Time tracking software built for lawyers

Work smarter, not harder with Xero’s intuitive time tracking software. You can handle your financial admin whenever it works for you and your law firm.

Industry-specific solutions

Xero adapts to the needs of your industry with customisable reports and tools, including third party apps.

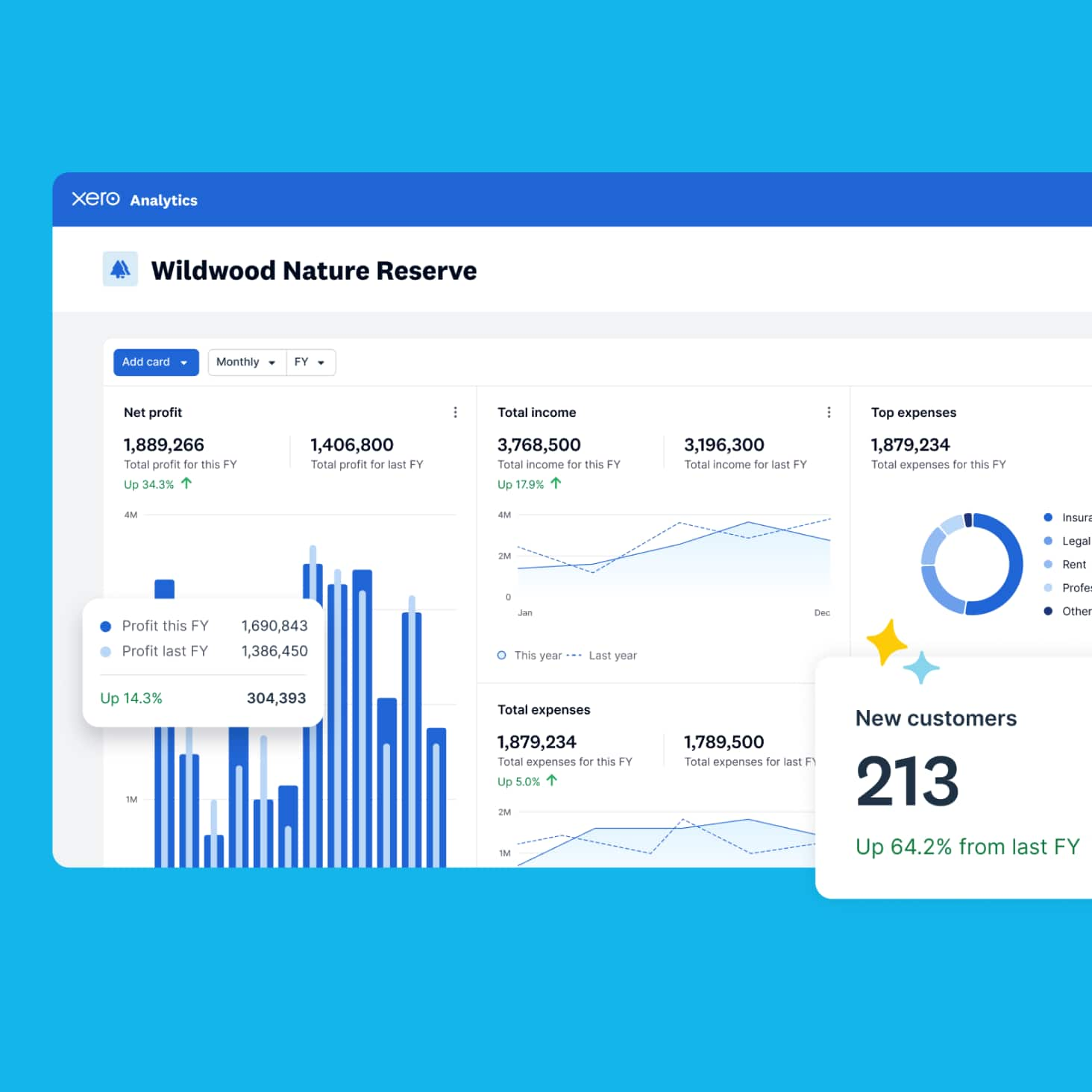

User-friendly design

View your financial position on a clean, easy-to-use interface. Get up to speed with the software quickly.

Compliance and tax support

Tax time is less stressful with a system that’s easy for your whole team to use.

Cloud-based accessibility

Access your Xero account on any device with an internet connection, wherever you are in the world.

Why Xero makes sense for lawyers

With Xero’s time tracking software for lawyers, you can track log time spent, invoice for logged time, and watch over your projects, all online.

Learn more about Xero’s software for other industries

Law firm invoicing software

Invoicing software built for lawyers.

Law firm accounting software

Accounting software for lawyers.

Small business accounting software

Learn more about how Xero accounting software works for your small business.

Apps that work with your law firm

The Xero App Store has hundreds of apps to help you run your law firm with Xero’s time tracking software.

- Choose the apps that work for you

- Smooth integration with Xero time tracking software

- Work smarter and do more with apps

FAQs about Xero in New Zealand

New Zealand’s financial year ends on 31 March. After this, businesses need to submit an end of year tax return to Inland Revenue. The deadline is 7 July if you're filing yourself, or 31 March the following year if you're registered with a tax agent.

New Zealand’s financial year ends on 31 March. After this, businesses need to submit an end of year tax return to Inland Revenue. The deadline is 7 July if you're filing yourself, or 31 March the following year if you're registered with a tax agent.

Yes, you can connect your Xero account with the IRD (Inland Revenue Department) to more easily prepare and submit your returns, so you never miss a deadline.

Find out more from the IRD on running a business.Yes, you can connect your Xero account with the IRD (Inland Revenue Department) to more easily prepare and submit your returns, so you never miss a deadline.

Find out more from the IRD on running a business.Yes, Xero complies fully with payday filing. Your payroll administrator only needs to connect to the IRD once, and then employee pay details are filed with the IRD each pay run.

Yes, Xero complies fully with payday filing. Your payroll administrator only needs to connect to the IRD once, and then employee pay details are filed with the IRD each pay run.

The best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plans.The best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plans.Yes, the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business in New Zealand.

Check out the Xero App Store.Yes, the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business in New Zealand.

Check out the Xero App Store.At the end of the financial year, it’s important to make sure your books are up to date. Start with reconciling all bank accounts and ensuring transactions are up to date. Review bills and invoices and chase any outstanding payments. If you hold inventory, conduct a stocktake. Run profit and loss statements and balance sheets to ensure everything is up to date. Finally, prepare and lodge your income tax by the deadline.

At the end of the financial year, it’s important to make sure your books are up to date. Start with reconciling all bank accounts and ensuring transactions are up to date. Review bills and invoices and chase any outstanding payments. If you hold inventory, conduct a stocktake. Run profit and loss statements and balance sheets to ensure everything is up to date. Finally, prepare and lodge your income tax by the deadline.

There’s no real difference between the financial year and tax year. Generally, they mean the same thing for most businesses in New Zealand – both refer to the 12 month period you use for your business accounting and tax. For most businesses, this runs from 1 April to 31 March.

There’s no real difference between the financial year and tax year. Generally, they mean the same thing for most businesses in New Zealand – both refer to the 12 month period you use for your business accounting and tax. For most businesses, this runs from 1 April to 31 March.

Plans to suit your business

All pricing plans cover the accounting essentials, with room to grow.

Ignite

Usually $35

Now $3.50

NZD per month

Save $94.50 over 3 months

Accounting basics for businesses starting out.

Grow

Usually $83

Now $8.30

NZD per month

Save $224.10 over 3 months

Accounting tools for the self-employed and growing businesses.

Comprehensive

Usually $110

Now $11

NZD per month

Save $297 over 3 months

Streamlined accounting and payroll for businesses with employees.

Ultimate

Usually $125

Now $12.50

NZD per month

Save $337.50 over 3 months

Accounting, payroll and forecasting tools to help businesses scale for future growth.

Get one month free

Purchase any Xero plan, and we will give you the first month free.

Discover Xero’s software for your law firm

Run your accounting online with Xero. Our beautiful cloud-based software is designed for your small business.