate resources: prioritise investment in higher-margin products or services

- secure funding: banks and investors examine margins when assessing loan or investment applications

What is a good profit margin?

There's no universal "good" profit margin. What counts as healthy depends on your industry and business model.

Industry matters: Low-end retail typically operates on thin margins (2 to 5%) with high volume, while luxury goods and software often achieve margins of 20% or higher.

Margin type matters: Gross margins are naturally higher than net margins because they exclude operating costs and taxes. For the clearest picture of financial health, focus on your operating and net profit margins.

Benefits of high profit margins for growth

High profit margins typically mean a business can:

- attract investment: strong margins signal financial stability to lenders and investors

- reinvest in growth: more retained profit means more capital for expansion

- experiment with pricing: healthy margins give you room to test competitive strategies

Compare your margins against industry benchmarks and competitors to spot trends and opportunities for improvement.

Do high profit margins guarantee growth?

No, high profit margins don't guarantee growth. Research from Yale Insights found that margins don't necessarily rise as businesses expand.

Rapid growth can actually reduce margins if short-term costs (hiring, inventory, equipment) outpace revenue increases. Prioritise sustainable growth and monitor how expansion affects your margins before scaling further.

Factors affecting profit margins

Profit margins vary based on factors both within and outside your control.

- Industry: Retail and hospitality face higher overheads and tighter margins than consultancies or software businesses.

- Economic conditions: Inflation raises costs across the board. If you've borrowed to fund operations, rising interest rates directly reduce your margins.

- Location: Rent and local taxes vary significantly. A London-based business faces different cost pressures than one in Manchester or a rural area.

Account for these factors when setting prices and assessing whether your margins are healthy for your specific situation.

How to increase your profit margins

To increase your profit margins, focus on three areas: reduce costs, improve operational efficiency, and adjust pricing. Each lever affects your bottom line differently.

Control your costs

Review your expenses regularly to find savings:

- audit subscriptions: cancel software or services you no longer use

- negotiate with suppliers: request better rates or explore alternative vendors

- manage labour costs: align staffing levels with demand and reduce overtime where possible

- reduce waste: track inventory to minimise spoilage or obsolete stock

Make your operations more efficient

Improve how your business operates to get more from existing resources:

- automate repetitive tasks: use software for invoicing, scheduling, and inventory management

- streamline workflows: identify bottlenecks that slow down delivery or service

- train your team: well-trained staff make fewer errors and work more productively

- encourage innovation: ask employees for ideas on improving processes

Adjust your pricing

A strong pricing strategy maximises revenue without losing customers. Consider these approaches:

- dynamic pricing: adjust prices based on demand, seasonality, or competitor activity

- premium tiers: offer higher-priced options with added features or faster service

- bundling: combine products or services at a slight discount to increase average order value

- regular reviews: reassess prices annually to account for rising costs

Learn from high-profit-margin businesses

Some industries consistently achieve higher profit margins due to lower overheads, premium pricing, or recurring revenue models.

Common factors behind high margins:

- strong value proposition: customers pay more for unique or specialist offerings

- operational efficiency: streamlined processes reduce costs per sale

- customer loyalty: repeat business lowers acquisition costs and stabilises revenue

Industries with high profit margins

Industries known for high profit margins include:

- software and SaaS: low marginal costs after development; margins often exceed 70%

- luxury goods: premium pricing supports margins of 50% or higher

- professional services: consultancies and agencies typically achieve 15 to 30% net margins

- online retail: lower overheads than physical stores often mean 10 to 20% higher margins

Tips for maintaining high profit margins

Apply these practices from high-margin businesses, regardless of your industry:

- Communicate your value clearly: Help customers understand why they should choose you over competitors. A strong value proposition justifies your pricing.

- Streamline operations: Reduce waste, automate where possible, and use resources efficiently. Lower costs directly improve margins.

- Build customer loyalty: Repeat customers cost less to serve than new ones. Use loyalty programmes, excellent service, and consistent quality to encourage return business.

Analyse your profit margins for better business decisions

Use your profit margin data to make smarter business decisions:

- set prices confidently: identify which products deliver healthy margins and adjust pricing on underperformers

- build better budgets: allocate resources toward higher-margin products or services for better returns

- guide investments: direct capital toward the most profitable areas of your business

What profit margin trends reveal

Profit margin trends reveal whether your financial health is improving or declining over time.

- rising margins: suggest improved efficiency, better pricing, or successful cost control

- falling margins: may indicate rising costs, pricing pressure, or operational inefficiencies

- flat margins: could mean stability or missed opportunities for improvement

Compare your trends against industry benchmarks and competitors to understand your relative performance.

Use Xero for comprehensive profitability insights

Understanding and tracking your profit margins helps you make confident decisions about pricing, budgeting, and growth.

With Xero accounting software, you can streamline your accounting and get real-time insights into your business's profitability. You can monitor margins, spot trends, and share reports with your accountant, all from one platform.

FAQs on profit margins

Here are answers to common questions about calculating and using profit margins in your business.

What's the difference between profit margin and markup?

Profit margin is profit as a percentage of the selling price. Markup is profit as a percentage of the cost. For example, if you buy an item for £50 and sell it for £100, your markup is 100% but your profit margin is 50%.

How do I calculate what selling price gives me a 30% profit margin?

Divide your cost by (1 minus your desired margin). For a 30% margin on an item costing £70: £70 ÷ 0.70 = £100 selling price.

Can my profit margin be negative?

Yes. A negative profit margin means you're losing money on each sale. This happens when costs exceed revenue. Negative margins require immediate attention to pricing, costs, or both.

How often should I calculate my profit margins?

Review margins monthly for a clear picture of trends. Calculate them after any significant change to pricing, costs, or product mix. Accounting software like Xero can track margins automatically in real time.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.