Professional tax software for easier UK compliance

Take care of accounts and tax returns in one place. Xero’s accounts production software integrates your tax management for companies, partnerships, and individuals. Get a fast data flow to keep everything up to date. And an automated digital system to follow HMRC rules without breaking a sweat.

Manage all your tax returns

Xero tax pro software supports your corporate, partnership, and personal returns. With one piece of kit!

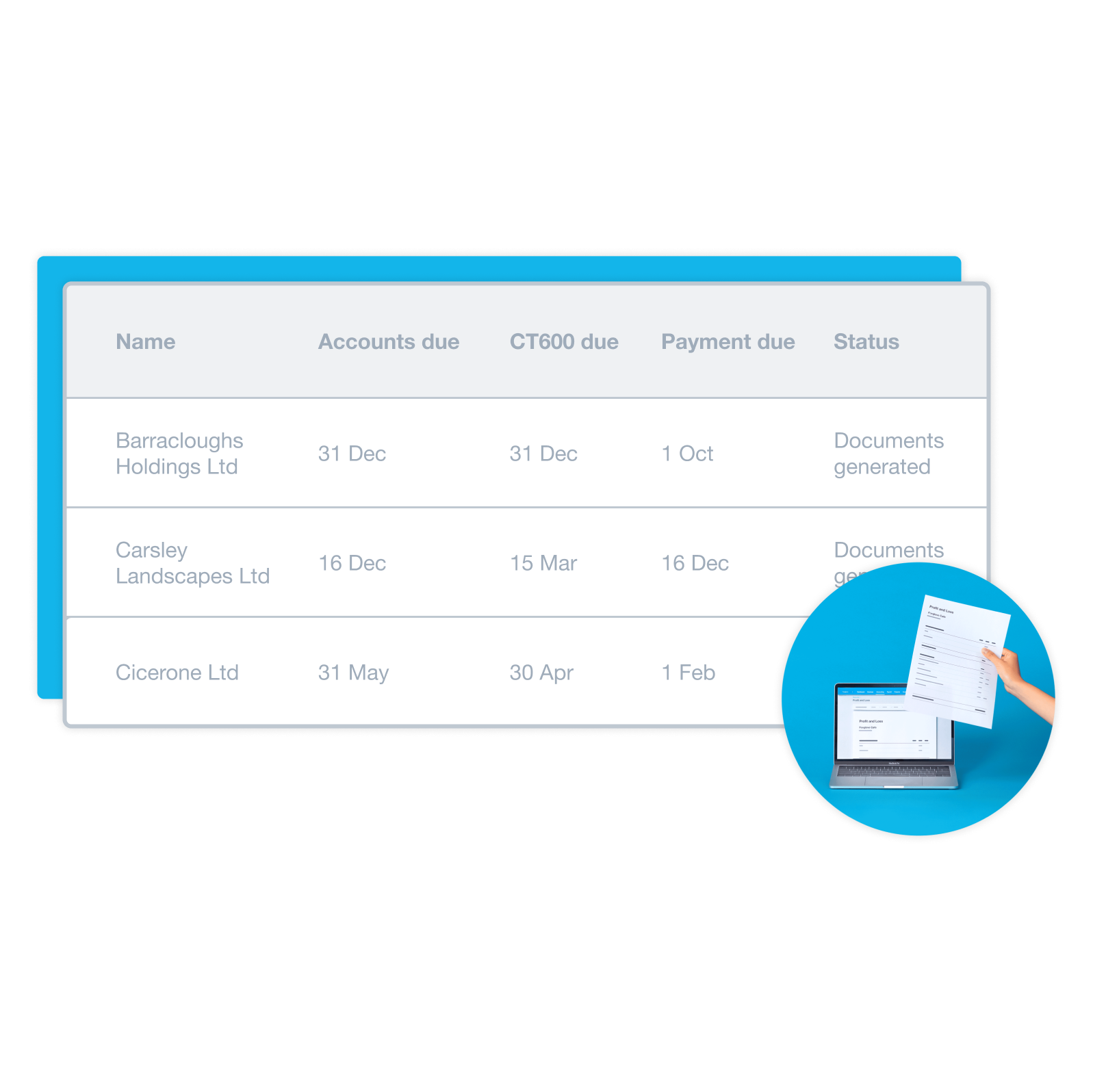

Streamline your workflows

Data flows between your books, accounts, and tax returns so you do less manual data entry.

Produce accounts easily

The right data is at your fingertips to produce accurate accounts and follow HMRC rules.

Submit tax returns online

You can file returns and accounts directly from Xero Tax to HMRC and Companies House. And ace your compliance.

Partnership tax is now live

Partnership tax enables you to serve more of your client base in one place. No need for multiple, disconnected tools.

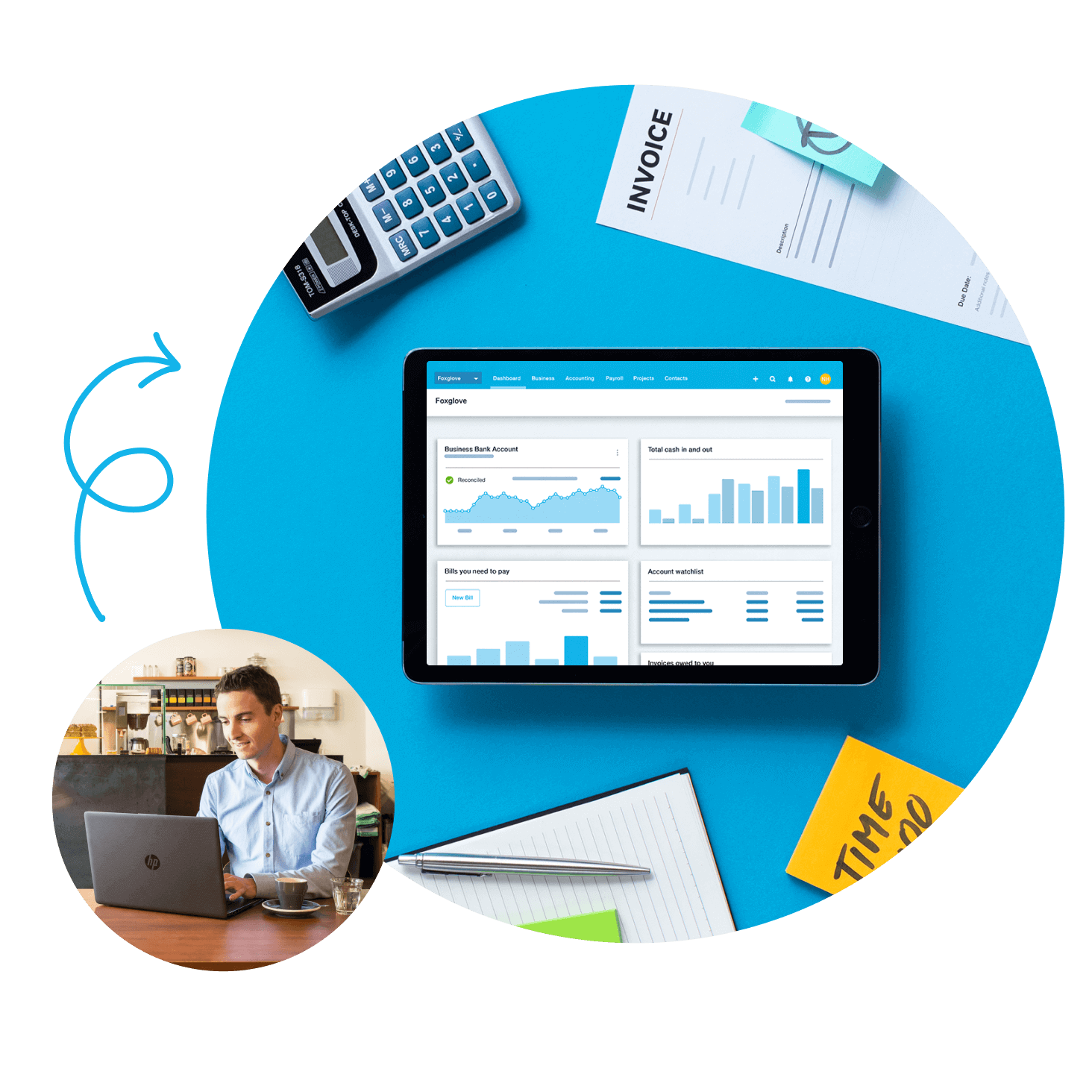

Tax return software for UK professionals

With Xero’s intuitive tax filing software, you can handle all your clients’ returns in one place. Forget jumping between tools and systems. Just log into Xero for a simple workflow from one job to the next. That way your once fiddly, time-consuming admin is fast and stress-free.

- Manage tax returns for corporations, partnerships, and individuals

- Handle multiple filings at the same time across different browsers and tabs

- Give your team members permission to help with tax filings during busy periods

Streamlined tasks with data flow

Get more done with your work days! Xero’s data flows between your client’s books, accounts, and tax returns – without you lifting a finger. Instead of typing up crucial information, let automatic updates provide the right details whenever you need them. And save time each week!

- Data automatically flows between parts of Xero – for example, from a chart of accounts to a tax return

- Details can auto-populate to speed up your returns admin and help eliminate errors

- Data is protected by multiple layers of security for your and your clients’ peace of mind

"The way Xero has structured partnership tax is brilliant. It's clean, it's simple, it works. The amount of time it's saved me is phenomenal."

Andy Housley, Square 1 Accounting

Read the case study

Easy accounts production and filing

Xero Tax works hand in glove with the rest of Xero’s software. This way you can let automations do lots of the admin, including filling in details for your accounts. Xero also connects with Companies House and HMRC to help you manage submissions for partnerships, corporations, and individuals.

- Let Xero retrieve a business’s information from Companies House to save you time and admin

- Check everything is accurate for HMRC before you submit a return

- Submit online returns directly to HMRC from within Xero

Self assessment and MTD help from Xero

Stressed about new rules around compliance? Xero helps you future-proof your business with its HMRC-recognised Making Tax Digital (MTD) software. You can stay up to date with changes in regulations so you nail your digital tax filings. And enjoy other benefits to your business, too.

- Store all your clients’ data securely in the cloud

- Let Xero’s self assessment software automate tax calculations to reduce mistakes

- Work anywhere, anytime, to stay in the loop with your clients’ returns during tax season

More about Xero Tax

No special connection is needed. Just enable Xero Tax in Xero HQ and give staff access. Xero Tax uses your existing Xero login details.

See how to set up Xero TaxNo special connection is needed. Just enable Xero Tax in Xero HQ and give staff access. Xero Tax uses your existing Xero login details.

See how to set up Xero TaxAvailable to our UK Xero Partners only, Xero Tax gives you advanced tools and features to manage your clients’ tax returns and compliance in one platform. You can use automations to simplify your online tax returns for self assessment, partnerships, and corporations . You can also generate HMRC data reports with full accuracy.

Find out moreAvailable to our UK Xero Partners only, Xero Tax gives you advanced tools and features to manage your clients’ tax returns and compliance in one platform. You can use automations to simplify your online tax returns for self assessment, partnerships, and corporations . You can also generate HMRC data reports with full accuracy.

Find out moreTo help you get going, we’ve created a handy all-in-one downloadable guide containing best practices.

Download the guideTo help you get going, we’ve created a handy all-in-one downloadable guide containing best practices.

Download the guideAccess our comprehensive Become a Xero Tax specialist self-paced course anytime, anywhere. This course covers how you can prepare your accounts and returns for company, personal and sole-trader clients.

Learn at your own paceAccess our comprehensive Become a Xero Tax specialist self-paced course anytime, anywhere. This course covers how you can prepare your accounts and returns for company, personal and sole-trader clients.

Learn at your own pacePreviously DSK Partners struggled with admin that took hours to organise. “So the question was, how can we go paperless and cloud-based? And that’s where Xero came into the picture.”

Watch the case studyPreviously DSK Partners struggled with admin that took hours to organise. “So the question was, how can we go paperless and cloud-based? And that’s where Xero came into the picture.”

Watch the case study

Plans to suit your business

All pricing plans cover the accounting essentials, with room to grow.

Start using Xero Tax for free

Xero Tax is included in Xero HQ. It’s available to accountants and bookkeepers in practice – at no extra cost – as part of the Xero partner programme.