Pro forma invoice: What it is, how it works and when your small business should use it

See how a pro forma invoice helps you quote, confirm orders, and get paid faster.

Published Wednesday 26 November 2025

Table of contents

Key takeaways

• Use pro forma invoices to provide cost estimates before finalizing sales, particularly for international transactions, procurement approvals, or when customers need detailed breakdowns for financing arrangements.

• Label documents clearly as "Pro Forma Invoice" and assign reference numbers instead of official invoice numbers to avoid confusion with actual sales invoices that require payment.

• Exclude pro forma invoices from your accounts receivable records since no payment is due and no sale has been completed, preventing accounting errors and tax complications.

• Send pro forma invoices only after customers accept your quote and specifically request one, ensuring proper timing for customs clearance, internal approvals, or financial planning purposes.

What is a pro forma invoice?

A pro forma invoice is a preliminary bill of sale sent before completing a transaction. It outlines products, services, and costs without requesting payment.

Pro forma invoices have these features:

- no payment is due

- use a reference number instead of an invoice number

- are not recorded in accounts receivable

- are sent before the sale is final

- payment is not requested

- uses a reference number instead of an invoice number

- does not appear in accounts receivable

- sent before the sale is final

3 common reasons for issuing a pro forma invoice

Three common reasons for issuing a pro forma invoice

- confirm costs to help you or your customer arrange financing

- provide required documents to clear customs for international shipments

- meet procurement requirements for internal approval

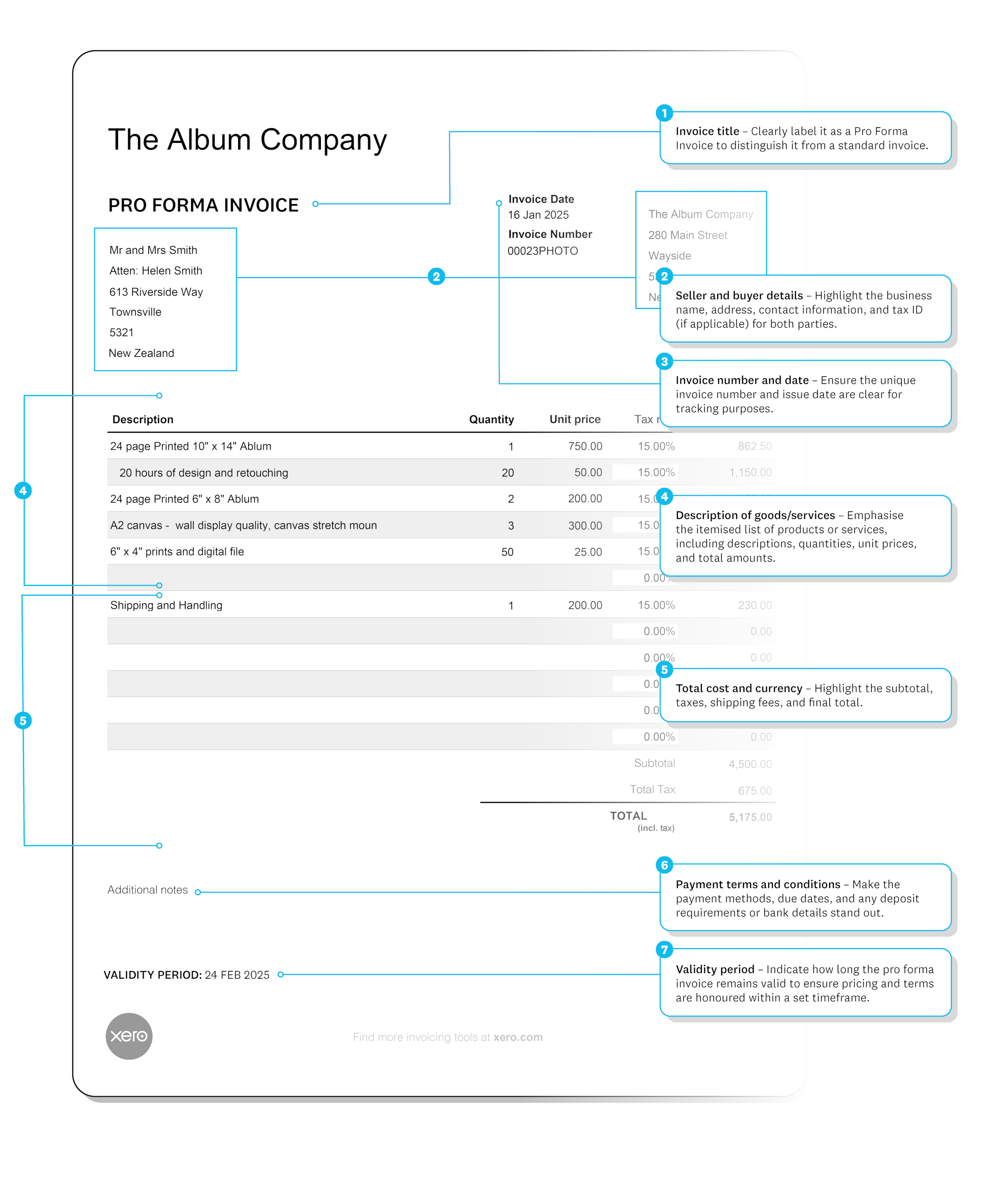

What should a pro forma invoice look like?

A pro forma invoice looks like a regular invoice but you must clearly label it as 'pro forma invoice'.

Standard information required:

- Buyer and seller details

- Product or service descriptions

- Prices and terms of sale

- Reference number (not an official invoice number)

Additional requirements for imports:

- Product weights and measurements

- Shipping costs and terms

How is a pro forma invoice different from other invoices (and quotes)?

How a pro forma invoice differs from other business documents

Pro forma vs sales invoice:

- Pro forma invoice: Sent before sale with no payment due

Pro forma vs commercial invoice:

- Pro forma invoice: Preliminary document to estimate costs and duties

Pro forma vs quote:

- Quote: Used during price negotiations

- Pro forma invoice: Sent after agreement for administrative purposes (customs, financing, procurement)

A pro forma invoice isn't a tax invoice

A pro forma invoice is not a tax invoice and does not create a VAT liability for your business.

Key tax implications:

- No tax due: No sale means no VAT obligation

- VAT preview: Can show expected VAT amounts for planning

- Tax liability: Only begins when final sales invoice is issued

When to send a pro-forma invoice

Send a pro forma invoice only if your customer requests one, usually after they accept your quote.

Common timing scenarios:

- After quote acceptance: Both parties committed but sale not final

- For import planning: Customer needs to calculate duties and fees

- Procurement requirements: Customer's internal approval process

Get final approval before you ship products or issue the final sales invoice.

How to create a pro forma invoice

How to create a pro forma invoice

Step 1: Use invoice template

- Complete all standard invoice fields

- Label clearly: Mark as 'Pro Forma Invoice'

Step 2: Handle accounting correctly

- Don't record: Keep out of accounts receivable

- No income entry: Sale isn't confirmed yet

Step 3: Software considerations

- Check your accounting software's pro forma features

- Avoid mistakes: Don't accidentally create a sales invoice

FAQs on pro forma invoices

Here are answers to common questions about pro forma invoices.

Is a pro forma invoice legally binding?

A pro forma invoice is not legally binding. You send it before you deliver products or services as a good-faith agreement.

Can a pro forma invoice be canceled?

You do not need to edit or cancel a pro forma invoice if the sale is not complete, as it is not an official accounting document.

Can you turn pro forma invoices into commercial invoices?

You cannot turn a pro forma invoice into a commercial invoice. A commercial invoice includes extra details, such as terms from the Uniform Commercial Code (UCC), and is used for customs and payment.

How can a pro forma invoice help you?

Some customers, such as importers, may ask for a pro forma invoice. Providing one helps you do business with them.

Is it OK to pay a pro forma invoice?

Do not pay a pro forma invoice. Wait until you receive an official sales invoice.

What are the advantages of pro forma invoices?

The three main advantages of the pro forma invoice are that:

- they ensure both the buyer and seller are on the same page

- they can assist businesses to provide necessary information to get through customs

- you can easily make changes to the products, services and costs listed without having to edit your business accounts

Related content

What is an invoice?

Get the lowdown on invoices.

How to send an invoice

Find out when and how to send an invoice.

How to make an invoice

Let’s walk through the process of making an invoice.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.