Accounting software for non-profits

Get 25% off Xero and see how online accounting software can work wonders for your non-profit or charity. The discount is available to registered not-for-profit organisations on a business pricing plan.

How to get the non-profit discount

The non-profit discount rate is applied once you've subscribed to Xero and we've confirmed your not-for-profit status. Learn more in Xero Central.

Start using Xero

Sign up for a 30-day free trial or choose ‘buy now‘ to start subscribing to Xero.

Provide your charity number or certification

During the free trial or within 31 days of subscribing, raise a case in Xero Central and send evidence of eligibility.

Set up payment

At the end of your free trial, or when you buy now, enter your payment details and the discount will be applied.

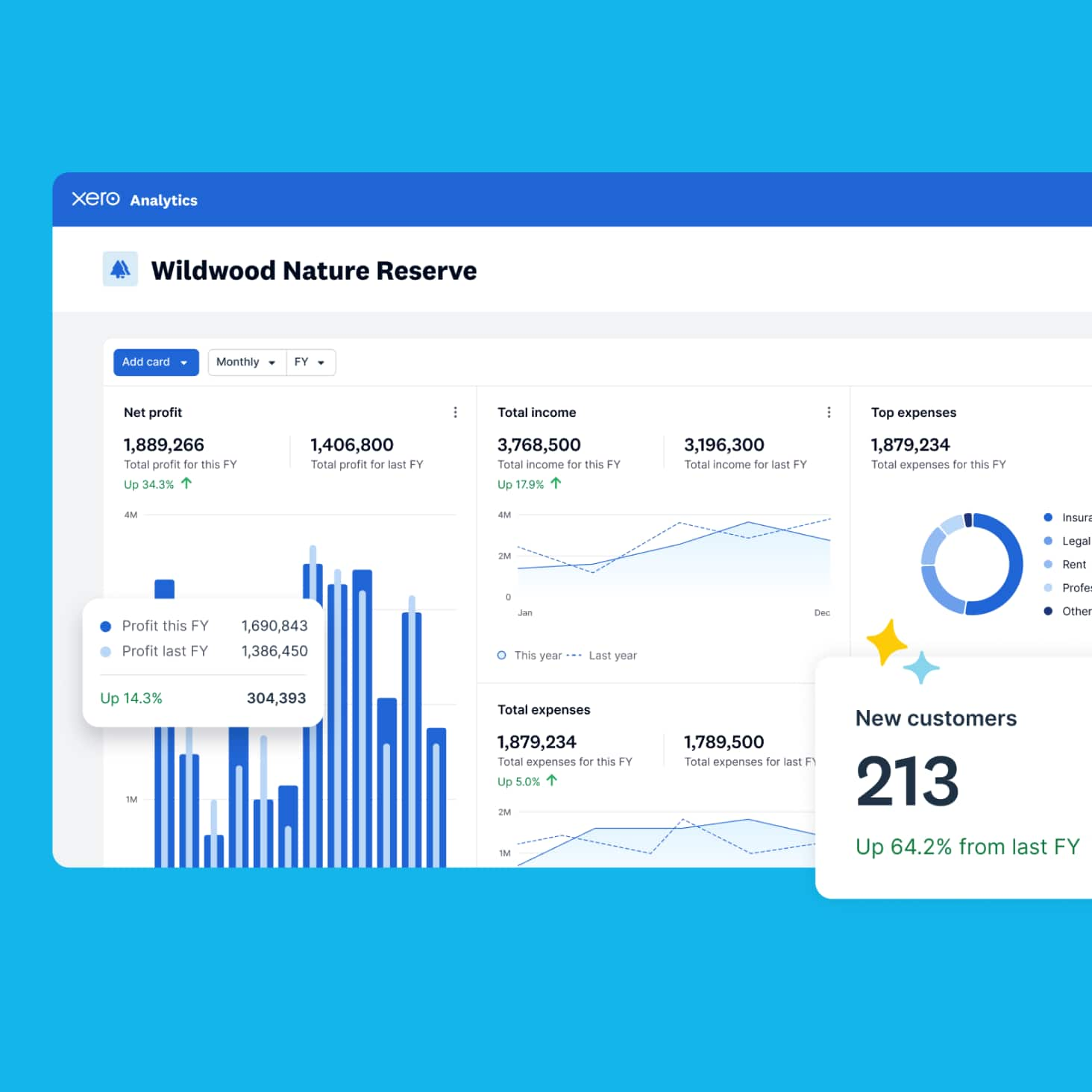

Keep track of cash flow

Easily record donations, grants, and expenses with Xero’s real-time financial dashboard.

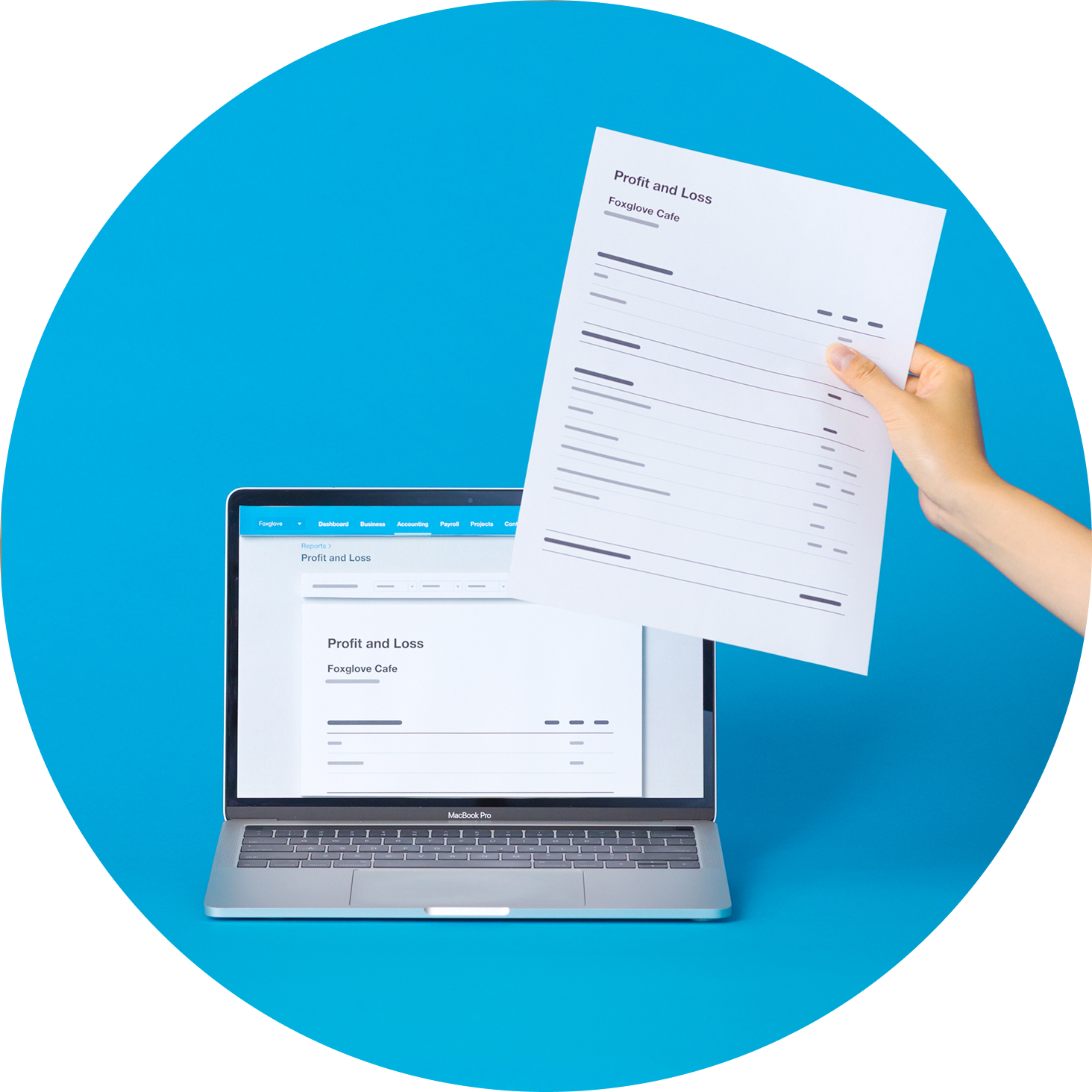

Share reports with stakeholders

Generate clear, insightful reports and easily share them with donors and boards.

Pay staff on time

Automate time-consuming payroll tasks like calculations, GST deductions, and staff payments.

Stay connected wherever you are

Use the Xero Accounting app to manage your non-profit’s from anywhere.

Stay on top of cash flow with Xero

Xero’s intuitive accounting tools give you a clear view of your finances, so you plan your next disbursement with confidence.

- Track income – record every donation, grant, and fundraising payment automatically

- Monitor your spending in real time to see exactly where your funds are going

- Plan ahead – Xero forecasting tools give you the info for smarter financial decisions for your non-profit

Keep your stakeholders up to date

Xero’s accounting software for charities lets you easily generate and share financial reports, then share them with your board, donors, volunteers, and advisors.

- Quickly create clear financial reports that all your stakeholders will follow

- Update your stakeholders securely by sharing snapshots of your financial position

- Collaborate in real time – give your advisor access to your reports, then jump online to work on the figures

Pay your staff on time, every time

Xero’s accounting software for non-profits makes it easy to manage your payroll. Automate time-consuming tasks, stay organised, and schedule staff payments – one less thing to remember!

- Automated calculations – let Xero handle wages, overtime, and GST deductions automatically

- Quick, secure pay runs – transfer wages directly so your team gets paid on time, every time

- Easier tax compliance – keep accurate payroll records and ensure compliance with local tax and reporting rules

Run your finances from anywhere

The Xero Accounting app gives you the flexibility to manage your non-profit’s finances wherever you are, whenever you need to – keeping you connected to your mission.

- Track spending from any device in real time to keep your charity on budget

- Approve payments on the move – job done

- Do your bank reconciliation from anywhere so you always have your latest figures in front of you

Non-profit payroll software

Payroll software built for non-profit businesses

Non-profit budgeting software

Budgeting software built for non-profit businesses

Small business accounting software

Learn more about how Xero accounting software works for your small business.

Spirit of Adventure Trust

“We’re about young people in New Zealand. And as a brand, working with Xero is a nice synergy of values and beliefs for us at Spirit.”

- Bruce Pilbrow, CEO of the Spirit of Adventure Trust.

FAQs about Xero in New Zealand

New Zealand’s financial year ends on 31 March. After this, businesses need to submit an end of year tax return to Inland Revenue. The deadline is 7 July if you're filing yourself, or 31 March the following year if you're registered with a tax agent.

New Zealand’s financial year ends on 31 March. After this, businesses need to submit an end of year tax return to Inland Revenue. The deadline is 7 July if you're filing yourself, or 31 March the following year if you're registered with a tax agent.

Yes, you can connect your Xero account with the IRD (Inland Revenue Department) to more easily prepare and submit your returns, so you never miss a deadline.

Find out more from the IRD on running a business.Yes, you can connect your Xero account with the IRD (Inland Revenue Department) to more easily prepare and submit your returns, so you never miss a deadline.

Find out more from the IRD on running a business.Yes, Xero complies fully with payday filing. Your payroll administrator only needs to connect to the IRD once, and then employee pay details are filed with the IRD each pay run.

Yes, Xero complies fully with payday filing. Your payroll administrator only needs to connect to the IRD once, and then employee pay details are filed with the IRD each pay run.

The best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plans.The best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plans.Yes, the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business in New Zealand.

Check out the Xero App Store.Yes, the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business in New Zealand.

Check out the Xero App Store.At the end of the financial year, it’s important to make sure your books are up to date. Start with reconciling all bank accounts and ensuring transactions are up to date. Review bills and invoices and chase any outstanding payments. If you hold inventory, conduct a stocktake. Run profit and loss statements and balance sheets to ensure everything is up to date. Finally, prepare and lodge your income tax by the deadline.

At the end of the financial year, it’s important to make sure your books are up to date. Start with reconciling all bank accounts and ensuring transactions are up to date. Review bills and invoices and chase any outstanding payments. If you hold inventory, conduct a stocktake. Run profit and loss statements and balance sheets to ensure everything is up to date. Finally, prepare and lodge your income tax by the deadline.

There’s no real difference between the financial year and tax year. Generally, they mean the same thing for most businesses in New Zealand – both refer to the 12 month period you use for your business accounting and tax. For most businesses, this runs from 1 April to 31 March.

There’s no real difference between the financial year and tax year. Generally, they mean the same thing for most businesses in New Zealand – both refer to the 12 month period you use for your business accounting and tax. For most businesses, this runs from 1 April to 31 March.

Trusted by non-profits everywhere

Xero grows with you. Whether you’re a grassroots non-profit or an established charity with a full team, Xero’s features help you stay organised, track your finances, and make confident decisions.

An all-in-one financial platform

Handle invoicing, payroll, reporting, and more – all in one system

Made for non-accountants

Xero’s intuitive features mean you don’t need to be an expert to get the most out of Xero

Less admin, more impact

Automate everyday tasks so you spend less time on spreadsheets and more time helping people.

Choose Xero for your small business

Connect Xero to apps for non-profits

Over 1000 third-party apps connect with Xero. Find apps for your charity or non-profit organisation at the Xero App Store.

- App

ApprovalMax

An approval app with powerful approval automation features for accounts payable and accounts receivable.

- App

Hubdoc

Hubdoc is the Xero tool that captures bills and receipts. It helps to make bookkeeping seamless and unlock insights.

- App

infoodle

A customer relationship management (CRM) app for non-profits to manage donors, volunteers, fundraising and more.

Plans to suit your business

All pricing plans cover the accounting essentials, with room to grow.

Ignite

Usually $35

Now $3.50

NZD per month

Save $94.50 over 3 months

Accounting basics for businesses starting out.

Grow

Usually $83

Now $8.30

NZD per month

Save $224.10 over 3 months

Accounting tools for the self-employed and growing businesses.

Comprehensive

Usually $110

Now $11

NZD per month

Save $297 over 3 months

Streamlined accounting and payroll for businesses with employees.

Ultimate

Usually $125

Now $12.50

NZD per month

Save $337.50 over 3 months

Accounting, payroll and forecasting tools to help businesses scale for future growth.

Get one month free

Purchase any Xero plan, and we will give you the first month free.

*About non-profit discount pricing

The non-profit discount rate is applied once you've subscribed to Xero and we've confirmed your not-for-profit status.

Learn more in Xero CentralXero resources to help your non-profit grow

Here are practical guides and tools to help you launch, manage, and grow your non-profit and support your worthy cause.

How to start a non-profit organisation

Learn how to set up your non-profit and understand the key legal and funding fundamentals.

Build a non-profit business plan

Download Xero’s business plan template to define your goals, attract funding, and build a strong foundation.

Explore Xero’s features for non-profits

Run your non-profit’s finances online with Xero’s cloud-based accounting software – tailored to meet your organisation’s needs.