HMRC-recognised payroll software for your small business

Simplify payroll, reporting and compliance with Xero. You’ll enjoy time-saving payroll features with the peace-of-mind that comes with HMRC-recognised software.

HMRC requirements sorted

Use HMRC payroll software to simplify compliance.

Automated payroll software

Pay employees online, in just a few clicks.

Fast pension re-enrolment

Save time with automatic enrolment for pensions.

Understanding HMRC and what it requires from your business

HMRC sets out how businesses and individuals must report income and calculate taxes. They require employing businesses to report the following PAYE (pay as you earn) details for each employee;

- salary and wages paid to each employee (including tips, bonuses, sick days and maternity pay)

- taxes deducted, which need to be in line with the income tax rates and bands

- further common deductions, such as national insurance contributions, student loan repayments and pensions

- plus payroll giving or child maintenance, where relevant

HMRC basic payroll tools and tips

HMRC provides useful forms, calculators and support to help – including information on payroll rules and penalties.

How Xero helps with your HMRC payroll

Xero software is officially recognised by HMRC, which means you can use it to submit PAYE reports online. Enjoy peace of mind while taking advantage of all the software’s payroll and accounting features. Xero can:

- automatically calculate employee pay, leave, and deductions

- submit online PAYE reports direct to HMRC

- automate VAT reporting and returns

- automate EOFY reporting and tax returns

- run your accounts receivable and accounts payable

- provide analysis into business performance

HMRC requirements sorted

Tick off your HMRC payroll obligations with software that’s designed to keep you compliant.

- automate PAYE calculations, including tax, insurance and pensions

- generate compliant PAYE reports and submit them online to HMRC each payday

- provide employees with electronic payslips

- keep accurate digital records of everything

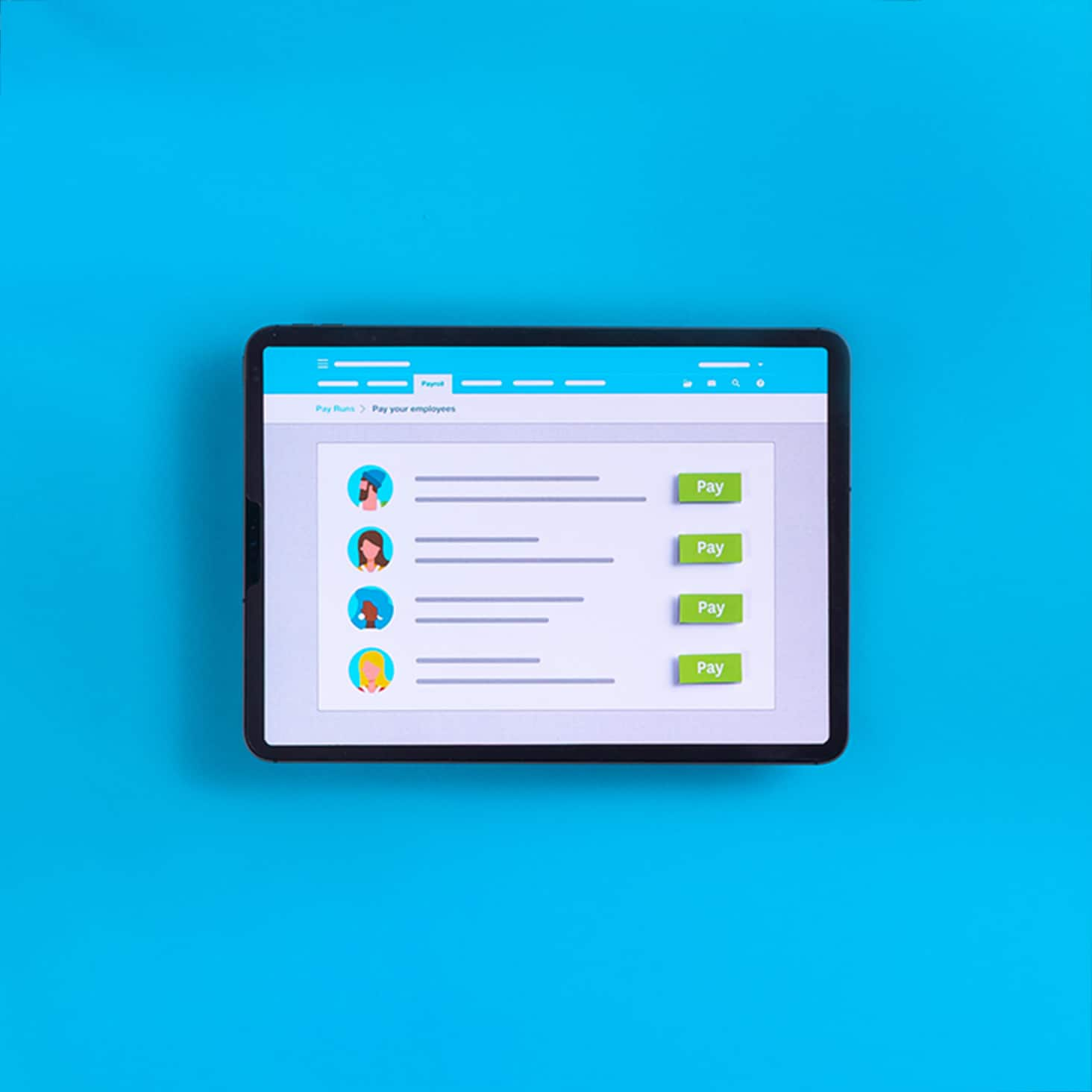

Automated payroll software

Pay employees in just a few clicks. Xero submits your PAYE reports to HMRC after every pay run so you never miss a deadline.

- Set your calendars and pay rates

- Connect time and attendance software to capture hours worked

- Integrate Xero expenses to pull through employee expense claims

- Tax, pensions, and leave calculations update automatically

- Email payslips that staff members can view online

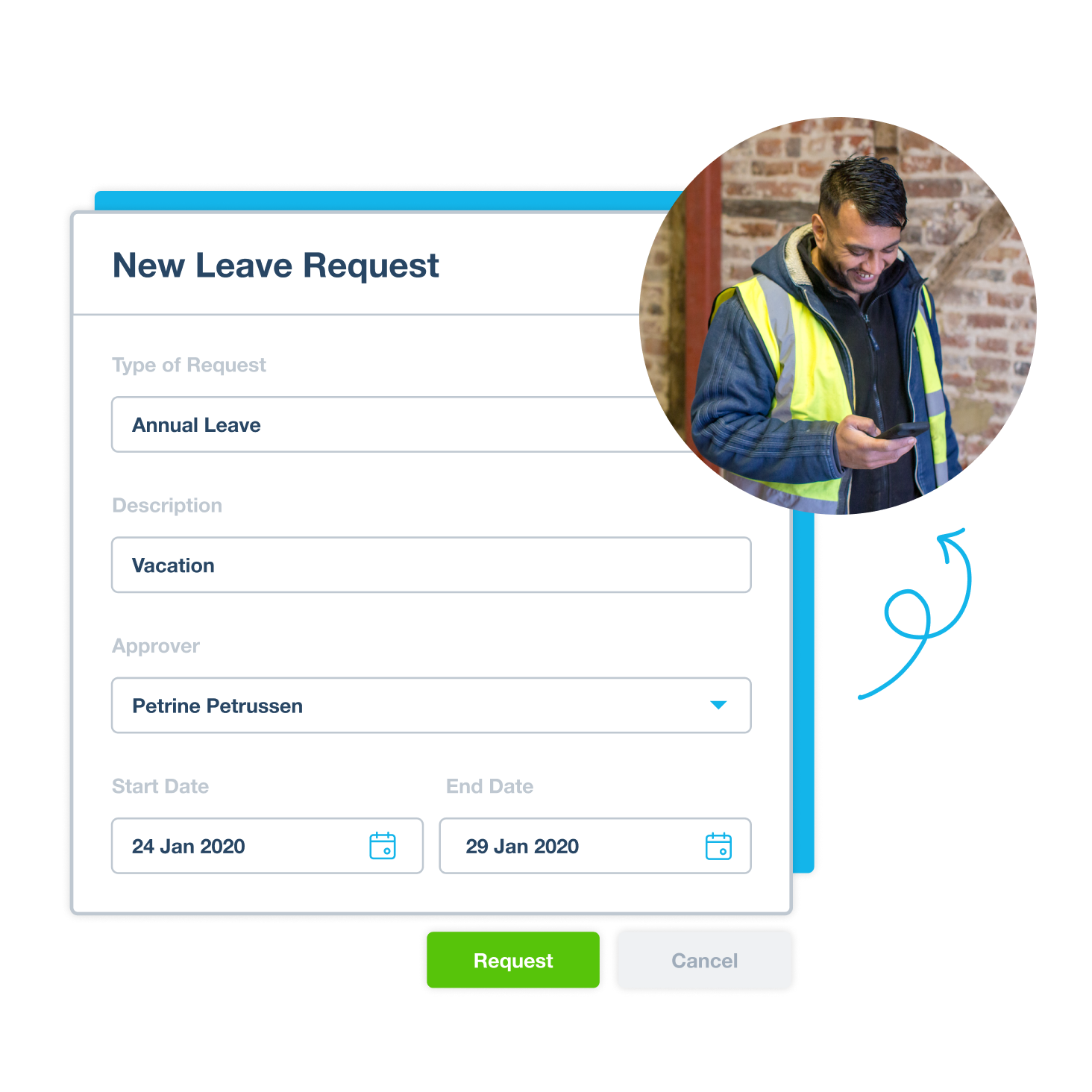

Employee self-service

Make it easy for employees to send requests and get information. The extra transparency and smoother communication will make everyone happier. Employees can:

- submit leave requests and timesheets for review

- see their leave balances and payslips

- use the Xero Me mobile app or web portal

Fast pension re-enrolment

Make pension re-enrolment a breeze. Xero’s HMRC-recognised payroll software automates the process to eliminate admin. You can:

- automatically assess and enrol employees

- reduce manual processing to avoid the risk of errors

- integrate securley with pension providers

Frequently asked questions about Xero and HMRC PAYE tools

When you enable automatic enrolment and re-enrolment in Xero, eligible employees are enrolled in your workplace pension, and contributions are deducted from their pay. Xero sends data directly to Nest or The People’s Pension, or lets you submit a file to another provider.

When you enable automatic enrolment and re-enrolment in Xero, eligible employees are enrolled in your workplace pension, and contributions are deducted from their pay. Xero sends data directly to Nest or The People’s Pension, or lets you submit a file to another provider.

Payroll reports allow you to review and check amounts paid and deducted over certain time frames or for specific employees. You can set as many filters as you like when generating a report. And you can drag and drop columns to display the data in the order that makes sense to you.

Payroll reports allow you to review and check amounts paid and deducted over certain time frames or for specific employees. You can set as many filters as you like when generating a report. And you can drag and drop columns to display the data in the order that makes sense to you.

HMRC lists software that can be used to report PAYE to them online. Software that’s not on the list can’t be used. The list includes free and paid-for software options. Besides satisfying HMRC, payroll software automates calculations to provide more certainty about payments and deductions. And when it’s integrated with your accounting ledger, like Xero, it ensures payroll expenses and liabilities are accurately recorded.

HMRC lists software that can be used to report PAYE to them online. Software that’s not on the list can’t be used. The list includes free and paid-for software options. Besides satisfying HMRC, payroll software automates calculations to provide more certainty about payments and deductions. And when it’s integrated with your accounting ledger, like Xero, it ensures payroll expenses and liabilities are accurately recorded.

On or before payday, you must report wages or salary paid, and amounts deducted for things like employee income tax, national insurance contributions and pension contributions. This report – known as Full Payment Submission – must be submitted using HMRC-recognised payroll software. You may also need to submit an Employer Payment Summary. Amounts owed to HMRC must be paid by the 22nd of the month.

Learn about HMRC pay run obligationsOn or before payday, you must report wages or salary paid, and amounts deducted for things like employee income tax, national insurance contributions and pension contributions. This report – known as Full Payment Submission – must be submitted using HMRC-recognised payroll software. You may also need to submit an Employer Payment Summary. Amounts owed to HMRC must be paid by the 22nd of the month.

Learn about HMRC pay run obligationsYes. Xero streamlines VAT reporting and allows you to submit returns online. It also automates EOFY reporting to expedite income and company tax filing. Xero can digitally save transaction records – such as receipts and invoices – so it’s easier for businesses to meet their record-keeping obligations.

Submit returns onlineYes. Xero streamlines VAT reporting and allows you to submit returns online. It also automates EOFY reporting to expedite income and company tax filing. Xero can digitally save transaction records – such as receipts and invoices – so it’s easier for businesses to meet their record-keeping obligations.

Submit returns online

What else can Xero do?

Satisfying HMRC payroll requirements is great, but there’s a lot more to business. Xero helps with everything from accounting and invoicing to reporting and financial analysis. Use Xero accounting software to run your business.

- Automatically captures transaction records from the bank

- Accounting ledger updates daily

- Organises bills (accounts payable)

- Raises and tracks invoices (accounts receivable)

- Forecasts cash flow

- Generates financial statements and reports

- Simplifies tax filing

Is your business ready to employ staff?

It can be hard knowing when or how to grow your team. We’ve got your back with guides and checklists..

Hiring employees

Get tips about onboarding new hires.

HMRC starter checklist

Learn all about the starter checklist, which your employee may need to fill out.

Small business guides

Find more guides on hiring, bookkeeping, taxes, finance and more.

Plans to suit your business

All pricing plans cover the accounting essentials, with room to grow.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

Simply everyday business tasks

Explore features and tools built for small businesses, accountants and bookkeepers.