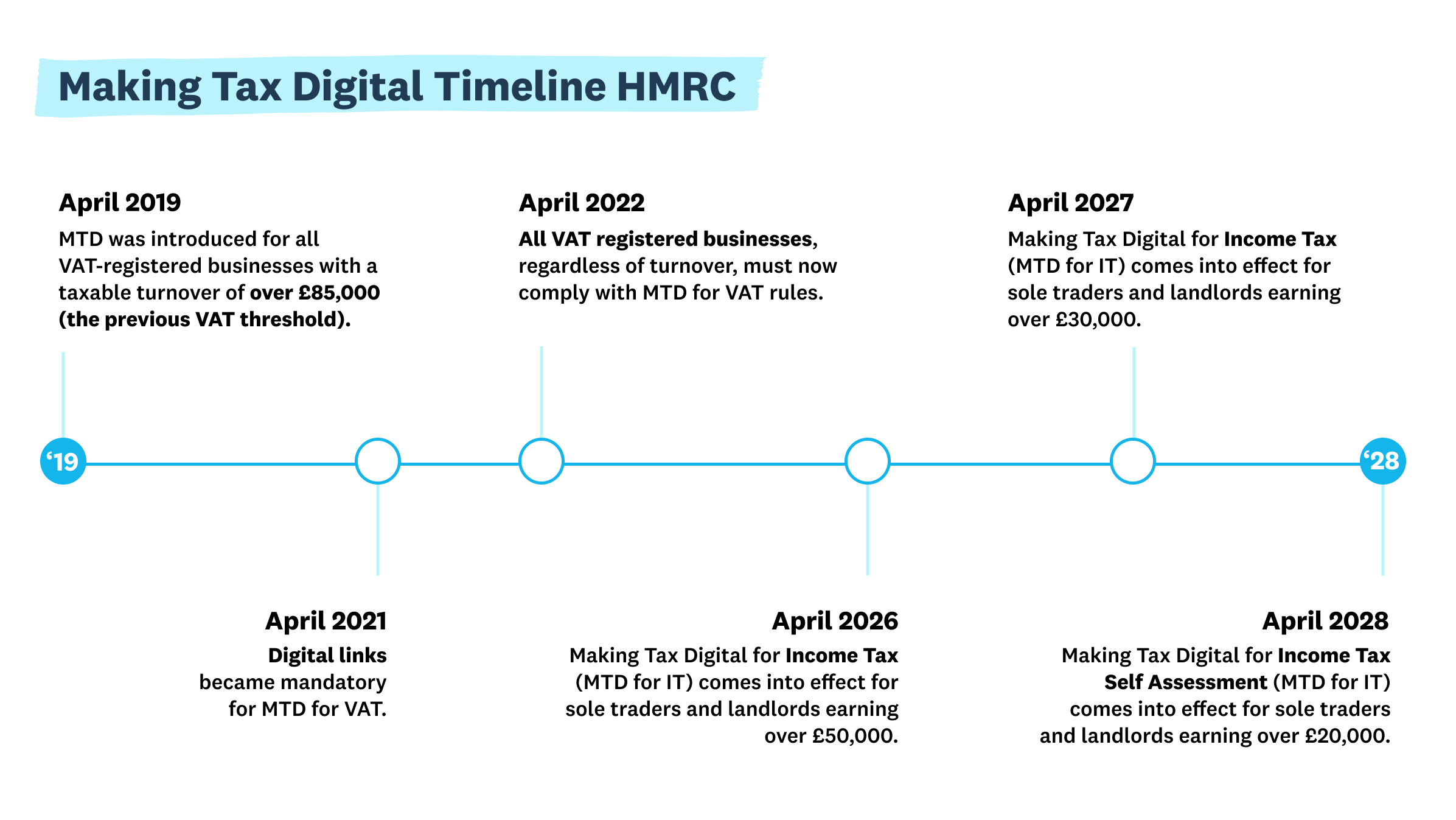

MTD deadlines and important dates

Our Making Tax Digital (MTD) timeline covers all of the key deadlines and dates for each stage of HMRC’s MTD initiative.

Making Tax Digital (MTD) is part of the Government’s plan to modernise the UK tax system, making it easier for people to get their tax right. It means individuals and businesses will need to use MTD-compatible software to keep digital records and submit returns.

Make sure you’re prepared for what’s ahead with our timeline of important changes and MTD deadlines.

A closer look at key Making Tax Digital dates

April 2019: MTD for VAT (Over £85,000 threshold)

MTD was introduced for all VAT-registered businesses with a taxable turnover above £85,000 (the previous VAT registration threshold). Businesses in this category must keep digital records and submit returns to HMRC using MTD-compatible software.

April 2021: Digital links

Digital links became mandatory for MTD for VAT. A digital link is a data transfer within and between functional compatible software — for example, adding VAT inputs and outputs to a spreadsheet and using a cell formula to calculate the totals. Manually copying and pasting data does not count as a digital link and is no longer allowed under the government’s MTD rules.

April 2022: MTD for VAT (All VAT-registered businesses)

All VAT registered businesses, regardless of turnover, must sign up to MTD for VAT and follow the rules for submitting returns. For a quick refresher, check out our guide on MTD for VAT key dates.

Note: HMRC now automatically signs up VAT registered businesses for MTD. You no longer need to sign up for MTD – just make sure you’re registered for VAT. The new VAT registration threshold (as of 1 April 2024) is £90,000.

April 2026: MTD for Income Tax (£50,000 threshold)

Making Tax Digital for Income Tax comes into effect. Sole traders and landlords with a total annual income above £50,000 need to use MTD for Income Tax compatible software to keep digital records and file returns.

You’ll need to send quarterly updates of all business income and expenditure to HMRC, as well as a Final Declaration with details of all other taxable income by 31 January every year.

Make sure you have HMRC-recognised software in place before April 2026 and ask your software provider how to sign up for MTD for Income Tax. Your accountant or bookkeeper will be able to help you with this.

April 2027: MTD for Income Tax (£30,000 threshold)

Sole traders and landlords with a total annual income above £30,000 need to use MTD for Income Tax compatible software to keep digital records and file returns.

April 2028: MTD for IT (£20,000 threshold)

Sole traders and landlords with a total annual income above £20,000 need to use MTD for IT compatible software to keep digital records and file returns.

If you want to learn more about Making Tax Digital and prepare for the next stage, visit our Making Tax Digital for Income Tax resource hubs or our Making Tax Digital for VAT resource hub for accountants and bookkeepers or small businesses.

MTD deadlines FAQs

When does digital tax start?

It depends on your business type and the type of tax.

Digital tax has already started for all VAT-registered businesses. If you’re registered for VAT, you’ll automatically be signed up for MTD for VAT.

The MTD deadline for self-employed people and landlords is April 2026 (if you earn above £50,000). This is when the first phase of MTD for IT begins. For those earning above £30,000, MTD for IT rules apply from April 2027. And, for those earning above £20,000, MTD for IT rules will apply to businesses from April 2028.

When is the MTD deadline for self-employed people?

Making Tax Digital deadlines for self-employed people are as follows:

- April 2026 for self-employed people and landlords earning above £50,000

- April 2027 for self-employed people and landlords earning above £30,000

- April 2028 for self-employed people and landlords earning above £20,000

You’ll need HMRC-recognised software in place before the MTD deadline that applies to your business.

Why was the Making Tax Digital deadline extended?

The MTD Income Tax start date was previously set for 2024. HMRC moved the MTD deadline to give businesses more time to prepare, in light of challenging economic circumstances.

The Making Tax Digital deadline extension means self-employed people and landlords won’t need to follow MTD rules until 2026 at the earliest.

Read more about the Making Tax Digital delay.

When does MTD for Income Tax start?

The MTD for Income Tax start date is April 2026 for self-employed people and landlords earning above £50,000, April 2027 for those earning above £30,000, and April 2028 for those earning above £20,000. Scroll up to the Making Tax Digital timeline for more information.

When does MTD for Self Assessment start?

April 2026. Check out the answer above for more details.

Where can I learn more about how to prepare for MTD deadlines?

The most important thing you can do to prepare for Making Tax Digital deadlines is to familiarise yourself with cloud-based accounting software that’s HMRC-recognised. Having the right software in place to keep digital records and file returns – and using it confidently – will be incredibly useful when tax goes digital.

We regularly update our website with the latest Making Tax Digital dates and information. Read our guides and get Making Tax Digital ready in a flash.

Let Xero help you stay compliant with MTD

Use MTD-compatible software like Xero to keep digital records and submit returns. Try free for 30-days.

- Safe and secure

- Cancel any time

- 24/7 online support