MTD for Income Tax resource hub: Prepare your practice

As an accountant or bookkeeper, you play a key role in Making Tax Digital for Income Tax (MTD for IT). Xero helps you prepare your practice, support clients, streamline workflows, and strengthen your role as a trusted adviser.

What does Making Tax Digital mean for your clients?

HMRC is expanding Making Tax Digital (MTD) to include Income Tax. This will change how your self-employed (sole trader) and landlord clients manage their personal tax. Under MTD, instead of completing their tax return all at once, clients will need to use HMRC-recognised software to:

- Create, store, and correct digital records of their self-employment and property income and expenses throughout the year

- Send quarterly updates to HMRC from this software

- Submit their tax return by 31 January of the following year

Building advisory services

As their trusted adviser, you will be key in helping them adapt – improving processes and deepening client relationships.

Making Tax Digital timeline

MTD for Income Tax will be rolled out in phases based on your clients’ total annual income from self-employment and property.

- Note: If your clients have multiple businesses, they’ll need to combine all income to determine their threshold. If they earn below £20,000, you can continue using traditional Self Assessment returns.

Phase 1: Annual income threshold above £50,000

6 April 2026

Phase 2: Annual income threshold above £30,000

6 April 2027

Phase 3: Annual income threshold above £20,000

6 April 2028

Beyond compliance: How MTD for Income Tax will benefit your practice

If you’re not doing this already, MTD for IT provides the chance to fully embrace digitalisation and all the benefits it can bring, from streamlined workflows and easier collaboration to better insights and improved accuracy. MTD for Income Tax takes planning, but it’s a real opportunity for growth.

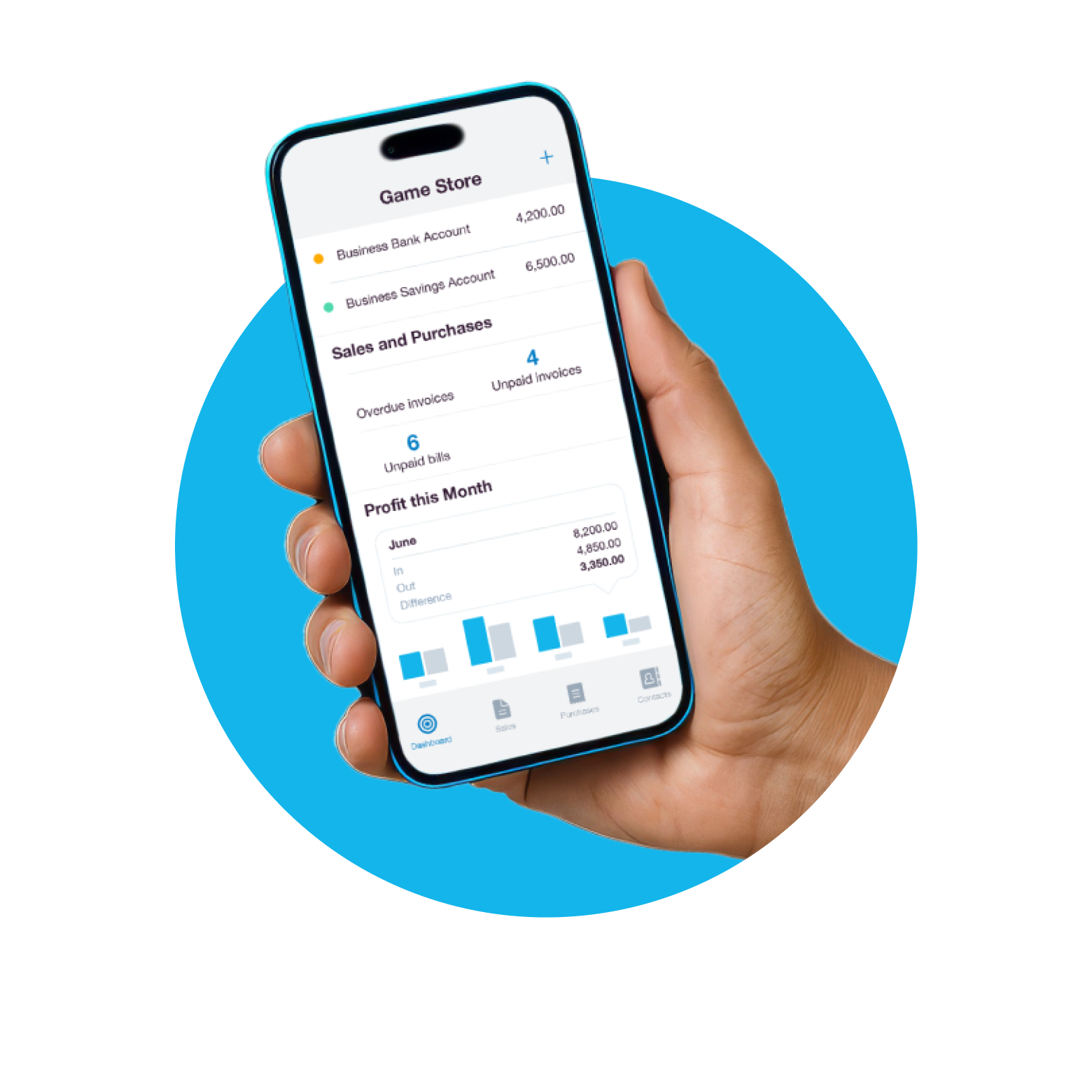

Clients scan receipts

Data is captured automatically for faster, more accurate processing.

Manage multiple businesses

Like sole traders and landlords – all under one Xero plan.

Seamless quarterly updates

Xero gives you and your clients greater visibility and control, with no year-end surprises.

How to price MTD services for your practice

Our guide shows how to set fees that reflect the extra workload, software investment, and process changes – helping your practice stay profitable and prepared.

Price for real value

Set fees that reflect your time, software costs, and the ongoing support MTD requires.

Pick the right model

Use hourly, fixed, or value-based pricing, or a mix, to balance profit and client satisfaction.

Create tiered packages

Offer clear MTD service tiers (Basic, Standard, Premium) so every client can choose the right level of support.

Why Xero?

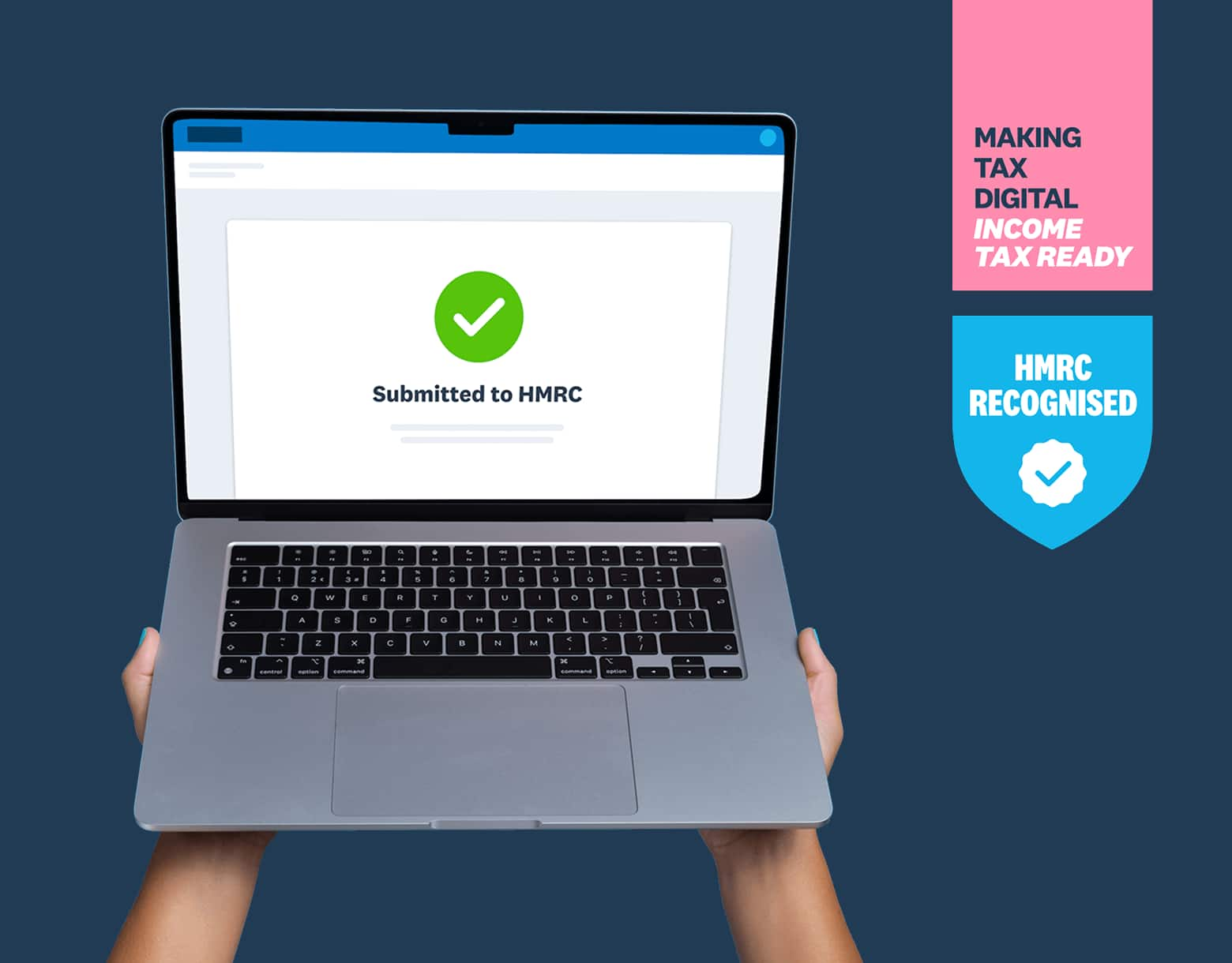

Xero is fully MTD-compatible and HMRC-recognised, with everything you and your clients need to navigate the upcoming changes.

HMRC-recognised and trusted by millions

Xero's flexible plans grow with your clients, allowing management of multiple businesses in one subscription.

No need for multiple tools

Xero's end-to-end solution does data capture to quarterly MTD for IT submissions and the final declaration.

A true partnership

Free, unlimited human support. We handle migration, setup, team upskilling, client training, and MTD updates.

Xero is the all-in-one platform to master MTD for Income Tax

We’ve worked closely with HMRC to ensure that our software is fully MTD-compatible and HMRC-recognised, ready for the changes ahead, while also making it easy to manage all your tax obligations from one single platform.

Compare pricing and plans

More than compliance – real support for you and your clients

MTD for Income Tax is a big change, but also an opportunity. Xero gives you the tools and support to help you make the transition smoothly.

Webinar: Making Tax Digital for Income Tax

Help your team stay informed with a live demo, expert advice, and resources to prepare your practice and support your clients.

Xero’s free client segmentation tool

Segmenting clients into manageable groups helps ease the transition – and Xero’s free tool makes it simple.

Migration services

Get help to move multiple clients quickly and easily, so you’re not left scrambling as MTD deadlines approach.

A big factor in choosing Xero was the user interface and the support available compared to other providers

Lorna Small, Accountant at Pennine Accounting Limited – Read Lorna's full story

Join the partner programme

Xero can help you get your practice and clients ready for MTD for IT.