Make the end of financial year practically effortless

Transform the way you work and get the new financial year off to the best start with Xero. Help make the business soar; have your books up to date and all in order before the end of the financial year.

End of financial year explained

The New Zealand financial year runs from 1 April to 31 March. Get your finances in order before the end of the financial year so an accurate tax return can be prepared and you have actionable insights at your fingertips.

When your income tax return is due

The due date for most businesses is 7 July unless you have an extension or use an advisor with an extension.

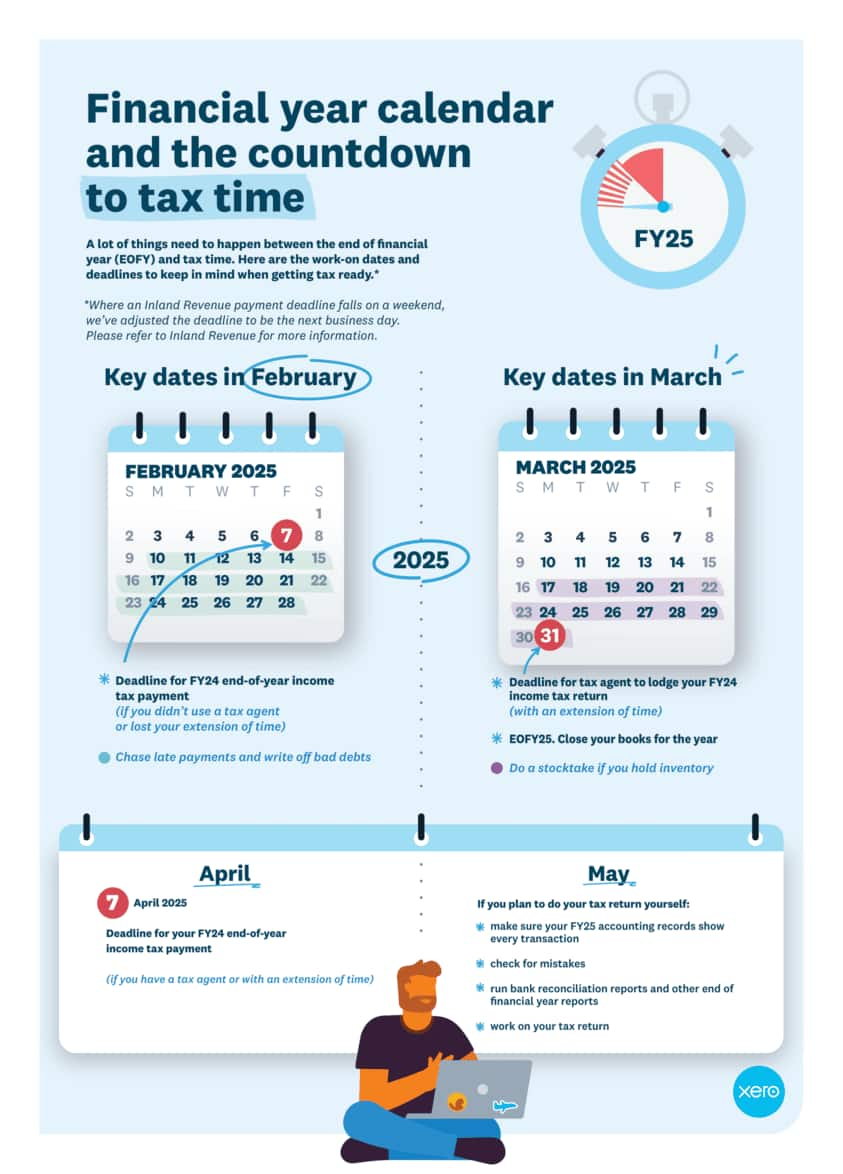

More end of financial year dates

Pay your EOFY income tax by 7 February in the next year, or 2 April if you or your advisor have an extension.

Complete your EOFY tax return

Declare how much profit your business earned and any business expenses you can claim as a deduction.

Retain business records

Inland Revenue requires businesses to keep certain records of business transactions for at least seven years.

Get your own financial year calendar

See all the key dates and deadlines for the financial year at a glance with this handy tax-year calendar.

Open the NZ financial year calendar (pdf)

Find an accountant or bookkeeper

Working with your accountant or bookkeeper is easy with Xero. Find someone you can trust who is experienced with Xero in the Xero advisor directory. They can provide business advice as well as helping you meet end of financial year requirements.

Find an advisor near you

Webinars to help you get sorted for the end of the financial year with Xero

Whether it’s your first financial year-end or your fiftieth, these webinars, videos, and guides can help you unleash the power of Xero as you get ready for tax time. Register for online webinars to learn more about Xero.

Browse and register for webinars now

Prepare for EOFY with Xero

Xero has the tools you need to keep track of your accounts and help you unlock actionable insights this financial year end.

Easy quoting and invoicing

Send online invoices as soon as the job is done. Set automatic reminders to spend less time chasing payments.

Simple bank reconciliation

Keep track of your cash flow with daily bank reconciliation. Save time and stay up-to-date on your finances.

Capture bills and receipts

Automate tasks like entering bills and receipts. Key info is extracted from bills and receipts into Xero.

FAQs about Xero in New Zealand

Yes, you can connect your Xero account with the IRD (Inland Revenue Department) to more easily prepare and submit your returns, so you never miss a deadline.

Find out more from the IRD on running a business.Yes, you can connect your Xero account with the IRD (Inland Revenue Department) to more easily prepare and submit your returns, so you never miss a deadline.

Find out more from the IRD on running a business.Yes, Xero complies fully with payday filing. Your payroll administrator only needs to connect to the IRD once, and then employee pay details are filed with the IRD each pay run.

Yes, Xero complies fully with payday filing. Your payroll administrator only needs to connect to the IRD once, and then employee pay details are filed with the IRD each pay run.

The best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plans.The best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plans.No – Xero is based in the cloud, so all you need is an internet connection. But you need a multi-factor authentication (MFA) app to log in to Xero. MFA extra layer of security by checking that it’s really you when you log in.

Learn about data protection with Xero.No – Xero is based in the cloud, so all you need is an internet connection. But you need a multi-factor authentication (MFA) app to log in to Xero. MFA extra layer of security by checking that it’s really you when you log in.

Learn about data protection with Xero.Yes, the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business in New Zealand.

Check out the Xero App Store.Yes, the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business in New Zealand.

Check out the Xero App Store.

Accounting software for your New Zealand small business

Run your business accounting online with Xero. Easy-to-use accounting software, designed for your small business.

- Everything in one place

- Connect to your bank

- Collaborate in real time

- Customise to suit your needs

Use Xero to get EOFY sorted

Access all Xero features free for 30 days and know your numbers this financial year end.