Xero Cashbook and Xero Ledger

Accountants and bookkeepers can add small clients to Xero with Xero Cashbook and Ledger by joining the partner program.

Import bank transactions

Connect directly to banks or import from downloads.

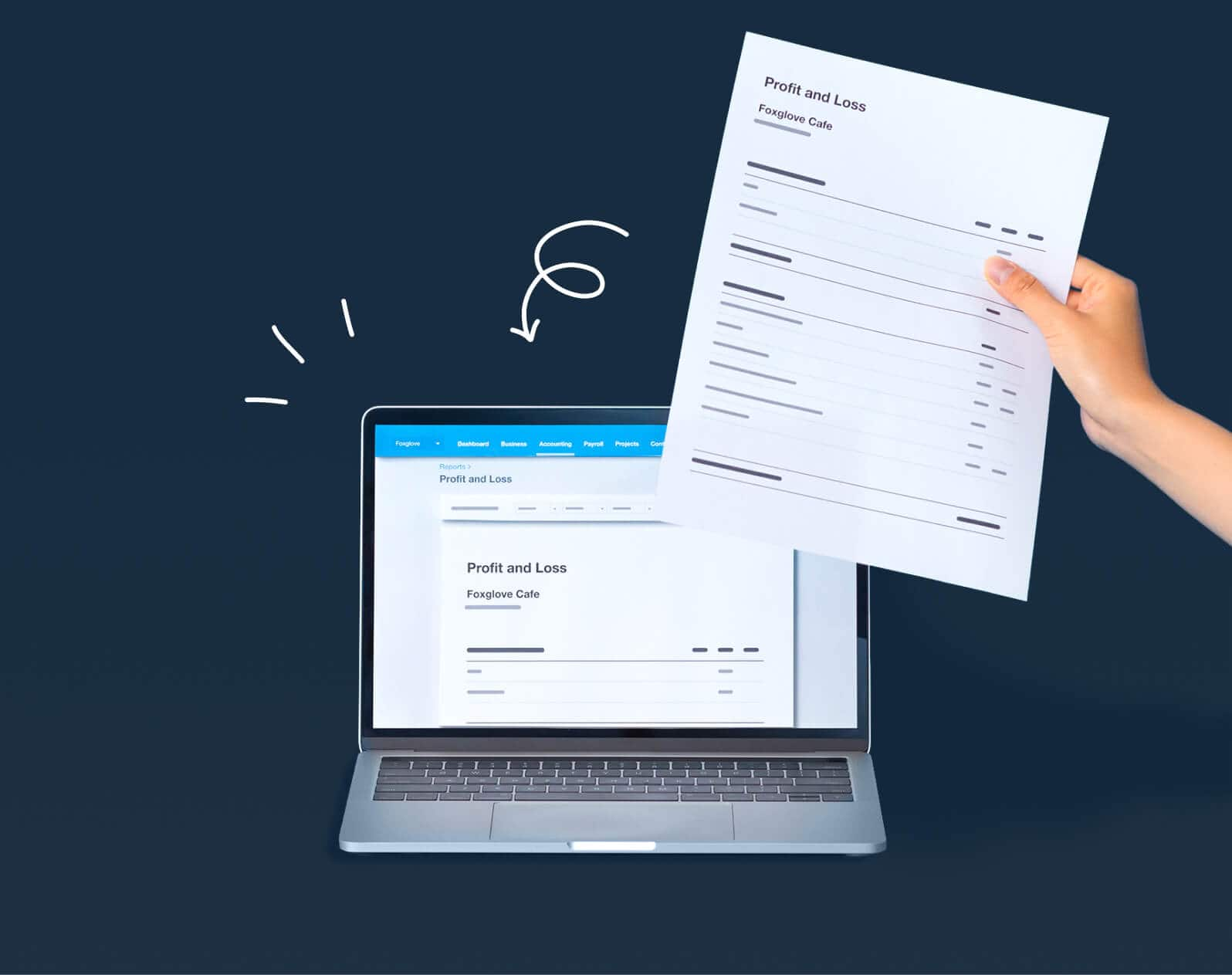

Reconcile and report

Get automated bank rec and powerful reports.

Give your clients access

Practice staff set up and manage client accounts.

Use with practice tools

Sync with Xero practice software to exchange data.

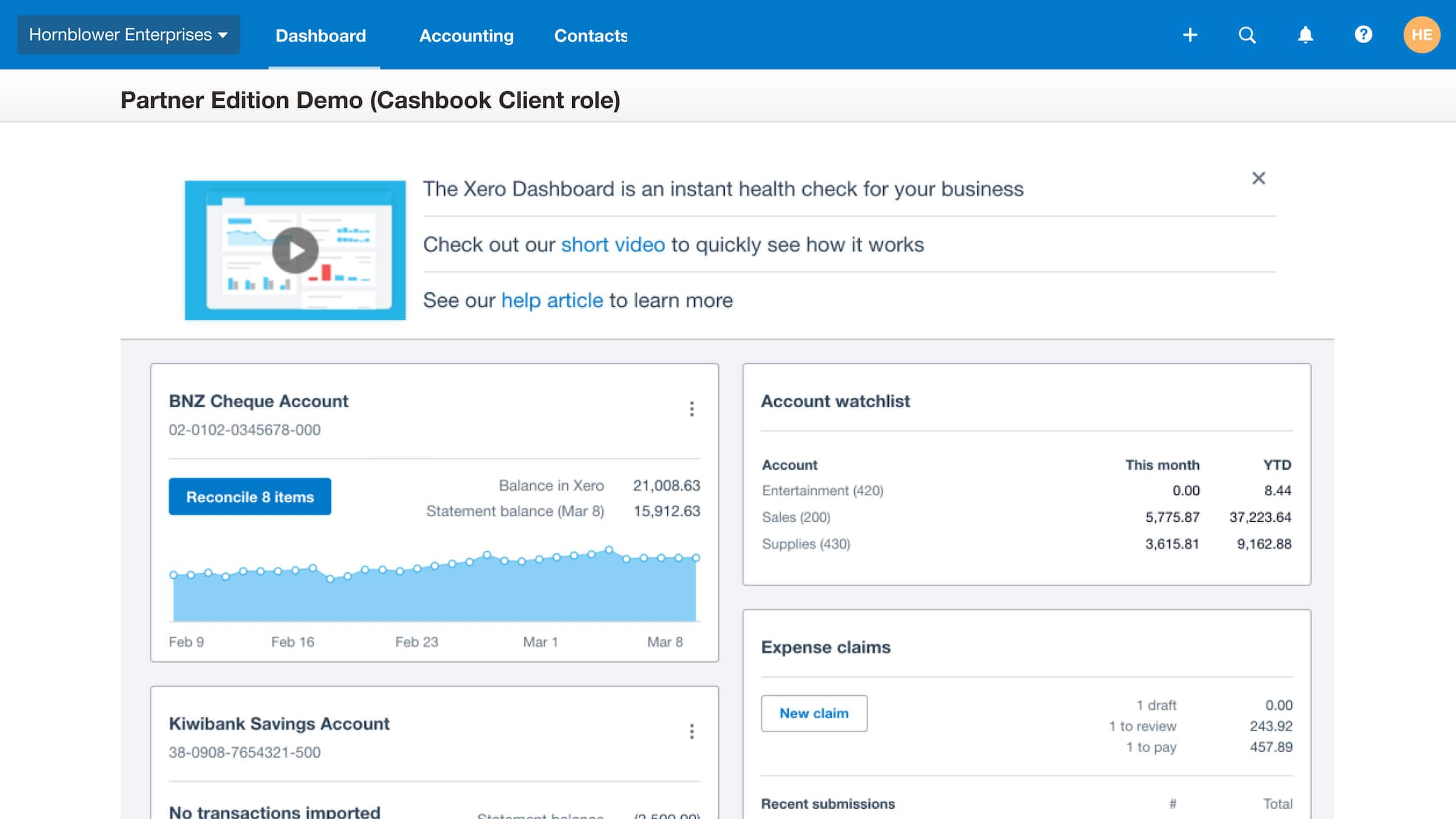

Import bank transactions

Get details of all bank transactions into Xero ready for regular reconciliation.

- Connect directly to banks from Xero Cashbook to get daily bank feeds

- Download bank transactions and import them into Xero Ledger or Xero Cashbook

Reconcile and report

All cashbook and ledger plans include bank reconciliation, fixed asset management, budget tools and financial statements.

- Reconcile bank transactions with automated transaction matching

- Manage fixed assets, prepare budgets and generate reports in any plan

Give your clients access

Practice staff are in control of the accounts with these plans.

- Choose the plans that best suit the way clients work

- Set up, code and manage client accounts

- Grant clients access to Xero Cashbook to view data and reconcile transactions

Use with practice tools

As with other Xero business plans, Xero Cashbook and Xero Ledger integrate with other Xero practice tools.

- Connect to Xero HQ and Xero Practice Manager to manage clients, jobs and activities

- Sync with Xero Workpapers to manage compliance workflow and queries

- Populate the accounts into Xero Tax without re-entering it

More about Xero Ledger and Xero Cashbook plans

Xero Ledger is for clients who need annual accounts preparation but not GST reporting or invoicing. It includes bank reconciliation, budgeting tools, fixed asset management, financial statements, and document storage in the Xero file library. You can let clients view their data and reports but they can’t code transactions.

Xero Ledger is for clients who need annual accounts preparation but not GST reporting or invoicing. It includes bank reconciliation, budgeting tools, fixed asset management, financial statements, and document storage in the Xero file library. You can let clients view their data and reports but they can’t code transactions.

Xero Cashbook provides bookkeeping essentials for non-GST-registered clients who don't need invoicing. Get daily bank feeds of client bank transactions in addition to all the features of Xero Ledger. Xero Cashbook is available to Xero accounting and bookkeeping partners. Businesses can’t subscribe to this plan themselves, but you can let clients code their own transactions and view their data and reports.

Xero Cashbook provides bookkeeping essentials for non-GST-registered clients who don't need invoicing. Get daily bank feeds of client bank transactions in addition to all the features of Xero Ledger. Xero Cashbook is available to Xero accounting and bookkeeping partners. Businesses can’t subscribe to this plan themselves, but you can let clients code their own transactions and view their data and reports.

As a Xero partner you can subscribe to these plans on behalf of your clients. As at 1 July 2024, Xero Ledger is $6.50 per month and Xero Cashbook is $16 per month. These prices exclude GST.

As a Xero partner you can subscribe to these plans on behalf of your clients. As at 1 July 2024, Xero Ledger is $6.50 per month and Xero Cashbook is $16 per month. These prices exclude GST.

Join the partner program to use Xero Ledger and Xero Cashbook

Xero Ledger and Xero Cashbook plans are only available via accounting and bookkeeping practices who are members of the Xero partner program. Partners can offer them to clients, and grant access to Xero Cashbook if they choose.

More for accountants & bookkeepers

See more products- Xero HQ

Manage clients and staff

- Xero Practice Manager

Manage your practice efficiently

- Xero Workpapers

Manage compliance workflows