What is accumulated depreciation? Definition and how to calculate it for your small business

Learn if accumulated depreciation is an asset and how to calculate it to keep your balance sheet clear.

Written by Jotika Teli—Certified Public Accountant with 24 years of experience. Read Jotika's full bio

Published Friday 5 December 2025

Table of contents

Key takeaways

• Calculate accumulated depreciation using the straight-line method by subtracting salvage value from asset cost, then dividing by useful life to determine annual depreciation expense that accumulates over time.

• Record accumulated depreciation as a contra asset account with a credit balance on your balance sheet, which reduces the asset's book value and provides a realistic picture of what the asset is worth today.

• Utilize depreciation as a non-cash expense to reduce your taxable income and lower your tax bill, while adding it back to net income on the cash flow statement since no actual cash leaves your business.

• Track accumulated depreciation accurately to improve financial planning by monitoring asset values over time, enabling better decisions about replacements, upgrades, and maintenance scheduling.

How accumulated depreciation works

Accumulated depreciation works by tracking the total reduction in an asset's value over time. You record it in a special type of account called a contra asset account.

Unlike regular asset accounts that have a debit balance, a contra asset account has a credit balance. On your balance sheet, it's paired with the related fixed asset. This setup allows you to see the asset's original cost and the total depreciation to date, side-by-side.

By subtracting the accumulated depreciation from the asset's original cost, you get its 'book value' – a more accurate picture of what the asset is worth to your business today.

Depreciation vs accumulated depreciation

Depreciation is the annual expense that shows how much an asset's value decreases each year.

Accumulated depreciation is the running total of all depreciation expenses for that asset. Each year, you add the current year's depreciation to the accumulated total.

Here's more information about depreciation

Is accumulated depreciation an asset or a liability?

Accumulated depreciation is neither an asset nor a liability. It's classified as a contra asset account.

Here's why accumulated depreciation isn't a liability:

- No debt obligation: you don't owe money to anyone

- No repayment required: it's simply a reduction in asset value over time

- Value decline: it measures wear, tear, and obsolescence

A contra asset reduces the value of assets on your balance sheet. It always has a negative value, showing how much an asset's worth has decreased from its original cost.

How does accumulated depreciation affect financial statements?

Here's how accumulated depreciation affects a variety of financial statements.

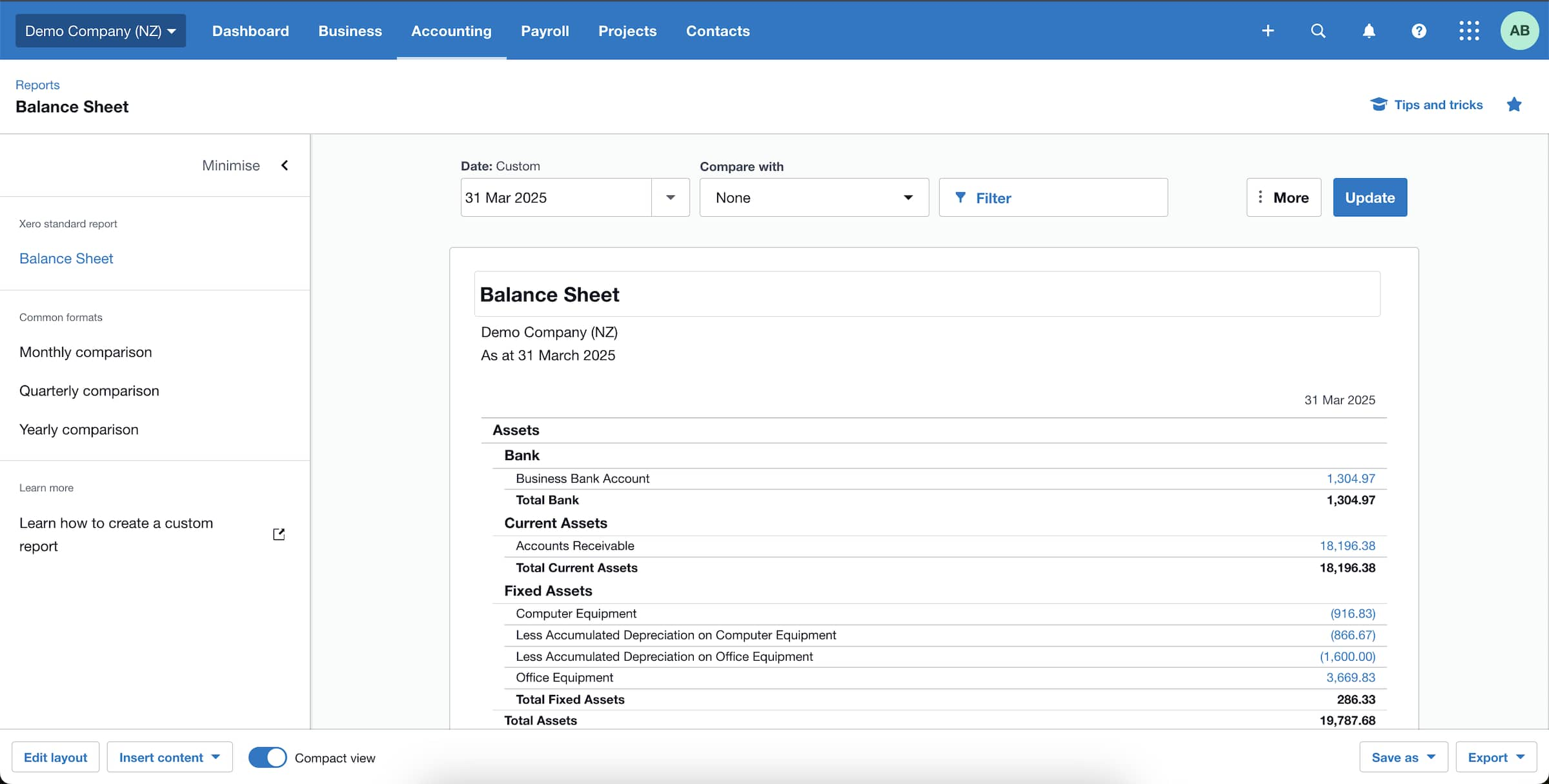

Accumulated depreciation on the balance sheet

Accumulated depreciation reduces your asset's book value on the balance sheet.

Your balance sheet shows the asset's original purchase price. Accumulated depreciation then subtracts from this amount to show the asset's current worth.

Accumulated depreciation on the income statement

Depreciation reduces your taxable income, which can lower your tax bill. For example, in the UK, businesses can often claim a 100% allowance on qualifying plant and machinery up to a £1 million threshold through the Annual Investment Allowance (AIA).

It's a non-cash expense, meaning you get the tax benefit without any money leaving your business.

Accumulated depreciation on the cash flow statement

Depreciation gets added back to net income on the cash flow statement because no actual cash left your business.

This shows the difference between accounting profits and actual cash available.

Example: balance sheet for accumulated depreciation

Here’s a simple example of how accumulated depreciation appears on a balance sheet for a delivery van:

- Cost of van: £20,000

- Accumulated depreciation after three years: £9,000

- Net book value: £11,000

On your balance sheet, you show the cost of the van and subtract the accumulated depreciation to arrive at the net book value.

How to calculate accumulated depreciation

Calculating accumulated depreciation helps you track your asset's current value for financial reporting and tax purposes. The straight-line method is the simplest approach and most popular with small businesses.

The straight-line depreciation method

The straight-line formula spreads an asset's cost evenly over its useful life:

Annual depreciation expense = (Asset cost − Salvage value) ÷ Useful life

Definitions of each term

Asset cost: Original purchase price including delivery and setup costs. Under certain accounting standards like IAS 23, businesses may also need to capitalise interest for the period of construction as part of the asset's total cost.

Salvage value: Expected resale or scrap value when the asset reaches end of life

Useful life: Number of years you expect to use the asset before replacement. This is an estimate that may require a reassessment of the useful life during the asset's lifetime, which would change the annual depreciation expense for future years.

Each of these affects the annual depreciation expense differently.

For example, an asset with a short useful life spreads depreciation over fewer years, resulting in a higher annual depreciation expense.

But if an asset holds its value well and has a relatively high salvage value, it'll depreciate less each year, leading to a lower annual depreciation expense.

Now, let's calculate accumulated depreciation using the straight-line depreciation method. In this example, the asset costs £1,000, has a useful life of five years, and a salvage value of £100.

Step 1: Calculate the annual depreciation expense

Using our formula above, our example gives us:

(£1000 – £100) ÷ 5 = £180 per year

Step 2: Track accumulated depreciation each year

Create a depreciation schedule to track how accumulated depreciation increases each year by the depreciation expense. In our example:

Year 1 (1 × £180) = £180Year 2 (2 × £180) = £360Year 3 (3 × £180) = £540Year 4 (4 × £180) = £720Year 5 (5 × £180) = £900

Step 3: Calculate the asset's book value at a point in time

Use the formula:

Book value = initial cost – accumulated depreciation

In our example, after 3 years, the asset's book value is:

£1000 – £540 = £460

Alternative depreciation methods

While the straight-line method is popular for its simplicity, other approaches might suit your business better. For example, for complex assets, you can depreciate components separately, such as depreciating a furnace's lining over five years while you depreciate the main body over ten years.

Declining balance method

This method applies a higher depreciation expense in the early years of an asset's life and a lower expense in later years. It's a good fit for assets like vehicles or tech equipment that lose value more quickly at the start.

Units of production method

Instead of time, this method bases depreciation on usage. It's ideal for manufacturing equipment or machinery where wear and tear is directly related to how much it's used. You calculate depreciation based on the number of units produced or hours operated.

Choosing the right method depends on the asset and your business needs. It's a good idea to talk with your accountant to decide what's best for you.

Why understanding accumulated depreciation matters for a business

Here's the importance of accumulated depreciation for your small business.

- Tax savings: depreciation reduces your taxable income, lowering your tax bill and keeping more cash in your business

- Better planning: track asset values over time so you can plan replacements, upgrades and maintenance

- Easier financing: accurate depreciation records can improve your chances of getting loans and attracting investment

Simplify your accounting with Xero

Keeping on top of depreciation and adjustments can quickly get complicated – especially as your business grows.

With Xero, you can streamline these tasks so you spend less time on admin and more time running your business. You can create detailed depreciation schedules for a clear view of your fixed asset values and more accurate financial reporting.

Try Xero for free today to get started.

FAQs on accumulated depreciation

Here are some of the most commonly asked questions about accumulated depreciation.

How does accumulated depreciation affect cash flow?

Accumulated depreciation doesn't directly affect cash flow because it's a non-cash expense.

However, it provides an indirect cash benefit:

- Reduces your taxable income

- Lowers your tax liability

- Keeps more cash in your business

What happens to an asset's accumulated depreciation when you sell it?

Accumulated depreciation gets removed from your balance sheet when you sell the asset.

You'll calculate a gain or loss by comparing:

- Sale price you received

- Book value (original cost minus accumulated depreciation)

Do I record accumulated depreciation as a debit or a credit?

Record accumulated depreciation as a credit on the balance sheet.

This happens because:

- It's a contra asset account that reduces asset values

- Assets normally have debit balances

- The credit entry shows the asset's declining value over time

Is accumulated depreciation a current liability?

No – accumulated depreciation is not a current liability. It's recorded on the balance sheet as a contra asset – an account type that reduces the value of an asset.

Current liabilities are short-term debts due within 12 months, whereas accumulated depreciation lowers the book value of an asset over time – it isn't an amount owed that you have to repay.

Here's more about current and non-current liabilities.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.