Accounting software for sole traders and freelancers

Empower your Australian small business with Xero self-employed accounting software for business owners. Xero’s advanced features save you time and manual effort everywhere – from automating your bank reconciliations and speeding up your invoicing process, to helping you master your cash flow.

Boost your business with Xero

Looking to grow your business? Xero accounting software for self-employed businesspeople makes it easy to manage finances and collaborate.

Industry-specific solutions

Meet the needs of your industry with Xero’s customisable reports and powerful tools, and hundreds of third-party apps.

A system for working together

Make tax time less stressful with a system that’s easy for your whole team to use – so everyone can pitch in.

Room to grow

Grow your business by adding more Xero users, automating your admin, and working from anywhere, anytime.

Easily send online quotes and invoices

Whenever a new client comes knocking, create a professional online quote with Xero accounting software for freelancers. And once the job’s done, just turn the quote into an invoice in a few clicks – and give clients multiple ways to pay so you get the money sooner.

- Use Xero quote templates for fast, professional quotes every time

- Add your logo and payment terms to appear on every quote and invoice automatically

- Link Xero with trusted payment providers to accept hassle-free online payments

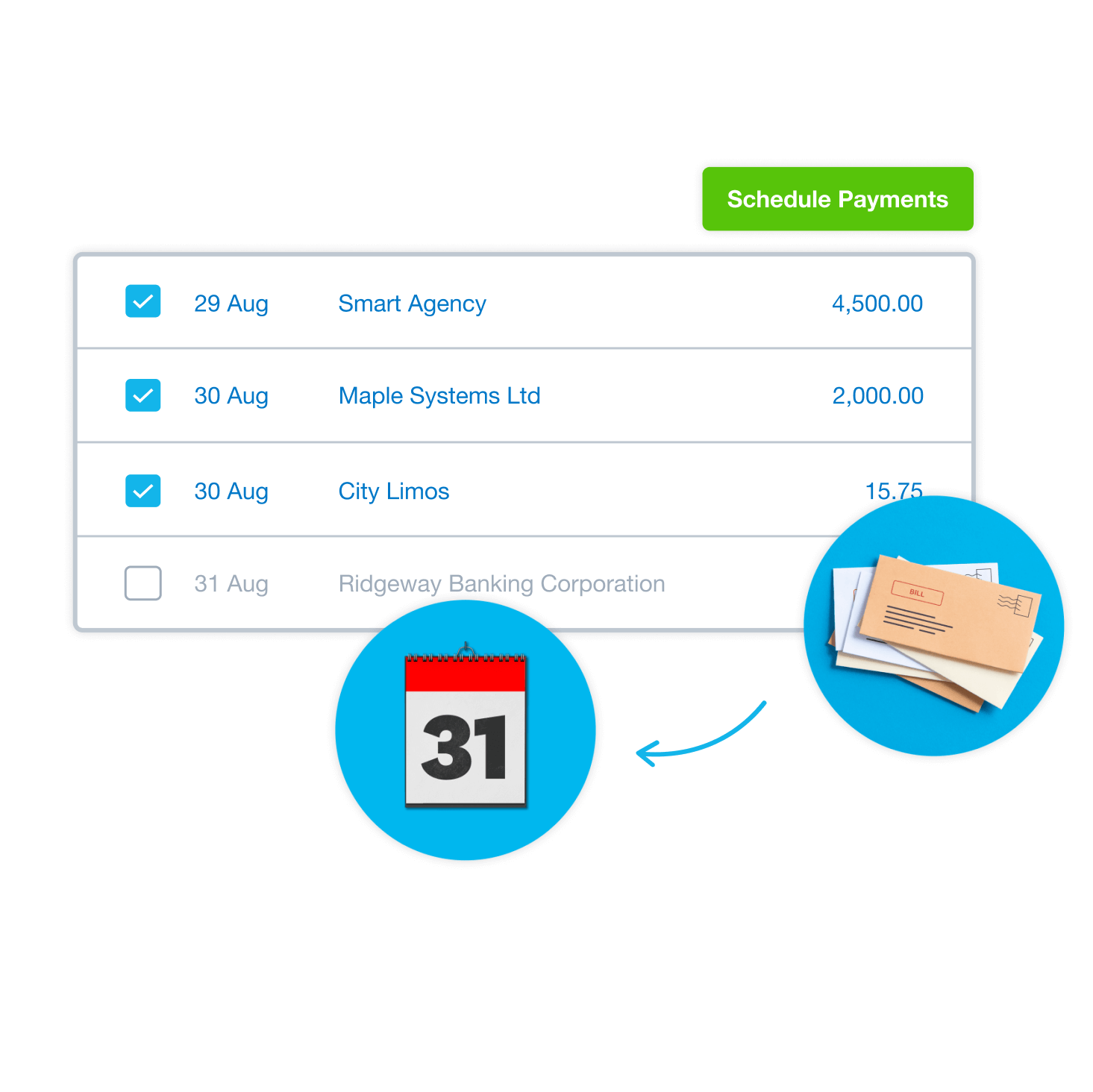

Schedule and track your bill payments

Xero’s self-employed bookkeeping software helps you organise and fast-track your bill payments. Automate your bill entry and payment schedule so you never miss a deadline. Then track outgoing payments so you know exactly how much cash you have available.

- Pay multiple bills at once to save time and effort

- Schedule bills to pay at a future date to help your cash flow

- Check your Xero dashboard for upcoming bill deadlines

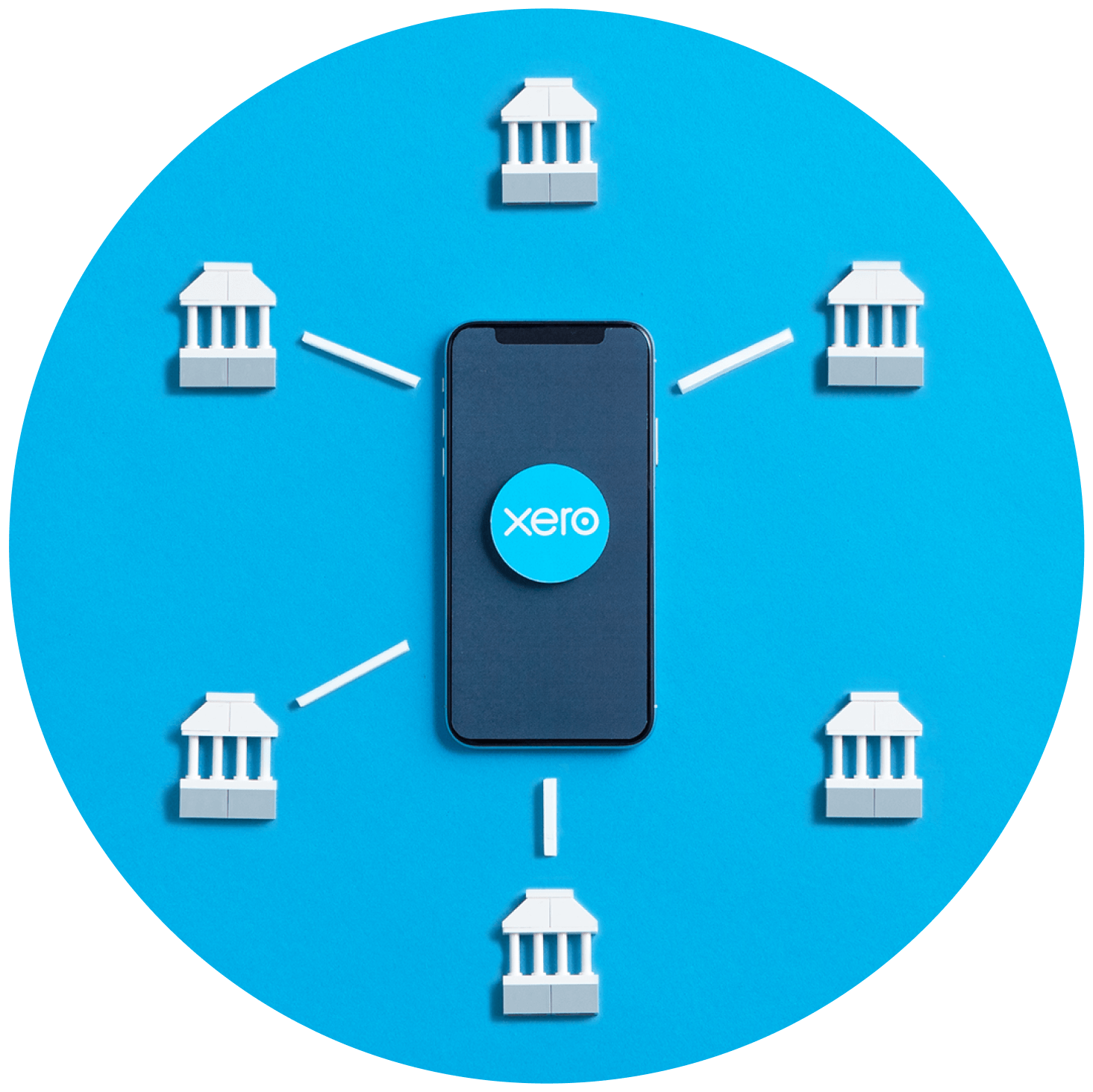

Reconcile your bank transactions effortlessly

Bank reconciliations are easy with Xero. In a spare minute, log in and let Xero’s self employed accounting software suggest matches. Just click – or tap your mobile – to match the transactions. Done! You’re up to date and ready to make confident spending decisions.

- Connect your business bank accounts to your Xero organisation to see all your info on one screen

- Reconcile transactions often for an accurate view of your cash flow

- Handle the admin on the spot with the Xero Accounting mobile app

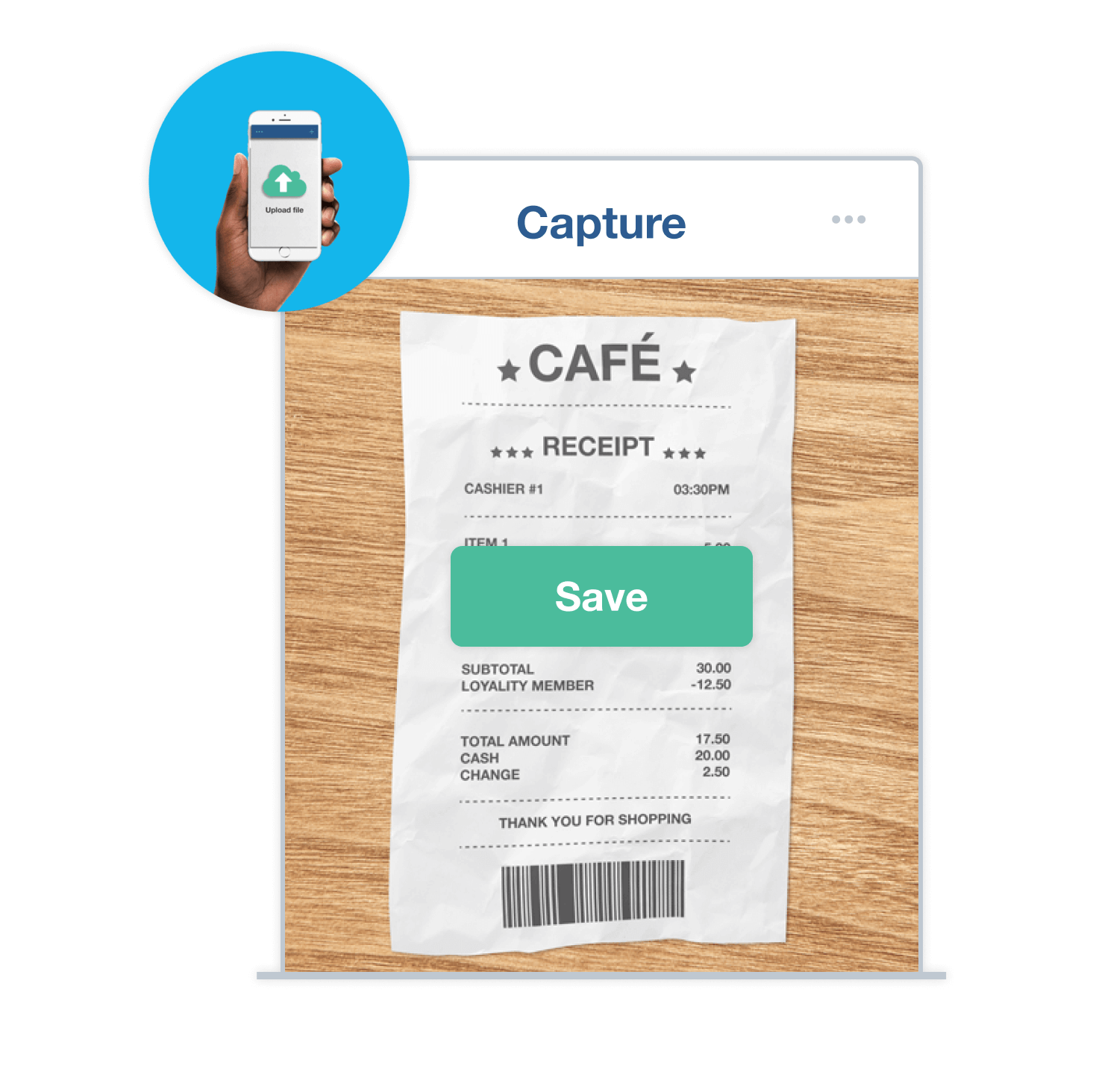

Record your bills and receipts with Hubdoc

Too many bills and not enough time? Simply snap a receipt with your phone, and let Xero’s accounting software for freelancers take care of the rest. Hubdoc captures the key details, sends them to Xero, and saves the original photo. You get reliable records and save time.

- Take photos, email, scan, or upload your documents to Xero

- Skip the data entry – Hubdoc extracts the data for you

- Store your documents online for easy access wherever you go

Xero’s made a big difference in helping keep my finances organised.

Ade Hassan, founder of Nubian Skin

Small business accounting software

Learn more about how Xero accounting software works for your small business

Freelance invoicing software

Invoicing software built for freelance businesses

Freelance time tracking software

Time tracking software built for freelance businesses

FAQs about Xero in Australia

Yes. You can connect your Xero account with the ATO (Australian Taxation Office) to help you easily prepare and submit your returns, so you never miss a deadline.

Here’s more info on tax and super from the ATO.Yes. You can connect your Xero account with the ATO (Australian Taxation Office) to help you easily prepare and submit your returns, so you never miss a deadline.

Here’s more info on tax and super from the ATO.Yes. Xero complies fully with STP. You can send reports to ATO each payday without any hassle so you have more time for the rest of your business.

Yes. Xero complies fully with STP. You can send reports to ATO each payday without any hassle so you have more time for the rest of your business.

The best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plans.The best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plans.No – Xero is based in the cloud, so all you need is an internet connection. But you need a multi-factor authentication (MFA) app to log in to Xero. MFA extra layer of security by checking that it’s really you when you log in.

Learn about data protection with Xero.No – Xero is based in the cloud, so all you need is an internet connection. But you need a multi-factor authentication (MFA) app to log in to Xero. MFA extra layer of security by checking that it’s really you when you log in.

Learn about data protection with Xero.Yes – the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business in Australia.

Check out the Xero App Store.Yes – the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business in Australia.

Check out the Xero App Store.

Why small businesses love Xero

Small business owners love Xero’s user-friendly design and dynamic features. You don’t need accounting knowledge – just an internet connection! Then it’s easy to sort your admin, from invoicing and bills to financial reporting.

Work from anywhere, anytime

Xero’s cloud-based software means you can handle admin wherever your business takes you.

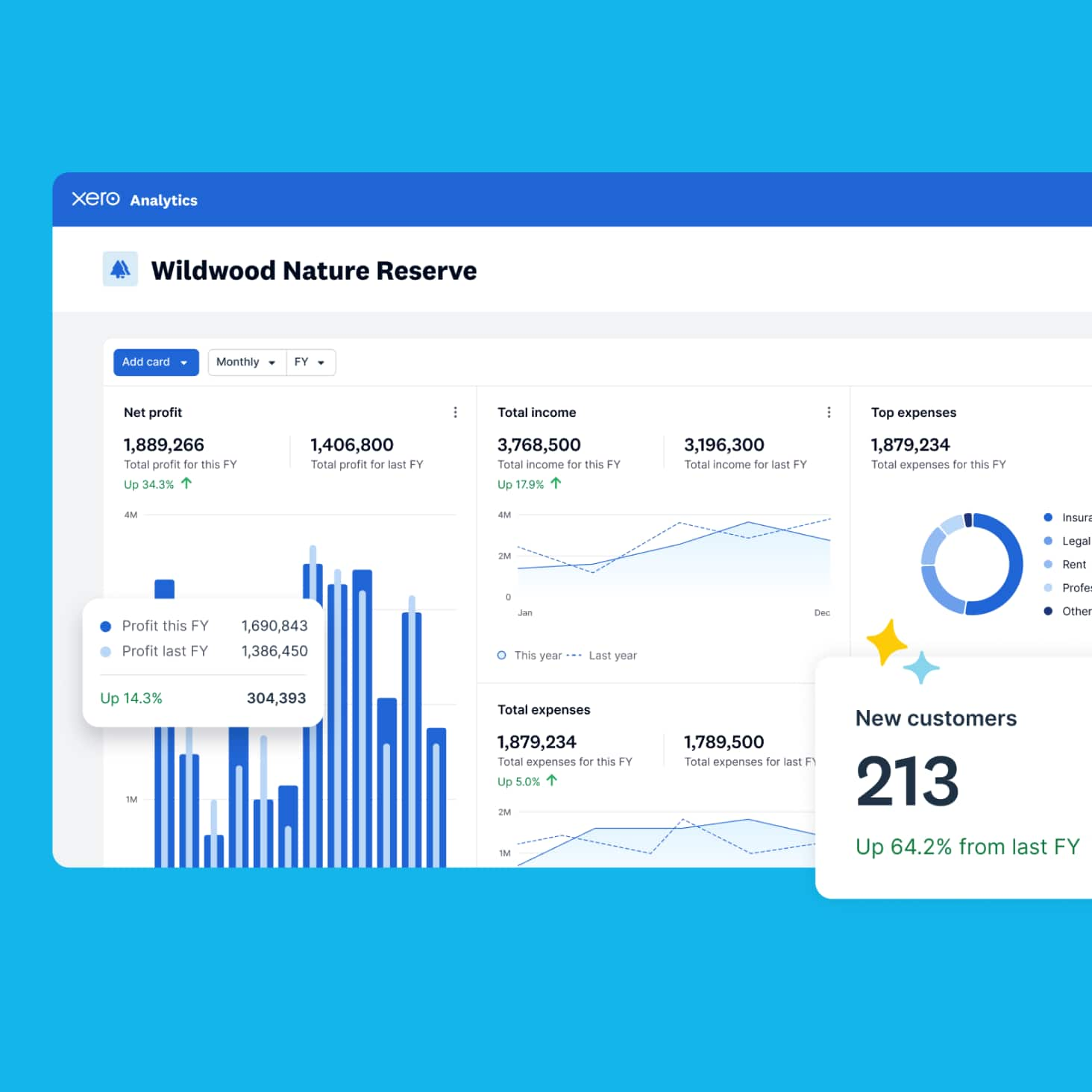

Understand your business better

Customised reports and data visualisations help you make confident decisions and set goals for your business.

Do more with apps

Xero’s sole-trader software integrates with third-party apps, like payroll, ecommerce, and invoicing.

Here’s why you should choose Xero for your small business

Your self-employed business resources

Boost your bookkeeping skills with these expert guides – all written in no-nonsense language.

Income tax calculator

Xero’s taxable income calculator is designed for small business owners, freelancers, and the self-employed.

How to pay yourself as a business owner

Learn how different types of business owners pay themselves – and decide on how much.

A free invoice template for freelancers

Get paid sooner with this easy-to-use professional template, designed by billing experts.

Plans to suit your business

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

Connect Xero to other apps for sole traders and the self-employed

Hundreds of third-party apps integrate with Xero. Find apps for your business at the Xero App Store.

- App

Oncord

Use Oncord to build a content-rich website, grow your customer database, and communicate with email, SMS and social.

- App

Stripe

Use Stripe to accept payments from debit and credit cards, Apple Pay, and Google Pay for online invoices sent from Xero.

- App

GoCardless

No more late payments. Automatically debit your customer’s bank account whenever your Xero invoices are due.

Explore Xero accounting software for sole traders

Take control of your accounting online with Xero. Our easy-to-use, cloud-based software helps your small business grow and succeed.