MTD deadline: key dates and what you need to do

Learn the Making Tax Digital (MTD) deadline dates you must hit to stay compliant and avoid fines. Plan ahead today.

Published Friday 5 December 2025

Table of contents

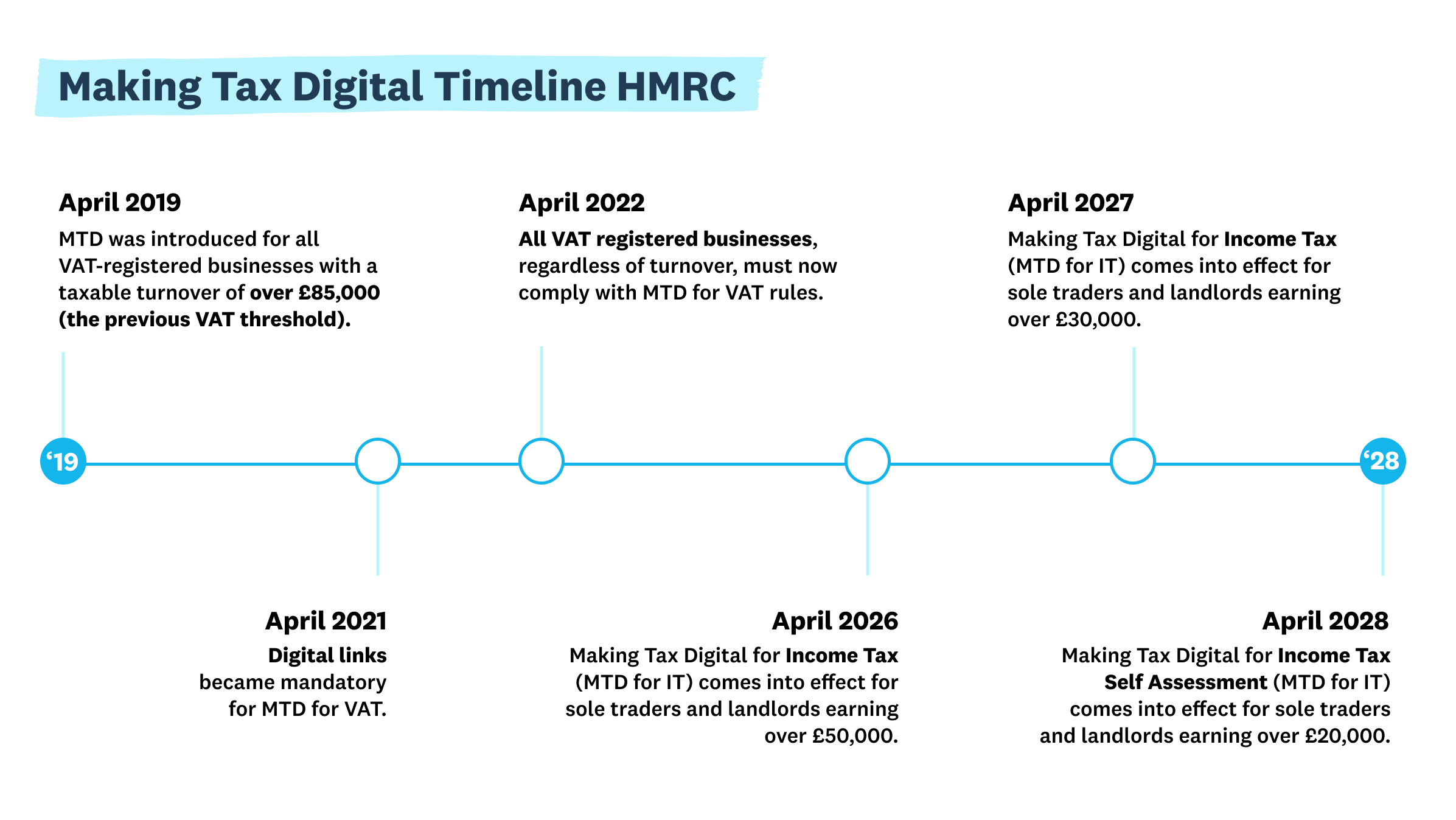

A closer look at key Making Tax Digital dates

April 2019: MTD for VAT (Over £85,000 threshold)

Making Tax Digital for VAT became mandatory for businesses with turnover above £85,000. These businesses must:

- Keep digital records using MTD-compatible software

- Submit VAT returns electronically through approved platforms

- Maintain digital links between all software and spreadsheets

April 2021: Digital links

Digital links are automated data transfers between MTD-compatible software and systems. They ensure your tax information flows electronically without manual intervention.

What counts as a digital link:

- Use spreadsheet formulas to calculate totals automatically

- Integrate software to transfer data automatically

- Connect accounting platforms using application programming interfaces (APIs)

What does not count:

- Copy and paste data manually between systems

- Type numbers from one system into another

April 2022: MTD for VAT (All VAT-registered businesses)

All VAT registered businesses, regardless of turnover, are required to keep digital records and file returns using MTD-compatible software.

HMRC now signs up VAT-registered businesses for Making Tax Digital automatically – just make sure you are registered for VAT. The VAT registration threshold as of 1 April 2024 is £90,000.

April 2026: MTD for Income Tax (£50,000 threshold)

MTD for Income Tax starts for sole traders and landlords earning above £50,000 annually, a move which is expected to impact around 780,000 people.

Who's affected:

- Self-employed individuals with income above £50,000

- UK landlords with rental income above £50,000

- Partnerships where the business income exceeds £50,000

What you'll need to do:

- Send quarterly updates of income and expenses to HMRC

- Submit a Final Declaration by 31 January each year

- Use HMRC-recognised software for all record-keeping

Action needed: Get MTD-compatible software set up before April 2026. Your accountant can help you choose the right platform and complete the sign-up process.

April 2027: MTD for Income Tax (£30,000 threshold)

Sole traders and landlords with a total annual qualifying income above £30,000 will need to use MTD for Income Tax compatible software to keep digital records and file their returns.

April 2028: MTD for IT (£20,000 threshold)

Sole traders and landlords with a total annual income above £20,000 need to use MTD for IT compatible software to keep digital records and file returns.

If you want to learn more about Making Tax Digital and prepare for the next stage, visit our Making Tax Digital for Income Tax resource hub.

What happens if you miss an MTD deadline

Submit your returns on time to avoid penalty points. HMRC gives you a penalty point for each late submission. If you reach the points threshold, you get a £200 fine.

The penalty threshold depends on how often you need to submit. For quarterly MTD updates, the threshold is 4 points. Submit on time using Making Tax Digital-compatible software to keep your records organised and avoid penalties.

FAQs on Making Tax Digital deadlines

When does digital tax start?

Digital tax start dates depend on your business type and income level.

For VAT-registered businesses: Digital tax is already in effect. You're automatically enrolled in MTD for VAT.

For sole traders and landlords:

- April 2026: Income above £50,000

- April 2027: Income above £30,000

- April 2028: Income above £20,000

Why was the Making Tax Digital deadline extended?

MTD for Income Tax was delayed from 2024 to 2026 to give businesses more preparation time. This extension applied only to Income Tax – Making Tax Digital for VAT remained unchanged.

Where can I learn more about how to prepare for MTD deadlines?

Preparing for MTD deadlines starts with choosing the right software and getting familiar with digital processes.

Essential preparation steps:

- Choose HMRC-recognised software for your business type

- Start using digital record-keeping now, before your deadline

- Test quarterly submission processes with your accountant

- Set up digital links between all your business systems

Why start early: Getting comfortable with digital processes before your MTD deadline reduces compliance stress and gives you time to resolve any technical issues. Early adoption also helps you maintain accurate records from the start, making tax time smoother.

Let Xero help you stay compliant with MTD

Use MTD-compatible software like Xero to keep digital records and submit returns. Try free for 30-days.

- Safe and secure

- Cancel any time

- 24/7 online support