Net operating profit after tax (NOPAT): formula and uses

Learn how net operating profit after tax shows true operating performance, and how to calculate and use it.

Written by Kari Brummond—Content Writer, Accountant, IRS Enrolled Agent. Read Kari's full bio

Published Thursday 18 December 2025

Table of contents

Key takeaways

- Calculate NOPAT by multiplying your operating profit by (1 minus your effective tax rate) to reveal your core business performance after taxes but before interest expenses.

- Use NOPAT to make fair comparisons between businesses with different debt structures, as it eliminates the distorting effects of financing decisions on profitability metrics.

- Apply NOPAT in Economic Value Added calculations to determine whether your investments generate value above the cost of capital by subtracting (invested capital × cost of capital) from your NOPAT.

- Track your NOPAT over time to assess operational efficiency improvements and demonstrate the underlying health of your business operations to potential lenders or investors.

What is NOPAT?

Net Operating Profit After Tax (NOPAT) is a financial metric that shows how much profit your business generates from core operations after paying taxes but before interest expenses.

For the 2024–25 income year, the Australian Taxation Office notes the tax rate for companies is 25% for base rate entities and 30% for others. This calculation excludes non-operating income and focuses solely on your main business activities.

NOPAT provides clear insights into operational performance by:

- Excluding non-operating income: Removes gains from investments or asset sales

- Ignoring interest expenses: Eliminates the impact of debt structure on profitability

- Focusing on core operations: Shows true business performance without financial distractions

- Measuring investment returns: Helps calculate the value generated from business investments

Why is NOPAT important?

NOPAT is important because it reveals true operational performance independent of financing decisions. This metric enables fair comparisons between businesses with different debt levels and helps measure returns on invested capital.

Reveals true business performance

NOPAT reveals true business performance by providing:

- Pure operational focus: Shows performance without debt influence

- Realistic tax impact: Includes actual tax burden in calculations

- Clear improvement insights: Identifies operational strengths and weaknesses

- Growth decision support: Guides long-term strategic planning

Helps to standardise comparisons

NOPAT eliminates financing differences that can distort performance comparisons. A debt-heavy business might show low net profits despite strong operations.

Example comparison:

- Company A: $100,000 net profit

- Company B: $80,000 net profit (but $120,000 NOPAT after excluding interest)

This reveals Company B's superior operational performance despite its debt burden. NOPAT also standardises comparisons across different tax jurisdictions by showing the true impact of regional tax rates.

Use NOPAT to improve your decisions

NOPAT enables you to calculate Economic Value Added (EVA), which shows true investment returns.

EVA formula:

NOPAT - (Total invested capital × Cost of capital)

Example calculation:

- NOPAT: $50,000

- Total investment: $200,000 (loans + equity)

- Average cost of capital: 3%

- EVA: $50,000 - ($200,000 × 3%) = $44,000

This shows your $200,000 investment generates $44,000 in annual value above the cost of capital.

Check out the research on Economic Value Added from the University of Melbourne. Or look at EVA calculation examples.

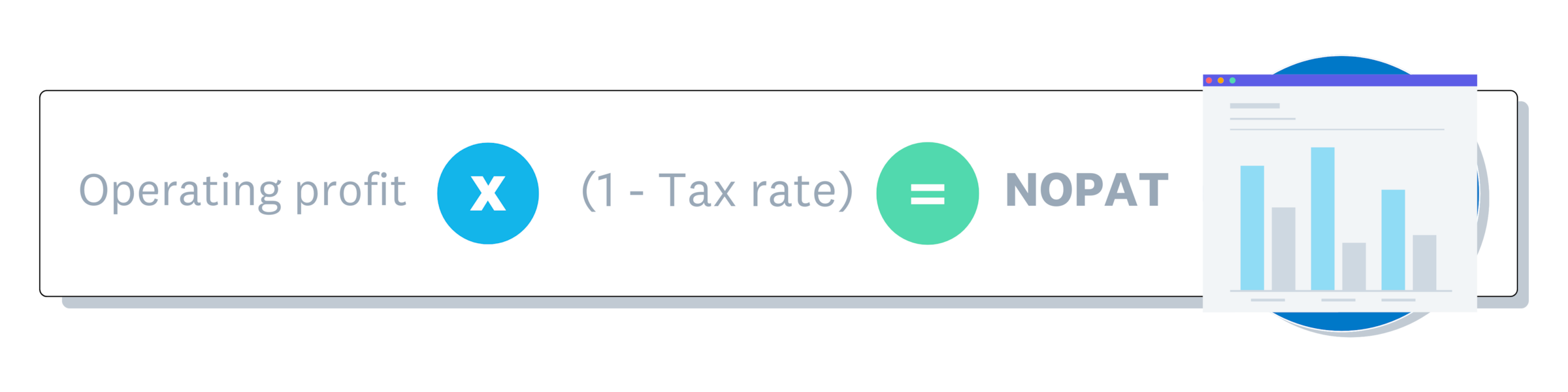

NOPAT formula explained

Use this formula to work out your after-tax profit from core operations:

NOPAT = Operating Profit x (1- tax rate)

Formula breakdown:

- Operating profit: Earnings from core business after all expenses (including depreciation) but before taxes and interest. These expenses can be substantial; one business analysis found that salary expense alone accounted for over 53% of sales.

- Tax adjustment: Multiply by (1 - tax rate) to show after-tax results. Example: 20% tax rate = multiply operating profit by 80%.

- Note: Operating profit differs from EBIT because it excludes non-operating income sources.

How to calculate NOPAT

1. Determine operating profit

Determine operating profit using this calculation:

Operating profit = Gross profit - Operating expenses(Where gross profit = Revenue - Cost of goods sold)

This excludes non-operating income and focuses on core business earnings before taxes and interest.

2. Find the tax rate

Find the tax rate with this formula:

Effective tax rate = Income tax paid ÷ Operating profit

Example: $20,000 tax ÷ $100,000 operating profit = 20% tax rate

For current year estimates, calculate projected tax rates based on expected earnings increases. Visit Income tax for business for rate guidance.

3. Apply the formula

Now that you have the numbers, it's time to apply the NOPAT formula. To illustrate, let's use these sample numbers:

- Operating profit: $50,000

- Tax rate: 25%

$37,500 = $50,000 * (1-.25)

That means after tax (but not including interest), your business's operations earn $37,500 per year.

NOPAT calculation example

Let's see how this works with a practical example. Imagine your small business, a local cafe, has an operating profit of $80,000 for the year. After checking the latest business tax information, you find your effective tax rate is 25%.

Using the formula: NOPAT = $80,000 x (1 - 0.25).

This gives you a NOPAT of $60,000. This figure shows you the profit from your core cafe operations after you account for tax.

NOPAT vs net income

NOPAT and net income differ in scope and calculation:

- Net income includes all business activities: operating income, non-operating income, interest expenses, and taxes.

- NOPAT focuses only on core operations after taxes but excludes interest expenses and non-operating activities.

Net income is the bottom line; it accounts for operational expenses, interest, depreciation, amortisation, and taxes. It also includes all of the income and expenses the business earns from side activities or investments. NOPAT excludes interest and any income or expenses that are not related to the business's core operations.

To explain, let's say a bakery has $100,000 in net income, but it earns $12,000 from renting space in its parking lot to a food truck, and it pays $8,000 in interest on loans. To find its NOPAT, exclude the interest and the rent (because that's not a core business activity). That brings the NOPAT to $80,000.

NOPAT focuses on operational efficiency, while net income includes everything. However, if a business doesn't have any debt or other income streams, then its NOPAT and net income are the same.

Operating profit vs NOPAT

Both operating profit and NOPAT show how much a business earns from its core operations before subtracting interest expenses. But operating profit doesn't include taxes, while NOPAT does. Neither of these numbers include income or expenses that aren't related to the main operations.

To calculate operating profit, add the tax back into NOPAT. Say the NOPAT is $80,000 and the business's tax liability is $16,000. That means that the operating profit is $96,000.

Using NOPAT in your business

Understanding your NOPAT helps you make smarter decisions. You can use it to:

- Assess operational efficiency: A rising NOPAT over time suggests your core business is getting more profitable, as illustrated in a case where a company's sales increased by 27% year-over-year.

- Compare investment opportunities: When looking at acquiring another business, NOPAT provides a level playing field to compare their core profitability, regardless of their debt structure.

- Secure financing: Showing potential lenders a strong NOPAT demonstrates the underlying health of your business operations, as poor performance can lead to indicators of financial distress, such as instances where cash holdings have substantially decreased.

Streamline your NOPAT analysis with Xero

Make working out NOPAT easier by automating the calculations.

Xero tracks all the financial data you need for NOPAT calculations: operating income, expenses, and tax information. Automated bookkeeping and instant financial reports make it easy to calculate and monitor your operational performance metrics. Try Xero for free.

FAQs on net operating profit after tax

Common questions about calculating and using NOPAT for your business.

How do you calculate net operating profit after taxes?

You can calculate NOPAT by taking your operating profit and multiplying it by (1 – your tax rate). For example, if your operating profit is $100,000 and your tax rate is 25%, your NOPAT would be $75,000.

Is NOPAT calculated before or after tax?

NOPAT stands for Net Operating Profit After Tax. It shows you the profit from your core business activities after your tax obligations have been accounted for, but before considering interest expenses.

What is the NOPAT margin ratio?

The NOPAT margin ratio measures how efficiently your business turns revenue into operating profit after tax. You calculate it by dividing your NOPAT by your total revenue. A higher margin indicates better operational efficiency. You can improve it by tackling issues such as stock shrinkage, which in one case study amounted to over 11% of the total cost of goods sold.

When should I use NOPAT instead of net income?

Use NOPAT when you want to evaluate the core operational performance of a business without the influence of its debt structure (interest payments). It's especially useful for comparing different businesses or for making investment decisions.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.