Estimating software built for movers

Work smarter, not harder with Xero’s intuitive estimating software. You can handle your financial admin whenever it works for you and your moving business.

Industry-specific solutions

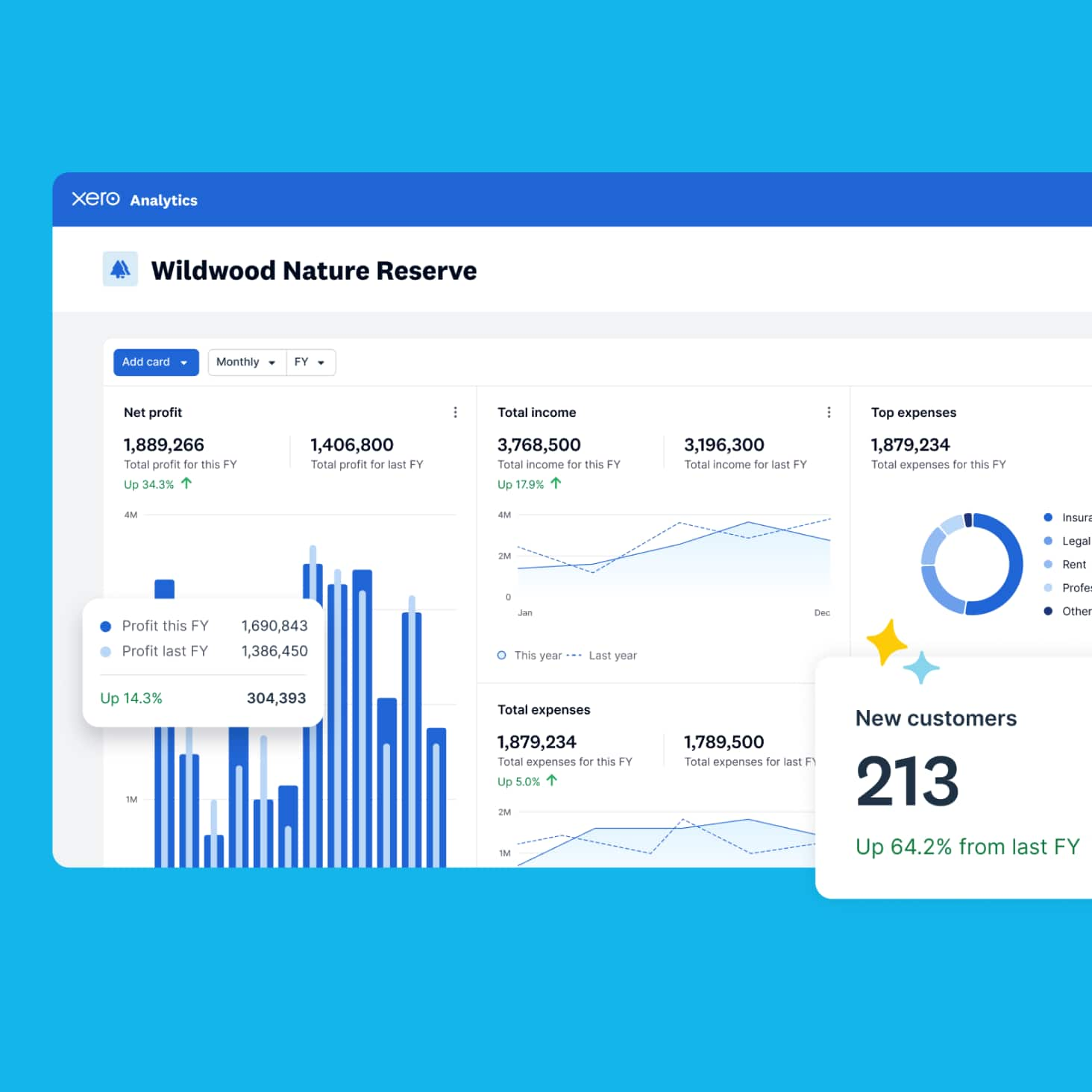

Xero adapts to the needs of your industry with customisable reports and tools, including third party apps.

Mobile app functionality

No more being glued to your desk. The mobile app lets you whiz through admin while on the go.

Compliance and tax support

Tax time is less stressful with a system that’s easy for your whole team to use.

Integration with other business tools

Xero connects to third party apps like Stripe and Vend so you can build a system to your business’s needs.

Why Xero makes sense for movers

With Xero’s estimating software for movers you can create professional online estimates and quotes, and send them instantly using Xero desktop software or the app.

Learn more about Xero’s software for other industries

Small business accounting software

Learn more about how Xero accounting software works for your small business

Mover accounting software

Accounting software built for moving businesses

Xero for other industries

Find out more about how Xero works for different business types

Apps that work with your moving business

The Xero App Store has hundreds of apps to help you run your moving business with Xero’s estimating software.

- Choose the apps that work for you

- Smooth integration with Xero estimating software

- Work smarter and do more with apps

FAQs about Xero in New Zealand

New Zealand’s financial year ends on 31 March. After this, businesses need to submit an end of year tax return to Inland Revenue. The deadline is 7 July if you're filing yourself, or 31 March the following year if you're registered with a tax agent.

New Zealand’s financial year ends on 31 March. After this, businesses need to submit an end of year tax return to Inland Revenue. The deadline is 7 July if you're filing yourself, or 31 March the following year if you're registered with a tax agent.

Yes, you can connect your Xero account with the IRD (Inland Revenue Department) to more easily prepare and submit your returns, so you never miss a deadline.

Find out more from the IRD on running a business.Yes, you can connect your Xero account with the IRD (Inland Revenue Department) to more easily prepare and submit your returns, so you never miss a deadline.

Find out more from the IRD on running a business.Yes, Xero complies fully with payday filing. Your payroll administrator only needs to connect to the IRD once, and then employee pay details are filed with the IRD each pay run.

Yes, Xero complies fully with payday filing. Your payroll administrator only needs to connect to the IRD once, and then employee pay details are filed with the IRD each pay run.

The best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plans.The best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plans.Yes, the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business in New Zealand.

Check out the Xero App Store.Yes, the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business in New Zealand.

Check out the Xero App Store.At the end of the financial year, it’s important to make sure your books are up to date. Start with reconciling all bank accounts and ensuring transactions are up to date. Review bills and invoices and chase any outstanding payments. If you hold inventory, conduct a stocktake. Run profit and loss statements and balance sheets to ensure everything is up to date. Finally, prepare and lodge your income tax by the deadline.

At the end of the financial year, it’s important to make sure your books are up to date. Start with reconciling all bank accounts and ensuring transactions are up to date. Review bills and invoices and chase any outstanding payments. If you hold inventory, conduct a stocktake. Run profit and loss statements and balance sheets to ensure everything is up to date. Finally, prepare and lodge your income tax by the deadline.

There’s no real difference between the financial year and tax year. Generally, they mean the same thing for most businesses in New Zealand – both refer to the 12 month period you use for your business accounting and tax. For most businesses, this runs from 1 April to 31 March.

There’s no real difference between the financial year and tax year. Generally, they mean the same thing for most businesses in New Zealand – both refer to the 12 month period you use for your business accounting and tax. For most businesses, this runs from 1 April to 31 March.

Plans to suit your business

All pricing plans cover the accounting essentials, with room to grow.

Ignite

Usually $35

Now $3.50

NZD per month

Save $94.50 over 3 months

Accounting basics for businesses starting out.

Grow

Usually $83

Now $8.30

NZD per month

Save $224.10 over 3 months

Accounting tools for the self-employed and growing businesses.

Comprehensive

Usually $110

Now $11

NZD per month

Save $297 over 3 months

Streamlined accounting and payroll for businesses with employees.

Ultimate

Usually $125

Now $12.50

NZD per month

Save $337.50 over 3 months

Accounting, payroll and forecasting tools to help businesses scale for future growth.

Get one month free

Purchase any Xero plan, and we will give you the first month free.

Discover Xero’s software for movers

Run your accounting online with Xero. Our beautiful cloud-based software is designed for your small business.